- Australia

- /

- Metals and Mining

- /

- ASX:RND

Alliance Nickel And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market is showing signs of optimism, with ASX200 futures indicating a positive start to the week, buoyed by favorable US CPI data and geopolitical developments. In this context, investors are increasingly looking toward opportunities that offer both value and potential growth. While the term "penny stocks" may seem outdated, it still captures the essence of smaller or emerging companies that can present significant opportunities when backed by strong financials. Here, we explore three such penny stocks on the ASX that stand out for their financial health and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.90 | A$240.44M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.04 | A$332.15M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.965 | A$109.89M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.11 | A$326.82M | ★★★★☆☆ |

Click here to see the full list of 1,025 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Alliance Nickel (ASX:AXN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alliance Nickel Limited focuses on the exploration and development of mineral properties in Australia, with a market cap of A$24.68 million.

Operations: The company generates A$1.14 million in revenue from its Resources Sector.

Market Cap: A$24.68M

Alliance Nickel Limited, with a market cap of A$24.68 million, is pre-revenue and unprofitable, generating less than US$1 million in revenue. The company is debt-free and has short-term assets (A$1.6 million) exceeding its liabilities (A$1.2 million). However, it faces financial constraints with less than a year of cash runway if cash flow continues to decline at historical rates. Management's average tenure is 1.8 years, indicating inexperience, though the board has more seasoned members with an average tenure of 3.4 years. Shareholders have not been significantly diluted recently despite high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Alliance Nickel.

- Evaluate Alliance Nickel's historical performance by accessing our past performance report.

Pureprofile (ASX:PPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pureprofile Ltd is a data and insights company offering online research solutions to agencies, marketers, researchers, publishers, and businesses across Australasia, Europe, and the United States with a market cap of A$40.58 million.

Operations: The company generates revenue from its Data & Insights segment, which accounts for A$48.07 million, and the Pure.Amplify Media AU segment, contributing A$0.0003 million.

Market Cap: A$40.58M

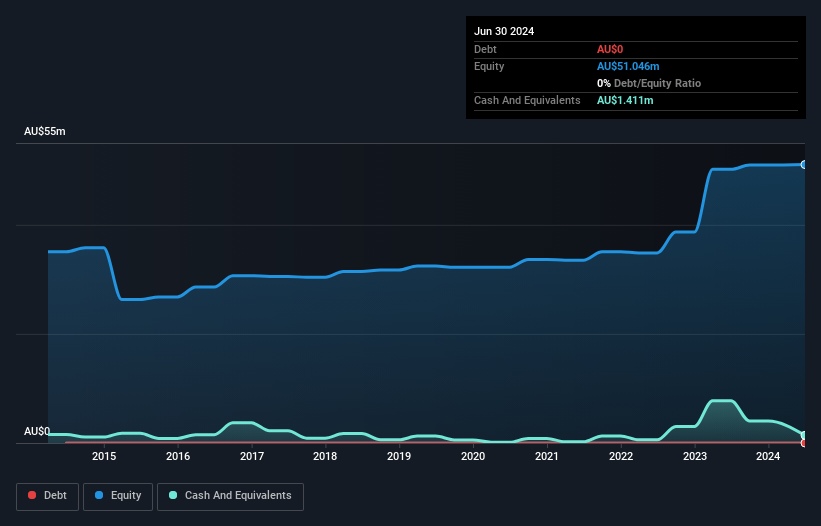

Pureprofile Ltd, with a market cap of A$40.58 million, has transitioned to profitability over the past year and is trading significantly below its estimated fair value. The company generates substantial revenue from its Data & Insights segment (A$48.07 million) and maintains more cash than total debt, with operating cash flow well covering its liabilities. While short-term assets exceed both short- and long-term liabilities, Pureprofile's Return on Equity remains low at 1.9%. The company's board lacks experience with an average tenure of 1.3 years, yet management shows stability at 4.4 years tenure amidst high share price volatility.

- Navigate through the intricacies of Pureprofile with our comprehensive balance sheet health report here.

- Understand Pureprofile's earnings outlook by examining our growth report.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is an Australian company focused on the exploration, development, and production of mineral properties with a market cap of A$86.45 million.

Operations: The company generates revenue primarily from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to A$34.76 million.

Market Cap: A$86.45M

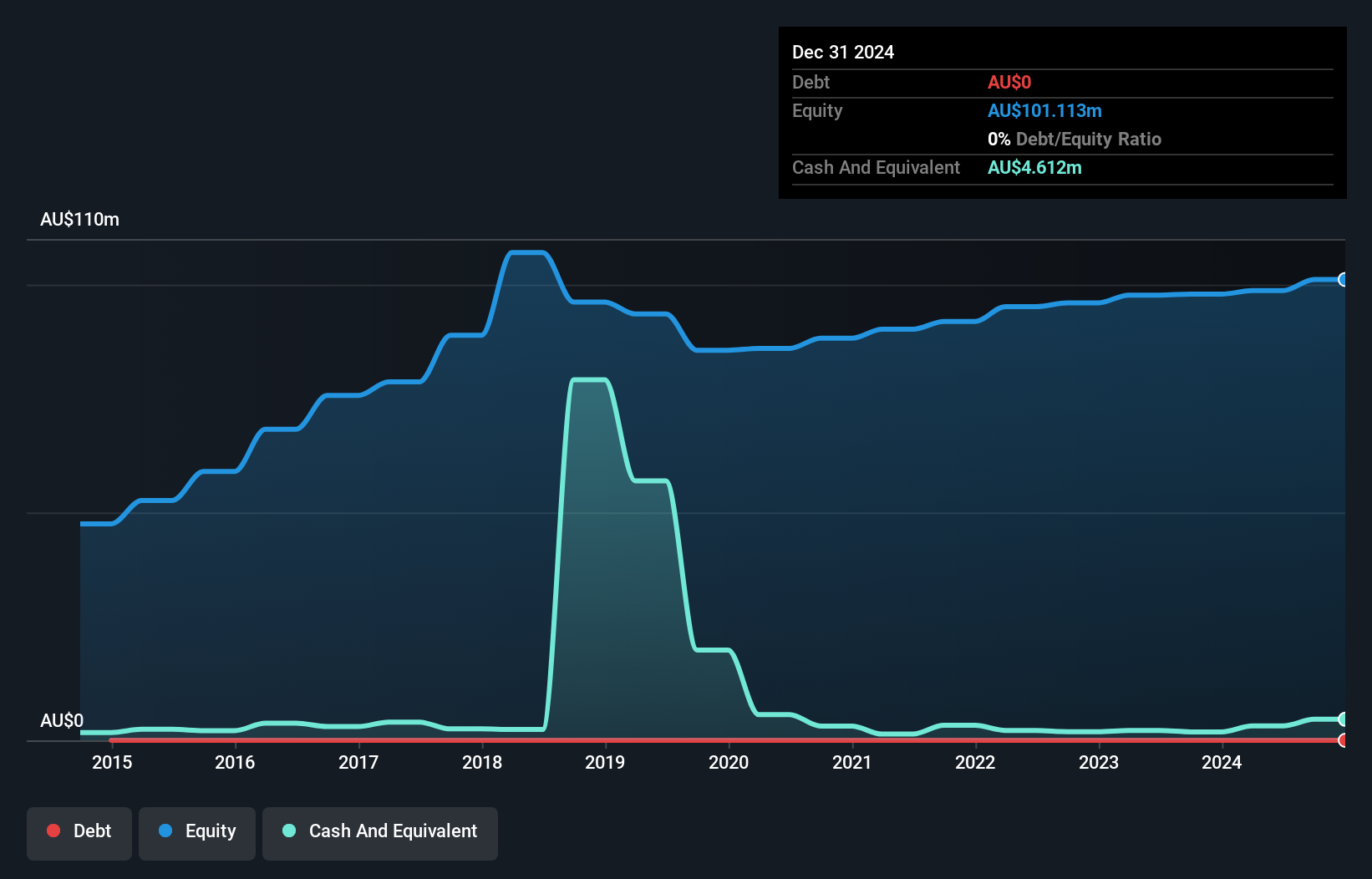

Rand Mining Limited, with a market cap of A$86.45 million, operates debt-free and is trading significantly below its estimated fair value. Despite high-quality earnings and strong asset coverage of liabilities, the company faces challenges with declining earnings over the past five years at an annual rate of 18.2%. Its Return on Equity is low at 6.8%, and profit margins have decreased from last year. Management and board members are highly experienced, averaging over two decades in tenure. Recently, Rand declared a fully franked dividend of 10 cents per share for shareholders as of November 2024.

- Take a closer look at Rand Mining's potential here in our financial health report.

- Gain insights into Rand Mining's historical outcomes by reviewing our past performance report.

Make It Happen

- Jump into our full catalog of 1,025 ASX Penny Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RND

Rand Mining

Engages in the exploration, development, and production of mineral properties in Australia.

Flawless balance sheet average dividend payer.