- Australia

- /

- Diversified Financial

- /

- ASX:IAM

Investors Who Bought Cashwerkz (ASX:CWZ) Shares A Year Ago Are Now Up 126%

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Cashwerkz Limited (ASX:CWZ). Its share price is already up an impressive 126% in the last twelve months. On top of that, the share price is up 46% in about a quarter. Looking back further, the stock price is 94% higher than it was three years ago.

See our latest analysis for Cashwerkz

Given that Cashwerkz didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, Cashwerkz's revenue grew by 10%. That's not a very high growth rate considering it doesn't make profits. So we wouldn't have expected the share price to rise by 126%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

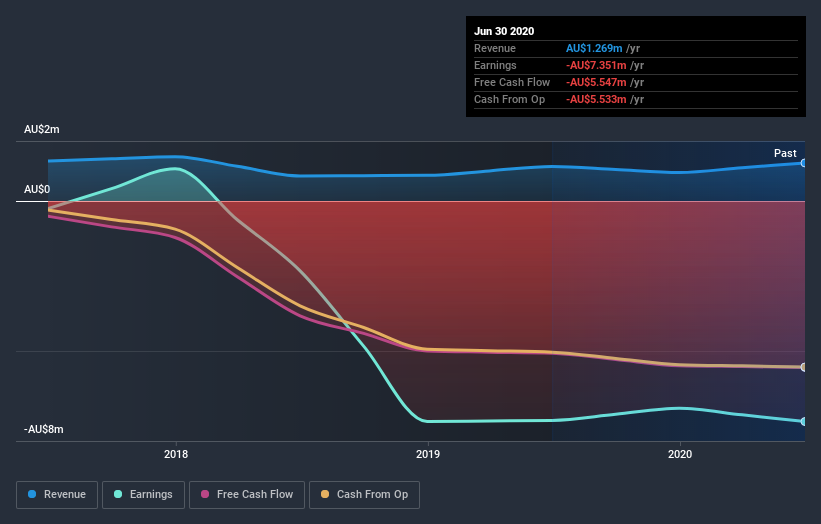

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Cashwerkz stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Cashwerkz shareholders have gained 126% (in total) over the last year. That's better than the annualized TSR of 25% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Cashwerkz (of which 1 is significant!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Cashwerkz, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:IAM

Income Asset Management Group

Engages in the provision of financial product solutions in cash/deposits and fixed income in Australia.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives