- Australia

- /

- Metals and Mining

- /

- ASX:CXO

ASX Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As the ASX navigates the highs and lows of recent sessions, with profit-taking setting the tone after a surprising climb, investors are keeping a close eye on smaller market segments. Penny stocks, though an older term, continue to capture interest as they represent smaller or emerging companies with potential for growth. By focusing on those with strong financials and clear growth paths, investors can uncover opportunities that offer both stability and potential upside amidst fluctuating market conditions.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.15 | A$101.42M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.595 | A$113.45M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.14 | A$484.13M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.21 | A$2.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.865 | A$493.12M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.69 | A$904.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.81 | A$887.04M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.90 | A$153.03M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 461 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited focuses on the exploration and development of mineral properties in Spain, with a market cap of A$258.56 million.

Operations: There are no reported revenue segments for the company.

Market Cap: A$258.56M

Berkeley Energia, with a market cap of A$258.56 million, is pre-revenue and has recently become profitable, marking a significant milestone in its financial journey. The seasoned management team and board of directors bring stability, with average tenures of 9.8 and 13.3 years respectively. The company benefits from strong asset coverage over both short-term (A$1.7M) and long-term liabilities (A$1.8M), supported by A$80.1M in short-term assets and no debt burden compared to five years ago when it had a notable debt to equity ratio. Shareholders have not faced dilution recently, adding to the stock's appeal among penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Berkeley Energia.

- Learn about Berkeley Energia's historical performance here.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaurus Metals Limited focuses on the exploration and evaluation of mineral resource properties in Brazil, with a market cap of A$186.26 million.

Operations: Centaurus Metals Limited does not report any revenue segments.

Market Cap: A$186.26M

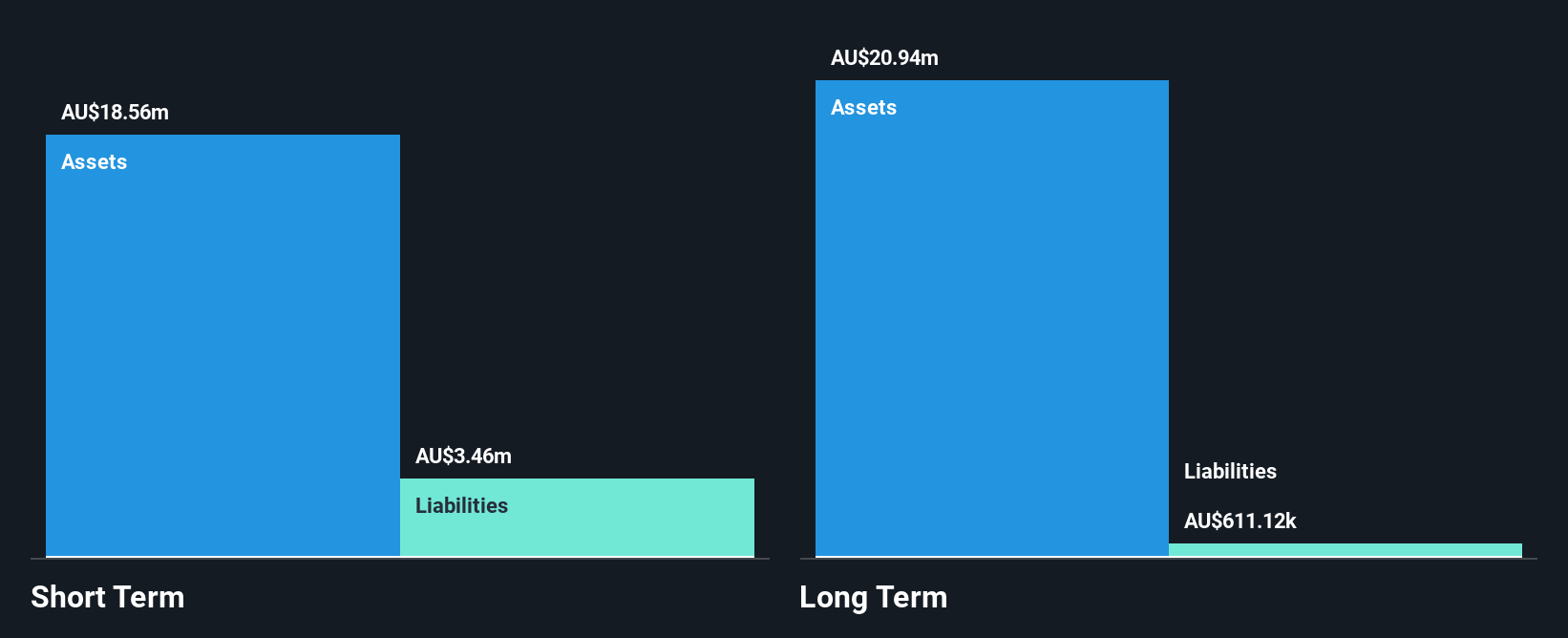

Centaurus Metals, with a market cap of A$186.26 million, is pre-revenue and debt-free, highlighting its conservative financial approach. The company’s short-term assets of A$18.6 million comfortably cover both short-term liabilities (A$3.5M) and long-term liabilities (A$611.1K), reflecting a solid balance sheet despite its unprofitability and increasing losses over the past five years at 26.3% annually. The seasoned board and management team have average tenures of 11.8 and 5.7 years respectively, providing experienced leadership during this growth phase where it maintains more than a year’s cash runway based on current free cash flow stability without significant shareholder dilution recently.

- Dive into the specifics of Centaurus Metals here with our thorough balance sheet health report.

- Gain insights into Centaurus Metals' outlook and expected performance with our report on the company's earnings estimates.

Core Lithium (ASX:CXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Core Lithium Ltd develops lithium and various metal deposits in Northern Territory and South Australia, with a market cap of A$257.16 million.

Operations: The company's revenue is derived from its Finniss Lithium Project, which generated A$52.28 million.

Market Cap: A$257.16M

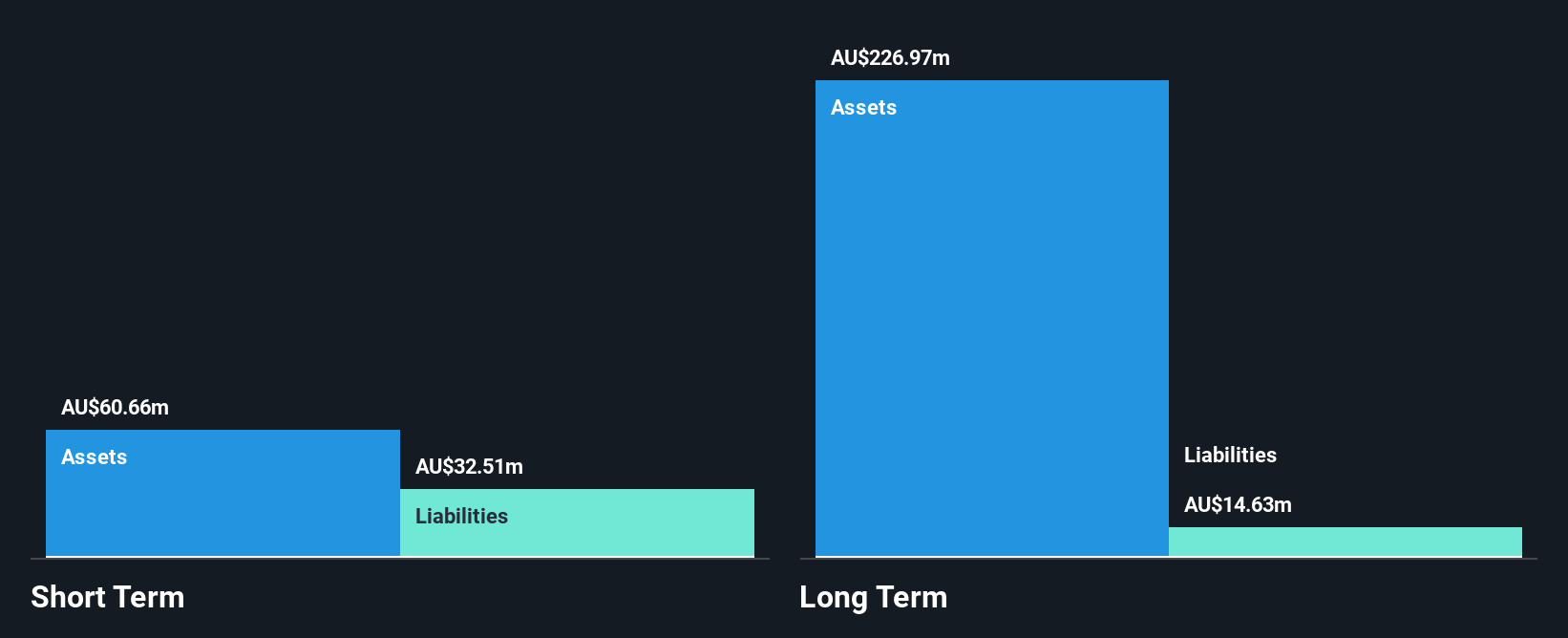

Core Lithium, with a market cap of A$257.16 million, is navigating the penny stock landscape with its Finniss Lithium Project generating A$52.28 million in revenue. Despite high volatility and unprofitability, the company maintains a debt-free status and has not diluted shareholders recently. Short-term assets of A$60.7 million cover both short-term (A$32.5M) and long-term liabilities (A$14.6M), indicating financial prudence despite less than a year’s cash runway if free cash flow continues to decline at historical rates. The board's experience contrasts with an inexperienced management team during this challenging growth phase where revenue is forecasted to grow significantly annually.

- Navigate through the intricacies of Core Lithium with our comprehensive balance sheet health report here.

- Learn about Core Lithium's future growth trajectory here.

Summing It All Up

- Investigate our full lineup of 461 ASX Penny Stocks right here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CXO

Core Lithium

Engages in the development of lithium and various metal deposits in Northern Territory and South Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives