- Australia

- /

- Real Estate

- /

- ASX:UOS

ASX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the Australian market prepares for a festive break, the ASX 200 is set to open slightly in the green following a mixed performance on Wall Street. In this context, penny stocks—though often considered niche—remain an intriguing area for investors seeking potential growth opportunities. These smaller or newer companies can offer unique value propositions when supported by strong financial health, and we'll highlight three such stocks that could present promising prospects for investors looking to uncover hidden value.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.89 | A$307.73M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.625 | A$796.38M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.915 | A$107.42M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$237.96M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$193.32M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.89 | A$482.47M | ★★★★☆☆ |

Click here to see the full list of 1,054 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

GR Engineering Services (ASX:GNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing industries both in Australia and internationally, with a market cap of A$410.84 million.

Operations: The company's revenue is primarily derived from its Mineral Processing segment, which generated A$346.21 million, and its Oil and Gas segment, contributing A$77.86 million.

Market Cap: A$410.84M

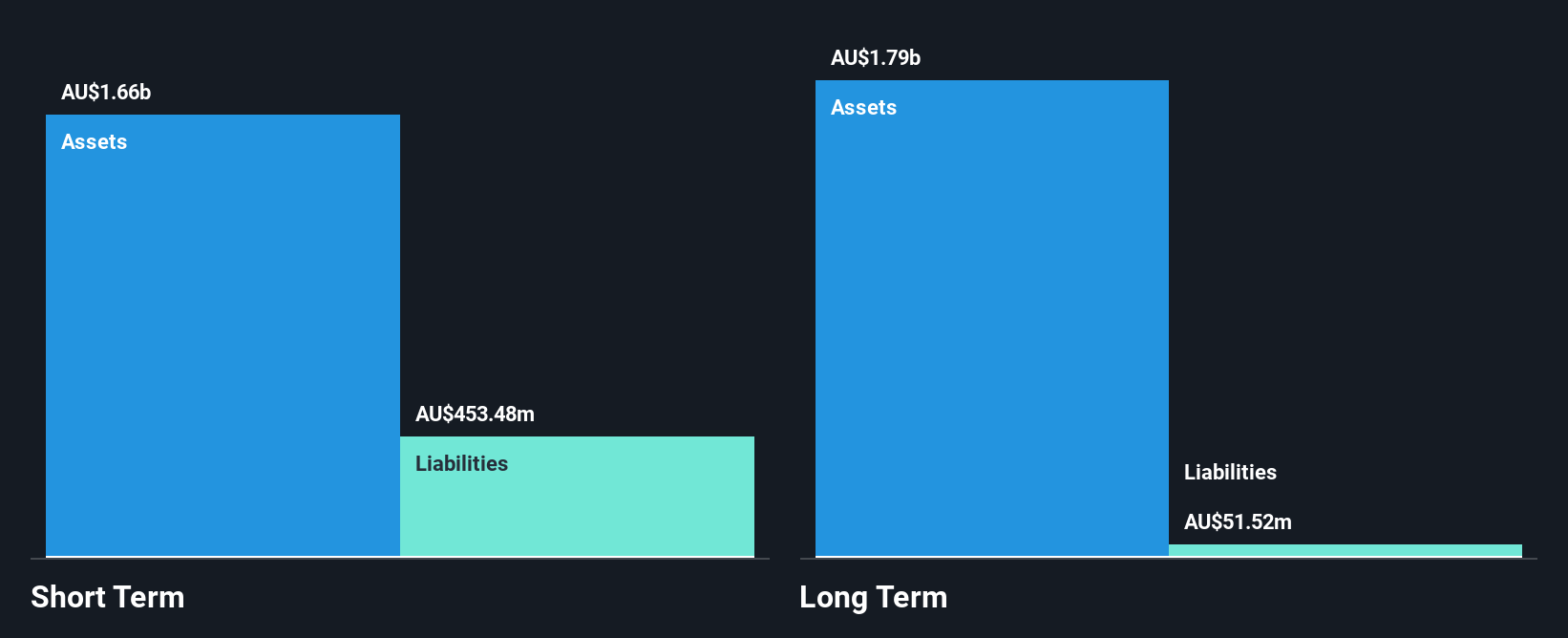

GR Engineering Services Limited has demonstrated robust financial health, with no debt and short-term assets of A$171.4 million exceeding both short-term and long-term liabilities. The company's Return on Equity is outstanding at 47%, although its earnings growth of 13.4% over the past year is below its five-year average of 38.9%. Despite a dividend yield of 7.72%, it is not well-covered by earnings or free cash flows, which could be a concern for income-focused investors. The stock's Price-To-Earnings ratio stands at an attractive level compared to the broader Australian market, suggesting potential value for investors seeking exposure in this sector.

- Get an in-depth perspective on GR Engineering Services' performance by reading our balance sheet health report here.

- Examine GR Engineering Services' past performance report to understand how it has performed in prior years.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Horizon Oil Limited, with a market cap of A$309.09 million, is involved in the exploration, development, and production of oil and gas properties across China, New Zealand, and Australia.

Operations: The company's revenue is derived from Australia Development ($0.39 million), China Exploration and Development ($76.83 million), and New Zealand Exploration and Development ($34.24 million).

Market Cap: A$309.09M

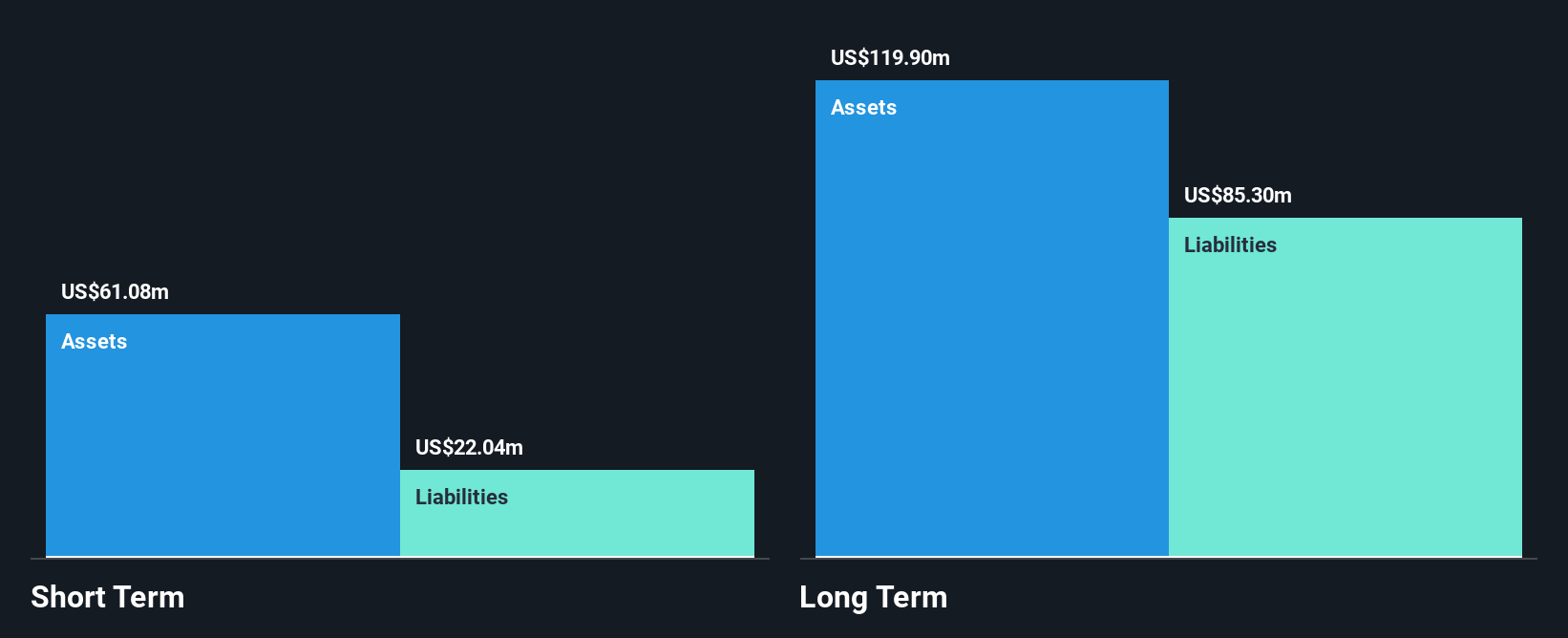

Horizon Oil Limited, with a market cap of A$309.09 million, presents a mixed investment case. The company is not pre-revenue, generating significant income from its operations in China and New Zealand. Despite having high-quality earnings and a strong Return on Equity of 31.1%, the dividend yield of 15.75% is not well covered by earnings or free cash flows, raising sustainability concerns for income investors. Positively, Horizon's debt levels are manageable with more cash than total debt and operating cash flow covering debt well. However, negative earnings growth over the past year contrasts with its five-year average growth trajectory.

- Click here to discover the nuances of Horizon Oil with our detailed analytical financial health report.

- Understand Horizon Oil's earnings outlook by examining our growth report.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, focuses on the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market capitalization of A$916.90 million.

Operations: The company's revenue segments include Investment, generating A$604.42 million, and Land Development and Resale, contributing A$250.14 million.

Market Cap: A$916.9M

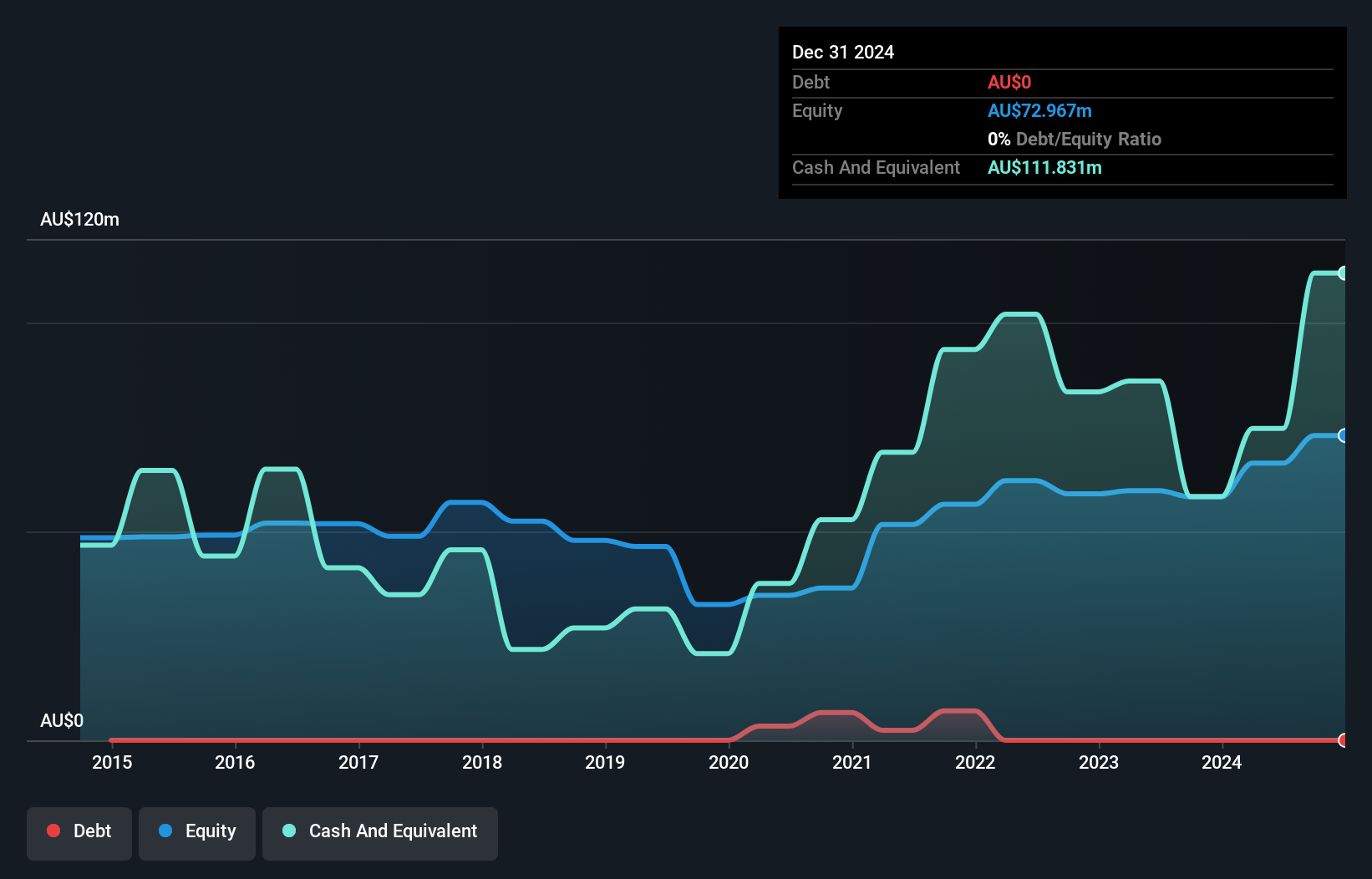

United Overseas Australia Ltd, with a market cap of A$916.90 million, shows a complex investment picture. The company is not pre-revenue, with significant revenue from its Investment and Land Development segments. Despite earnings declining by 4.4% annually over five years, recent growth of 1.5% indicates potential improvement. The debt to equity ratio has increased but remains manageable as cash exceeds total debt and interest coverage is adequate. Short-term assets comfortably cover liabilities, though shareholder dilution occurred recently. While the Return on Equity remains low at 4.8%, seasoned management and board members provide stability amidst large one-off gains impacting recent results.

- Unlock comprehensive insights into our analysis of United Overseas Australia stock in this financial health report.

- Understand United Overseas Australia's track record by examining our performance history report.

Summing It All Up

- Click here to access our complete index of 1,054 ASX Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Excellent balance sheet and fair value.