- Australia

- /

- Oil and Gas

- /

- ASX:PDN

Can Paladin Energy's (ASX:PDN) PLS Cost Update Reshape Long-Term Confidence in Project Execution?

Reviewed by Simply Wall St

- Paladin Energy recently provided an update on its Patterson Lake South (PLS) uranium project in Canada, confirming unchanged life of mine production estimates, revised cost figures, and a targeted first uranium output in 2031 following the acquisition of Fission Uranium in December 2024.

- This update underscores the company's ability to maintain robust project economics and clarity on development timelines, even as capital and operating costs adjust for inflation and project advancements.

- To explore the impact on Paladin's investment case, we'll assess how the stable long-term outlook and refreshed cost structure for the PLS project shift the broader narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Paladin Energy Investment Narrative Recap

To be a shareholder in Paladin Energy, you need confidence in the long-term promise of uranium demand, prudent expansion into Canada, and stable project execution. The recent Patterson Lake South (PLS) update confirms consistent production and cost outlooks for the project, but does not move the needle on the top short-term catalyst: Langer Heinrich Mine’s operational ramp-up. The largest current risk remains margin pressure from rising unit costs at Langer Heinrich; that risk is unchanged by this news.

The company’s most recently announced full-year results highlight a net loss despite higher sales, underlining the immediate challenge: delivering profitable growth before PLS production begins. This context reinforces that, while PLS may improve the long-term outlook, near-term performance remains closely tied to success at Langer Heinrich, where cost management and production stability are crucial.

By contrast, investors should be aware that ongoing increases in unit production costs at Langer Heinrich could...

Read the full narrative on Paladin Energy (it's free!)

Paladin Energy's narrative projects $530.2 million revenue and $171.1 million earnings by 2028. This requires 56.5% yearly revenue growth and a $209.1 million increase in earnings from the current -$38.0 million.

Uncover how Paladin Energy's forecasts yield a A$8.35 fair value, a 4% upside to its current price.

Exploring Other Perspectives

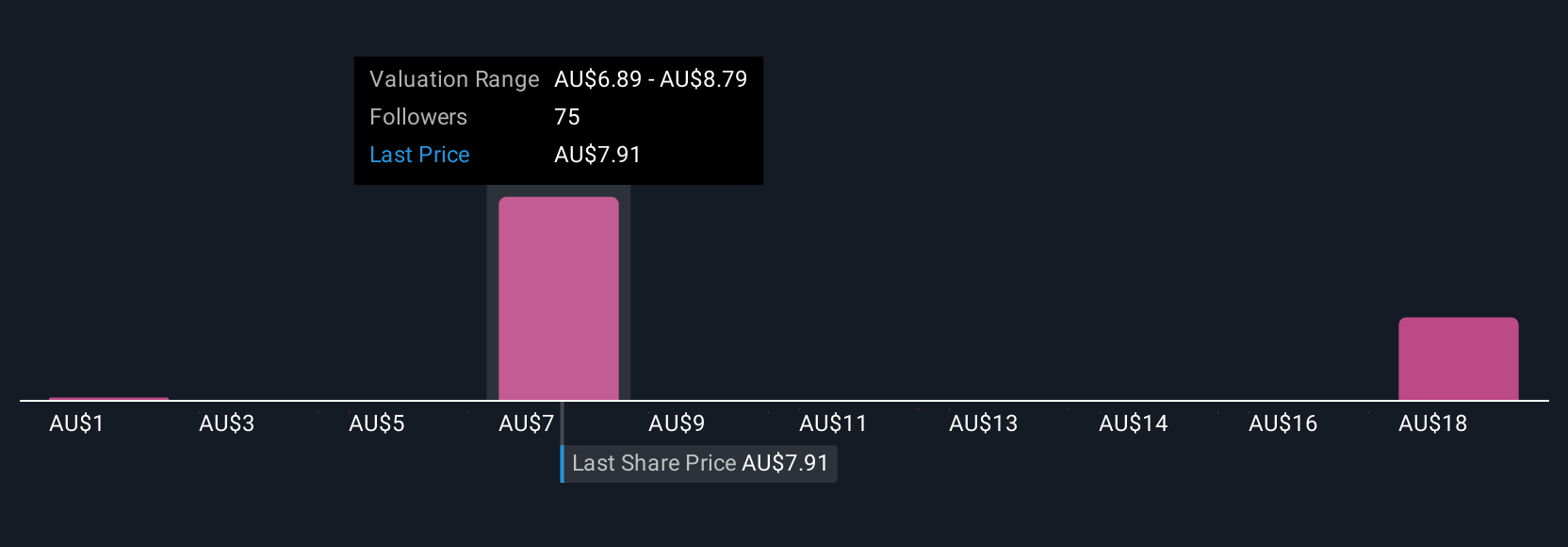

Thirteen members of the Simply Wall St Community have set fair value estimates for Paladin Energy, ranging widely from A$1.18 to A$19.72 per share. While some expect outsized upside, the company’s margin pressure from higher production costs could impact performance, highlighting the importance of comparing diverse viewpoints before investing.

Explore 13 other fair value estimates on Paladin Energy - why the stock might be worth less than half the current price!

Build Your Own Paladin Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paladin Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Paladin Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paladin Energy's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PDN

Paladin Energy

Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives