- Australia

- /

- Healthcare Services

- /

- ASX:HLA

I Ran A Stock Scan For Earnings Growth And Healthia (ASX:HLA) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Healthia (ASX:HLA). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Healthia

How Fast Is Healthia Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. It is therefore awe-striking that Healthia's EPS went from AU$0.0045 to AU$0.10 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

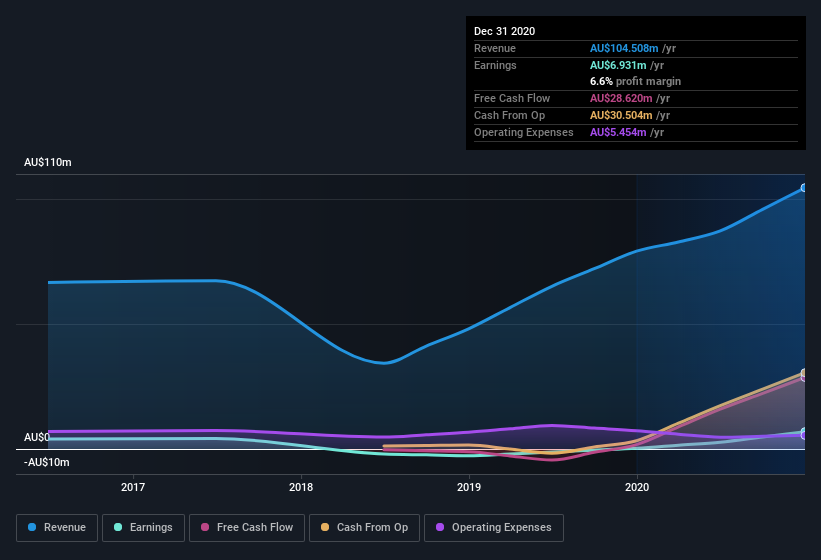

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Healthia's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Healthia isn't a huge company, given its market capitalization of AU$178m. That makes it extra important to check on its balance sheet strength.

Are Healthia Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insiders both bought and sold Healthia shares in the last year, but the good news is they spent AU$7.7k more buying than they netted selling. So, on balance, the insider transactions are mildly encouraging. We also note that it was the Independent Non-Executive Director, Paul Wilson, who made the biggest single acquisition, paying AU$95k for shares at about AU$1.60 each.

The good news, alongside the insider buying, for Healthia bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$54m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 30% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Wes Coote, is paid less than the median for similar sized companies. For companies with market capitalizations under AU$273m, like Healthia, the median CEO pay is around AU$370k.

The Healthia CEO received AU$313k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Healthia To Your Watchlist?

Healthia's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Healthia belongs on the top of your watchlist. However, before you get too excited we've discovered 3 warning signs for Healthia (2 are a bit concerning!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Healthia, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Healthia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Healthia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HLA

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives