As the Australian market experiences marginal fluctuations, with the ASX200 slightly down at 8,248 points and sectors like Information Technology and Real Estate showing positive momentum, investors are keenly observing dividend stocks for potential stability and income. In such a dynamic environment, selecting dividend stocks that demonstrate resilience in diverse sector performances can be an effective strategy for those seeking steady returns amidst market variability.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.45% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.54% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.59% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.80% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.64% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.24% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.88% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 4.94% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 9.09% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.50% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Collins Foods (ASX:CKF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$870.65 million.

Operations: Collins Foods Limited generates revenue through its restaurant operations, with A$54.38 million from Taco Bell Australia, A$313.47 million from KFC Restaurants Europe, and A$1.12 billion from KFC Restaurants Australia.

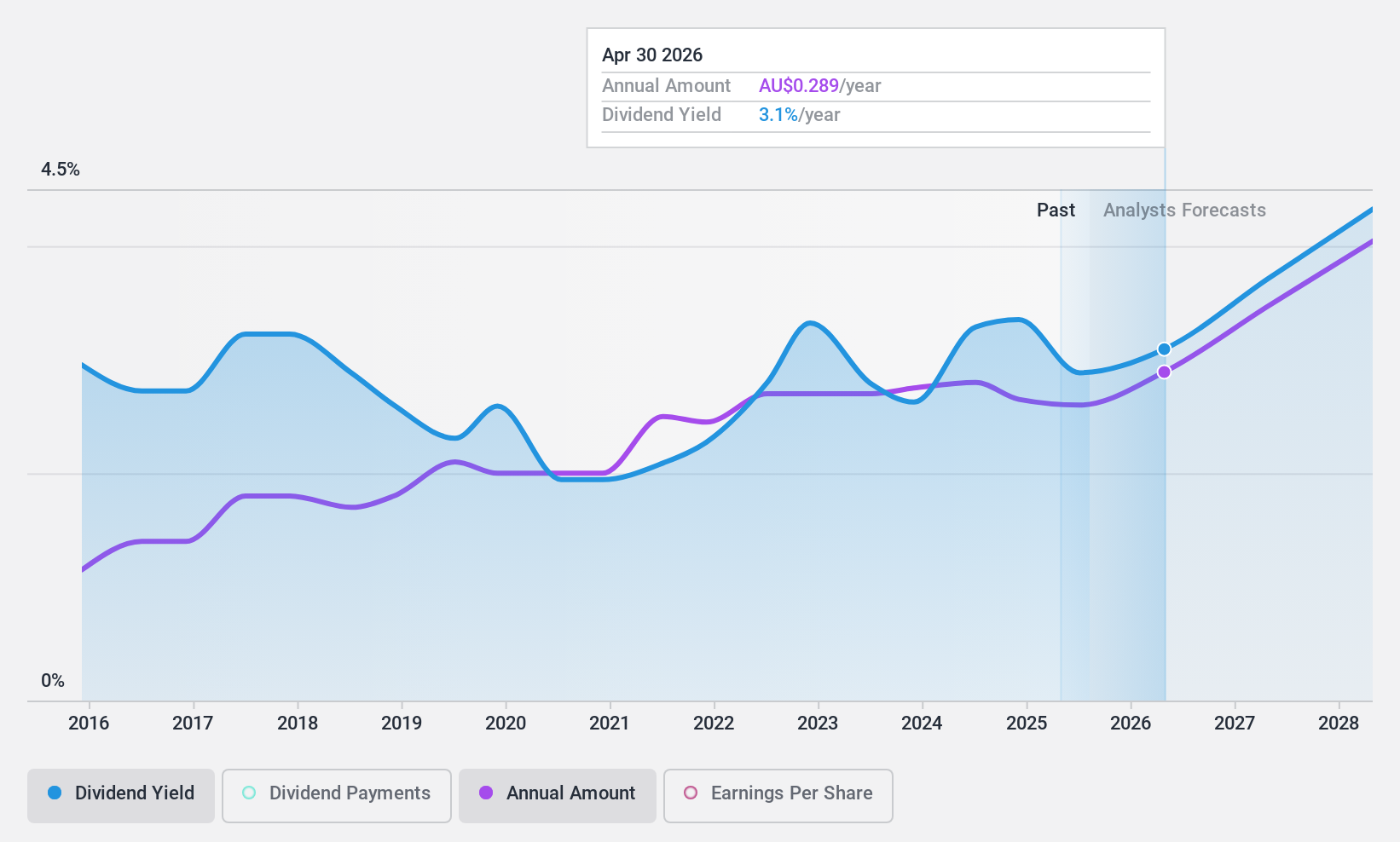

Dividend Yield: 3.6%

Collins Foods offers a stable dividend history, with payments reliably growing over the past decade. Despite a recent decrease to A$0.11 per share for the six months ended October 2024, dividends remain well-covered by earnings and cash flows, boasting payout ratios of 59.1% and 33.3%, respectively. The company trades below fair value estimates and peers, though its dividend yield of 3.59% is modest compared to top Australian payers.

- Click to explore a detailed breakdown of our findings in Collins Foods' dividend report.

- In light of our recent valuation report, it seems possible that Collins Foods is trading behind its estimated value.

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$29.64 billion.

Operations: QBE Insurance Group Limited generates revenue through its segments: International ($9.56 billion), North America ($7.71 billion), and Australia Pacific ($5.91 billion).

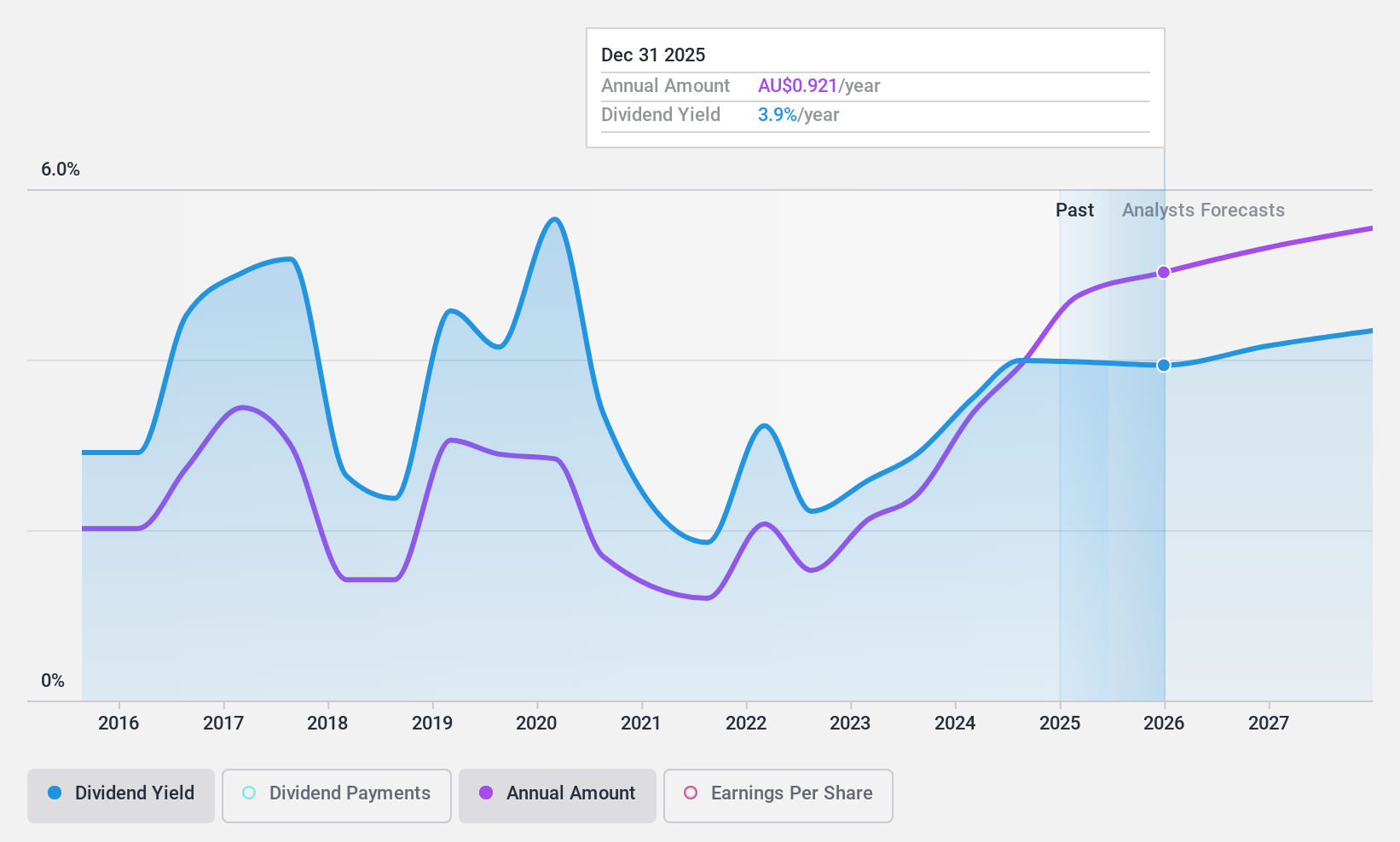

Dividend Yield: 3.6%

QBE Insurance Group's dividend payments have been volatile over the past decade, despite recent growth. While trading at 57.3% below estimated fair value, its dividends are well-covered by earnings and cash flows, with payout ratios of 42.9% and 19.3%, respectively. However, its dividend yield of 3.64% is lower than Australia's top payers' average of 6.13%. A recent A$45 million fixed-income offering may impact future financial stability and dividend reliability.

- Click here to discover the nuances of QBE Insurance Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of QBE Insurance Group shares in the market.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a rice food company with operations in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally; it has a market cap of A$722.32 million.

Operations: Ricegrowers Limited generates revenue through its segments: Riviana (A$228.15 million), Cop Rice (A$249.32 million), Rice Food (A$127.76 million), Rice Pool (A$477.65 million), Corporate Segment (A$41.03 million), and International Rice (A$892 million).

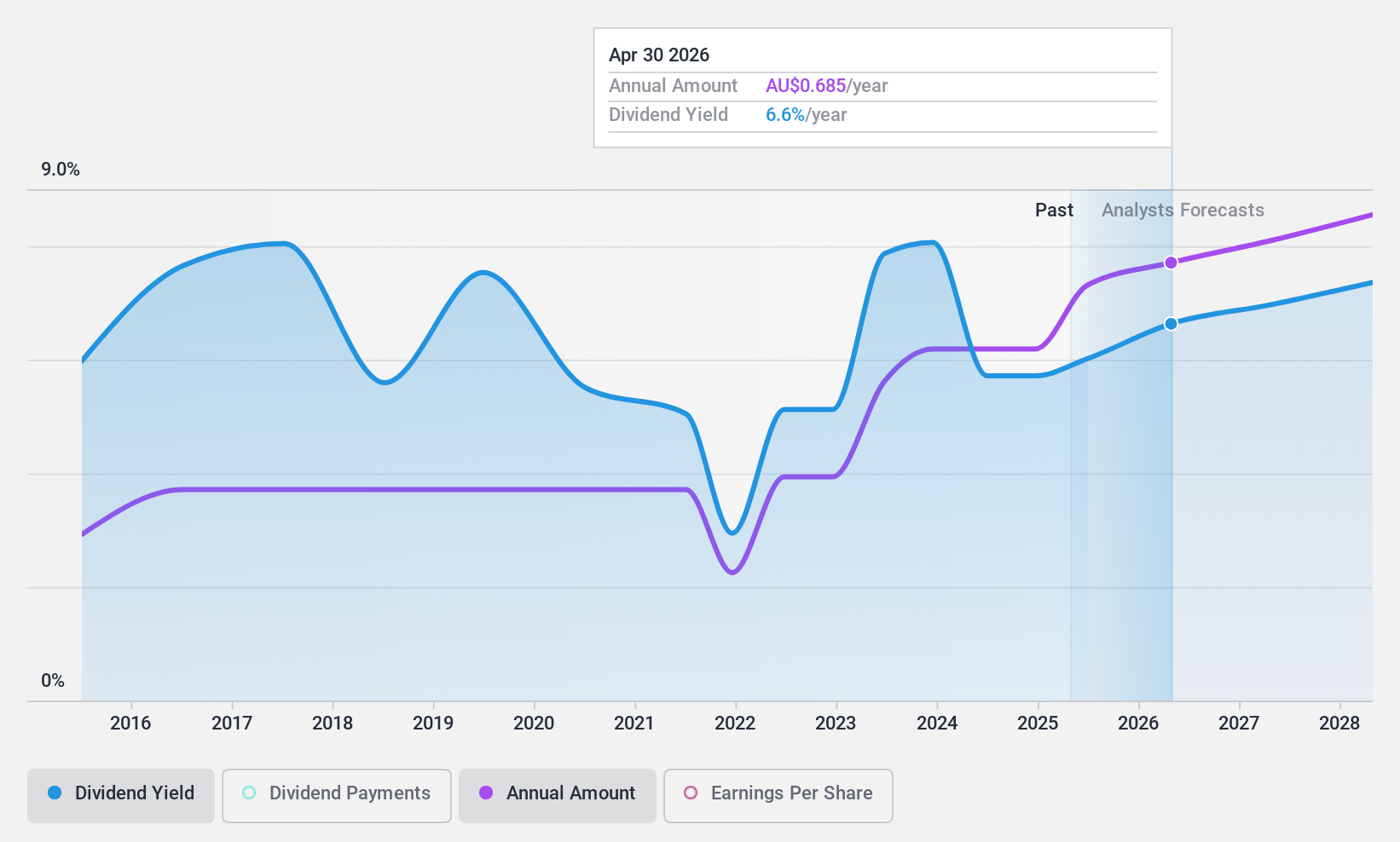

Dividend Yield: 4.9%

Ricegrowers Limited's dividend payments have been volatile over the past decade, though they are currently well-covered by earnings and cash flows, with payout ratios of 56.3% and 41%, respectively. The company recently declared a A$0.15 per share dividend for H1 2025. Despite trading at a significant discount to fair value, its dividend yield of 4.94% is below the top quartile in Australia, and revenue remained stable year-over-year at A$910.67 million for H1 FY25.

- Take a closer look at Ricegrowers' potential here in our dividend report.

- The valuation report we've compiled suggests that Ricegrowers' current price could be quite moderate.

Taking Advantage

- Investigate our full lineup of 31 Top ASX Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.