- Australia

- /

- Metals and Mining

- /

- ASX:CMM

ASX Value Picks Including Capricorn Metals And Two Others Below Estimated Worth

Reviewed by Simply Wall St

In a session marked by cautious investor sentiment, the ASX closed slightly down as market participants awaited the latest CPI data and monitored geopolitical developments. Amid these conditions, identifying undervalued stocks can be advantageous, particularly those with strong fundamentals that may benefit from broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.11 | A$5.66 | 45.1% |

| Resimac Group (ASX:RMC) | A$1.175 | A$2.16 | 45.7% |

| NRW Holdings (ASX:NWH) | A$4.75 | A$9.12 | 47.9% |

| Liontown Resources (ASX:LTR) | A$1.055 | A$2.07 | 49.1% |

| James Hardie Industries (ASX:JHX) | A$34.15 | A$60.89 | 43.9% |

| Immutep (ASX:IMM) | A$0.285 | A$0.48 | 41.2% |

| Credit Clear (ASX:CCR) | A$0.29 | A$0.47 | 38.1% |

| CleanSpace Holdings (ASX:CSX) | A$0.715 | A$1.38 | 48.2% |

| Betmakers Technology Group (ASX:BET) | A$0.18 | A$0.32 | 43.3% |

| Airtasker (ASX:ART) | A$0.37 | A$0.71 | 48.1% |

Let's uncover some gems from our specialized screener.

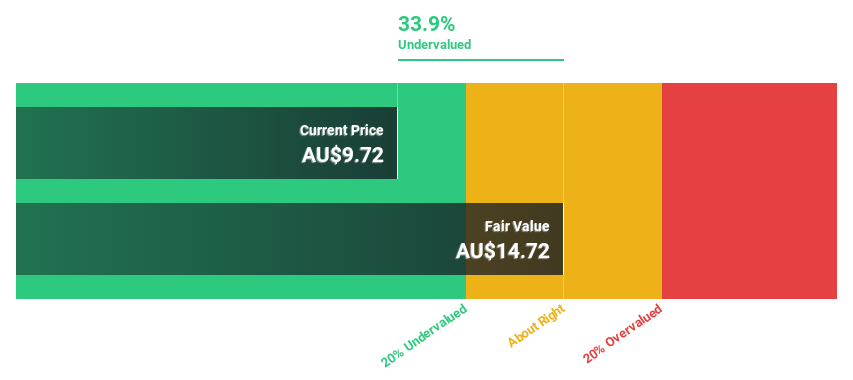

Capricorn Metals (ASX:CMM)

Overview: Capricorn Metals Ltd, with a market cap of A$5.22 billion, explores, develops, evaluates, and produces gold in Australia through its subsidiaries.

Operations: The company's revenue primarily comes from its Karlawinda segment, generating A$505.89 million.

Estimated Discount To Fair Value: 19.6%

Capricorn Metals is trading at A$12.1, below its estimated fair value of A$15.05, suggesting potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow significantly faster than the Australian market over the next three years, with expected annual earnings growth of 25.4% and revenue growth of 24.3%. Recent earnings results showed strong performance with sales reaching A$505.89 million and net income increasing to A$150.28 million from the previous year.

- The analysis detailed in our Capricorn Metals growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Capricorn Metals stock in this financial health report.

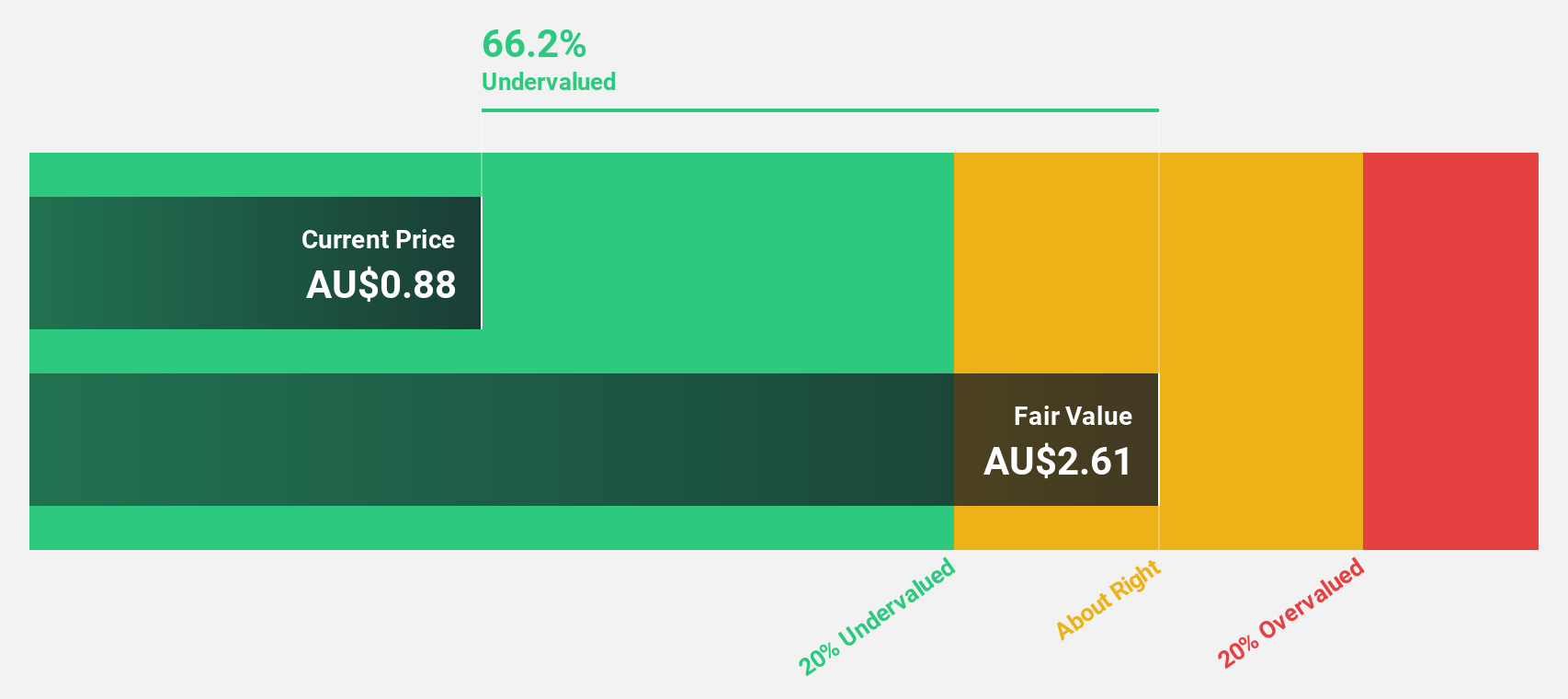

Resimac Group (ASX:RMC)

Overview: Resimac Group Limited operates in Australia and New Zealand, offering residential mortgage and asset finance lending products, with a market cap of A$464.49 million.

Operations: The company's revenue segments include Home Loan Lending at A$132.63 million, New Zealand Lending at A$3.03 million, and Asset Finance Lending at A$27.93 million.

Estimated Discount To Fair Value: 45.7%

Resimac Group is trading at A$1.18, significantly below its estimated fair value of A$2.16, highlighting potential undervaluation based on cash flows. The company projects robust revenue growth of 32.6% annually over the next three years, outpacing the Australian market's 7.8%. However, its dividend yield of 5.96% is not well covered by free cash flows and debt coverage by operating cash flow remains inadequate despite a recent share buyback worth A$4.07 million.

- Our growth report here indicates Resimac Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Resimac Group's balance sheet health report.

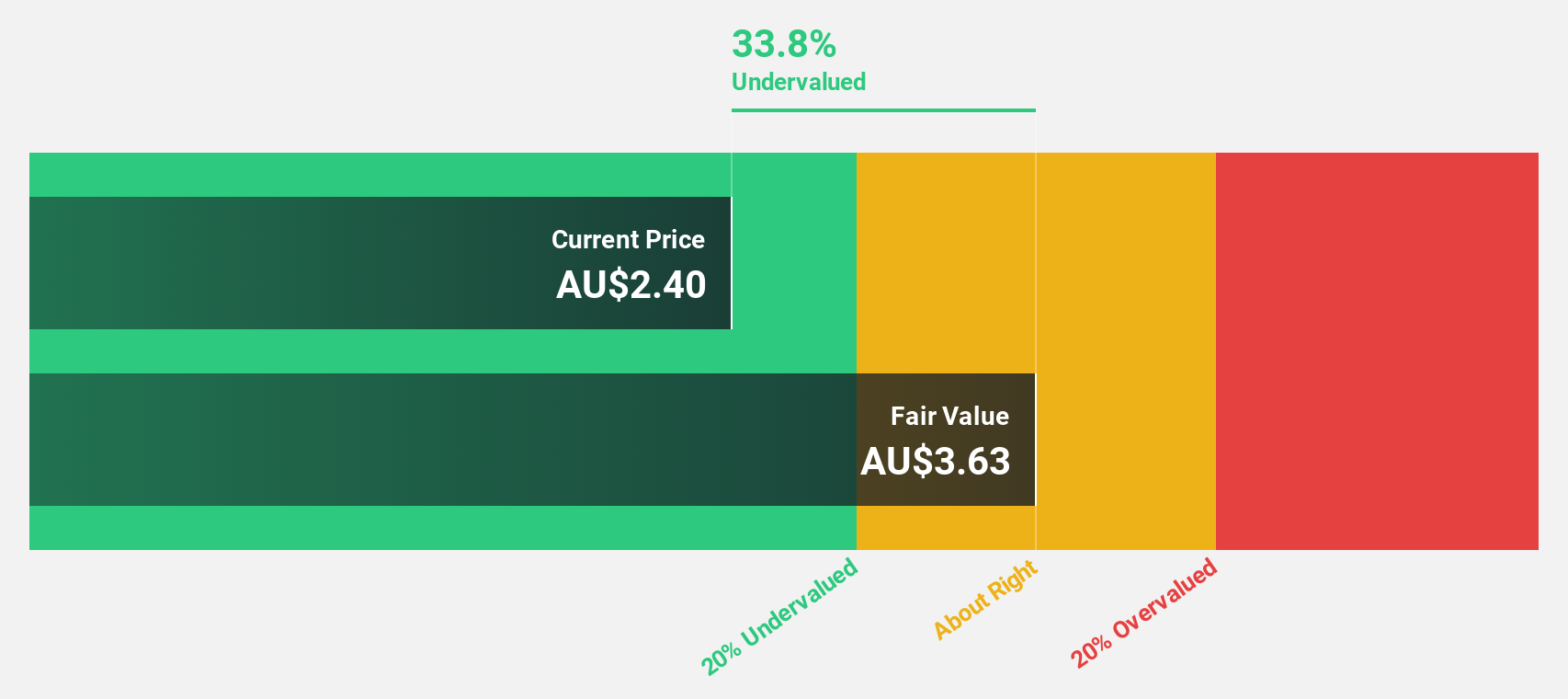

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.13 billion.

Operations: The company generates revenue of A$245.45 million from its investment management services.

Estimated Discount To Fair Value: 36.8%

Regal Partners is trading at A$3.08, well below its estimated fair value of A$4.87, suggesting undervaluation based on cash flows. Despite this, net profit margins have declined from 28.1% to 17.2% over the past year, and significant insider selling has occurred recently. Revenue growth is forecasted at 15.9% annually, outpacing the market's 7.8%, while earnings are expected to grow significantly by 31.5% per year despite a reduced dividend yield of 5.19%.

- Our expertly prepared growth report on Regal Partners implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Regal Partners here with our thorough financial health report.

Seize The Opportunity

- Embark on your investment journey to our 30 Undervalued ASX Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Explores, develops, evaluates, and produces gold in Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)