- Australia

- /

- Medical Equipment

- /

- ASX:COH

Cochlear (ASX:COH) Appoints New CFO Amid Strong Financials and Strategic Buyback Plan

Reviewed by Simply Wall St

Dive into the specifics of Cochlear here with our thorough analysis report.

Strengths: Core Advantages Driving Sustained Success For Cochlear

Cochlear has demonstrated robust growth and profitability, with revenue reaching AUD 2.258 billion, marking a 15% increase, and 12% growth in constant currency, as highlighted by CEO Dig Howitt. The company maintains a strong financial position with significant cash reserves, which supports its strategic initiatives and market leadership, holding over 60% global market share. Employee engagement remains high at 80%, fostering a productive work environment. Additionally, Cochlear's commitment to innovation is evident from its substantial investment in R&D, accounting for 12% of sales, or AUD 270 million. This focus on research and development positions the company well for future advancements and maintaining its competitive edge.

Weaknesses: Critical Issues Affecting Cochlear's Performance and Areas For Growth

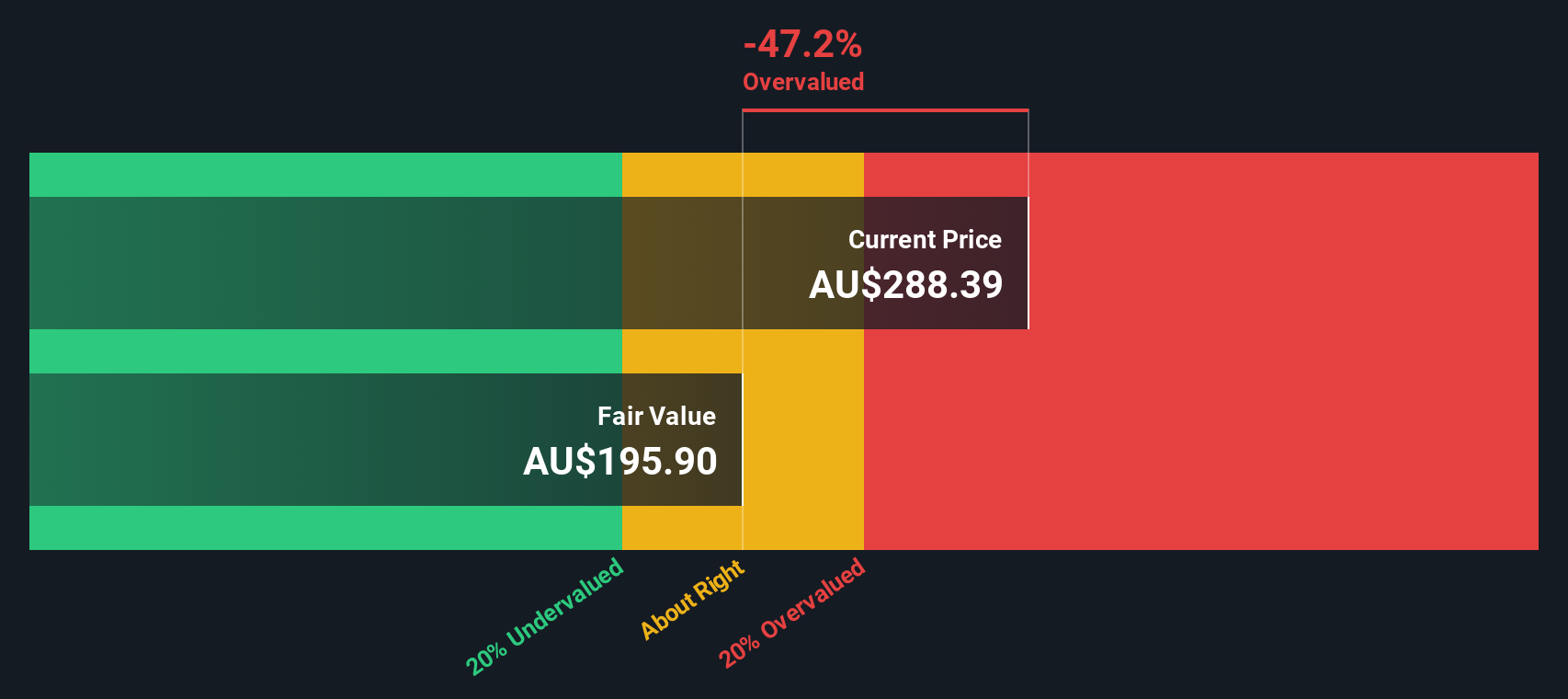

Despite its strengths, Cochlear faces several challenges. Emerging market growth slowed to 5%, with a notable decline in the second half of the year. The integration of Oticon Medical incurred significant costs, with CFO Stuart Sayers reporting AUD 28 million in integration expenses. Additionally, the company faced stock write-offs amounting to AUD 22 million. The valuation also presents a concern, as Cochlear is trading above its estimated fair value of AUD 242.18, with a Price-To-Earnings Ratio of 51.9x, which is expensive compared to the peer average of 28.8x and the industry average of 25.9x. These factors indicate areas where the company needs to focus on cost management and market expansion to sustain growth.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Cochlear has several promising opportunities to enhance its market position. The company is actively working on closing the gap in market uptake with its Osia product, which CEO Dig Howitt believes is well-suited for market needs. Increasing awareness and referrals for hearing loss treatments are also key strategies. The company is making significant strides in new product development, meeting various milestones across its development areas. Furthermore, direct-to-consumer activities are contributing to over 30% of surgeries in the U.S., indicating a growing market presence. These initiatives can drive future revenue growth, which is forecasted at 8.2% per year, outpacing the Australian market's 5.4% growth rate.

Threats: Key Risks and Challenges That Could Impact Cochlear's Success

Competition remains a significant threat, as acknowledged by CEO Dig Howitt. The economic environment, characterized by inflation and tightening macroeconomic conditions, poses additional risks. Regulatory challenges also loom, with the company undertaking a full Scope 3 inventory to address greenhouse gas emissions. Operational risks, such as reduced hospital capacity, could impact the company's service delivery. Although Cochlear's earnings are forecasted to grow at 11.5% per year, this is slower than the Australian market's 12.3% growth rate, indicating potential headwinds in maintaining its competitive edge. Addressing these threats will be crucial for sustaining long-term growth and market leadership.

Conclusion

Cochlear's strong financial position, market leadership, and commitment to innovation have driven its impressive revenue growth and profitability. However, challenges such as slowed growth in emerging markets, high integration costs, and significant stock write-offs highlight the need for improved cost management and strategic market expansion. The company's promising opportunities in product development and direct-to-consumer activities could enhance future growth, although competition and economic risks remain significant threats. Notably, Cochlear is currently trading at a Price-To-Earnings Ratio of 51.9x, well above its estimated fair value of AUD 242.18 and higher than both peer and industry averages, which may impact investor sentiment and necessitate careful financial and strategic planning to sustain long-term performance and market leadership.

Where To Now?

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:COH

Cochlear

Provides implantable hearing solutions for children and adults worldwide.

Flawless balance sheet with moderate growth potential.