The Australian market has shown mixed performance recently, with the ASX200 experiencing a slight uptick, closing up 0.07% at 7,942 points, and sectors like IT and Health Care leading the gains. In this environment of sector-specific fluctuations, investors often look to dividend stocks for their potential to provide steady income streams; here we explore three ASX-listed companies offering yields up to 6.6%.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| IPH (ASX:IPH) | 7.73% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.20% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| GR Engineering Services (ASX:GNG) | 6.57% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.93% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.00% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.67% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.67% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.26% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.56% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers retail and commercial banking services across Australia, New Zealand, and internationally, with a market cap of A$248.51 billion.

Operations: Commonwealth Bank of Australia's revenue is derived from several segments, including Retail Banking Services (Incl. Bankwest) at A$12.73 billion, Business Banking at A$8.37 billion, New Zealand operations at A$2.97 billion, and Institutional Banking and Markets at A$2.65 billion.

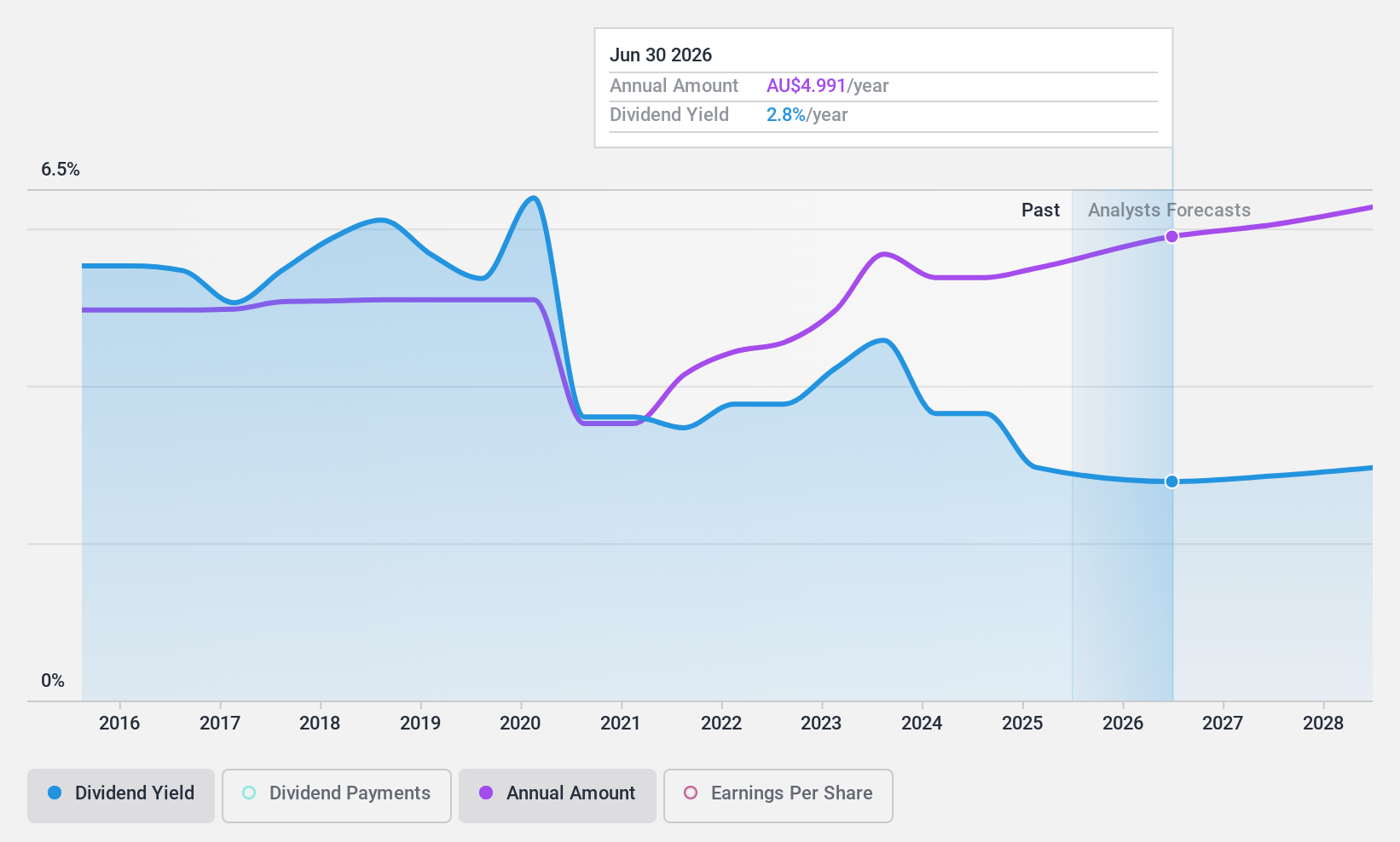

Dividend Yield: 3.1%

Commonwealth Bank of Australia's dividend payments have been volatile over the past decade, though they are currently covered by earnings with an 81.2% payout ratio. While dividends have grown in recent years, the yield of 3.13% is low compared to top Australian dividend payers. Recent events include a A$1.25 billion fixed-income offering and board changes, which could influence future financial strategies and stability in dividend distribution.

- Get an in-depth perspective on Commonwealth Bank of Australia's performance by reading our dividend report here.

- According our valuation report, there's an indication that Commonwealth Bank of Australia's share price might be on the expensive side.

Medibank Private (ASX:MPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medibank Private Limited offers private health insurance and health services in Australia, with a market cap of A$12.09 billion.

Operations: Medibank Private Limited generates revenue from its Health Insurance segment, which accounts for A$8.06 billion, and its Medibank Health segment, contributing A$447.10 million.

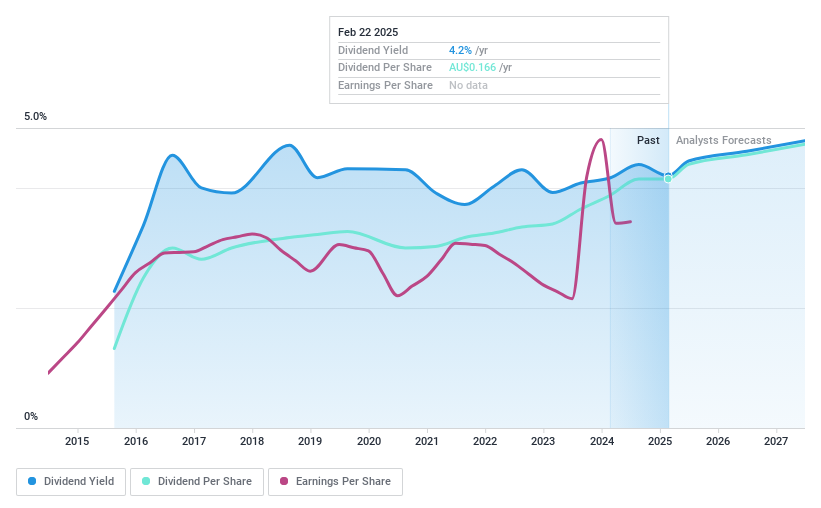

Dividend Yield: 3.8%

Medibank Private's dividends have been stable and growing over the past decade, though its 3.78% yield is lower than top Australian dividend payers. Despite a high payout ratio of 96.7%, dividends are covered by cash flows but not earnings, raising sustainability concerns. Recently, Medibank announced a A$0.078 per share dividend for the half year ended December 2024, with net income slightly declining to A$340.3 million from A$343.2 million year-on-year.

- Dive into the specifics of Medibank Private here with our thorough dividend report.

- Upon reviewing our latest valuation report, Medibank Private's share price might be too optimistic.

SHAPE Australia (ASX:SHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SHAPE Australia Corporation Limited, listed as ASX:SHA, operates in the construction, fitout, and refurbishment of commercial properties across Australia with a market capitalization of A$249.87 million.

Operations: SHAPE Australia Corporation Limited generates revenue primarily from its heavy construction segment, amounting to A$902.63 million.

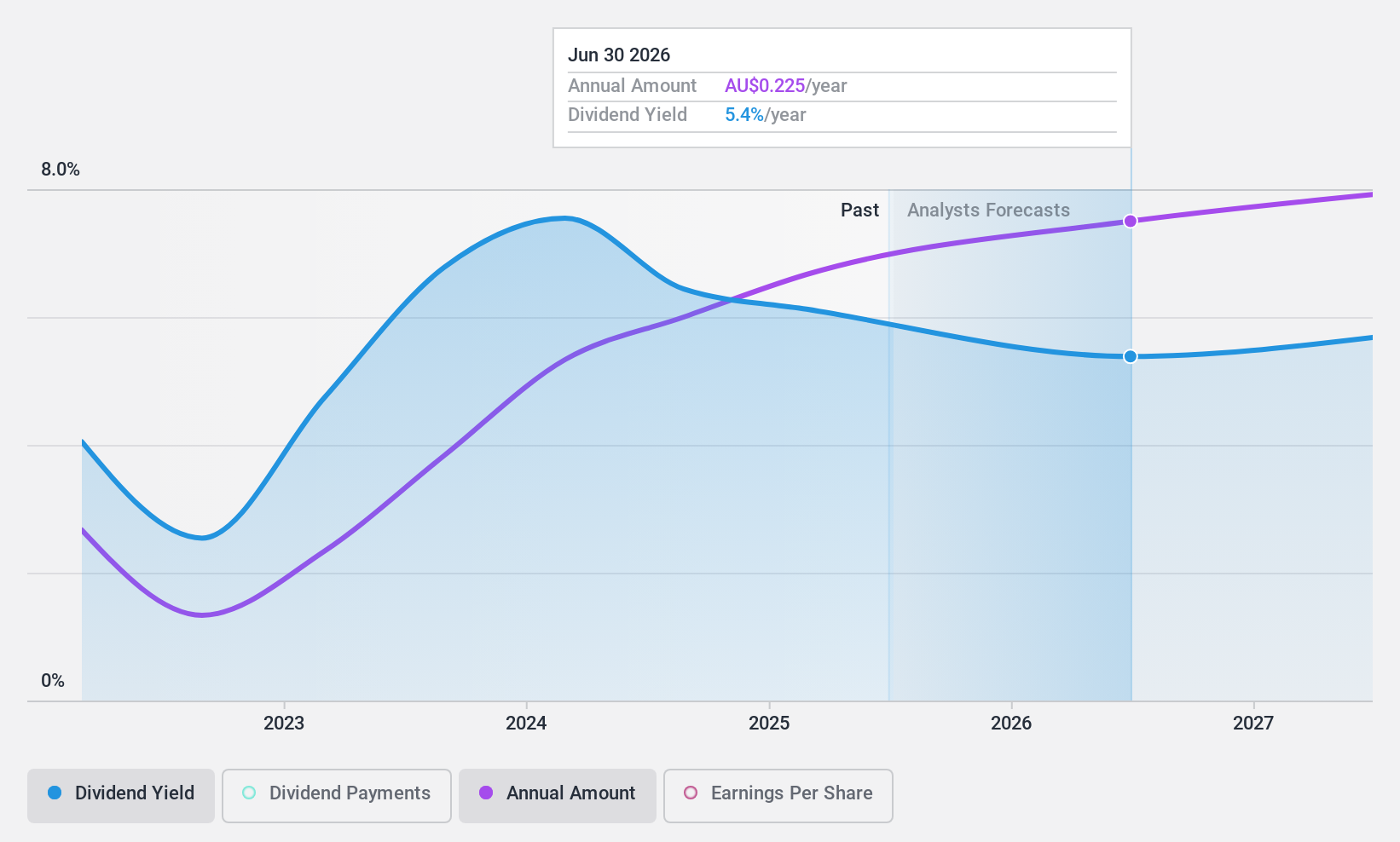

Dividend Yield: 6.6%

SHAPE Australia's dividend yield of 6.62% places it among the top 25% in Australia, though its track record is short and volatile. Despite this, dividends are well-covered by earnings and cash flows, with a payout ratio of 87.9% and cash payout ratio of 39.3%. Recent inclusion in the S&P/ASX indices may enhance visibility, while earnings growth to A$9.42 million supports dividend sustainability despite historical volatility concerns.

- Click here to discover the nuances of SHAPE Australia with our detailed analytical dividend report.

- The analysis detailed in our SHAPE Australia valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Explore the 31 names from our Top ASX Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives