- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Chalice Mining Leads The Charge On ASX With 2 Other Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it is up 20% over the past year with earnings expected to grow by 12% per annum in the coming years. For investors willing to explore beyond well-known companies, penny stocks—often representing smaller or newer firms—can offer intriguing opportunities. Although considered an outdated term, these stocks can still provide surprising value and resilience; this article will focus on three such stocks that combine financial strength with potential growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$303.87M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$838.04M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.82B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$114.45M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market cap of A$661.35 million.

Operations: Chalice Mining Limited does not report any revenue segments.

Market Cap: A$661.35M

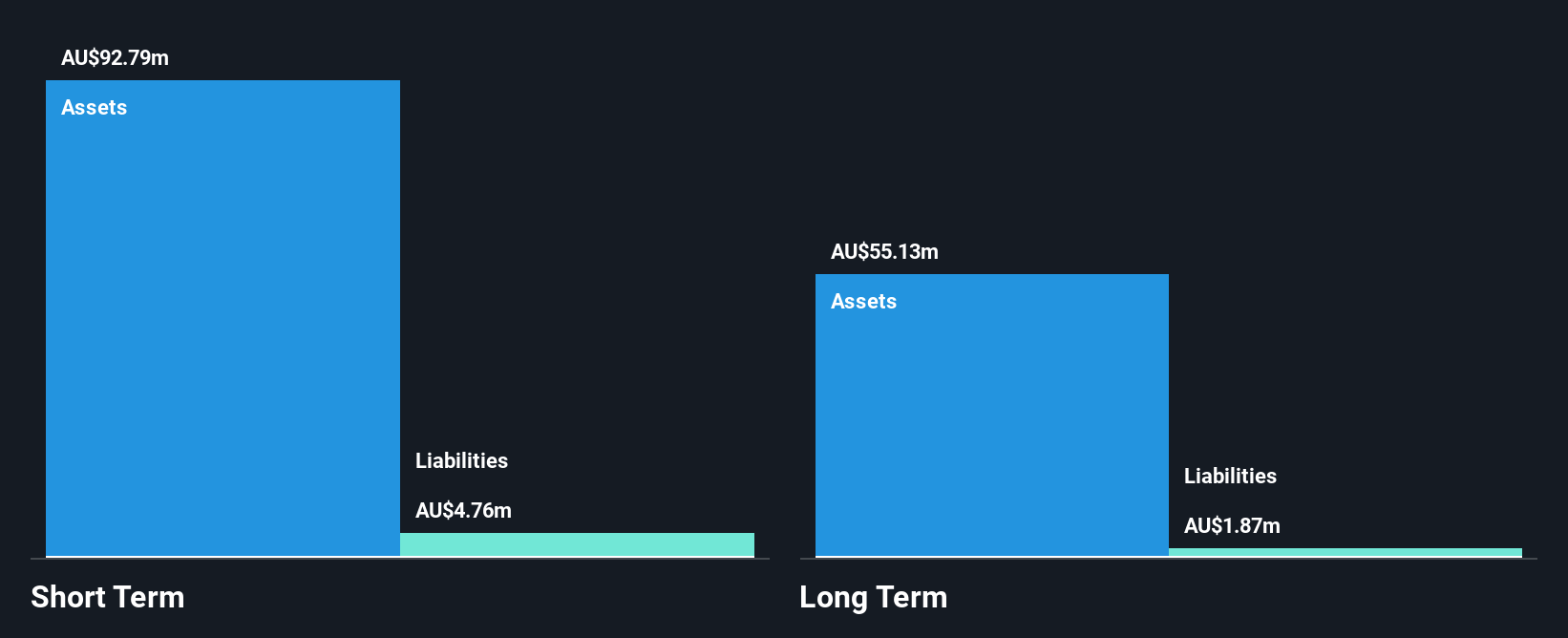

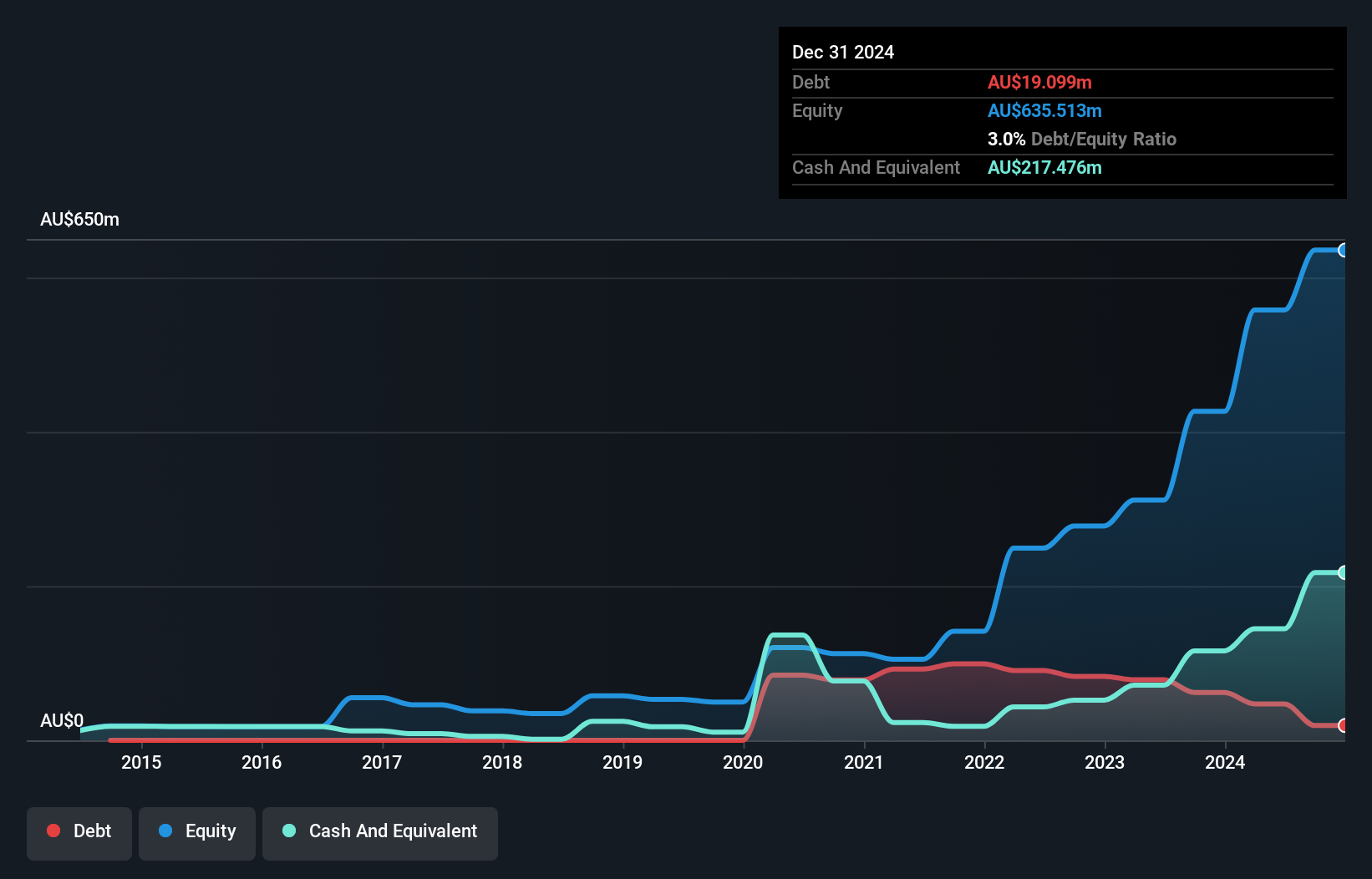

Chalice Mining Limited, with a market cap of A$661.35 million, is pre-revenue and unprofitable, reporting a net loss of A$39.5 million for the year ended June 30, 2024. Despite these challenges, the company has no debt and maintains sufficient cash runway for over three years if current cash flow trends continue. Recent strategic adjustments include reducing board size and corporate overheads to adapt to the metals price environment. The management team is experienced with an average tenure of 3.8 years, and short-term assets significantly exceed both short- and long-term liabilities.

- Click here and access our complete financial health analysis report to understand the dynamics of Chalice Mining.

- Gain insights into Chalice Mining's future direction by reviewing our growth report.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.76 billion.

Operations: The company generates revenue primarily from its mine operations, amounting to A$366.04 million.

Market Cap: A$2.76B

Emerald Resources, with a market cap of A$2.76 billion, has demonstrated stable weekly volatility and experienced management with an average tenure of 8.1 years. The company reported full-year sales of A$371.07 million and net income of A$84.27 million, reflecting improved profit margins from the previous year. Although shareholders faced dilution with shares outstanding increasing by 5.7%, Emerald's debt is well covered by operating cash flow, and its short-term assets exceed liabilities significantly. Recent board changes include the retirement of long-serving non-executive director Simon Lee AO, marking a transition in leadership after his impactful tenure since 2014.

- Dive into the specifics of Emerald Resources here with our thorough balance sheet health report.

- Gain insights into Emerald Resources' outlook and expected performance with our report on the company's earnings estimates.

Nickel Industries (ASX:NIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market capitalization of A$3.97 billion.

Operations: The company generates revenue from its Nickel Ore Mining operations in Indonesia, amounting to $48.97 million, and its RKEF Projects in Indonesia and Singapore, contributing $1.66 billion.

Market Cap: A$3.97B

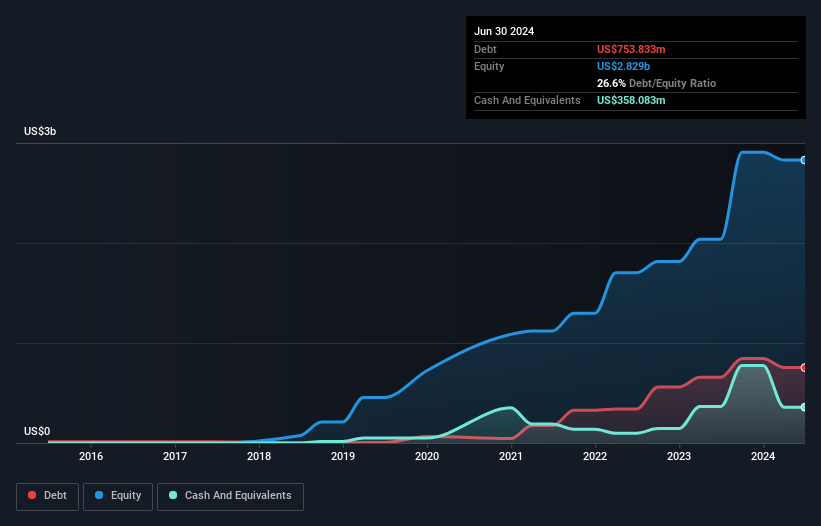

Nickel Industries Limited, with a market cap of A$3.97 billion, has shown stable weekly volatility and experienced management with an average tenure of 3.4 years. Despite low return on equity at 5%, the company maintains strong short-term asset coverage over liabilities and well-covered interest payments by EBIT. Earnings have grown modestly by 6.3% over the past year, outpacing industry growth. Recent developments include acquiring a 51% stake in the Siduarsi Project in Indonesia, indicating potential for future resource expansion pending further exploration results and feasibility study approval for increased ownership to up to 100%.

- Unlock comprehensive insights into our analysis of Nickel Industries stock in this financial health report.

- Review our growth performance report to gain insights into Nickel Industries' future.

Seize The Opportunity

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,023 more companies for you to explore.Click here to unveil our expertly curated list of 1,026 ASX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives