- Australia

- /

- Metals and Mining

- /

- ASX:CY5

Cygnus Metals (ASX:CY5) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Cygnus Metals (ASX:CY5) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Cygnus Metals

When Might Cygnus Metals Run Out Of Money?

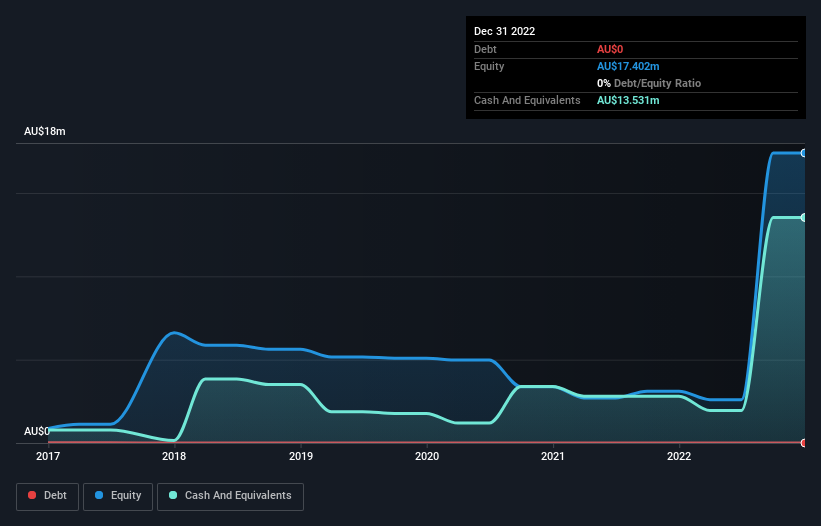

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2022, Cygnus Metals had AU$14m in cash, and was debt-free. Looking at the last year, the company burnt through AU$6.7m. So it had a cash runway of about 2.0 years from December 2022. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is Cygnus Metals' Cash Burn Changing Over Time?

Because Cygnus Metals isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Its cash burn positively exploded in the last year, up 327%. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Cygnus Metals To Raise More Cash For Growth?

While Cygnus Metals does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of AU$71m, Cygnus Metals' AU$6.7m in cash burn equates to about 9.4% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Cygnus Metals' Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Cygnus Metals' cash burn relative to its market cap was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Separately, we looked at different risks affecting the company and spotted 6 warning signs for Cygnus Metals (of which 3 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CY5

Cygnus Metals

Engages in the exploration of mineral properties in Canada and Western Australia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)