Key Takeaways

- Ramp-up at Langer Heinrich and optimized operations position Paladin for efficiency gains and significant growth as uranium demand rises globally.

- Strategic project pipeline, disciplined financial management, and diversified sales contracts provide resilience, future growth potential, and exposure to uranium market upside.

- Paladin faces significant operational, cost, regulatory, and market risks that threaten production reliability, margin stability, project progression, and long-term profitability.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- The ramp-up to full operations at the Langer Heinrich Mine is expected to be completed by the end of FY '26, positioning Paladin for a substantial increase in production volumes and sales revenue beginning FY '27, as global uranium demand accelerates due to widespread electrification and decarbonization efforts.

- The company continues to optimize plant throughput, ore blending, and recovery rates, driving improved operating efficiencies that should support higher net margins and earnings as Paladin transitions from ramp-up to steady-state operations.

- Acceptance of the final environmental impact statement for the Patterson Lake project in Canada enhances Paladin's project pipeline and optionality, providing future growth opportunities that could positively impact long-term revenues and valuation amid increasing energy security and supply chain localization concerns.

- The company's strategy to secure a balanced uranium sales portfolio-blending fixed, escalated, and market-related contracts-offers downside protection while providing exposure to further uranium price increases, directly benefiting revenue and cash flow in a tightening uranium market.

- Strong financial discipline, highlighted by a healthy cash position and undrawn credit facilities, improves Paladin's flexibility to pursue new project developments or potential acquisitions at a time when ESG investment themes are favoring low-carbon, nuclear-linked commodities-potentially enhancing future growth and access to capital.

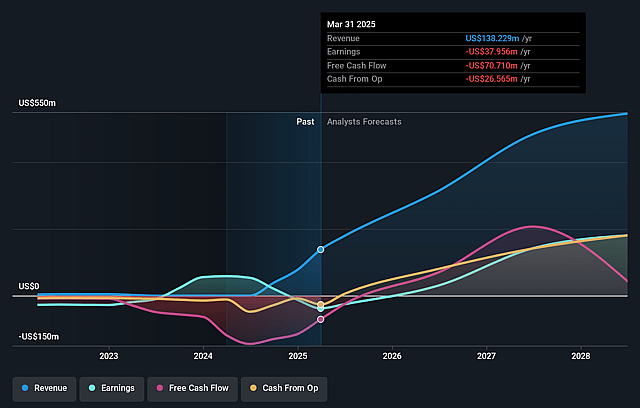

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paladin Energy's revenue will grow by 56.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -27.5% today to 32.3% in 3 years time.

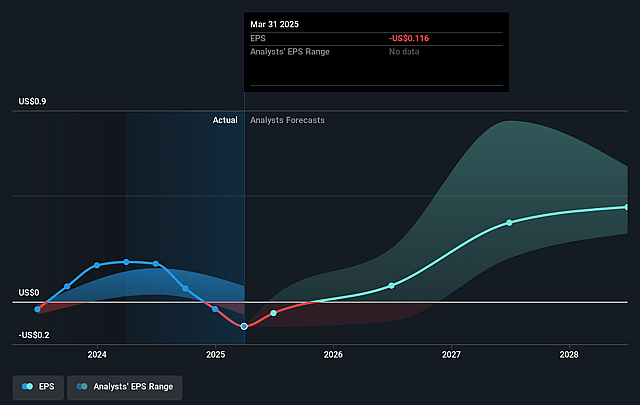

- Analysts expect earnings to reach $171.1 million (and earnings per share of $0.43) by about August 2028, up from $-38.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $340.1 million in earnings, and the most bearish expecting $81.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from -45.2x today. This future PE is greater than the current PE for the AU Oil and Gas industry at 13.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Paladin Energy's long-term financial performance is heavily dependent on the Langer Heinrich Mine; any operational disruptions, delays in mining fleet mobilization, or ongoing water supply interruptions could materially impact production volumes and revenue stability.

- Rising unit production costs and variability tied to the transition from stockpiled ore to fresh ore, combined with higher expected costs ($44–$48/lb for FY26 vs. $37.5/lb recently), expose Paladin to margin compression, particularly if uranium spot prices underperform or contract pricing remains below market rates.

- The company's realized sales prices are subject to volatility and, due to a contract structure with a mix of fixed and market-related prices, future revenue growth may be limited even in a strong uranium price environment, impacting net earnings and cash flow.

- Regulatory and environmental risks remain material, as the permitting of Canadian projects is still undergoing public review, and compliance requirements or shifting public sentiment could lead to cost overruns, project delays, or restricted access to new developments, affecting long-term growth.

- As Paladin expands into full-scale mining operations, there is heightened exposure to the long project lead times, potential decommissioning liabilities, and costly rehabilitation requirements common in the uranium industry, which could erode profitability and strain capital resources over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.424 for Paladin Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$12.45, and the most bearish reporting a price target of just A$5.14.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $530.2 million, earnings will come to $171.1 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$6.59, the analyst price target of A$8.42 is 21.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.