- Australia

- /

- Healthtech

- /

- ASX:ONE

Despite shrinking by AU$30m in the past week, Oneview Healthcare (ASX:ONE) shareholders are still up 306% over 1 year

It's been a soft week for Oneview Healthcare PLC (ASX:ONE) shares, which are down 13%. But that isn't a problem when you consider how the share price has soared over the last year. Indeed, the share price is up a whopping 306% in that time. Arguably, the recent fall is to be expected after such a strong rise. While winners often keep winning, it can pay to be cautious after a strong rise.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Oneview Healthcare

Oneview Healthcare isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Oneview Healthcare's revenue grew by 5.3%. That's not a very high growth rate considering it doesn't make profits. So the 306% gain in just twelve months is completely unexpected. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. It just goes to show that big money can be made if you buy the right stock early.

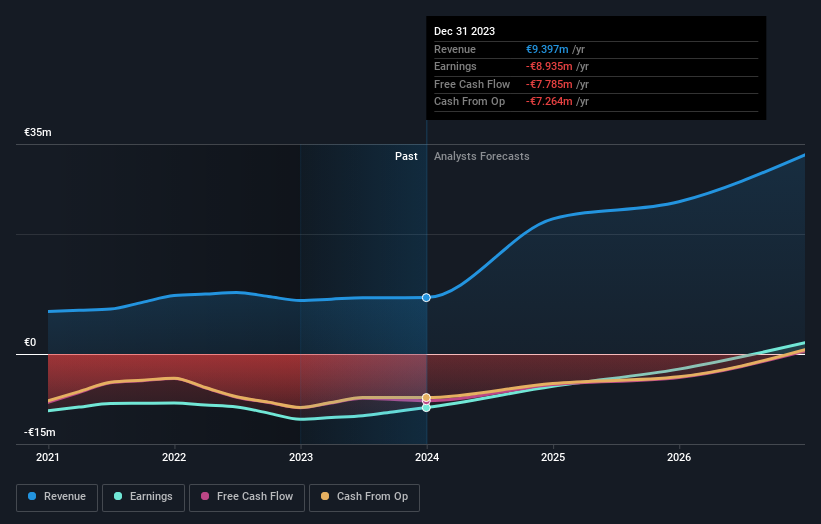

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Oneview Healthcare has rewarded shareholders with a total shareholder return of 306% in the last twelve months. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Oneview Healthcare , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ONE

Oneview Healthcare

Develops and sells software services for the healthcare sector in Ireland, the United States, Australia, Ireland, the Middle East, and Asia.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives