Should You Be Adding Australian Agricultural Projects (ASX:AAP) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Australian Agricultural Projects (ASX:AAP), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Australian Agricultural Projects

Australian Agricultural Projects' Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Impressively, Australian Agricultural Projects' EPS catapulted from AU$0.0018 to AU$0.0034, over the last year. It's not often a company can achieve year-on-year growth of 94%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

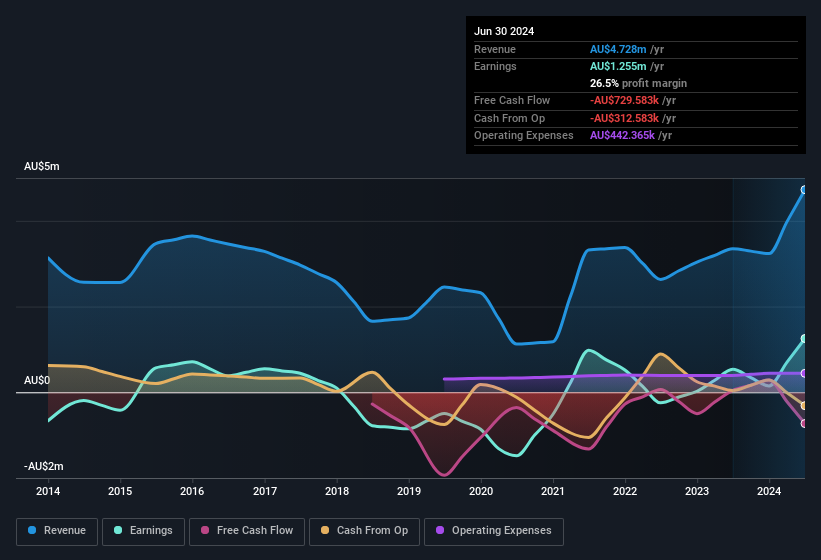

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Australian Agricultural Projects shareholders is that EBIT margins have grown from 12% to 29% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Australian Agricultural Projects is no giant, with a market capitalisation of AU$16m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Australian Agricultural Projects Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders in Australian Agricultural Projects both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. So, on balance, the insider transactions are mildly encouraging. It is also worth noting that it was Non Executive Director Daniel Stefanetti who made the biggest single purchase, worth AU$2.0m, paying AU$0.042 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Australian Agricultural Projects insiders own more than a third of the company. To be exact, company insiders hold 54% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Australian Agricultural Projects is a very small company, with a market cap of only AU$16m. So this large proportion of shares owned by insiders only amounts to AU$8.5m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Australian Agricultural Projects' CEO, Paul Challis, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under AU$320m, like Australian Agricultural Projects, the median CEO pay is around AU$464k.

Australian Agricultural Projects' CEO took home a total compensation package of AU$164k in the year prior to June 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Australian Agricultural Projects Deserve A Spot On Your Watchlist?

Australian Agricultural Projects' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Australian Agricultural Projects belongs near the top of your watchlist. You should always think about risks though. Case in point, we've spotted 4 warning signs for Australian Agricultural Projects you should be aware of, and 2 of them are significant.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Australian Agricultural Projects, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AAP

Australian Agricultural Projects

Operates and manages olive groves in Australia.

Excellent balance sheet and good value.

Market Insights

Community Narratives