- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Airtasker Leads The Pack Of 3 ASX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Australian stock market approaches the end of 2025, it faces a modest decline, influenced by global trends and holiday trading slowdowns. Despite this sluggishness, investors continue to seek opportunities in various sectors, with penny stocks remaining an area of interest for those looking to explore smaller or newer companies. While the term "penny stocks" may seem outdated, these investments can still offer significant growth potential when backed by strong financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.10 | A$143.09M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$216.86M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$106.58M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.85 | A$478.53M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia, with a market cap of A$192.70 million.

Operations: The company's revenue is derived from Established Marketplaces, generating A$45.22 million, and New Marketplaces, contributing A$1.42 million.

Market Cap: A$192.7M

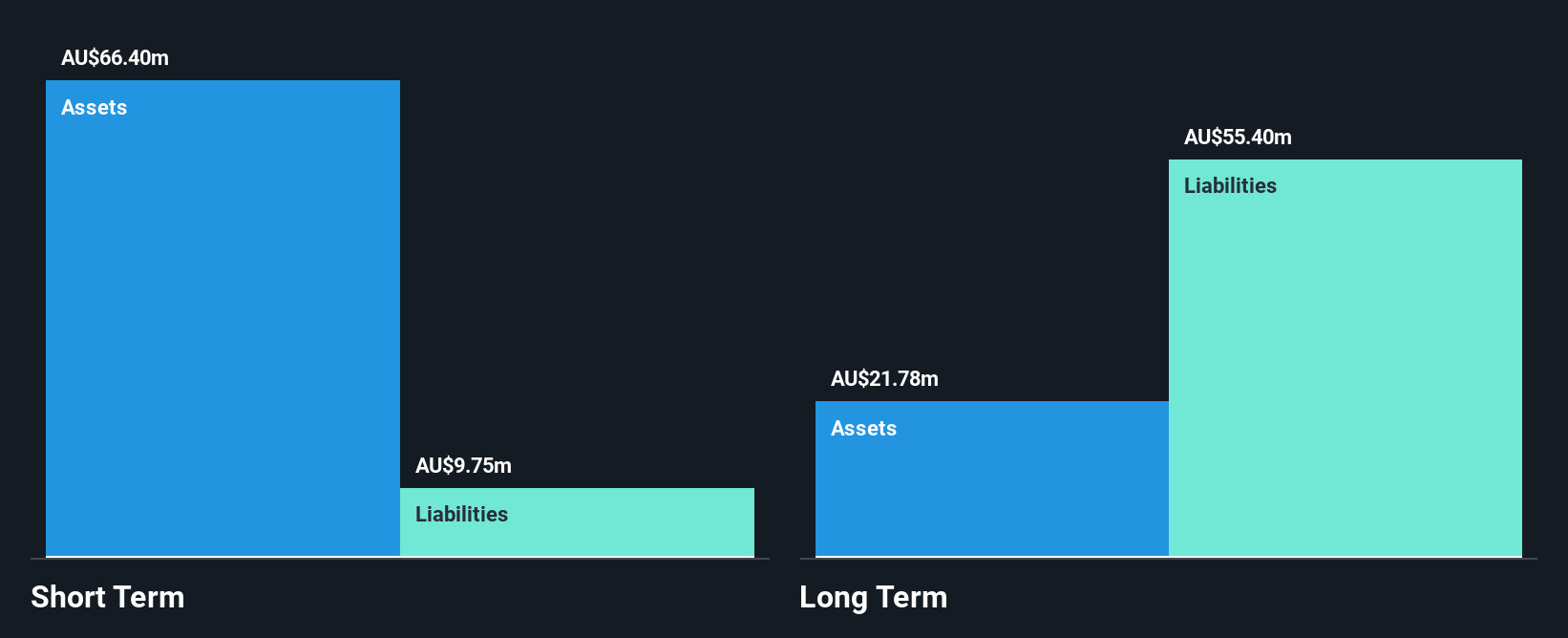

Airtasker Limited, with a market cap of A$192.70 million, operates an online marketplace and is currently unprofitable but has managed to reduce losses over the past five years by 13.3% annually. Despite its negative return on equity, Airtasker benefits from a strong cash position that provides a runway exceeding three years, even as free cash flow shrinks slightly. The company's short-term assets comfortably cover both its short- and long-term liabilities, and it remains debt-free without shareholder dilution in the past year. Earnings are projected to grow significantly at 57.48% per year according to analyst estimates.

- Jump into the full analysis health report here for a deeper understanding of Airtasker.

- Understand Airtasker's earnings outlook by examining our growth report.

Catalyst Metals (ASX:CYL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market capitalization of A$587.55 million.

Operations: The company's revenue is derived from its operations in Tasmania, generating A$75.08 million, and Western Australia, contributing A$243.77 million.

Market Cap: A$587.55M

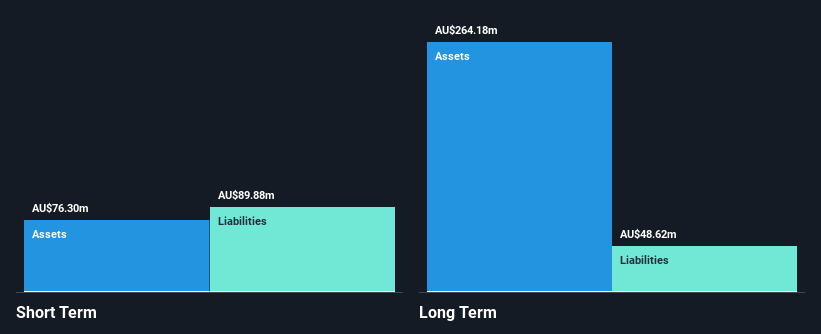

Catalyst Metals Limited, with a market cap of A$587.55 million, has recently transitioned to profitability, overcoming challenges in earnings growth over the past five years. The company maintains more cash than debt, with its operating cash flow significantly covering its debt obligations. However, short-term liabilities exceed short-term assets by A$13.6 million. Despite shareholder dilution and low return on equity at 11.7%, the company's long-term liabilities are adequately covered by its assets. Analysts project earnings growth at 33.13% annually and suggest the stock is trading well below estimated fair value by 84.6%.

- Get an in-depth perspective on Catalyst Metals' performance by reading our balance sheet health report here.

- Learn about Catalyst Metals' future growth trajectory here.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market cap of A$284.20 million.

Operations: The company generates revenue of A$8.07 million from its manganese operations in South Africa.

Market Cap: A$284.2M

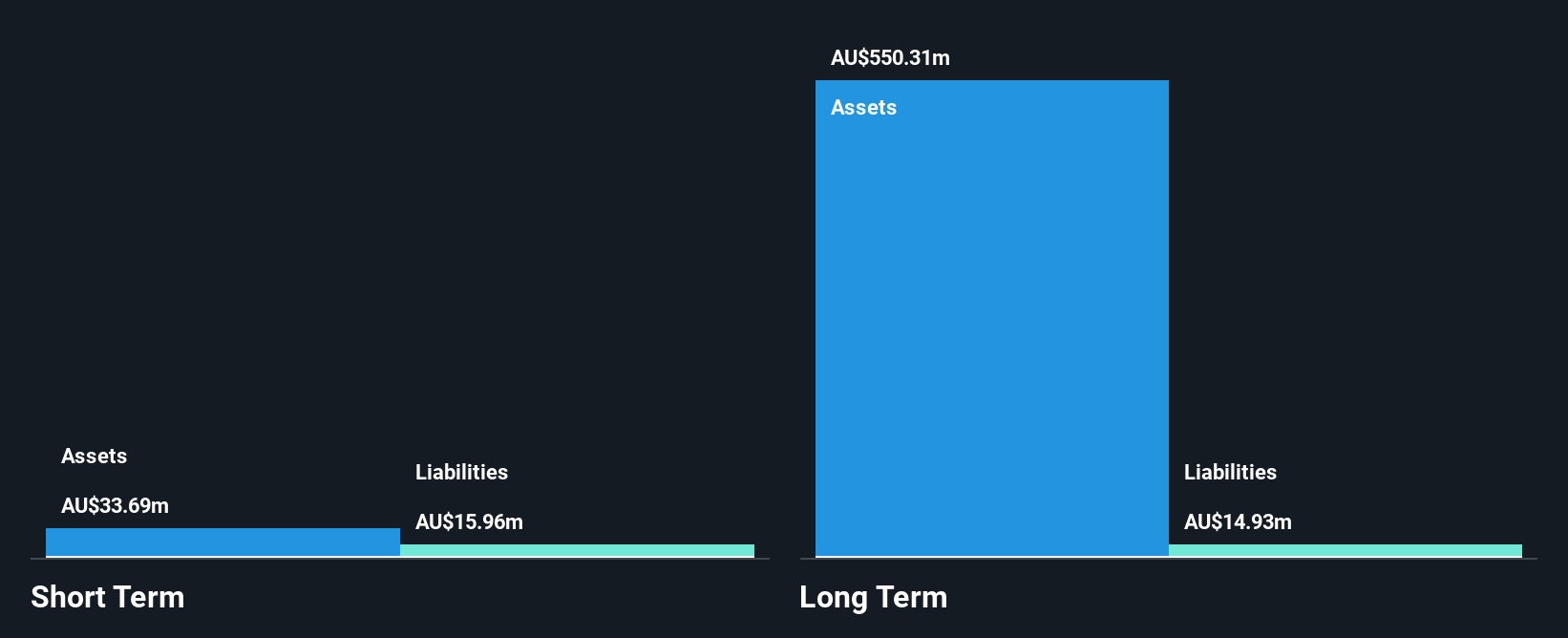

Jupiter Mines Limited, with a market cap of A$284.20 million, faces challenges with declining earnings over the past five years and negative growth last year. The company's net profit margins have decreased from the previous year, and its return on equity is low at 7.2%. Despite these issues, Jupiter Mines remains debt-free and has high-quality earnings with short-term assets exceeding both short-term and long-term liabilities. Recent board changes include Peter North stepping down as a director, which may influence future governance dynamics as Ntsimbintle Holding (Pty) Ltd nominates a replacement.

- Unlock comprehensive insights into our analysis of Jupiter Mines stock in this financial health report.

- Learn about Jupiter Mines' historical performance here.

Next Steps

- Embark on your investment journey to our 1,053 ASX Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives