- Australia

- /

- Metals and Mining

- /

- ASX:EMR

3 ASX Stocks Estimated To Be Up To 48.3% Below Intrinsic Value

Reviewed by Simply Wall St

As the Australian market mirrors the upward trends seen in the U.S., with ASX 200 futures indicating a potential gain, investors are keenly observing opportunities for undervalued stocks amidst this positive momentum. In such an environment, identifying stocks trading below their intrinsic value can present compelling opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Praemium (ASX:PPS) | A$0.715 | A$1.35 | 47.2% |

| PointsBet Holdings (ASX:PBH) | A$1.185 | A$2.10 | 43.5% |

| Lynas Rare Earths (ASX:LYC) | A$9.67 | A$18.70 | 48.3% |

| Integral Diagnostics (ASX:IDX) | A$2.58 | A$4.57 | 43.6% |

| Infomedia (ASX:IFM) | A$1.22 | A$2.06 | 40.9% |

| Fenix Resources (ASX:FEX) | A$0.29 | A$0.50 | 42.5% |

| Collins Foods (ASX:CKF) | A$8.96 | A$15.73 | 43% |

| City Chic Collective (ASX:CCX) | A$0.086 | A$0.14 | 40.5% |

| Charter Hall Group (ASX:CHC) | A$19.13 | A$35.43 | 46% |

| Advanced Braking Technology (ASX:ABV) | A$0.084 | A$0.16 | 48.8% |

We'll examine a selection from our screener results.

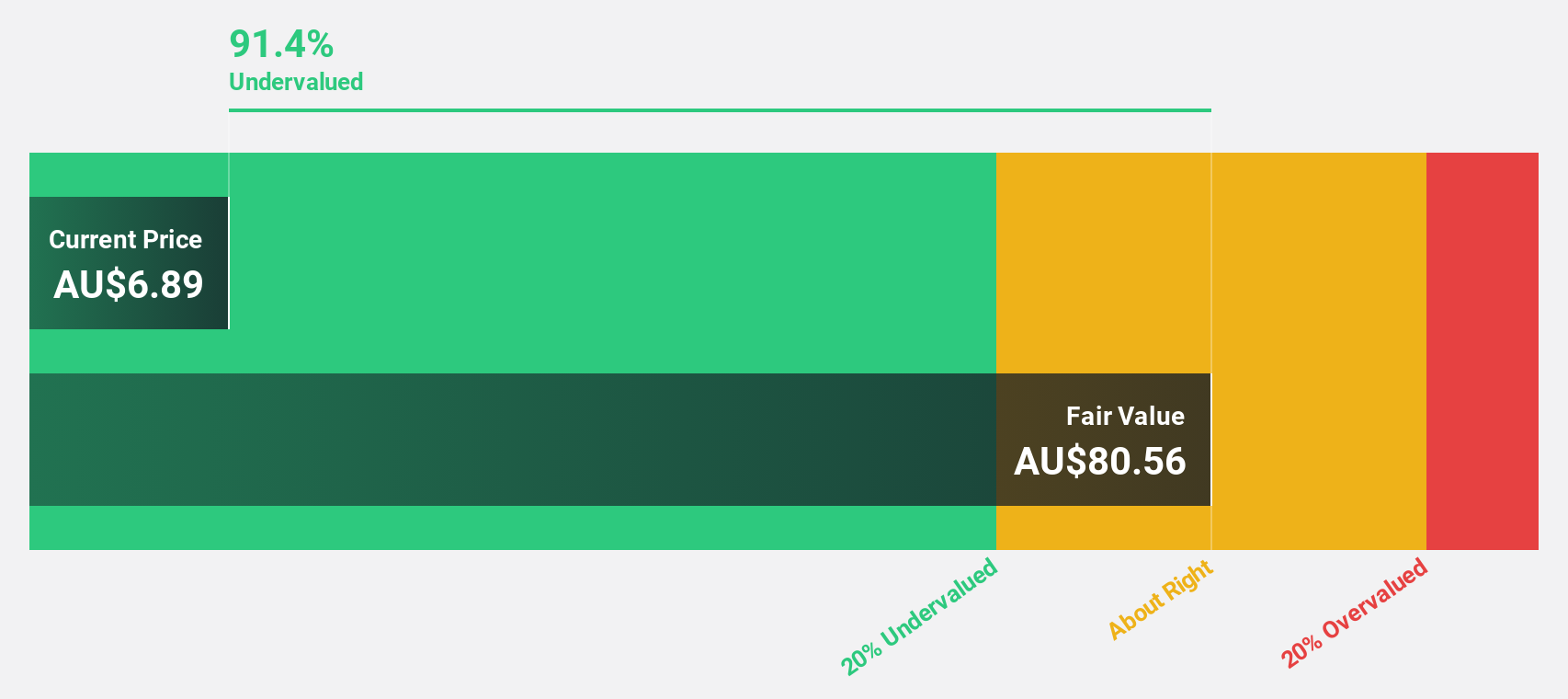

Emerald Resources (ASX:EMR)

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.36 billion.

Operations: The company's revenue is primarily derived from mine operations, which account for A$427.32 million.

Estimated Discount To Fair Value: 29.3%

Emerald Resources appears undervalued with its current trading price of A$3.59 below the estimated fair value of A$5.08, representing a discount exceeding 20%. The company forecasts robust earnings growth at 36.3% annually, outpacing the Australian market average of 10.9%. Recent updates indicate steady gold production from Okvau Gold Mine, supporting revenue growth projections of 23.3% per year, which surpasses the broader market's expected growth rate.

- The analysis detailed in our Emerald Resources growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Emerald Resources.

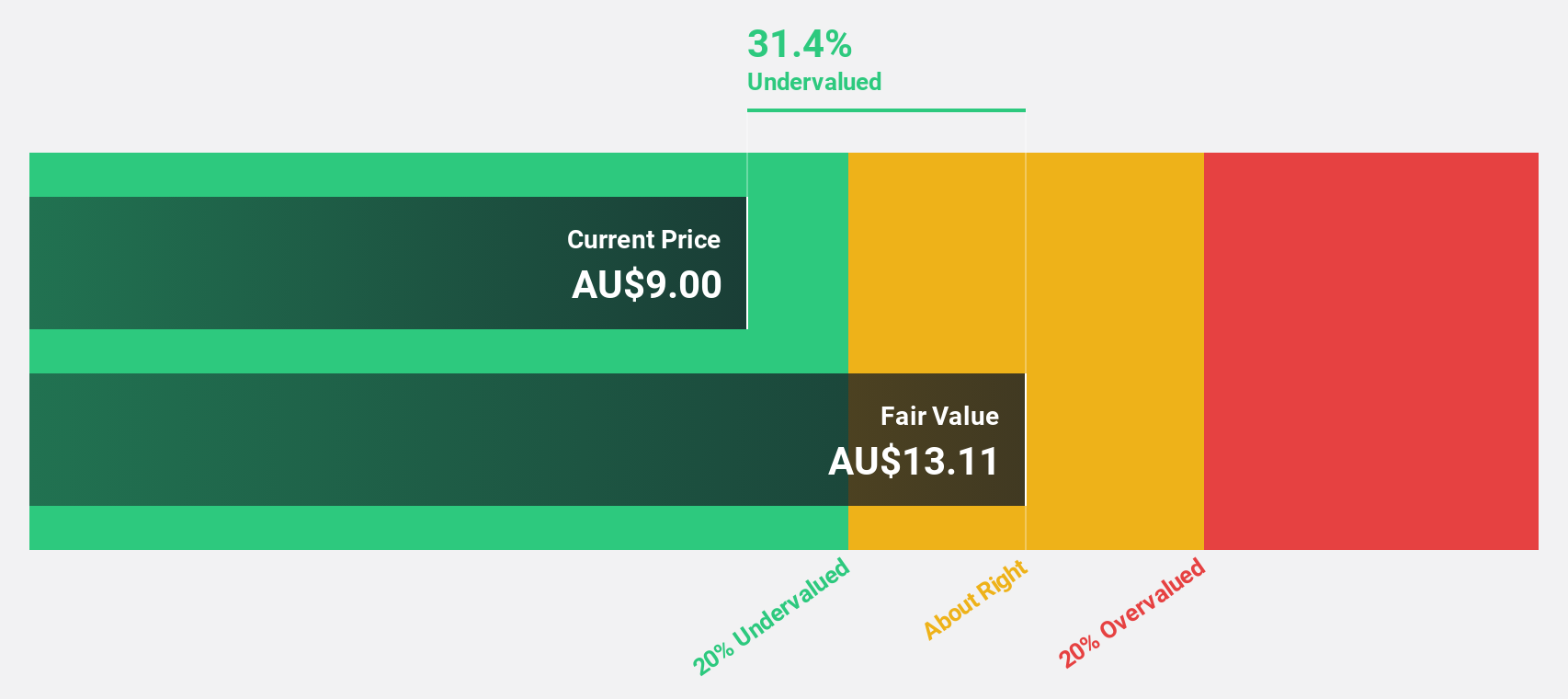

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, along with its subsidiaries, is involved in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia, with a market capitalization of A$9.05 billion.

Operations: The company's revenue is primarily generated from its Rare Earth Operations, amounting to A$482.82 million.

Estimated Discount To Fair Value: 48.3%

Lynas Rare Earths is trading at A$9.67, significantly below its estimated fair value of A$18.7, representing a discount of over 48%. The company's earnings are projected to grow substantially at 62.31% annually, far exceeding the market average of 10.9%. Although profit margins have decreased from last year, revenue growth is expected to remain strong at 37.8% per year, outpacing the Australian market's growth rate and indicating potential undervaluation based on cash flows.

- Our earnings growth report unveils the potential for significant increases in Lynas Rare Earths' future results.

- Click here to discover the nuances of Lynas Rare Earths with our detailed financial health report.

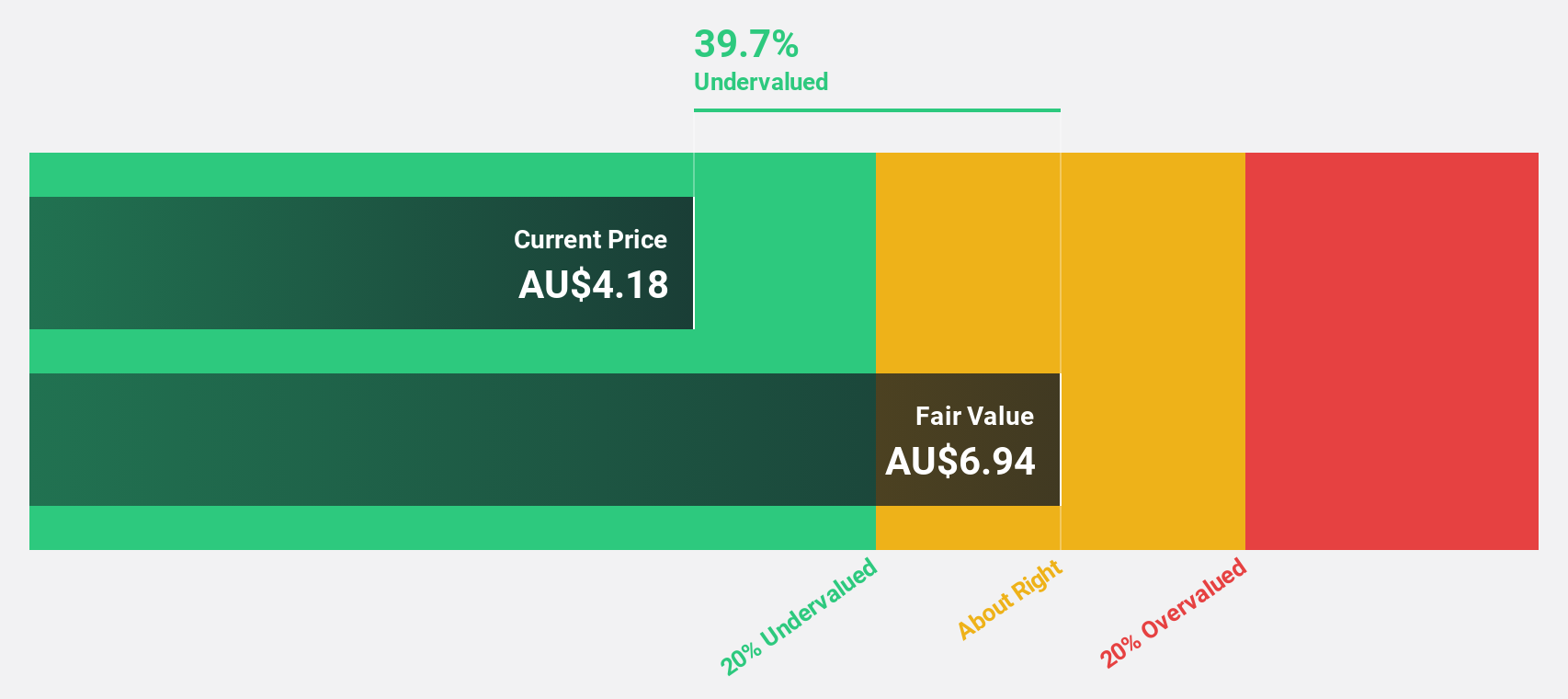

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1.19 billion.

Operations: The company's revenue is primarily generated from its Healthcare Equipment segment, amounting to A$183.97 million.

Estimated Discount To Fair Value: 22.4%

Nanosonics, trading at A$3.92, is priced 22.4% below its estimated fair value of A$5.05, suggesting it is undervalued based on cash flows. The company's earnings are expected to grow significantly at 22.9% annually, surpassing the Australian market's growth rate of 10.9%. Revenue growth is forecasted at 9.6% per year, also above the market average of 5.5%, highlighting potential for value appreciation despite a lower future return on equity forecast of 13.9%.

- The growth report we've compiled suggests that Nanosonics' future prospects could be on the up.

- Get an in-depth perspective on Nanosonics' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 38 companies within our Undervalued ASX Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives