- Australia

- /

- Capital Markets

- /

- ASX:FID

Most Shareholders Will Probably Agree With Fiducian Group Ltd's (ASX:FID) CEO Compensation

Performance at Fiducian Group Ltd (ASX:FID) has been reasonably good and CEO Indy Singh has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 20 October 2021. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Fiducian Group

How Does Total Compensation For Indy Singh Compare With Other Companies In The Industry?

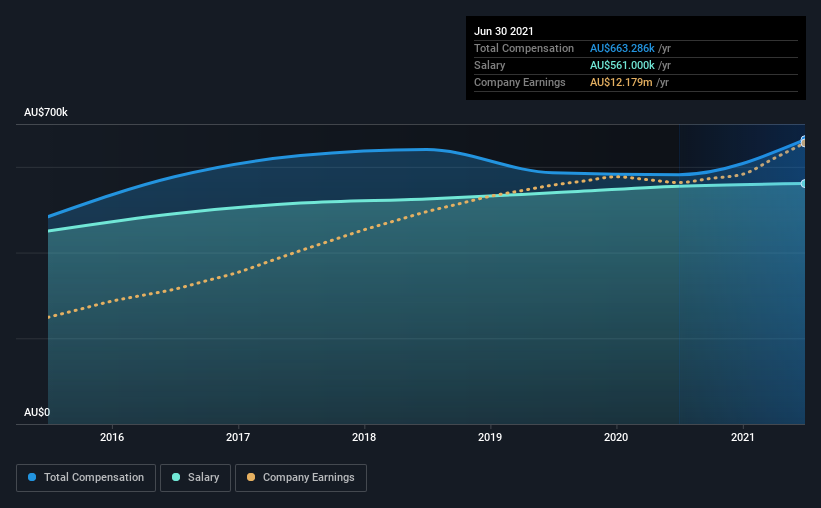

Our data indicates that Fiducian Group Ltd has a market capitalization of AU$264m, and total annual CEO compensation was reported as AU$663k for the year to June 2021. That's a notable increase of 14% on last year. We note that the salary portion, which stands at AU$561.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$136m and AU$543m had a median total CEO compensation of AU$785k. From this we gather that Indy Singh is paid around the median for CEOs in the industry. What's more, Indy Singh holds AU$92m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$561k | AU$555k | 85% |

| Other | AU$102k | AU$27k | 15% |

| Total Compensation | AU$663k | AU$582k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. It's interesting to note that Fiducian Group pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Fiducian Group Ltd's Growth Numbers

Fiducian Group Ltd's earnings per share (EPS) grew 9.6% per year over the last three years. In the last year, its revenue is up 7.0%.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Fiducian Group Ltd Been A Good Investment?

Boasting a total shareholder return of 118% over three years, Fiducian Group Ltd has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Fiducian Group that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)