- Australia

- /

- Capital Markets

- /

- ASX:EQT

Discovering Australia's Hidden Stock Gems This October 2025

Reviewed by Simply Wall St

As the Australian market navigates a dynamic landscape, small-cap stocks have captured attention, particularly in the wake of a significant critical mineral deal between Canberra and Washington. With materials leading the charge amid broader positive sentiment, now is an opportune time to explore lesser-known stocks that may benefit from these developments. Identifying promising opportunities often involves looking at companies poised to capitalize on emerging trends and strategic partnerships within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Mayfield Group Holdings | 0.21% | 11.99% | 30.07% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

EQT Holdings (ASX:EQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: EQT Holdings Limited, with a market cap of A$603.75 million, operates in Australia offering philanthropic, trustee, and investment services through its subsidiaries.

Operations: EQT Holdings generates revenue primarily from its Trustee & Wealth Services and Corporate & Superannuation Trustee Services segments, with the latter contributing A$79.99 million. The company's net profit margin reveals important insights into its financial efficiency and profitability trends over time.

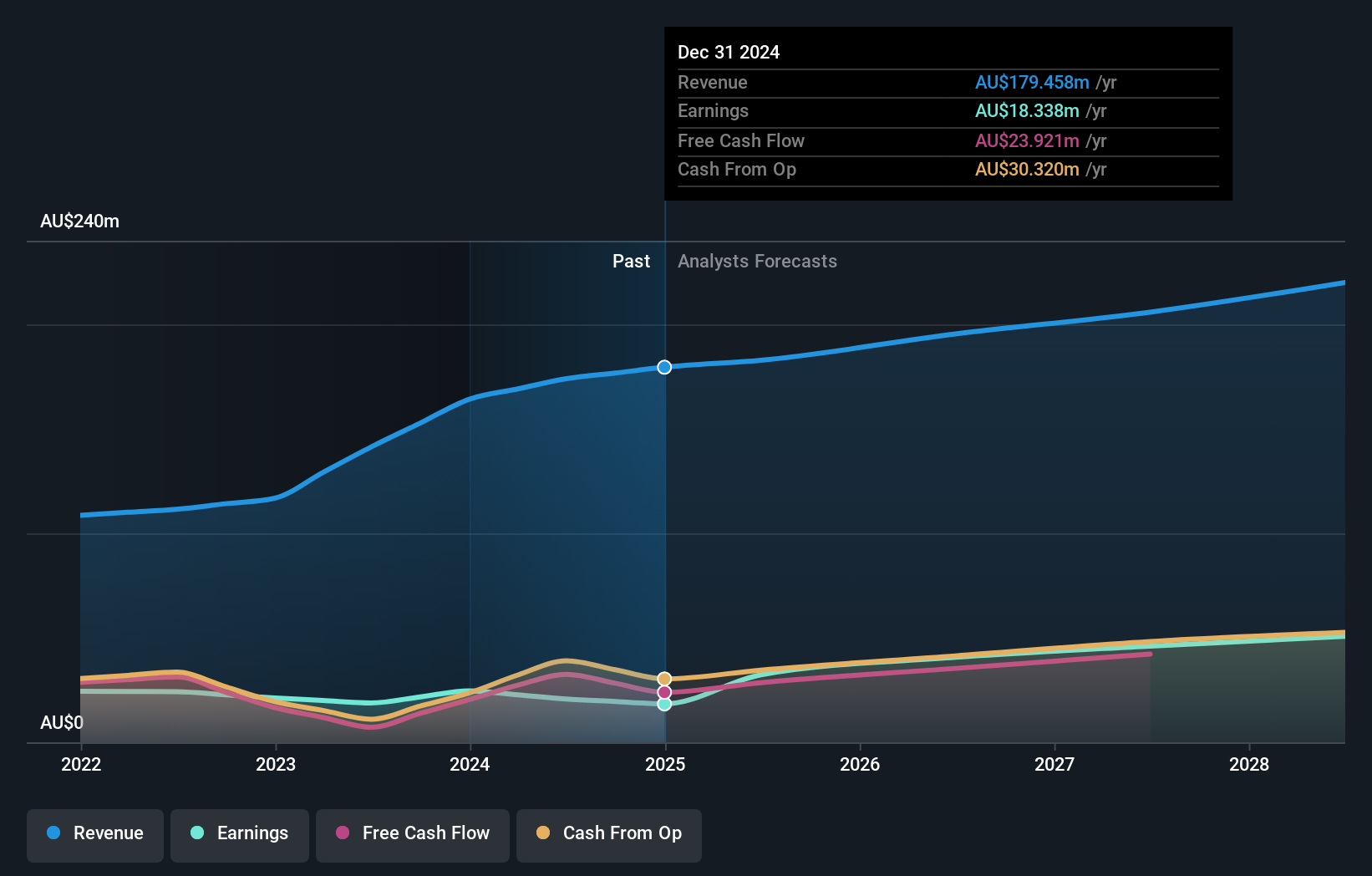

EQT Holdings, a nimble player in the Australian market, is seeing robust growth with earnings surging 19.7% over the past year, outpacing industry averages. Despite an increased debt-to-equity ratio from 10.8% to 20.5% over five years, interest obligations are comfortably covered at 10.8 times by EBIT, underscoring financial stability. The company’s strategic focus on digital transformation and corporate trustee services is driving operational efficiency and profitability amid rising regulatory demands for trustee services. With a price-to-earnings ratio of 17.6x below the market average of 21.5x, EQT offers compelling value prospects despite facing regulatory scrutiny challenges from ASIC regarding its subsidiary's practices in superannuation fund management.

Fiducian Group (ASX:FID)

Simply Wall St Value Rating: ★★★★★★

Overview: Fiducian Group Ltd operates as a financial services provider in Australia through its subsidiaries, with a market capitalization of approximately A$410.38 million.

Operations: Fiducian Group generates revenue primarily from four segments: Financial Planning (A$29.66 million), Funds Management (A$25.59 million), Corporate Services (A$17.67 million), and Platform Administration (A$16.45 million).

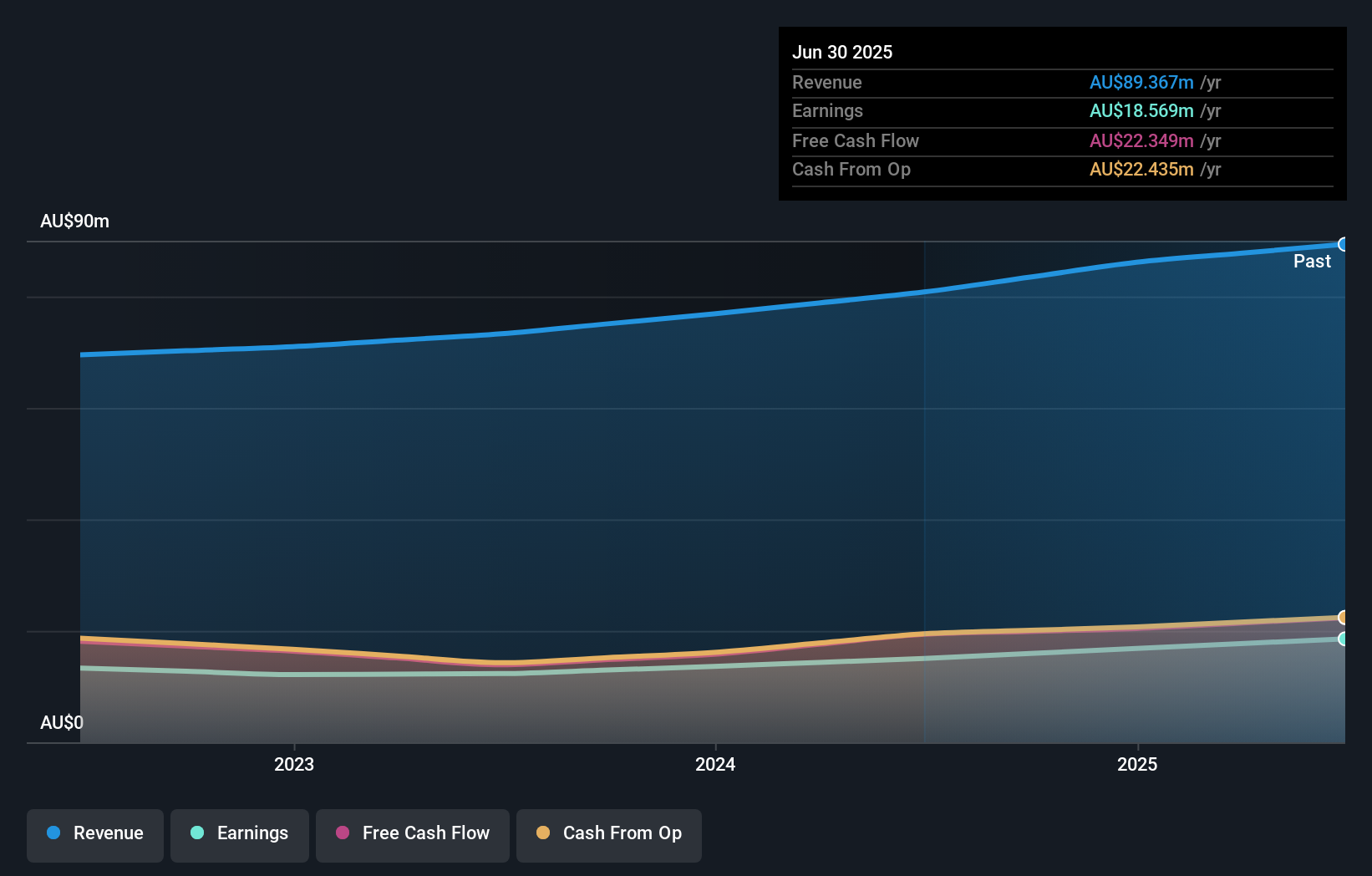

Fiducian Group, a nimble player in the financial sector, has been making waves with its impressive performance. The company reported earnings growth of 23.5% over the past year, outpacing the Capital Markets industry's 19.3%. With no debt on its books for five years, Fiducian enjoys a robust financial position that eliminates concerns about interest payments. Its high-quality earnings are reflected in a net income rise to A$18.57 million from A$15.04 million last year and an increase in diluted EPS to A$0.5883 from A$0.4774 previously. The recent dividend increase signals confidence in sustained profitability and shareholder value enhancement.

- Click to explore a detailed breakdown of our findings in Fiducian Group's health report.

Gain insights into Fiducian Group's historical performance by reviewing our past performance report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★★

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.75 billion.

Operations: MFF Capital Investments generates revenue primarily from its equity investments, amounting to A$631.43 million. The firm has a market capitalization of A$2.75 billion.

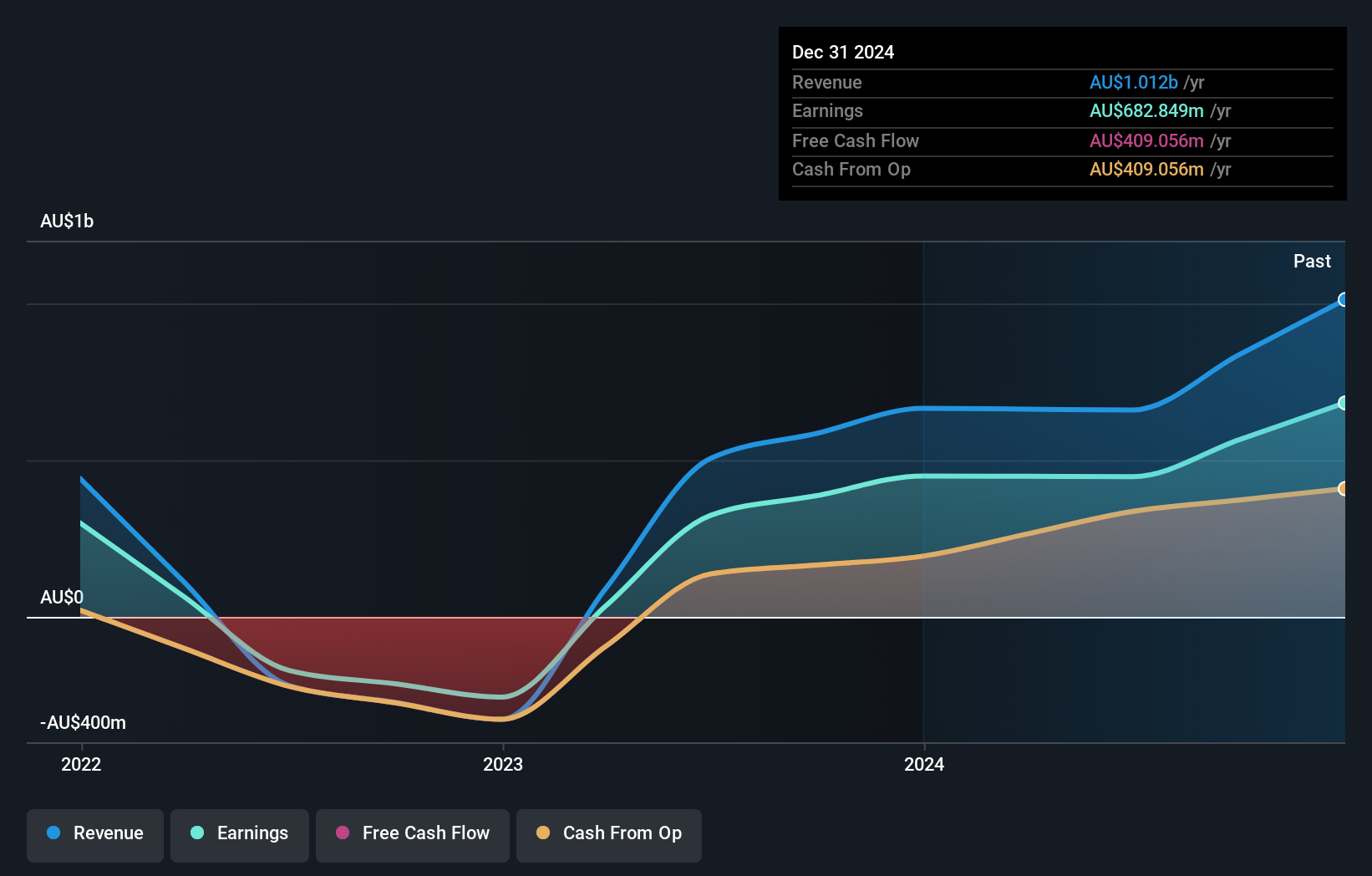

MFF Capital Investments, a nimble player in the financial sector, is trading significantly below its estimated fair value by 67.5%, suggesting potential undervaluation. Despite a recent earnings dip of 3.4%, contrasting with the industry’s robust growth of 19.3%, the company remains debt-free and boasts high-quality past earnings, underscoring its financial resilience. Recent executive appointments, including a seasoned CFO and Chief Risk Officer, could bolster strategic oversight. With free cash flow turning positive at A$336 million as of June 2025 and no interest coverage concerns due to zero debt, MFF stands poised for operational stability amidst market fluctuations.

Key Takeaways

- Reveal the 58 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EQT Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EQT

EQT Holdings

Provides philanthropic, trustee, and investment services in Australia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)