- Australia

- /

- Metals and Mining

- /

- ASX:CTM

3 Promising ASX Penny Stocks With Market Caps Under A$300M

Reviewed by Simply Wall St

The Australian stock market recently experienced a downturn, with the ASX200 closing down 0.83% at 8,180 points, as investors reacted to inflation figures and anticipated decisions from the Reserve Bank of Australia. Despite these broader market challenges, opportunities for growth remain, particularly in niche areas like penny stocks. Although the term "penny stock" might seem outdated, it still represents an investment area full of potential surprises and opportunities for those willing to explore smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$72.68M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$145.87M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.745 | A$285.11M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$331.78M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$847.84M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.145 | A$61M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.50 | A$151.04M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.22 | A$124.18M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$151.38 million.

Operations: The company generates revenue from several regions, with A$111.84 million from Australia, A$24.41 million from Indonesia, A$5.68 million from Thailand, and A$10.93 million from other foreign countries.

Market Cap: A$151.38M

Bisalloy Steel Group has demonstrated financial stability and growth, with a market cap of A$151.38 million and annual sales of A$152.86 million. The company has improved its net profit margin to 10.3% from 8.4% last year, showcasing strong earnings growth that surpasses the industry average. Its debt is well-covered by operating cash flow and interest payments are secure with EBIT coverage at 29.5 times, while short-term assets comfortably cover liabilities. Despite an unstable dividend track record, Bisalloy's reduced debt-to-equity ratio to 1% over five years reflects prudent financial management amidst stable volatility levels.

- Take a closer look at Bisalloy Steel Group's potential here in our financial health report.

- Learn about Bisalloy Steel Group's historical performance here.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaurus Metals Limited is involved in the exploration and evaluation of mineral resource properties in Brazil, with a market capitalization of A$228.48 million.

Operations: Centaurus Metals Limited does not report any specific revenue segments.

Market Cap: A$228.48M

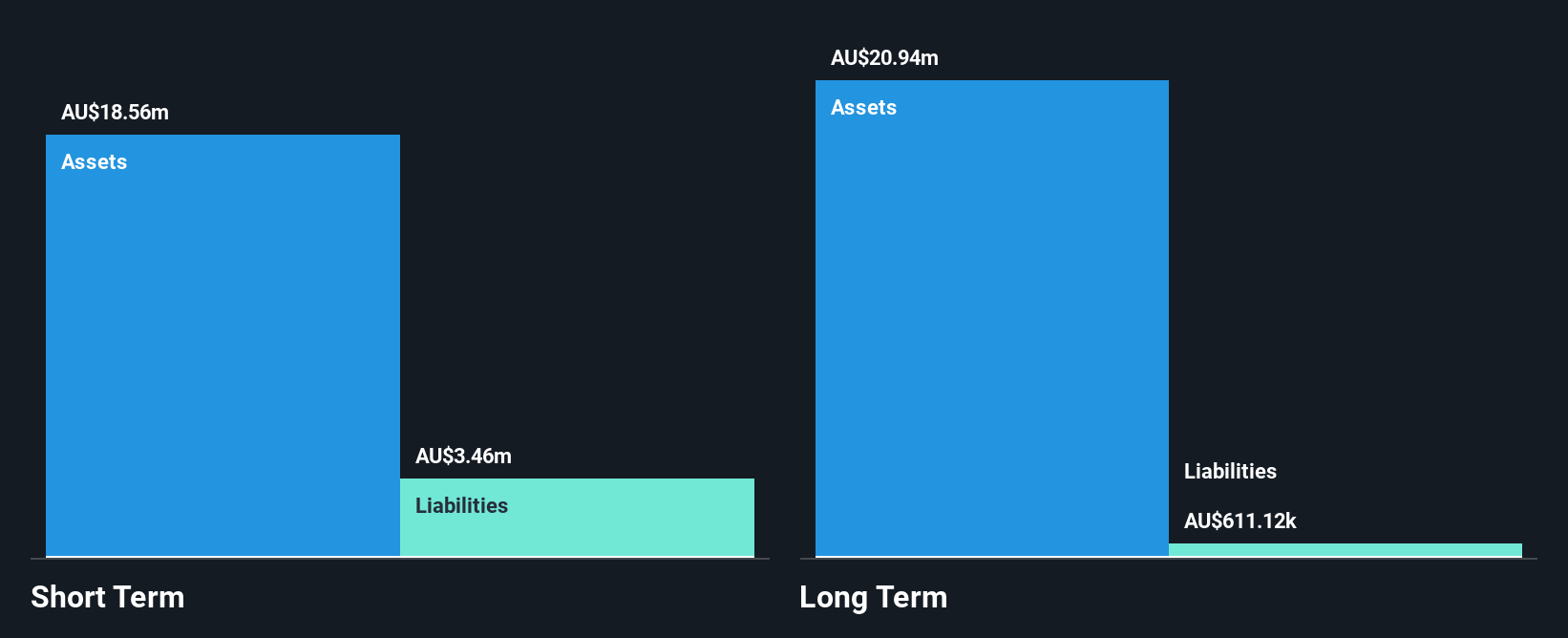

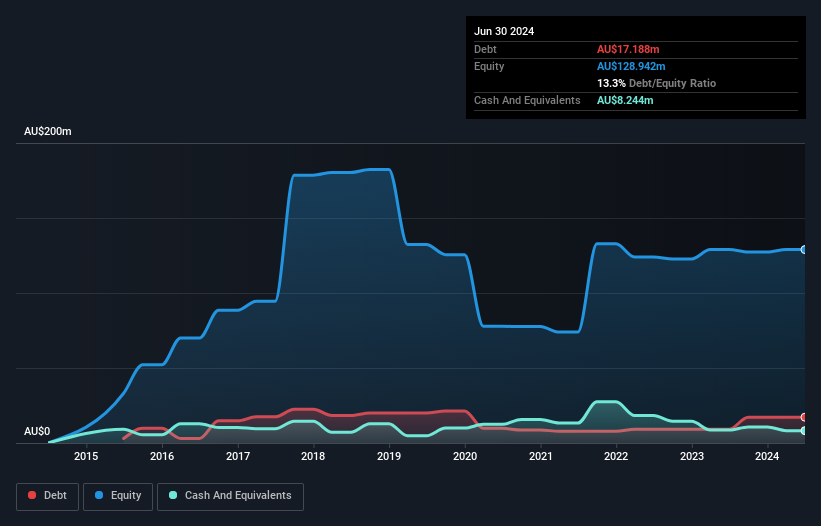

Centaurus Metals Limited, with a market cap of A$228.48 million, operates in the mineral exploration sector and remains pre-revenue. The company has no debt and short-term assets of A$27.8 million comfortably cover both short-term (A$3.5 million) and long-term liabilities (A$670.8K). Despite an experienced management team and board, Centaurus is currently unprofitable with a negative return on equity of -56.73% and has seen losses increase by 39% annually over five years. Recent exclusion from the S&P Global BMI Index highlights its volatility, while cash runway concerns persist due to limited free cash flow sustainability.

- Unlock comprehensive insights into our analysis of Centaurus Metals stock in this financial health report.

- Assess Centaurus Metals' future earnings estimates with our detailed growth reports.

Experience Co (ASX:EXP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Experience Co Limited operates in the adventure tourism and leisure industry across Australia and New Zealand, with a market capitalization of A$94.68 million.

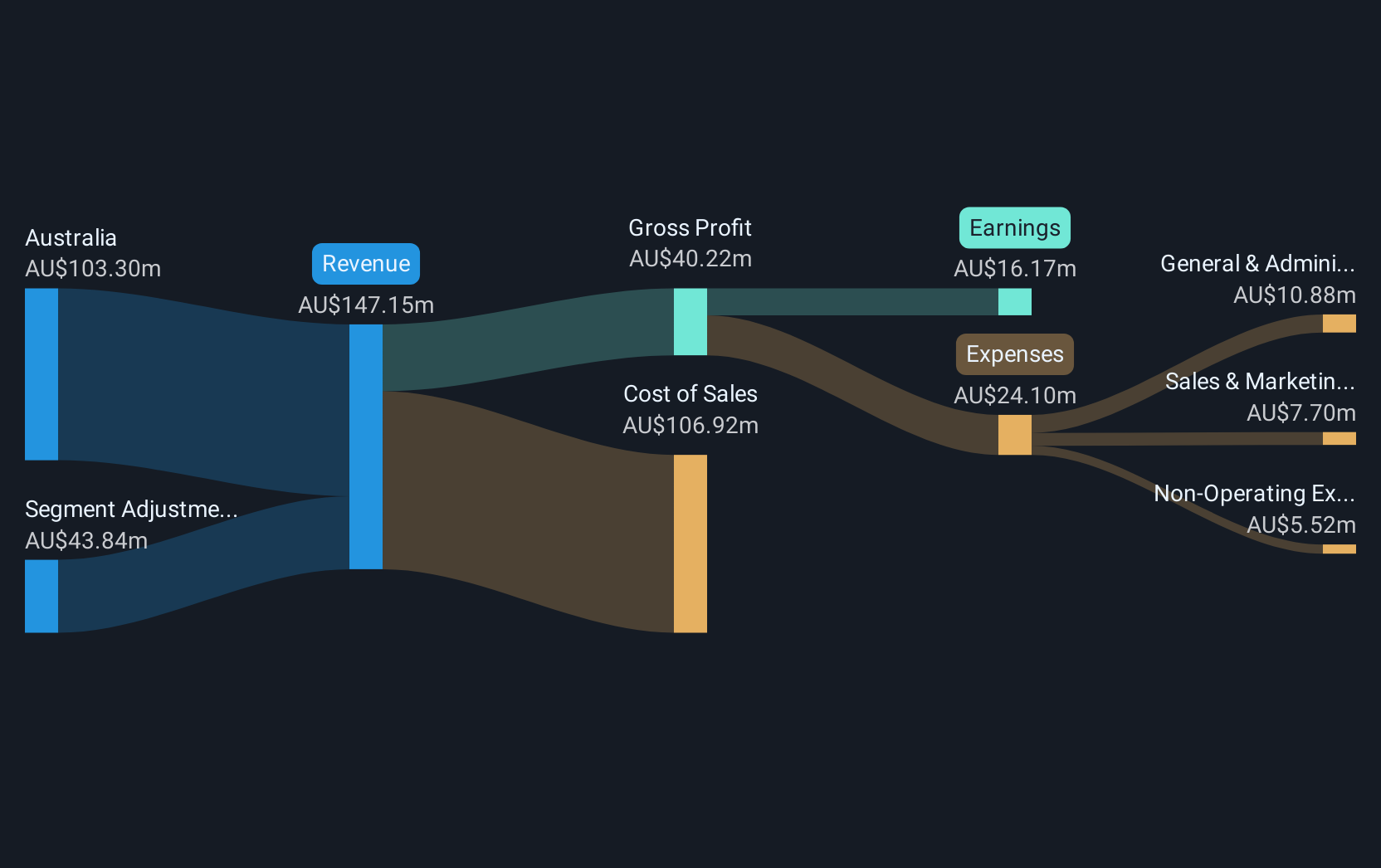

Operations: The company's revenue is primarily generated from its Skydiving segment, which contributes A$62.05 million, and Adventure Experiences segment, which brings in A$64.97 million.

Market Cap: A$94.68M

Experience Co Limited, with a market cap of A$94.68 million, operates in the adventure tourism sector and reported sales of A$127.04 million for the fiscal year ending June 2024, up from A$108.6 million the previous year. Despite being unprofitable with a net loss of A$0.071 million, it has reduced losses over five years by 27.3% annually and maintains a satisfactory net debt to equity ratio of 6.9%. The company has sufficient cash runway for more than three years despite short-term assets not covering liabilities and an inexperienced management team with an average tenure of 1.9 years.

- Click here to discover the nuances of Experience Co with our detailed analytical financial health report.

- Examine Experience Co's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Unlock our comprehensive list of 1,033 ASX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTM

Centaurus Metals

Engages in the exploration and evaluation of mineral resource properties Brazil.

Excellent balance sheet low.