Cobram Estate Olives (ASX:CBO) Valuation in Focus After Recent Equity Offerings and Capital Raise

Reviewed by Kshitija Bhandaru

Cobram Estate Olives (ASX:CBO) just wrapped up several follow-on equity offerings in late September and early October, raising millions through direct listings. These moves provide the company with fresh capital and may support expansion plans and greater liquidity.

See our latest analysis for Cobram Estate Olives.

After completing a series of equity offerings, Cobram Estate Olives has seen its momentum pick up, with a 90-day share price return of 41.25% and a 1-year total shareholder return of 99.38%. The latest share price of $3.39 reflects growing optimism around expansion plans and the company's strong long-term positioning.

If you’re interested in discovering more companies generating excitement, now is a great moment to broaden your horizons and explore fast growing stocks with high insider ownership.

But after such rapid rises and fresh capital flowing in, is Cobram Estate Olives now trading below its true value and presenting a buying opportunity, or has the market already factored in the company’s future growth?

Most Popular Narrative: 8% Overvalued

With Cobram Estate Olives' consensus fair value sitting at A$3.14, slightly below its recent closing price of A$3.39, the most closely followed narrative highlights a market that may be running a bit ahead of itself. The gap is not large, but it is enough to spark debate over whether expectations are now overshooting fundamentals.

The market appears to be factoring in outsized, uninterrupted long-term revenue growth based on rising global demand for healthy oils and increased adoption of olive oil in the US and Asia-Pacific. However, current operational constraints, notably limited short-term supply growth in both Australia and the US while new groves mature, mean near-term revenues are likely to be flat or only modestly higher. This creates a disconnect between expectations and upcoming sales results.

Want to peek inside the numbers behind this narrow gap in fair value? This narrative hinges on bold revenue forecasts, shrinking margins, and a profit projection that breaks the mold for food producers. Curious which assumptions set the stage for today’s stock price? Dive in for the essential details behind the valuation debate.

Result: Fair Value of $3.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued grove maturation, along with strong branded sales growth in both Australia and the US, could quickly shift the outlook in Cobram Estate’s favor.

Find out about the key risks to this Cobram Estate Olives narrative.

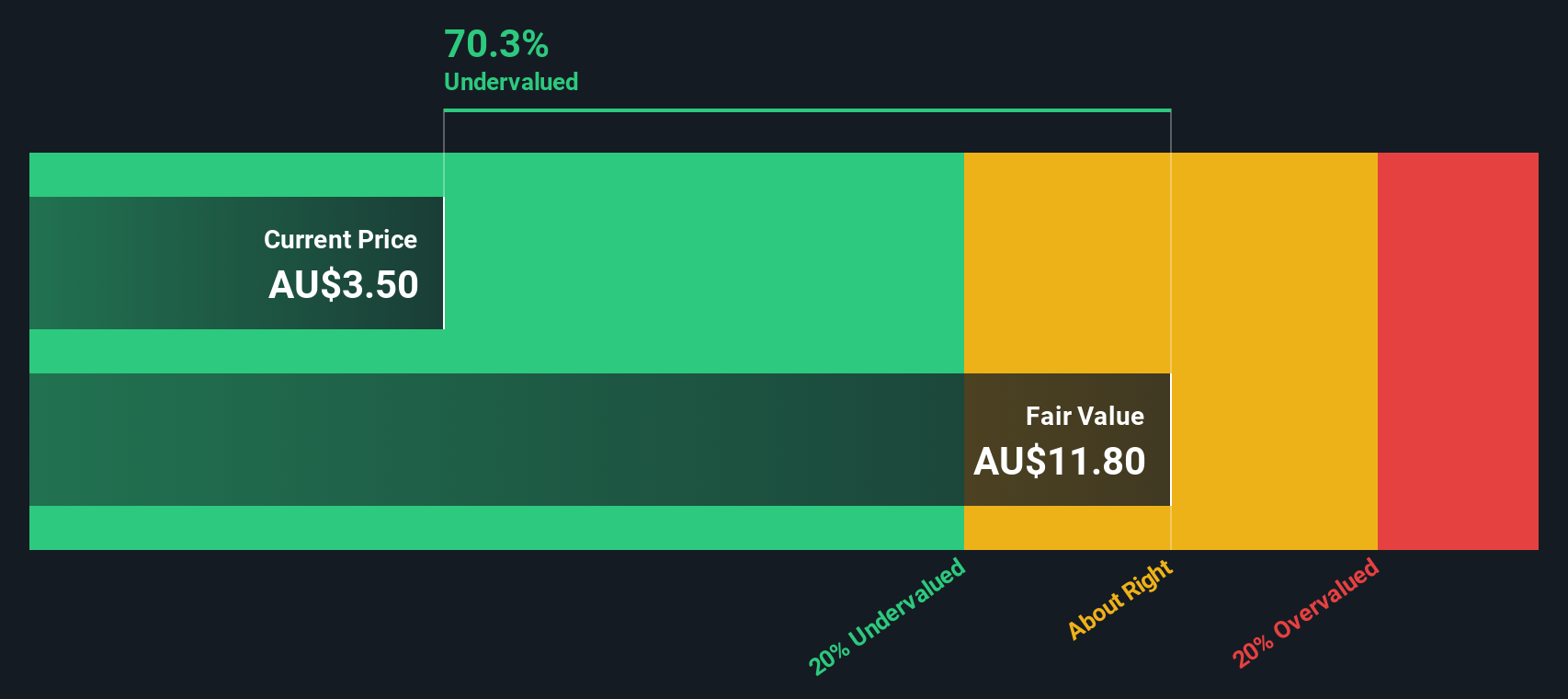

Another Perspective: What the DCF Model Says

Taking a step back from analyst consensus and applying the Simply Wall St DCF model, a very different story emerges. The DCF suggests the shares could be significantly undervalued compared to current market pricing, which may indicate an opportunity that analysts might be missing. Could this alternative approach reshape expectations for Cobram Estate Olives?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cobram Estate Olives for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cobram Estate Olives Narrative

If you have a different take or want your own voice in the story, it's quick and easy to dig into the numbers and assemble your own view in just a few minutes. Do it your way.

A great starting point for your Cobram Estate Olives research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let fresh opportunities slip by you. The market is moving fast, and top ideas come and go quickly. Put yourself ahead of the trend with these hand-picked screens:

- Uncover hidden value as you scan the market for untapped potential with these 891 undervalued stocks based on cash flows, which offers great upside based on real cash flow strength.

- Ride the next technology wave and catch tomorrow’s leaders by keeping an eye on these 25 AI penny stocks, featuring innovative AI companies pushing new boundaries.

- Secure regular income for your portfolio with these 18 dividend stocks with yields > 3%, featuring strong yields above 3% and resilient business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBO

Cobram Estate Olives

Engages in production and marketing of olive oil in Australia, the United States, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)