As the ASX200 experiences a slight dip of 0.25% at 8178 points amidst global market shifts following Donald Trump's re-election, Australian investors are closely monitoring dividend stocks for stable returns in a volatile environment. In such times, selecting stocks with strong dividend yields can provide a reliable income stream, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.84% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.72% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.10% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.29% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.32% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.43% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.38% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.22% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.06% | ★★★★☆☆ |

| Santos (ASX:STO) | 7.01% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

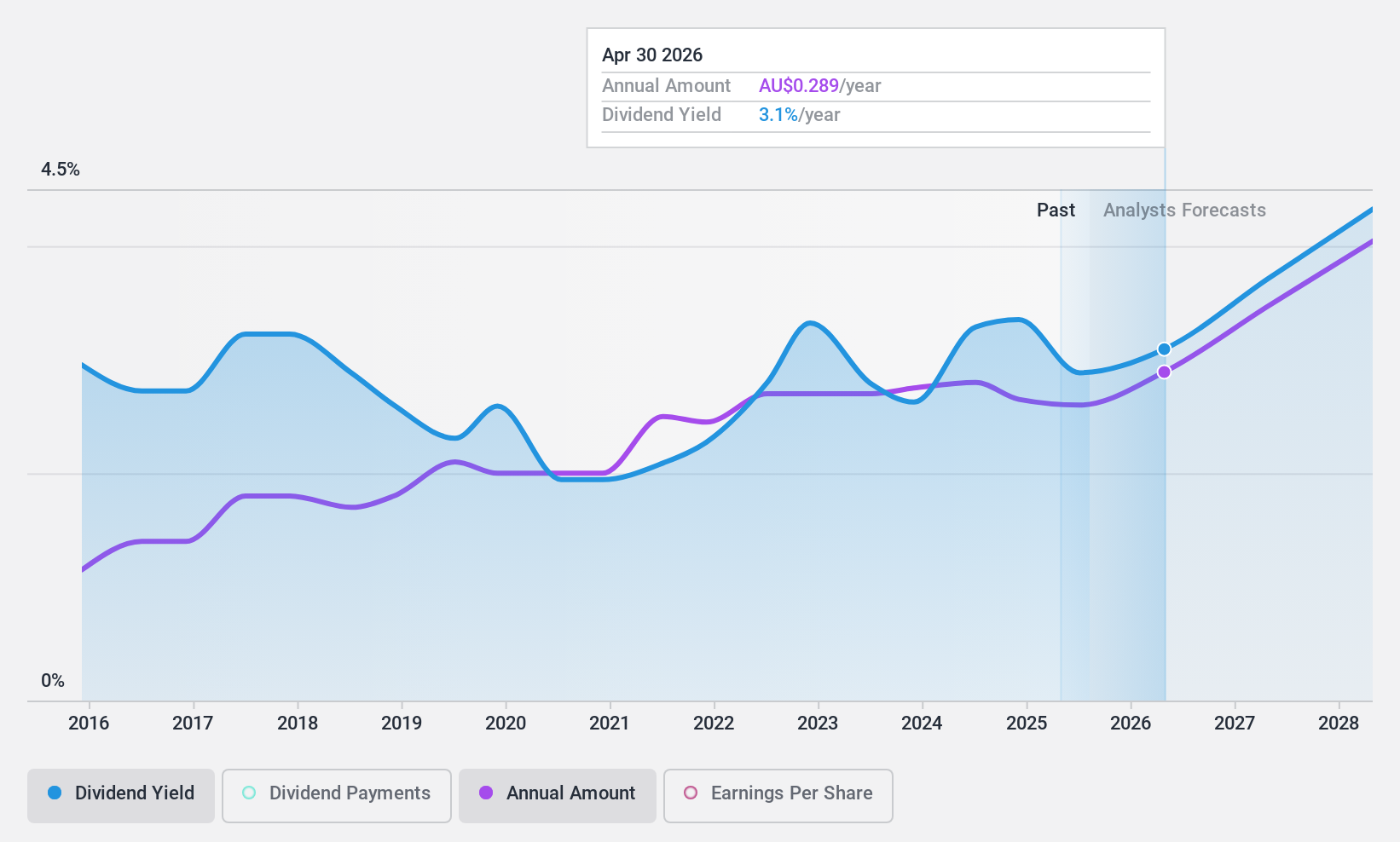

Collins Foods (ASX:CKF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$1 billion.

Operations: Collins Foods Limited generates revenue from its restaurant operations, with A$54.38 million from Taco Bell Restaurants, A$313.47 million from KFC Restaurants in Europe, and A$1.12 billion from KFC Restaurants in Australia.

Dividend Yield: 3.3%

Collins Foods offers a stable dividend history with payments growing over the past decade, supported by a cash payout ratio of 35.2% and an earnings payout ratio of 59.1%, indicating sustainability. The dividend yield is relatively low at 3.29% compared to top Australian payers but is well-covered by cash flows and earnings. Recent leadership changes, including Xavier Simonet as CEO, may influence future strategic direction, potentially impacting dividends indirectly through operational performance enhancements.

- Click here to discover the nuances of Collins Foods with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Collins Foods shares in the market.

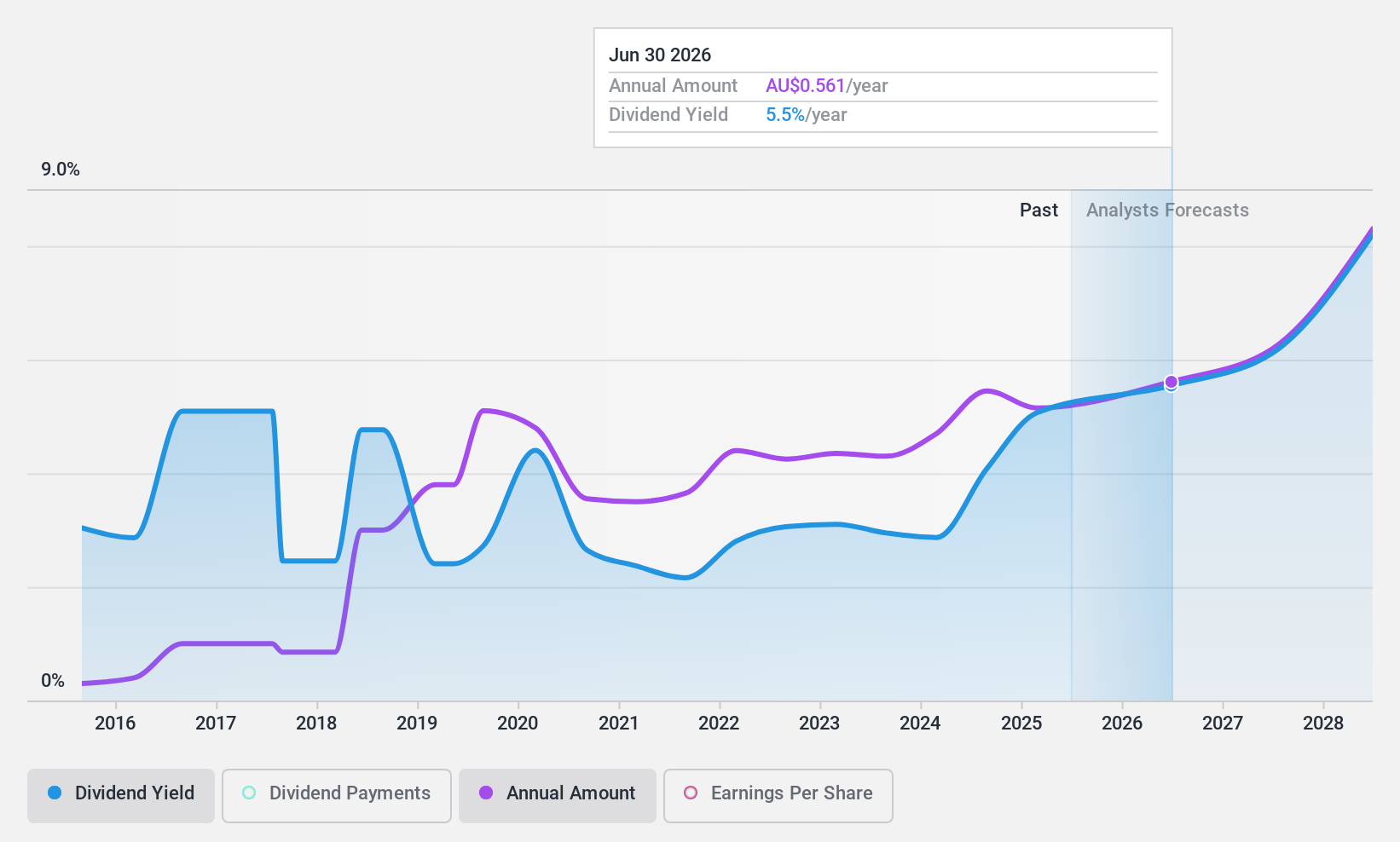

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates as a retailer of lottery tickets via internet and mobile platforms across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market cap of A$821.83 million.

Operations: Jumbo Interactive Limited generates revenue through three main segments: Managed Services (A$25.84 million), Lottery Retailing (A$123.40 million), and Software-As-A-Service (SaaS) (A$50.73 million).

Dividend Yield: 4.2%

Jumbo Interactive's dividend payments, though volatile over the past decade, are covered by earnings and cash flows with payout ratios of 79.1% and 63.2%, respectively. The recent A$0.275 per share fully franked dividend reflects a growing trend despite its yield being lower than top Australian payers at 4.16%. Recent strategic initiatives include seeking acquisitions to enhance scale, which might influence future dividends depending on integration success and market conditions.

- Unlock comprehensive insights into our analysis of Jumbo Interactive stock in this dividend report.

- In light of our recent valuation report, it seems possible that Jumbo Interactive is trading behind its estimated value.

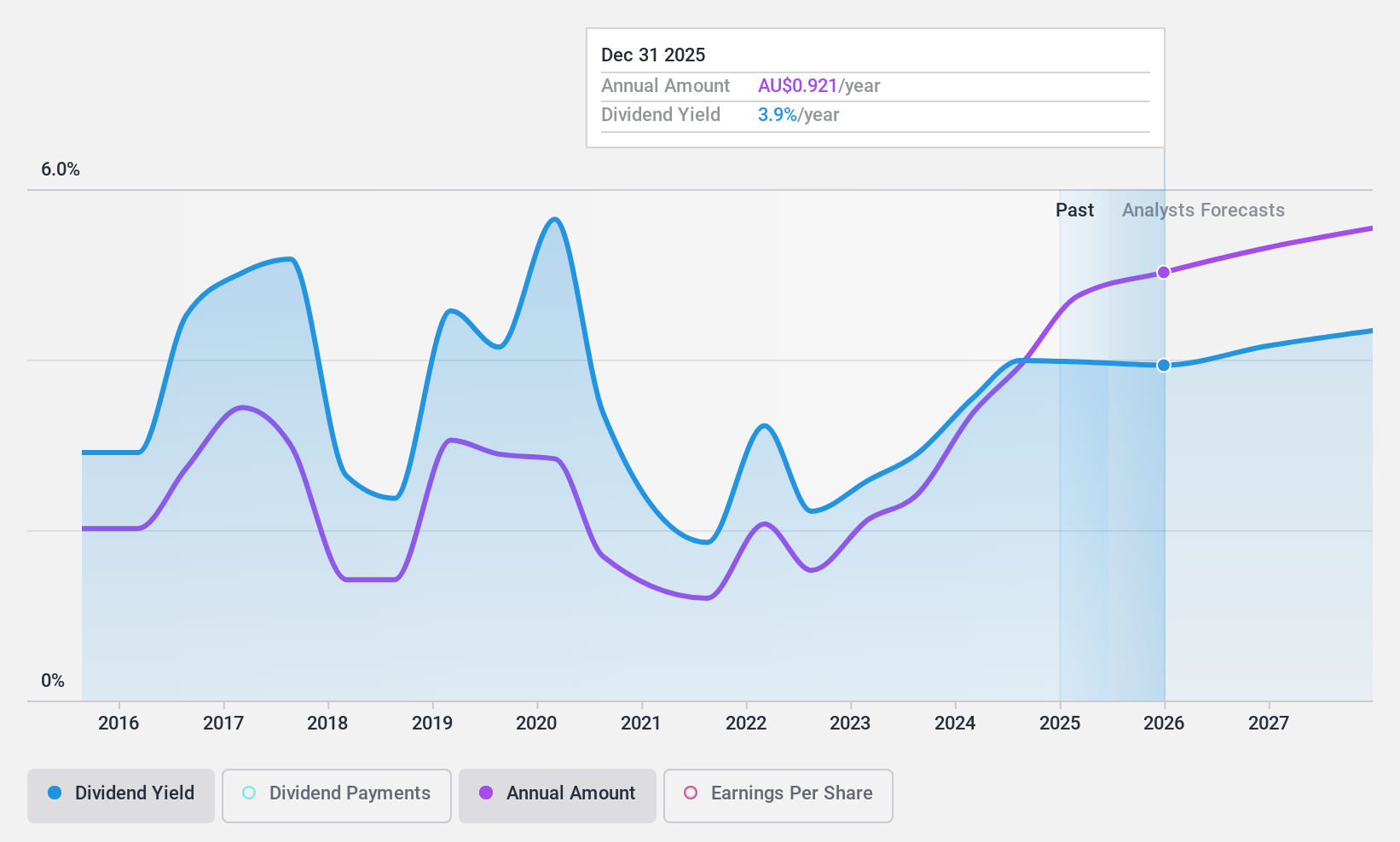

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited is involved in underwriting general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$26.53 billion.

Operations: QBE Insurance Group Limited generates revenue from its International segment ($9.56 billion), North America ($7.71 billion), and Australia Pacific ($5.91 billion).

Dividend Yield: 4.1%

QBE Insurance Group's dividend payments, though historically volatile, are well covered by earnings and cash flows with payout ratios of 42.9% and 20.5%, respectively. Recent financial performance shows strong earnings growth, with net income reaching US$802 million for H1 2024. The company announced an increased interim dividend of A$0.24 per share for the half year ended June 2024, indicating a positive trend despite its yield being lower than top Australian payers at 4.09%.

- Click to explore a detailed breakdown of our findings in QBE Insurance Group's dividend report.

- The valuation report we've compiled suggests that QBE Insurance Group's current price could be quite moderate.

Next Steps

- Access the full spectrum of 35 Top ASX Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Undervalued with solid track record and pays a dividend.