- Australia

- /

- Metals and Mining

- /

- ASX:CIA

3 Undervalued Asian Small Caps With Insider Buying To Watch

Reviewed by Simply Wall St

In the current economic landscape, Asian markets are experiencing a wave of cautious optimism amid ongoing trade policy uncertainties and inflation concerns. As investors navigate these turbulent waters, small-cap stocks with strong fundamentals and insider buying may present intriguing opportunities for those looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.8x | 1.1x | 35.34% | ★★★★★★ |

| New Hope | 5.4x | 1.6x | 29.51% | ★★★★★★ |

| Atturra | 26.7x | 1.1x | 41.79% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 21.85% | ★★★★★☆ |

| Puregold Price Club | 8.6x | 0.4x | 18.82% | ★★★★☆☆ |

| Hansen Technologies | 294.5x | 2.8x | 26.22% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.8x | 34.94% | ★★★★☆☆ |

| Integral Diagnostics | 147.7x | 1.7x | 43.15% | ★★★☆☆☆ |

| Zip Co | NA | 2.0x | -58.26% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 41.94% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

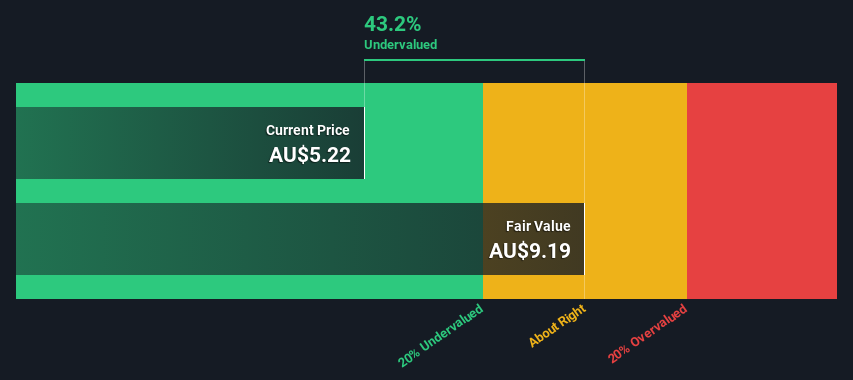

Adriatic Metals (ASX:ADT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Adriatic Metals is a mining company focused on the exploration and development of precious metals, with operations primarily in gold and other precious metals, and a market capitalization of approximately $1.19 billion AUD.

Operations: Adriatic Metals' primary revenue stream is from the Metals & Mining sector, specifically in gold and other precious metals, with a reported revenue of $27.59 million for the latest period. The company has experienced fluctuating gross profit margins, most recently recorded at 0.04%. Operating expenses are significant, with general and administrative expenses reaching $43.03 million in the latest period.

PE: -14.9x

Adriatic Metals, a company with significant mineral assets in Bosnia and Herzegovina, has seen insider confidence with recent share purchases. The company's updated Mineral Resource and Ore Reserve Estimates for the Rupice Deposit were completed by AMC Consultants, indicating strong resource potential despite a net loss of US$62.49 million in 2024. Production is ramping up, evidenced by a 43% increase in ore milled from Q4 2024 to Q1 2025. Future growth prospects are promising with expected production increases throughout 2025 and 2026.

- Click to explore a detailed breakdown of our findings in Adriatic Metals' valuation report.

Evaluate Adriatic Metals' historical performance by accessing our past performance report.

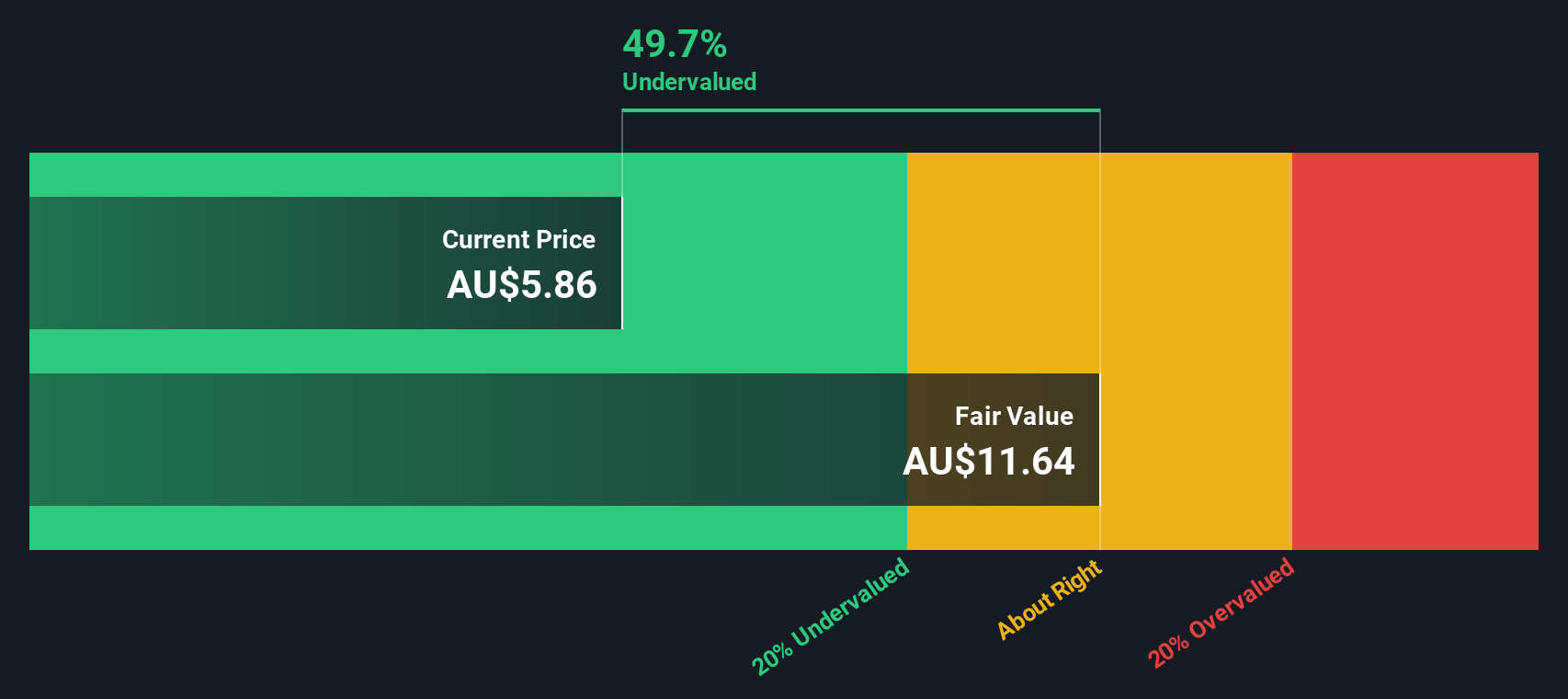

Champion Iron (ASX:CIA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Champion Iron is a mining company focused on the production and development of high-grade iron ore concentrate, with a market cap of approximately CA$3.5 billion.

Operations: The company generates revenue primarily from iron ore concentrate, with recent figures showing CA$1.51 billion. It has experienced fluctuations in its gross profit margin, which was 32.94% as of the latest period. Operating expenses include general and administrative costs, depreciation and amortization, and research and development expenses.

PE: 16.4x

Champion Iron, a smaller player in Asia's market, showcases potential despite recent challenges. Sales dropped to C$363 million in Q3 2024 from C$507 million the previous year, with net income also declining significantly. However, insider confidence is evident through share purchases over the past year. While profit margins have narrowed to 8.5% from 17.9%, earnings are projected to grow annually by 18.6%. The company's reliance on external borrowing poses higher risk but offers growth opportunities if managed well.

- Click here and access our complete valuation analysis report to understand the dynamics of Champion Iron.

Gain insights into Champion Iron's historical performance by reviewing our past performance report.

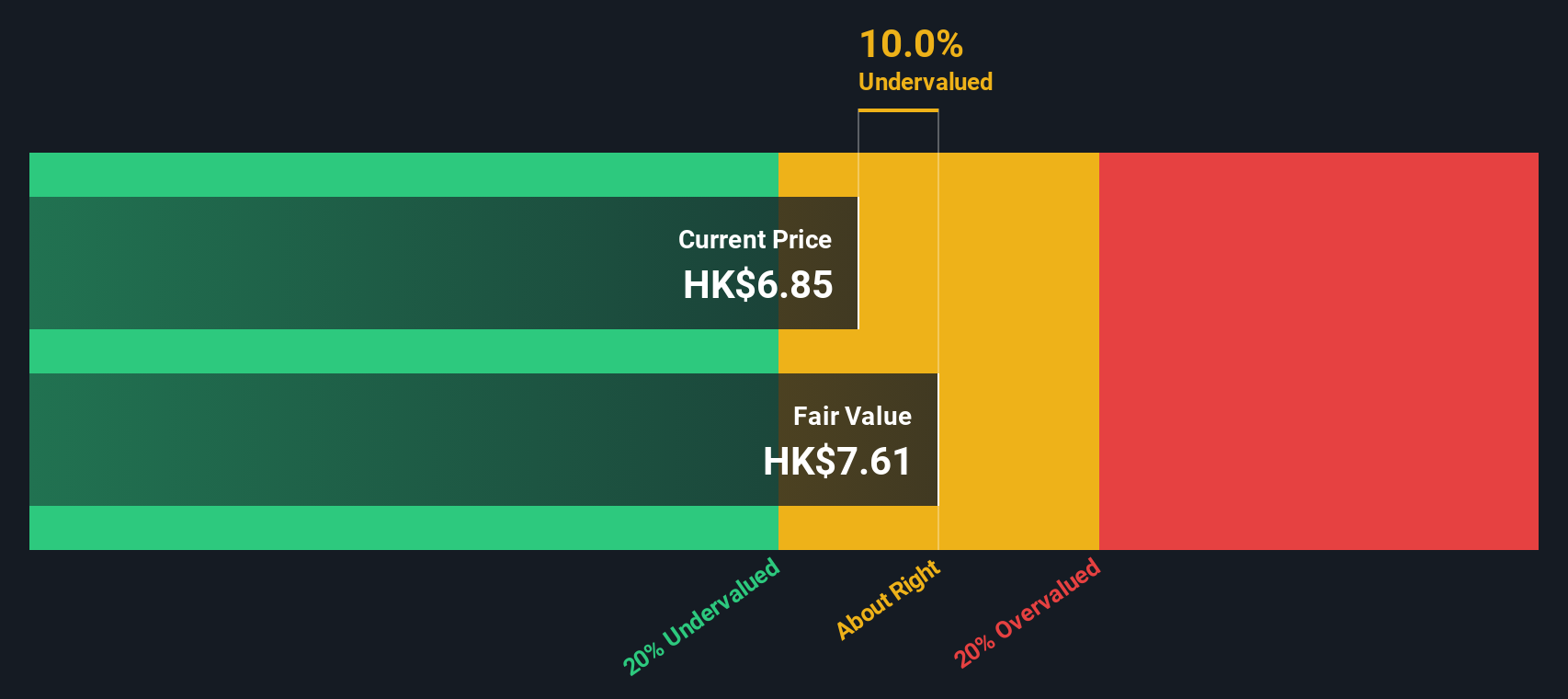

Nissin Foods (SEHK:1475)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nissin Foods is a company engaged in the production and sale of instant noodles and related products, with operations primarily in Mainland China and Hong Kong, boasting a market capitalization of HK$7.51 billion.

Operations: Mainland China and Hong Kong and Other Asia are key revenue segments contributing HK$2.50 billion and HK$1.72 billion, respectively. The gross profit margin shows a notable trend, peaking at 34.43% in late 2024, indicating efficient cost management relative to revenue generation over time.

PE: 30.5x

Nissin Foods, a smaller player in the Asian market, recently entered into a Master Supply Agreement with Nissin Australia, effective from March 2025 to December 2027. This partnership aims to boost sales channels for instant noodles and snacks in Australia and New Zealand. Despite a dip in net income to HK$200.99 million from HK$330.17 million last year due to asset impairments, insider confidence is evident through recent share purchases. A special dividend of HKD 0.0619 per share was announced alongside reduced ordinary dividends for 2024, reflecting cautious financial management amidst fluctuating earnings results.

- Dive into the specifics of Nissin Foods here with our thorough valuation report.

Explore historical data to track Nissin Foods' performance over time in our Past section.

Next Steps

- Access the full spectrum of 55 Undervalued Asian Small Caps With Insider Buying by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Champion Iron, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CIA

Champion Iron

Engages in the acquisition, exploration, development, and production of iron ore deposits in Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives