ASX Value Picks Catalyst Metals And 2 Stocks Possibly Trading Below Estimated Worth

Reviewed by Simply Wall St

In a turbulent day for the Australian market, the ASX200 fell by 0.9%, with sectors like IT and Industrials experiencing significant declines while Utilities and Energy managed to post gains. In such fluctuating conditions, identifying stocks that might be trading below their estimated worth can offer potential opportunities for investors seeking value amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Acrow (ASX:ACF) | A$1.03 | A$2.00 | 48.4% |

| Domino's Pizza Enterprises (ASX:DMP) | A$26.71 | A$52.52 | 49.1% |

| Nido Education (ASX:NDO) | A$0.87 | A$1.62 | 46.1% |

| Champion Iron (ASX:CIA) | A$4.91 | A$9.07 | 45.9% |

| Cettire (ASX:CTT) | A$0.925 | A$1.72 | 46.1% |

| SciDev (ASX:SDV) | A$0.41 | A$0.81 | 49.5% |

| Charter Hall Group (ASX:CHC) | A$16.37 | A$31.81 | 48.5% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.14 | A$2.26 | 49.6% |

| ReadyTech Holdings (ASX:RDY) | A$2.75 | A$5.20 | 47.2% |

| Adriatic Metals (ASX:ADT) | A$4.26 | A$8.14 | 47.7% |

We're going to check out a few of the best picks from our screener tool.

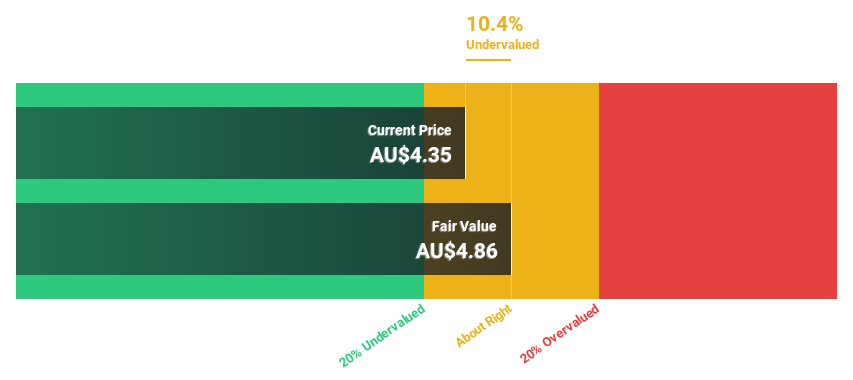

Catalyst Metals (ASX:CYL)

Overview: Catalyst Metals Limited explores and evaluates mineral properties in Australia, with a market cap of A$928.79 million.

Operations: The company's revenue segments include A$93.77 million from Tasmania and A$315.38 million from Western Australia.

Estimated Discount To Fair Value: 15.6%

Catalyst Metals reported A$224.1 million in sales for the half-year ending December 2024, up from A$133.81 million a year earlier, with net income reaching A$46.29 million compared to a previous loss. Trading at approximately 15.6% below its estimated fair value of A$4.87 per share, it shows potential as an undervalued stock based on cash flows despite insider selling and moderate growth forecasts in earnings and revenue relative to the market.

- Insights from our recent growth report point to a promising forecast for Catalyst Metals' business outlook.

- Take a closer look at Catalyst Metals' balance sheet health here in our report.

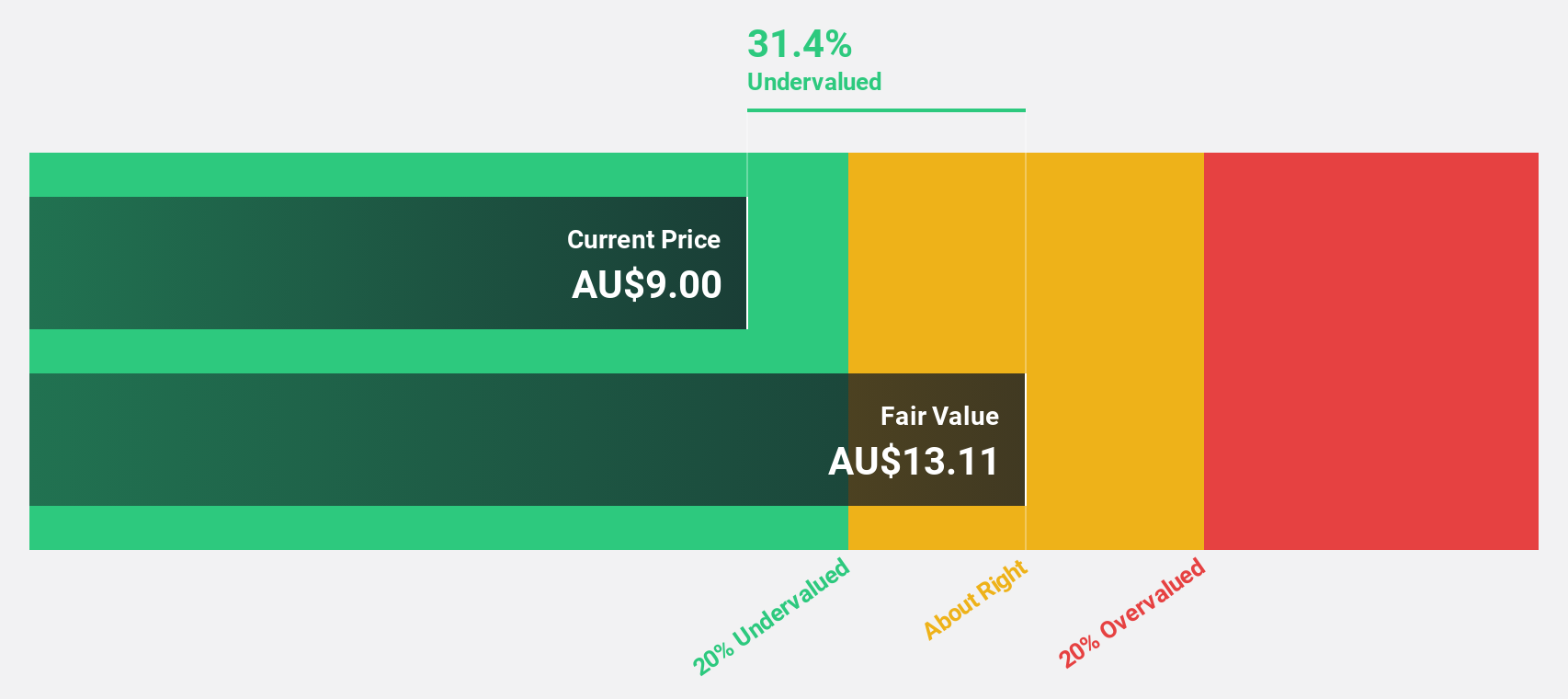

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited operates in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia with a market capitalization of A$6.55 billion.

Operations: The company's revenue is primarily generated from its rare earth operations, amounting to A$482.82 million.

Estimated Discount To Fair Value: 21.4%

Lynas Rare Earths reported A$254.31 million in sales for the half-year ending December 2024, up from A$234.78 million a year earlier, though net income dropped to A$5.85 million from A$39.54 million. Trading at about 21% below its estimated fair value of A$8.91 per share, it presents potential as an undervalued stock based on cash flows despite declining profit margins and high levels of non-cash earnings impacting perceived quality.

- Our earnings growth report unveils the potential for significant increases in Lynas Rare Earths' future results.

- Click to explore a detailed breakdown of our findings in Lynas Rare Earths' balance sheet health report.

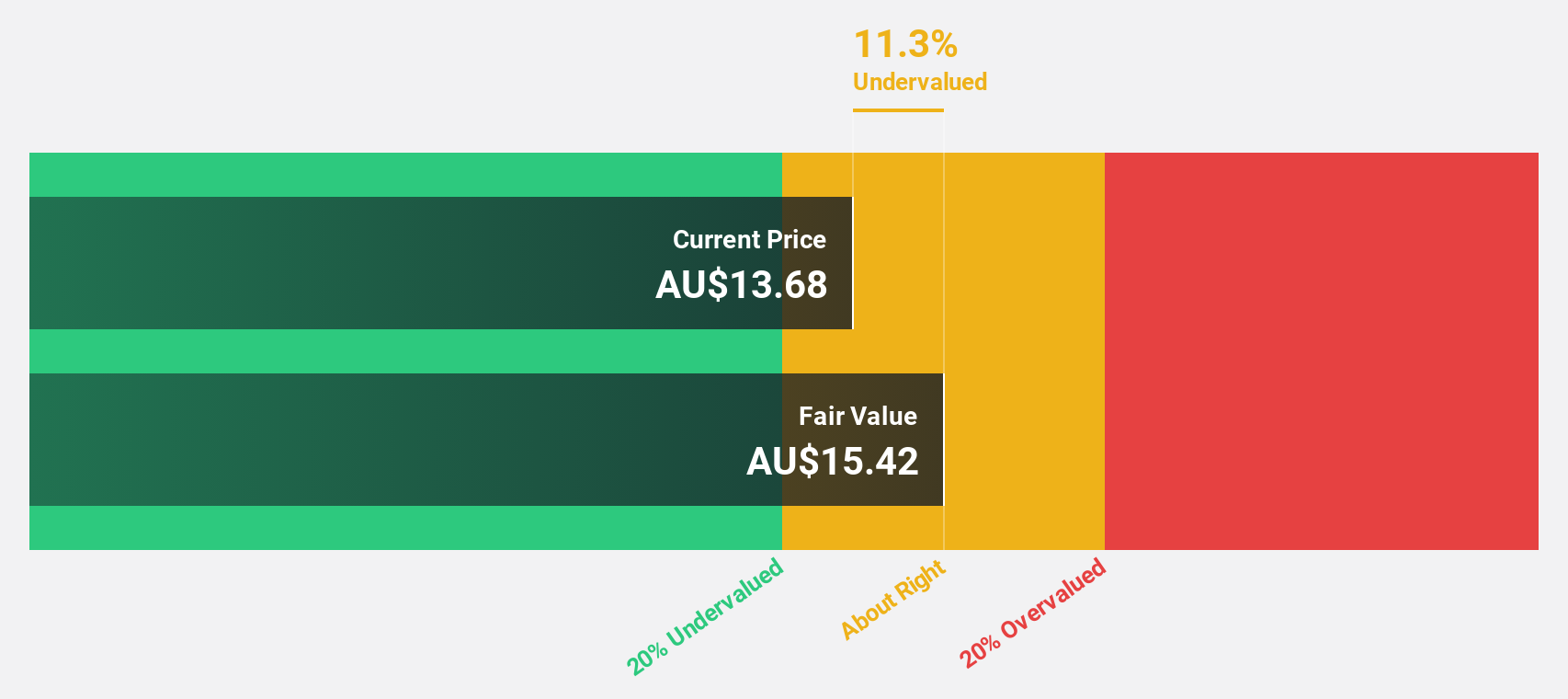

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across various regions, including Australia, New Zealand, Asia, North America, and Europe, with a market cap of A$1.65 billion.

Operations: The company's revenue is derived from three main segments: Europe (A$33.85 million), Asia-Pacific (A$55.29 million), and North America (A$117.77 million).

Estimated Discount To Fair Value: 15.6%

Megaport's recent performance and forecasts highlight its potential as an undervalued stock based on cash flows. The company raised its 2025 revenue guidance to A$216 million-A$222 million, reflecting growth across regions and stabilizing Net Revenue Retention. Although net income fell to A$0.89 million for the half-year ending December 2024, Megaport trades at A$10.26, below the estimated fair value of A$12.16 per share, with earnings projected to grow significantly at 39.8% annually over the next three years.

- The growth report we've compiled suggests that Megaport's future prospects could be on the up.

- Navigate through the intricacies of Megaport with our comprehensive financial health report here.

Next Steps

- Unlock our comprehensive list of 44 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives