Over the last 7 days, the Australian market has dropped 1.3%, driven by a loss of 4.4% in one sector, yet it remains up 10% over the past year with earnings forecasted to grow by 12% annually. In this fluctuating environment, identifying undervalued small-cap stocks with insider buying can present unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 19.4x | 2.3x | 9.62% | ★★★★★☆ |

| GWA Group | 15.4x | 1.4x | 45.24% | ★★★★★☆ |

| Eagers Automotive | 9.9x | 0.2x | 42.16% | ★★★★★☆ |

| SHAPE Australia | 13.9x | 0.3x | 36.61% | ★★★★☆☆ |

| Credit Corp Group | 20.2x | 2.7x | 42.83% | ★★★★☆☆ |

| Coventry Group | 233.0x | 0.4x | -15.65% | ★★★☆☆☆ |

| Dicker Data | 20.6x | 0.7x | -68.15% | ★★★☆☆☆ |

| Megaport | 125.2x | 6.2x | 44.90% | ★★★☆☆☆ |

| BSP Financial Group | 7.7x | 2.7x | 3.82% | ★★★☆☆☆ |

| Abacus Group | NA | 6.0x | 25.79% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

De Grey Mining (ASX:DEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: De Grey Mining is an Australian-based company focused on gold exploration and development, with a market cap of A$1.55 billion.

Operations: De Grey Mining's revenue primarily stems from exploration activities, with a recent gross profit of A$0.04154 million. The company incurred operating expenses amounting to A$28.35 million and non-operating expenses of -A$11.09 million, resulting in a net income margin of -414.58%.

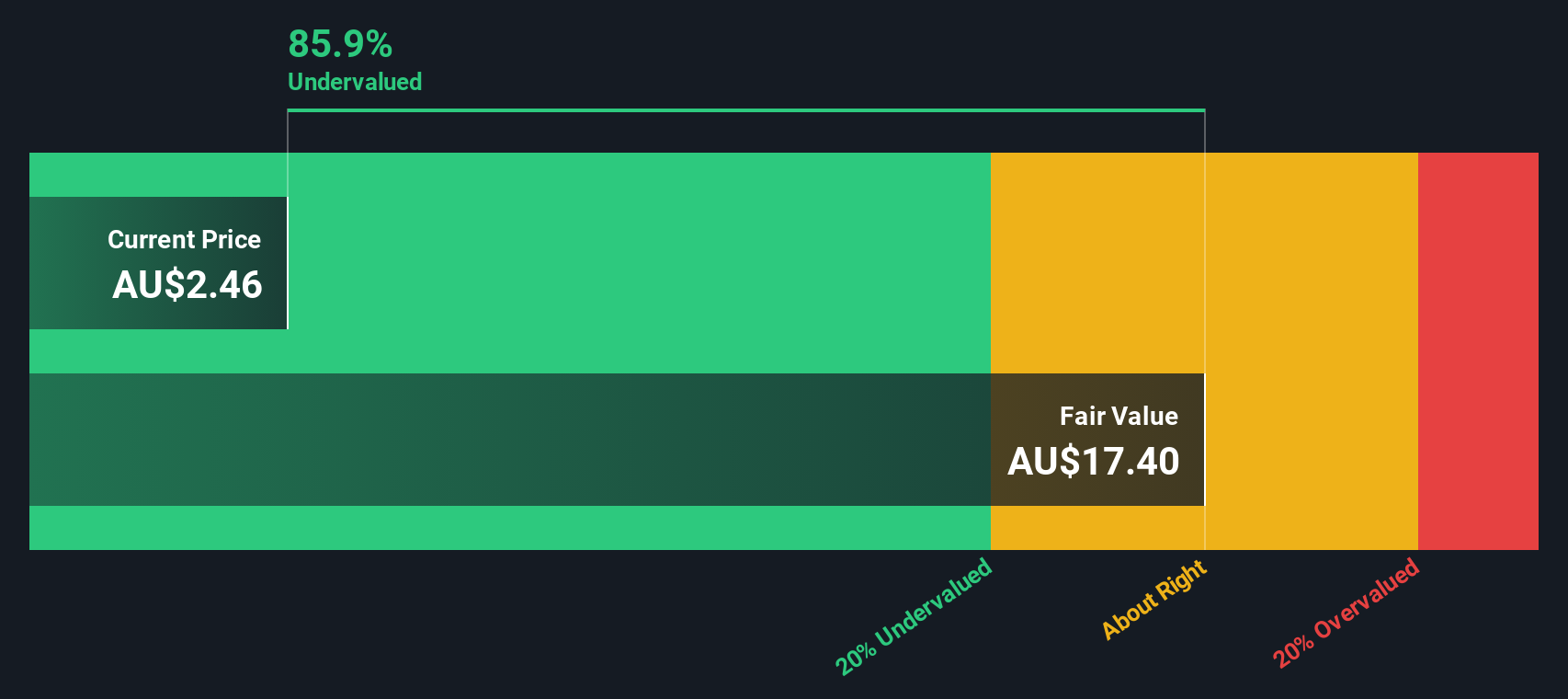

PE: -154.5x

De Grey Mining, a small company in Australia, reported a net loss of A$17.22 million for the year ended June 30, 2024, slightly improving from A$19.01 million last year. They showcased promising drilling results at the Becher Project and Lowe prospects in H2 2023 and recommenced follow-up programs with an ambitious 28,000 m combined AC and RC drilling plan. Insider confidence is evident with recent share purchases by key personnel between July and September 2024.

- Click to explore a detailed breakdown of our findings in De Grey Mining's valuation report.

Assess De Grey Mining's past performance with our detailed historical performance reports.

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Deterra Royalties operates by managing and acquiring royalty arrangements, with a market cap of A$2.11 billion.

Operations: Deterra Royalties generates revenue primarily through royalty arrangements, with a recent gross profit margin of 96.22%. The company's net income margin has shown variability, reaching 64.40% in the most recent period.

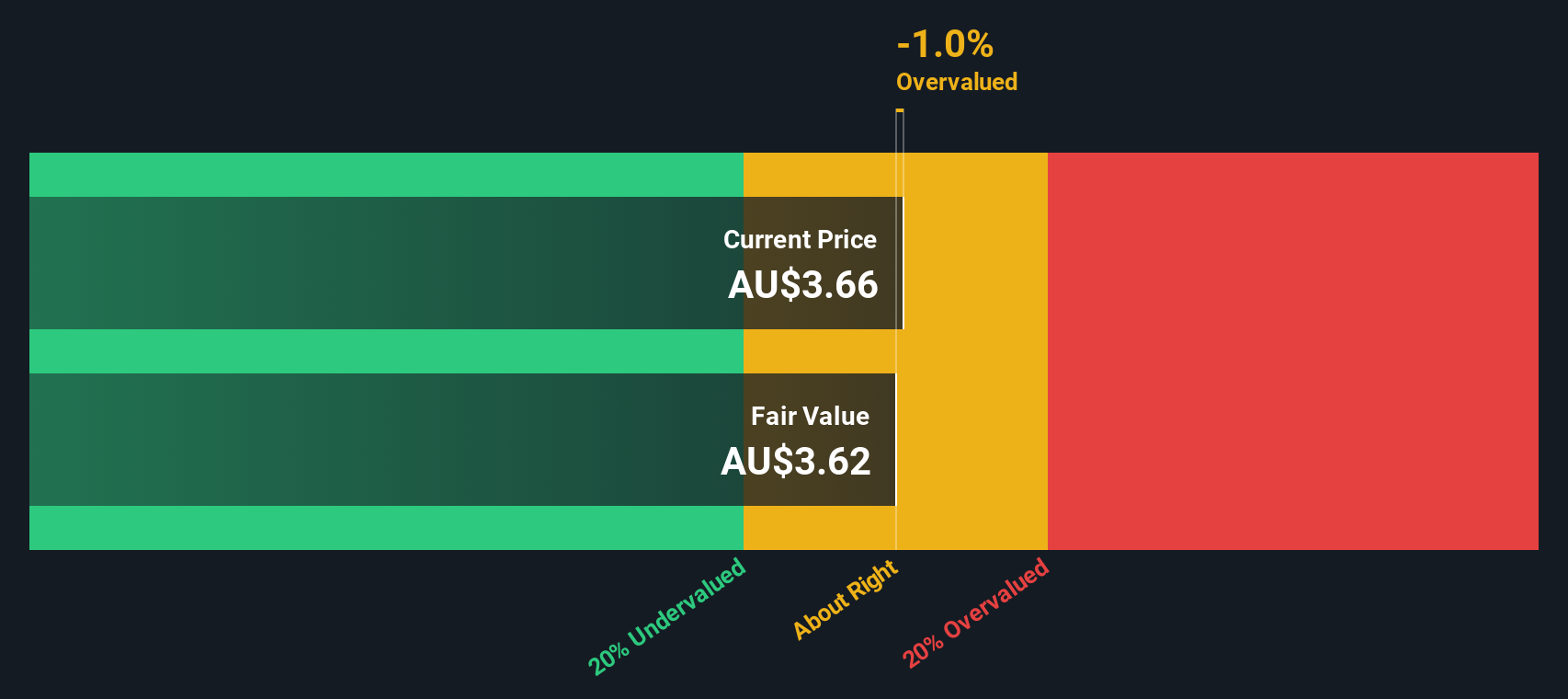

PE: 12.0x

Deterra Royalties, a smaller player in the Australian market, reported net income of A$154.89 million for the year ending June 30, 2024, slightly up from A$152.46 million the previous year. Basic earnings per share rose to A$0.293 from A$0.2885. Despite forecasted earnings decline of 7.6% annually over the next three years and reliance on higher-risk external borrowing, insider confidence is evident with recent share purchases throughout July and August 2024 signaling potential optimism about future prospects.

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders operates a diverse agribusiness with services including a branch network, wholesale products, and feed and processing services, and has a market cap of approximately A$1.72 billion.

Operations: Branch Network generates the highest revenue at A$2.54 billion, followed by Wholesale Products and Feed and Processing Services with A$341.19 million and A$120.14 million, respectively. The company’s gross profit margin has shown variability, reaching a peak of 21.71% in September 2018 and most recently recorded at 19.41% in March 2024.

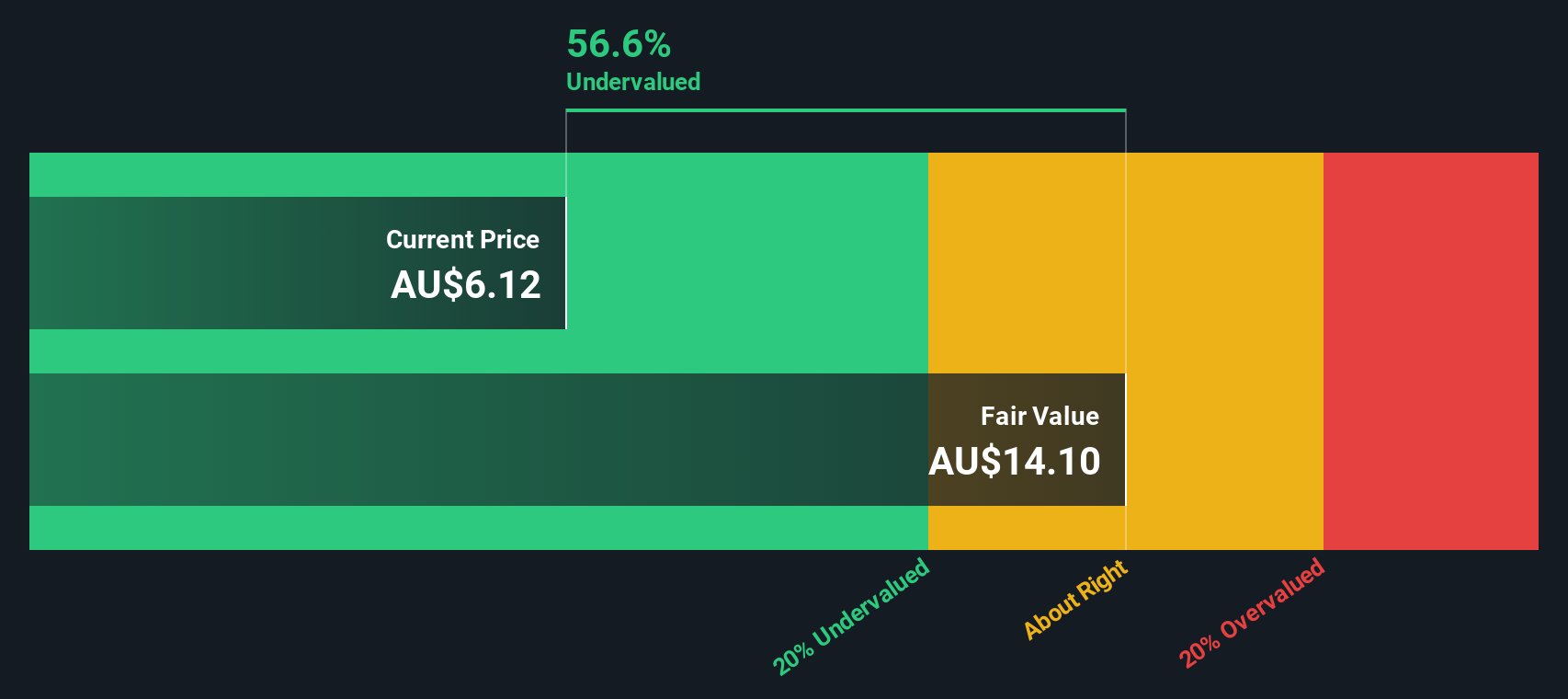

PE: 23.2x

Elders, a small cap in Australia, recently appointed Glenn Davis as a non-executive director, bringing nearly 40 years of legal and corporate governance experience. Despite profit margins slipping from 3.4% to 2.1% over the past year, earnings are forecasted to grow by 22.8% annually. Insider confidence is evident with recent share purchases by executives in July 2024, signaling strong belief in the company's future prospects despite its high debt levels and reliance on external borrowing for funding.

- Navigate through the intricacies of Elders with our comprehensive valuation report here.

Gain insights into Elders' historical performance by reviewing our past performance report.

Seize The Opportunity

- Access the full spectrum of 24 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elders might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELD

Elders

Provides agricultural products and services to rural and regional customers primarily in Australia.

Moderate and good value.