- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Have Insiders Been Buying Boss Energy Limited (ASX:BOE) Shares This Year?

It is not uncommon to see companies perform well in the years after insiders buy shares. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So before you buy or sell Boss Energy Limited (ASX:BOE), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

View our latest analysis for Boss Energy

The Last 12 Months Of Insider Transactions At Boss Energy

Over the last year, we can see that the biggest insider purchase was by Independent Non Executive Chairman Peter O’Connor for AU$194k worth of shares, at about AU$0.069 per share. We do like to see buying, but this purchase was made at well below the current price of AU$0.14. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

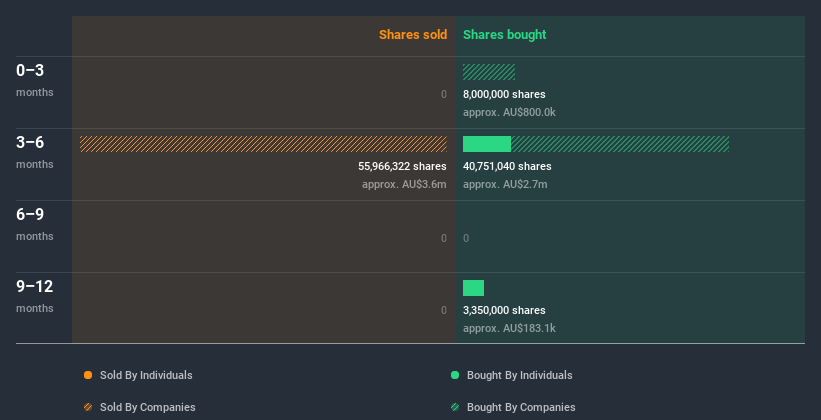

While Boss Energy insiders bought shares during the last year, they didn't sell. The average buy price was around AU$0.041. It is certainly positive to see that insiders have invested their own money in the company. However, you should keep in mind that they bought when the share price was meaningfully below today's levels. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Boss Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Boss Energy insiders own 9.4% of the company, worth about AU$25m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Boss Energy Tell Us?

It doesn't really mean much that no insider has traded Boss Energy shares in the last quarter. But insiders have shown more of an appetite for the stock, over the last year. Insiders own shares in Boss Energy and we see no evidence to suggest they are worried about the future. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Boss Energy. When we did our research, we found 4 warning signs for Boss Energy (1 is significant!) that we believe deserve your full attention.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Boss Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives