The Australian market has climbed by 2.1% over the past week, with every sector up, and is up 13% over the last 12 months. In light of these positive trends and an annual earnings growth forecast of 12%, identifying dividend stocks that offer reliable income and potential for capital appreciation becomes crucial for investors.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.55% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.73% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.17% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.41% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.47% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.45% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.38% | ★★★★★☆ |

| GrainCorp (ASX:GNC) | 6.10% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.96% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.37% | ★★★★☆☆ |

Click here to see the full list of 35 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

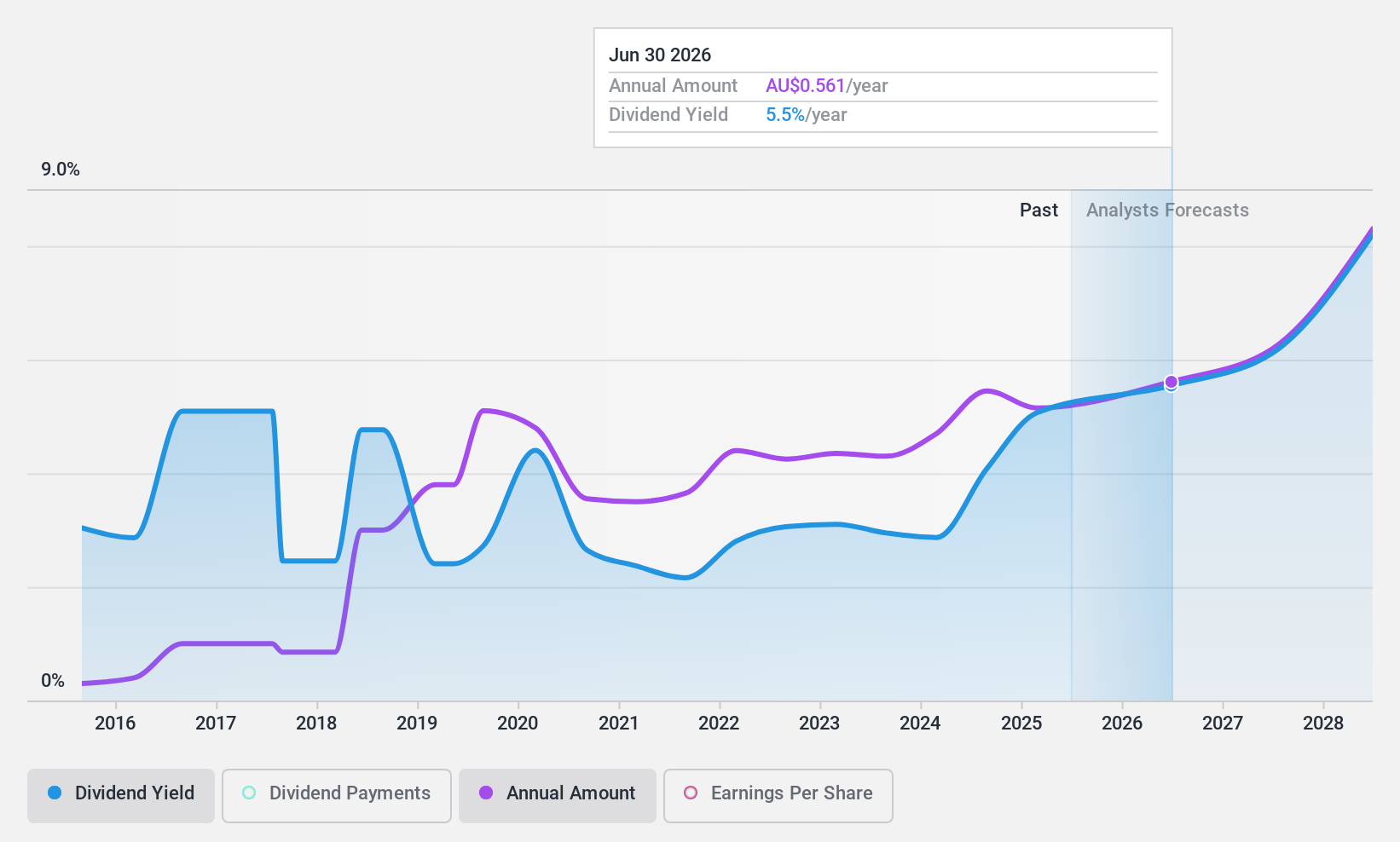

Bendigo and Adelaide Bank (ASX:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited provides banking and financial services to retail customers and small to medium-sized businesses in Australia, with a market cap of A$6.92 billion.

Operations: Bendigo and Adelaide Bank Limited's revenue segments include Consumer (A$1.12 billion), Corporate (A$67.50 million), and Business & Agribusiness (A$761.10 million).

Dividend Yield: 5.2%

Bendigo and Adelaide Bank declared a fully franked full-year dividend of A$0.63 per share, with a second-half dividend of A$0.33 for the period ended June 30, 2024, up from A$0.61 in fiscal year 2023. The bank reported net income of A$545 million compared to A$497 million last year, reflecting earnings growth. While its dividends are covered by earnings (65.4% payout ratio), the bank has had an unstable dividend track record over the past decade despite recent increases.

- Unlock comprehensive insights into our analysis of Bendigo and Adelaide Bank stock in this dividend report.

- Our valuation report here indicates Bendigo and Adelaide Bank may be undervalued.

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates in the retail of lottery tickets via internet and mobile devices across Australia, the United Kingdom, Canada, Fiji, and internationally with a market cap of A$856.38 million.

Operations: Jumbo Interactive Limited generates revenue from three primary segments: Managed Services (A$25.84 million), Lottery Retailing (A$123.40 million), and Software-As-A-Service (SaaS) (A$50.73 million).

Dividend Yield: 4%

Jumbo Interactive's dividend payments, though covered by earnings (79.1% payout ratio) and cash flows (63.3% cash payout ratio), have been volatile over the past decade. The company recently declared a fully franked dividend of A$0.275 per share for the six months ending June 30, 2024. Despite trading at good value compared to peers and industry, its dividend yield of 4% is low relative to top Australian dividend payers. Earnings have grown consistently, with a recent annual increase in net income from A$31.57 million to A$43.35 million.

- Dive into the specifics of Jumbo Interactive here with our thorough dividend report.

- Upon reviewing our latest valuation report, Jumbo Interactive's share price might be too pessimistic.

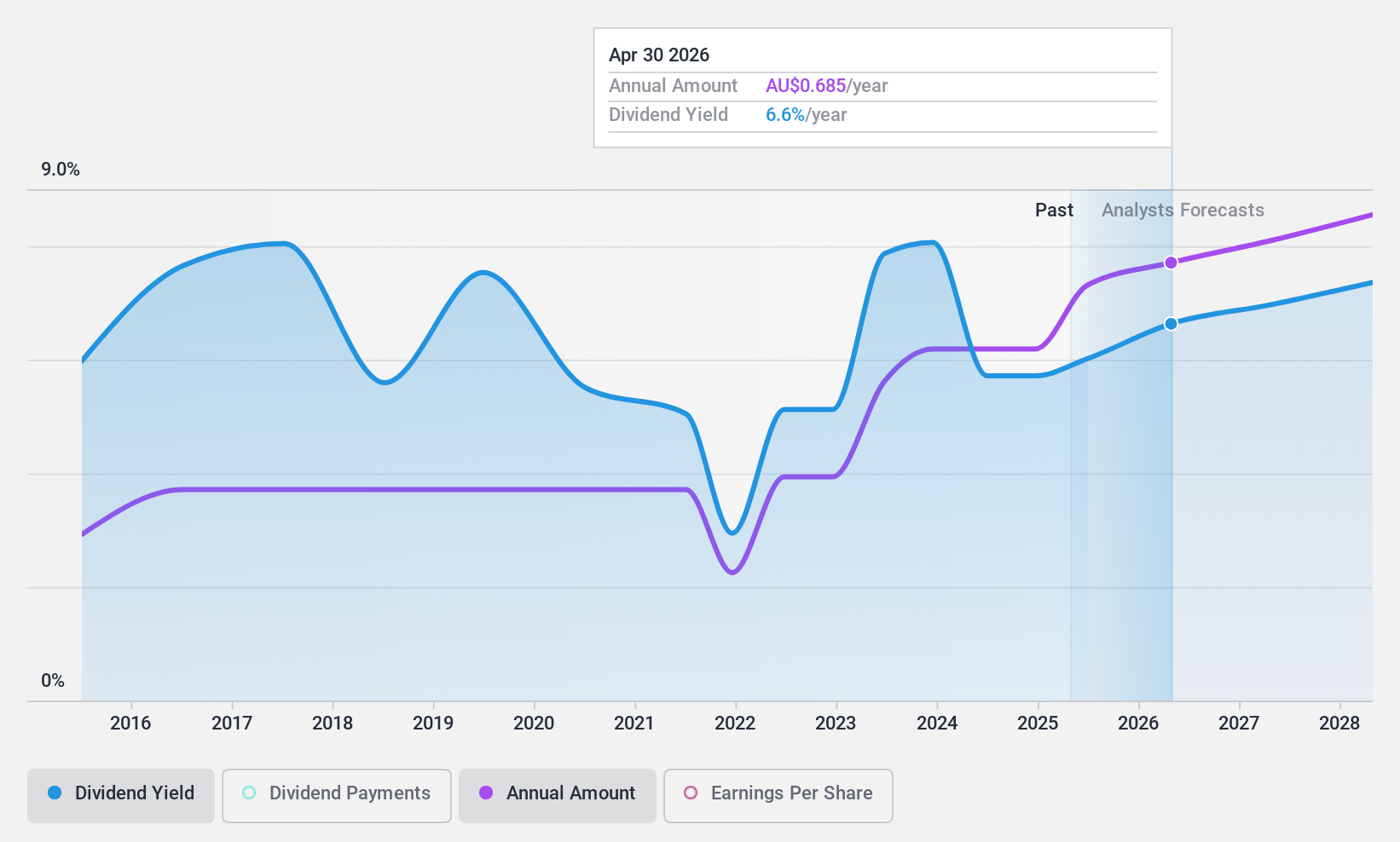

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, with a market cap of A$542.61 million, operates as a rice food company serving markets in Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and internationally.

Operations: Ricegrowers Limited generates revenue from various segments, including Riviana (A$222.01 million), Cop Rice (A$252.75 million), Rice Food (A$121.03 million), Rice Pool (A$498.11 million), Corporate Segment (A$45.79 million), and International Rice (A$894.03 million).

Dividend Yield: 6.5%

Ricegrowers' dividend payments are well covered by earnings (56.4% payout ratio) and cash flows (44% cash payout ratio). Despite a volatile dividend track record over the past nine years, its current yield of 6.54% ranks in the top 25% of Australian dividend payers. The company reported strong financials for FY2024, with net income rising to A$63.14 million on sales of A$1.87 billion, and it is actively seeking strategic acquisitions to bolster growth.

- Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

- Our expertly prepared valuation report Ricegrowers implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 35 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bendigo and Adelaide Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BEN

Bendigo and Adelaide Bank

Engages in the provision of banking and other financial services to retail customers and small to medium sized businesses in Australia.

Flawless balance sheet average dividend payer.