ASX Penny Stocks Spotlight: Berkeley Energia Leads A Trio Of Picks

Reviewed by Simply Wall St

The Australian stock market has been relatively flat, with the ASX200 down slightly by 0.1% at 8,317 points, as energy and financial sectors show resilience amidst fluctuating oil prices and growing US crude stockpiles. Despite the somewhat outdated term, penny stocks continue to capture investor interest due to their affordability and potential for growth. Focusing on companies with strong financials can reveal promising opportunities within this segment of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.495 | A$1.7B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited is involved in the exploration and development of mineral properties in Spain, with a market cap of A$160.49 million.

Operations: No revenue segments have been reported.

Market Cap: A$160.49M

Berkeley Energia, with a market cap of A$160.49 million, is currently pre-revenue and unprofitable, reporting a net loss of A$3.26 million for the year ending June 30, 2024. Despite this, the company has no debt and boasts a strong cash runway exceeding three years based on current free cash flow trends. The management team and board are seasoned with extensive tenure averaging over nine years. While its share price has been highly volatile recently, Berkeley's financial stability is supported by short-term assets significantly outweighing liabilities (A$77.8M vs A$2.5M).

- Unlock comprehensive insights into our analysis of Berkeley Energia stock in this financial health report.

- Explore historical data to track Berkeley Energia's performance over time in our past results report.

Credit Clear (ASX:CCR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Credit Clear Limited develops and implements a receivables management platform and provides receivable collection services in Australia and New Zealand, with a market cap of A$149.29 million.

Operations: The company generates revenue through its Collections segment, which accounts for A$35.09 million, and Legal Services, contributing A$7.15 million.

Market Cap: A$149.29M

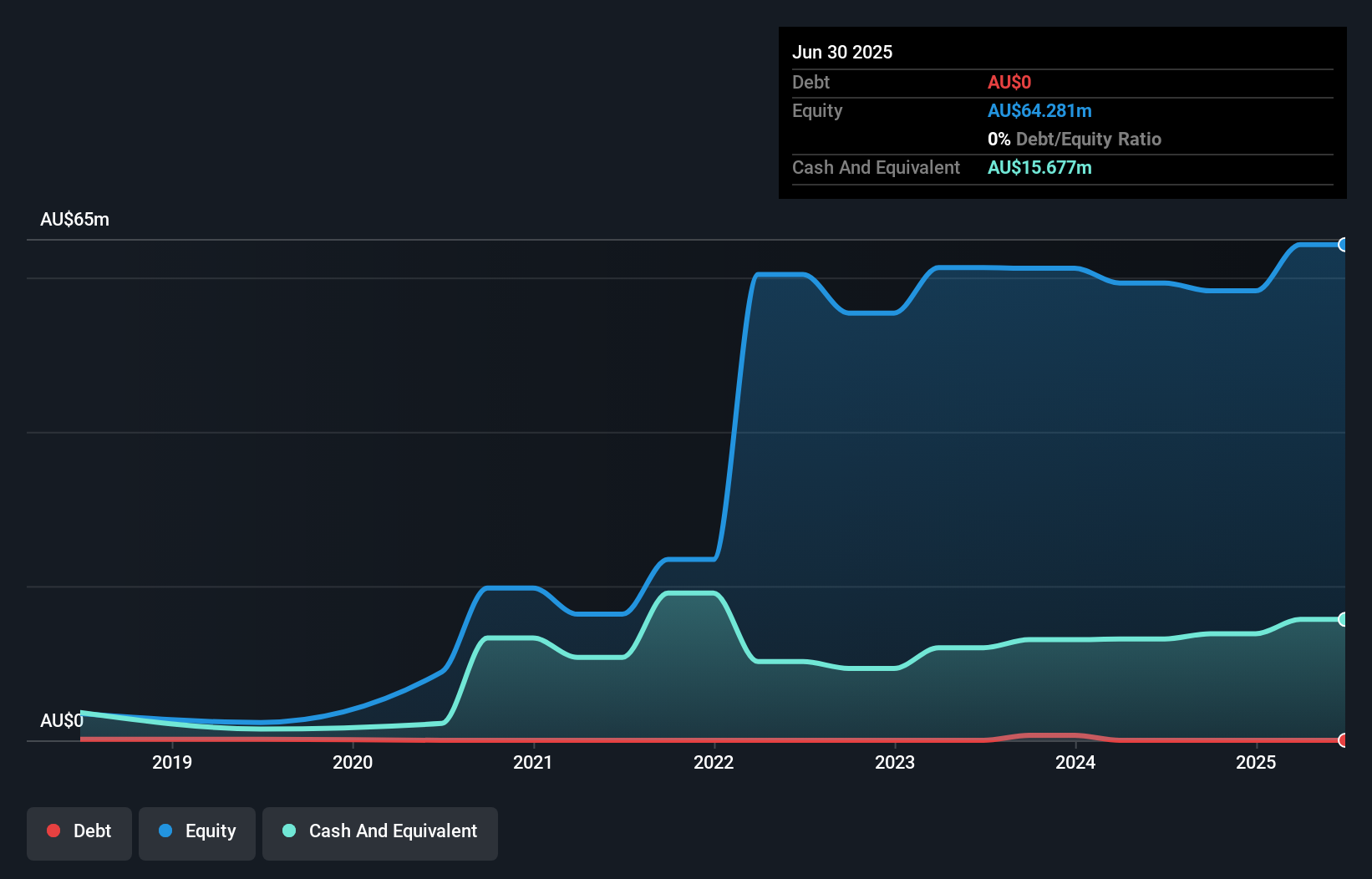

Credit Clear Limited, with a market cap of A$149.29 million, reported sales of A$42 million for the year ending June 30, 2024, but remains unprofitable with a net loss of A$4.5 million. Despite this, it maintains a strong financial position with short-term assets exceeding both long and short-term liabilities (A$26M vs A$3.7M and A$15.1M respectively) and has no debt. The company benefits from an experienced management team and recently appointed Jodie Bedoya to its board to enhance expertise in debt resolution strategies. Its cash runway is secure for over three years due to positive free cash flow trends.

- Take a closer look at Credit Clear's potential here in our financial health report.

- Assess Credit Clear's future earnings estimates with our detailed growth reports.

Ridley (ASX:RIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ridley Corporation Limited, with a market cap of A$868.98 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: The company generates revenue through its Bulk Stockfeeds segment, which accounts for A$886.59 million, and its Packaged/Ingredients segment, contributing A$376.31 million.

Market Cap: A$868.98M

Ridley Corporation Limited, with a market cap of A$868.98 million, shows potential for growth despite recent challenges. The company trades significantly below its estimated fair value and has stable weekly volatility, indicating a relatively steady stock performance. Although it experienced negative earnings growth last year, Ridley's forecasted annual earnings growth is 11.49%. Its debt is well-covered by operating cash flow at 70%, and the net debt to equity ratio of 35.8% is satisfactory. Recent board changes include the appointment of Dan Masters as a non-executive director, potentially strengthening governance and strategic direction amidst ongoing share repurchase efforts aimed at enhancing shareholder value.

- Jump into the full analysis health report here for a deeper understanding of Ridley.

- Learn about Ridley's future growth trajectory here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1,044 companies within our ASX Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCR

Credit Clear

Engages in the development and implementation of receivables management platform, and provision of receivable collection services in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.