The Australian market has shown mixed performance, with the ASX200 slightly down and sectors like Information Technology and Real Estate leading gains. Penny stocks, though an old term, remain a relevant area for investors seeking growth opportunities at lower price points. By focusing on companies with strong balance sheets and solid fundamentals, these stocks can offer potential upside while minimizing some of the typical risks associated with this investment category.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$218.54M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.945 | A$109.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.13 | A$346.8M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$105.38M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.91 | A$484.45M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.10 | A$325.27M | ★★★★☆☆ |

Click here to see the full list of 1,051 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GTN Limited, along with its subsidiaries, operates broadcast media advertising platforms providing traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil with a market cap of A$116.61 million.

Operations: GTN generates its revenue primarily from advertising, amounting to A$184.23 million.

Market Cap: A$116.61M

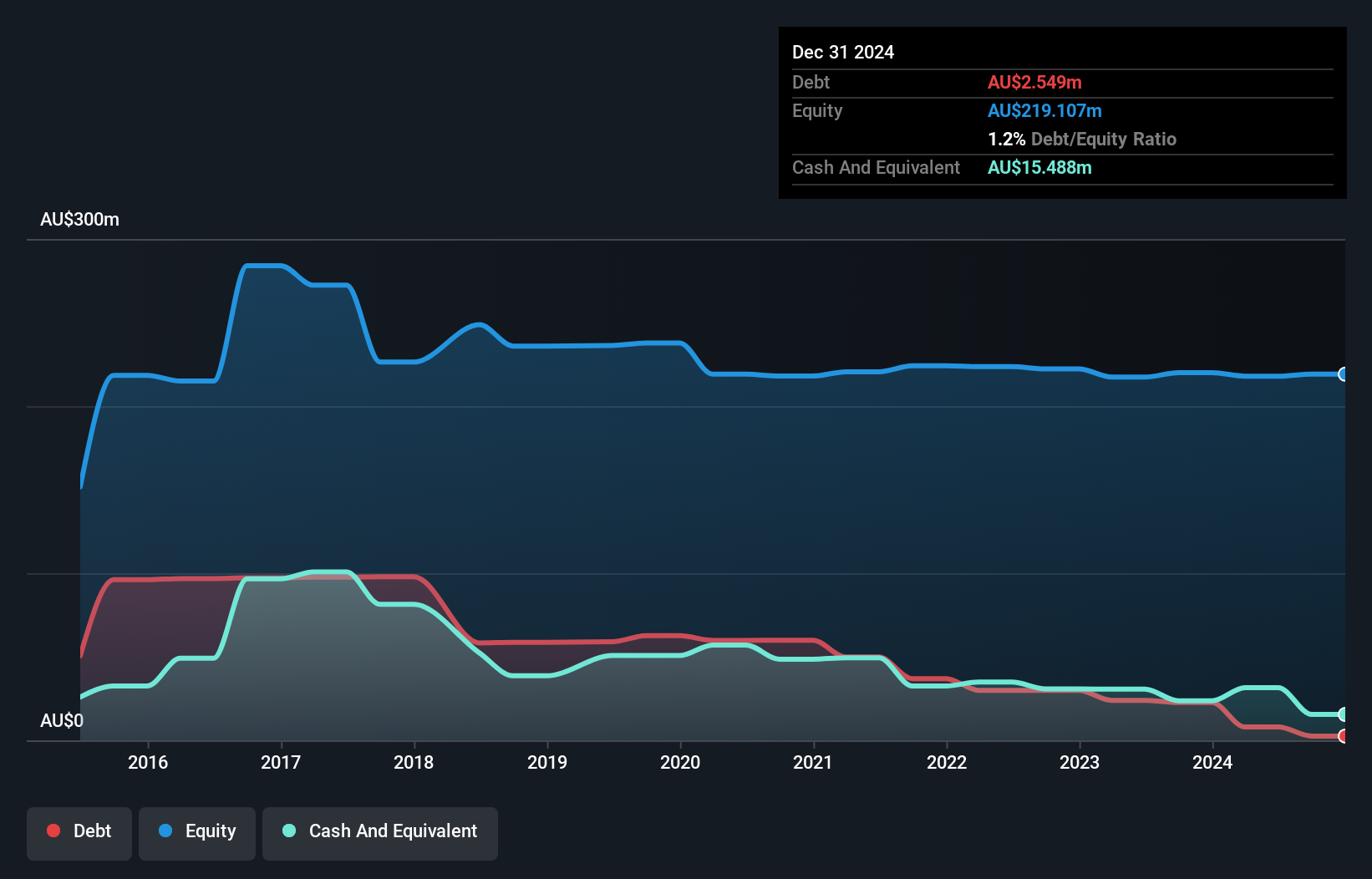

GTN Limited, with a market cap of A$116.61 million, has shown notable financial resilience as a penny stock. The company generates substantial revenue from advertising, amounting to A$184.23 million, and has improved its net profit margin from 1.5% to 3.1%. GTN's debt is well-covered by operating cash flow and short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Despite a decline in earnings over the past five years, recent growth of 114.9% suggests a positive turnaround. However, the management team and board are relatively new with limited tenure experience which may impact strategic stability moving forward.

- Click here to discover the nuances of GTN with our detailed analytical financial health report.

- Evaluate GTN's prospects by accessing our earnings growth report.

Kairos Minerals (ASX:KAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kairos Minerals Limited, with a market cap of A$36.83 million, is a resource exploration company operating in Australia through its subsidiaries.

Operations: No revenue segments are reported for this resource exploration company operating in Australia.

Market Cap: A$36.83M

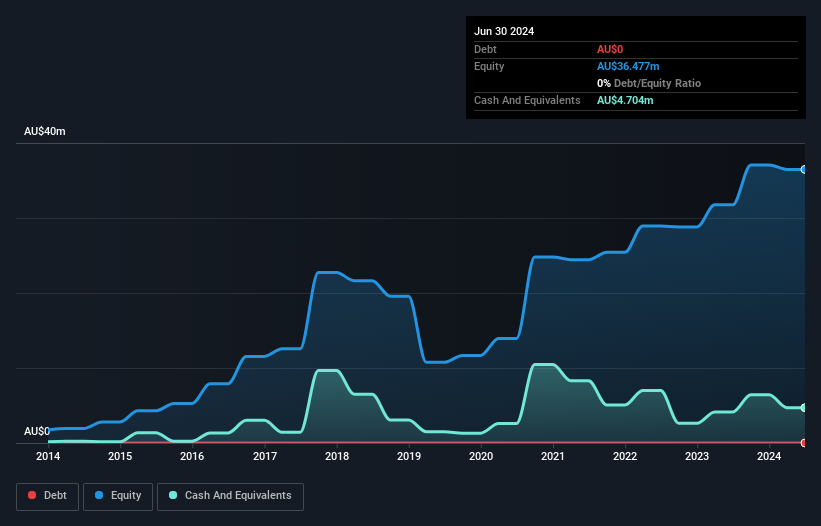

Kairos Minerals Limited, with a market cap of A$36.83 million, is pre-revenue and currently unprofitable but has been reducing its losses at 36% annually over the past five years. The company benefits from having no debt and its short-term assets (A$4.8M) comfortably cover both short- (A$378.7K) and long-term liabilities (A$77.6K). However, it faces challenges with less than a year of cash runway based on current free cash flow levels and experiences high share price volatility compared to most Australian stocks. The board's limited average tenure suggests potential strategic instability in leadership decisions.

- Navigate through the intricacies of Kairos Minerals with our comprehensive balance sheet health report here.

- Explore historical data to track Kairos Minerals' performance over time in our past results report.

Platinum Investment Management (ASX:PTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Platinum Investment Management Limited is a publicly owned hedge fund sponsor with a market cap of A$397.92 million.

Operations: The company's revenue is primarily derived from its Funds Management segment, which generated A$178.63 million, while Investments and Other contributed A$6.35 million.

Market Cap: A$397.92M

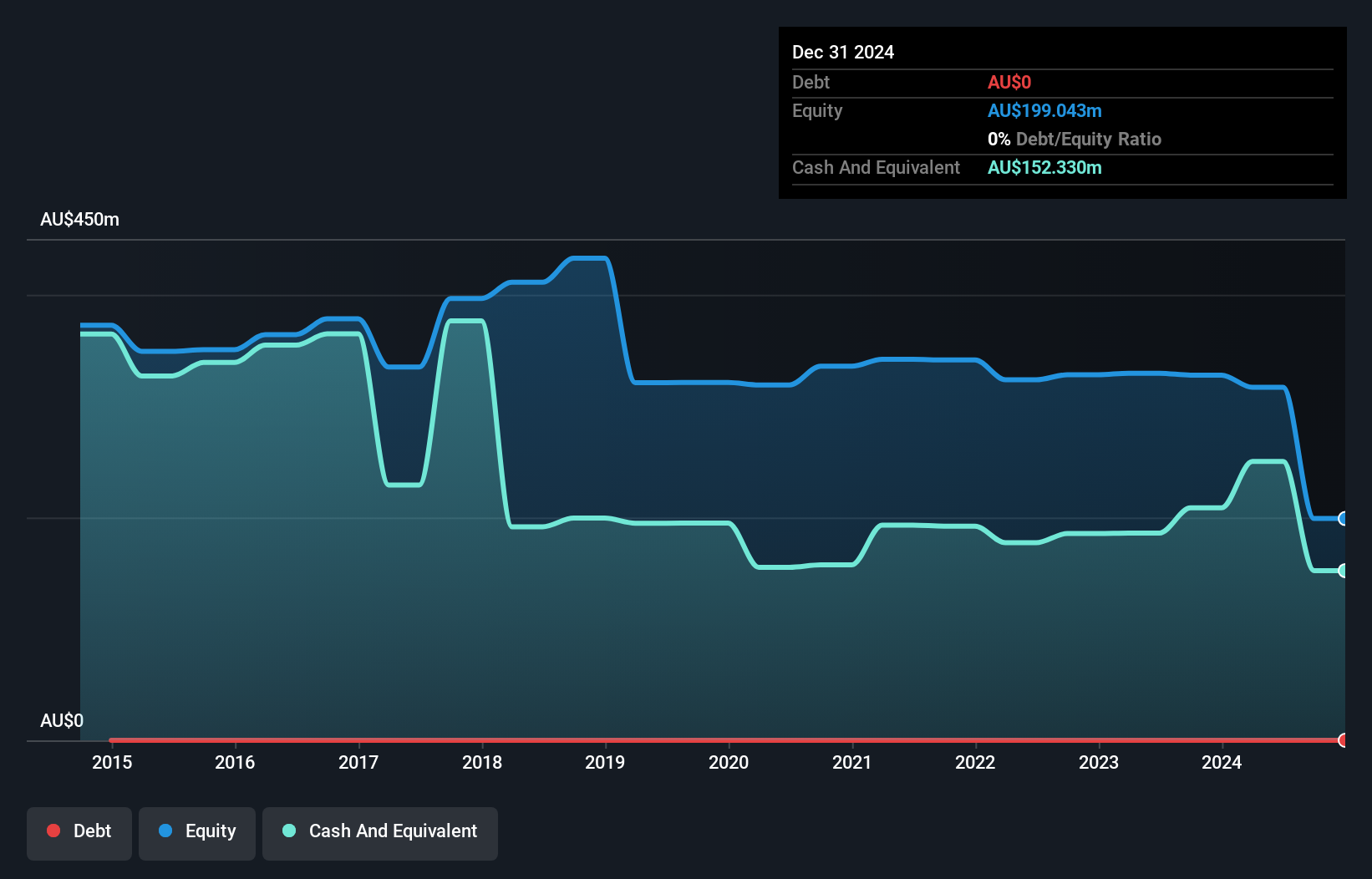

Platinum Investment Management Limited, with a market cap of A$397.92 million, derives most of its revenue from the Funds Management segment. Despite being debt-free and trading at a good value compared to peers, the company faces challenges such as declining profit margins and negative earnings growth over the past year. The management team is experienced, but the board's short tenure may suggest strategic shifts ahead. Recent developments include M&A discussions involving high-profile firms potentially impacting future operations and a special dividend announcement of A$0.20 per share, highlighting shareholder return amidst ongoing takeover talks.

- Unlock comprehensive insights into our analysis of Platinum Investment Management stock in this financial health report.

- Review our growth performance report to gain insights into Platinum Investment Management's future.

Next Steps

- Jump into our full catalog of 1,051 ASX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GTN

GTN

Operates broadcast media advertising platforms that supply traffic and news information reports to radio stations in Australia, Canada, the United Kingdom, and Brazil.

Flawless balance sheet and good value.