- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Here's Why I Think Bisalloy Steel Group (ASX:BIS) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Bisalloy Steel Group (ASX:BIS). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Bisalloy Steel Group

Bisalloy Steel Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Bisalloy Steel Group has grown EPS by 33% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

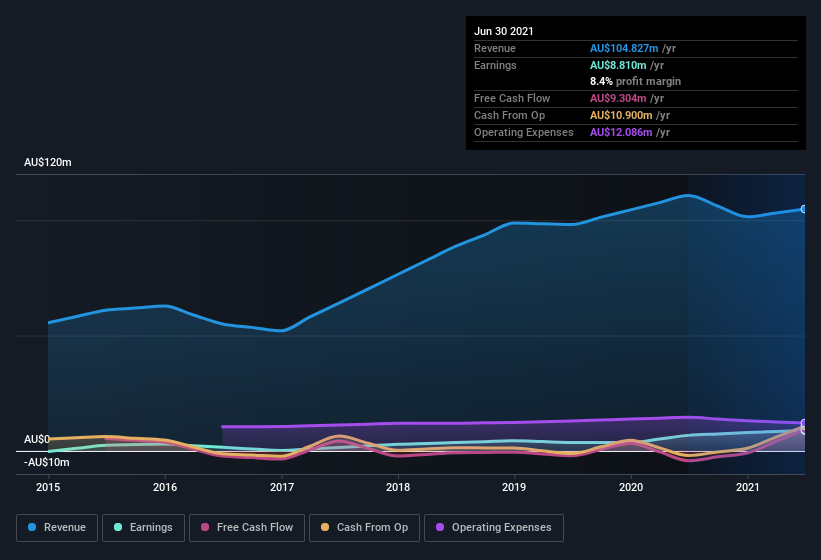

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Bisalloy Steel Group's EBIT margins have actually improved by 2.6 percentage points in the last year, to reach 11%, but, on the flip side, revenue was down 5.3%. That's not ideal.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Bisalloy Steel Group is no giant, with a market capitalization of AU$88m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Bisalloy Steel Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's worth noting that there was some insider selling of Bisalloy Steel Group shares last year, worth -AU$9.2k. But this is outweighed by the Non-Executive Director Ian Greenyer who spent AU$92k buying shares, at an average price of around around AU$0.92.

Along with the insider buying, another encouraging sign for Bisalloy Steel Group is that insiders, as a group, have a considerable shareholding. Indeed, they hold AU$21m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 24% of the company; visible skin in the game.

Is Bisalloy Steel Group Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Bisalloy Steel Group's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Even so, be aware that Bisalloy Steel Group is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bisalloy Steel Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives