- Australia

- /

- Metals and Mining

- /

- ASX:AWJ

Insiders purchases in Auric Mining Limited (ASX:AWJ) last year yet to pay off, remain down AU$27k despite recent gains

Some of the losses seen by insiders who purchased AU$88k worth of Auric Mining Limited (ASX:AWJ) shares over the past year were recovered after the stock increased by 12% over the past week. The purchase, however, has proven to be a pricey bet, with losses currently totalling AU$27k.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Auric Mining

The Last 12 Months Of Insider Transactions At Auric Mining

While no particular insider transaction stood out, we can still look at the overall trading.

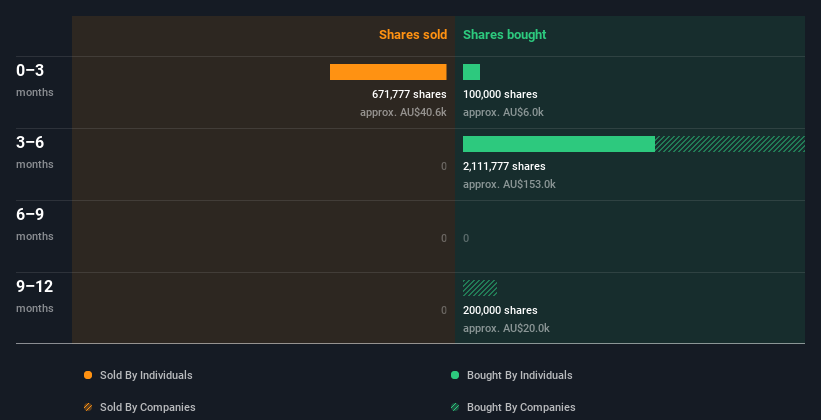

In the last twelve months insiders purchased 1.21m shares for AU$88k. On the other hand they divested 671.78k shares, for AU$43k. Overall, Auric Mining insiders were net buyers during the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insiders At Auric Mining Have Sold Stock Recently

Over the last three months, we've seen a bit of insider selling at Auric Mining. The selling netted AU$43k for insider Tom Fairchild. But at least we saw AU$6.0k worth of buying. While it's not great to see insider selling, the net amount sold isn't enough for us to want to read anything into it.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Insiders own 30% of Auric Mining shares, worth about AU$2.0m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Auric Mining Insiders?

Insider selling has just outweighed insider buying in the last three months. But the difference is small, and thus, not concerning. But insiders have shown more of an appetite for the stock, over the last year. Insiders own shares in Auric Mining and we see no evidence to suggest they are worried about the future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. For instance, we've identified 5 warning signs for Auric Mining (3 are a bit unpleasant) you should be aware of.

Of course Auric Mining may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AWJ

Auric Mining

Engages in exploration, development, mining, and production of gold in Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)