As the Australian market navigates through uncertainty with tariff concerns and sector fluctuations, investors are keenly observing how these dynamics impact dividend stocks. In such a volatile environment, identifying robust dividend stocks that offer stability and consistent returns can be crucial for enhancing portfolio resilience.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Premier Investments (ASX:PMV) | 6.44% | ★★★★★★ |

| IPH (ASX:IPH) | 7.34% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.86% | ★★★★★☆ |

| GR Engineering Services (ASX:GNG) | 6.76% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 7.97% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.67% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.74% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.58% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.27% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fleetwood (ASX:FWD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleetwood Limited, with a market cap of A$219.98 million, operates in Australia and New Zealand, focusing on the design, manufacture, sale, and installation of modular accommodation and buildings.

Operations: Fleetwood Limited generates revenue through three main segments: Building Solutions (A$340.12 million), RV Solutions (A$71.51 million), and Community Solutions (A$50.02 million).

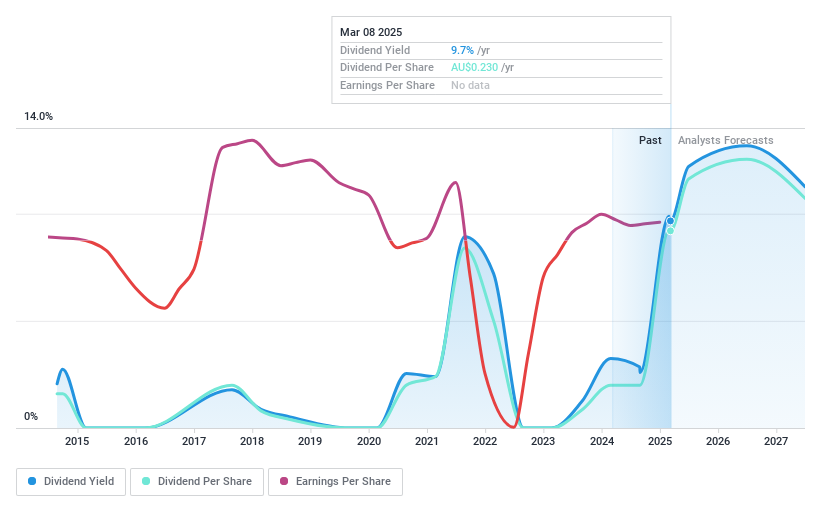

Dividend Yield: 9.7%

Fleetwood's dividend yield of 9.75% ranks in the top 25% of Australian payers, yet its sustainability is questionable due to a high payout ratio of 286.1%, indicating dividends are not well-covered by earnings. Despite reasonable cash flow coverage with a cash payout ratio of 57.4%, the dividend history has been volatile over the past decade, with inconsistent growth and reliability issues. Recent earnings show improvement, but profit margins have declined year-over-year to 1%.

- Delve into the full analysis dividend report here for a deeper understanding of Fleetwood.

- Insights from our recent valuation report point to the potential undervaluation of Fleetwood shares in the market.

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets with a market cap of A$31.79 billion.

Operations: QBE Insurance Group Limited generates revenue from its segments as follows: International at $9.82 billion, North America at $7.54 billion, and Australia Pacific at $5.96 billion.

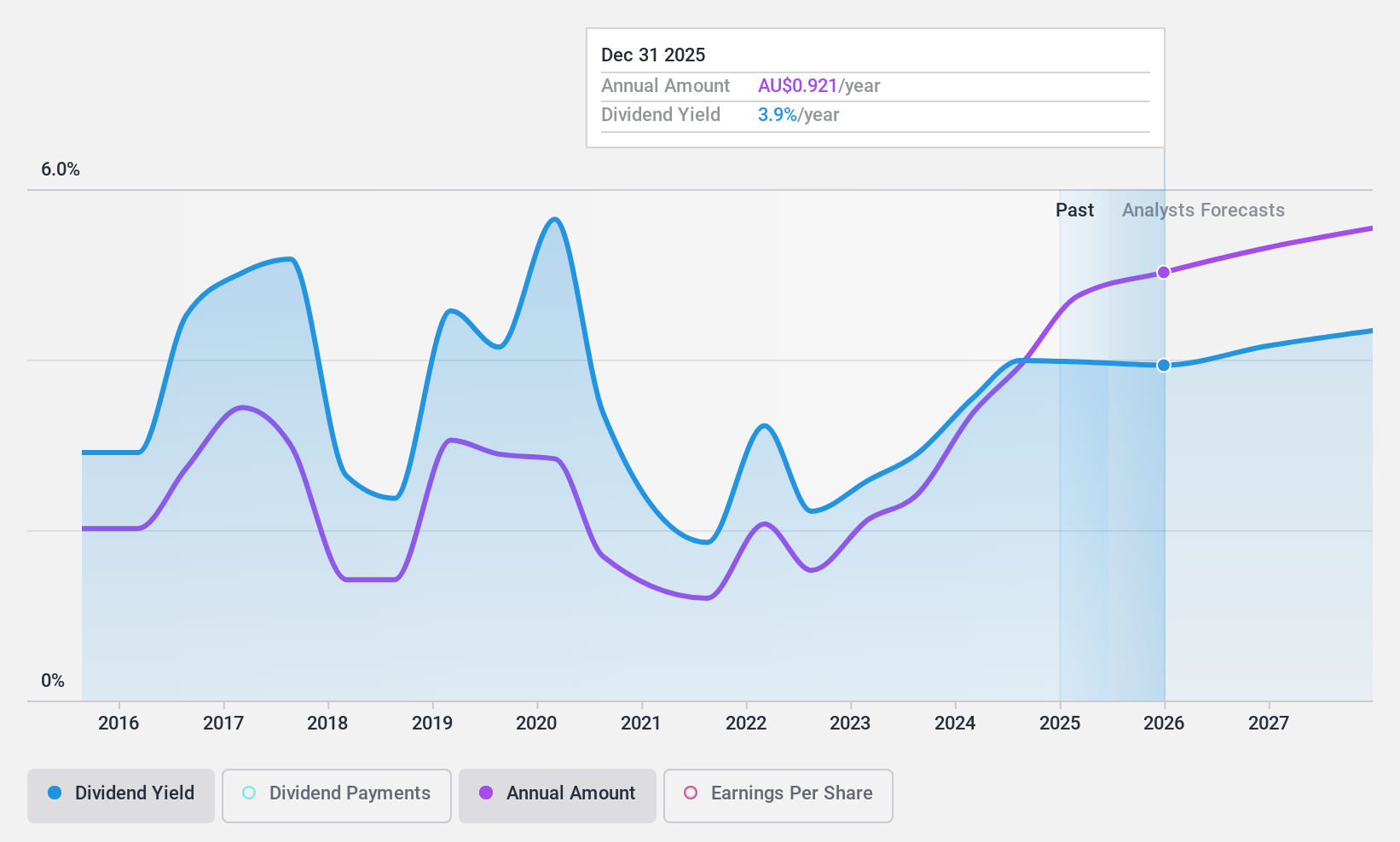

Dividend Yield: 4.1%

QBE Insurance Group's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 46.7% and 33.5%, respectively, indicating sustainability. The company declared a full-year dividend increase to A$0.87 per share for 2024, reflecting consistent growth over the past decade despite historical volatility in payouts. Recent earnings have shown significant growth, enhancing its financial position for dividends; however, the yield remains lower than top-tier Australian payers at 4.07%.

- Click here to discover the nuances of QBE Insurance Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, QBE Insurance Group's share price might be too pessimistic.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, with a market cap of A$665.21 million, operates as a rice food company serving markets in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Operations: Ricegrowers Limited generates its revenue through several segments, including Riviana (A$228.15 million), Cop Rice (A$249.32 million), Rice Food (A$127.76 million), Rice Pool (A$477.65 million), Corporate Segment (A$41.03 million), and International Rice (A$892 million).

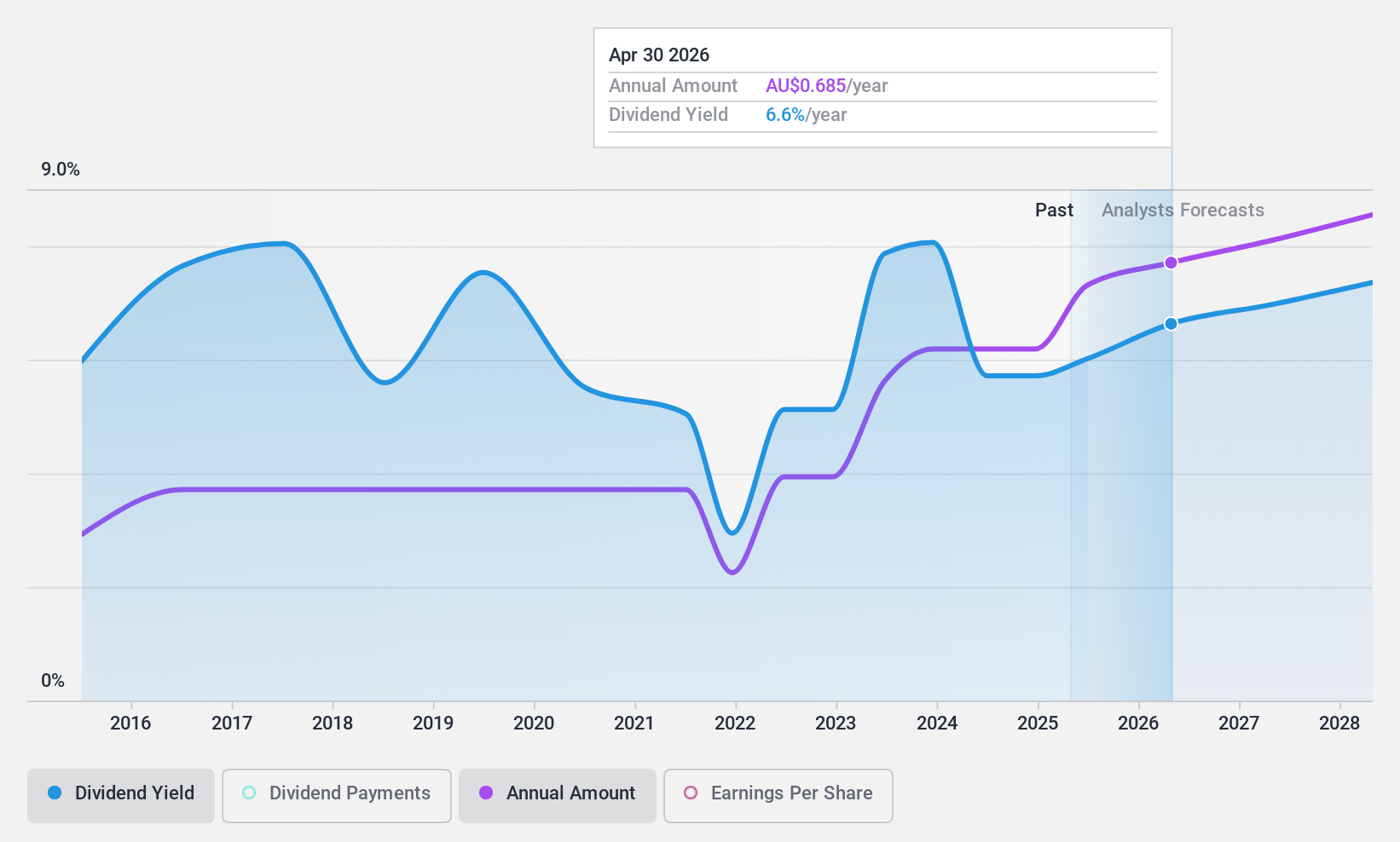

Dividend Yield: 5.4%

Ricegrowers' dividends are supported by earnings and cash flows, with payout ratios of 56.3% and 41%, respectively, ensuring coverage despite a historically volatile dividend track record. The company declared a semi-annual dividend of A$0.15 per share for the period ending October 2024, maintaining its practice of regular payouts. While the yield is lower than Australia's top-tier dividend stocks, recent earnings stability and low trading valuation relative to fair value offer potential appeal for investors seeking income.

- Dive into the specifics of Ricegrowers here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Ricegrowers is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Access the full spectrum of 34 Top ASX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ricegrowers, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.