- Australia

- /

- Capital Markets

- /

- ASX:AUI

Discovering 3 Australian Dividend Stocks With Yields Ranging From 3.5% To 7.5%

Reviewed by Kshitija Bhandaru

Amidst a cautiously optimistic atmosphere, Australian shares have shown resilience with sectors like mining leading the charge, buoyed by rising commodity prices and positive movements in major indices such as the S&P/ASX 200. This backdrop sets a compelling stage for investors looking towards dividend stocks, which can offer both stability and attractive yields in a market navigating through economic uncertainties and awaiting pivotal global financial cues.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.72% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.11% | ★★★★★☆ |

| Computershare (ASX:CPU) | 3.03% | ★★★★★☆ |

| Joyce (ASX:JYC) | 8.21% | ★★★★★☆ |

| Korvest (ASX:KOV) | 6.76% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.52% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.35% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.40% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.25% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.18% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

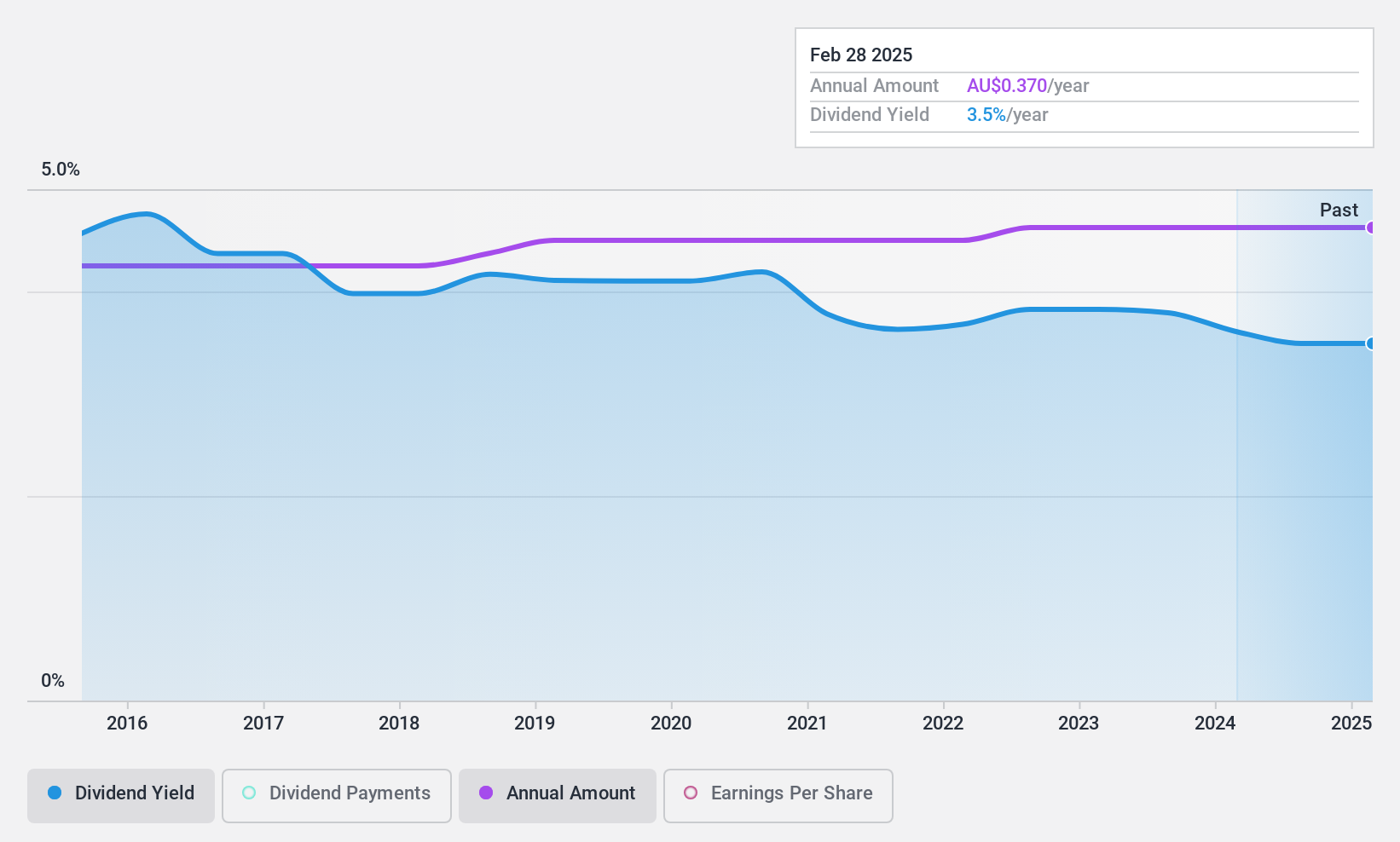

Overview: Australian United Investment Company Limited operates as a publicly owned investment manager, with a market capitalization of approximately A$1.30 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily through investments, amounting to A$58.33 million.

Dividend Yield: 3.6%

Australian United Investment Company Limited reported a net income of A$24.31 million for the half-year ended December 31, 2023, a decrease from the previous year's A$30.06 million. Despite this dip in earnings, it maintained its dividend payout with a recent cash dividend announced at A$0.17. The company's current dividend yield stands at 3.6%, below the top tier in Australia's market but has shown stability and growth over the past decade. However, concerns arise due to its high payout ratio of 92.4% and coverage issues, as dividends are not well covered by earnings or free cash flow (cash payout ratio at 88.5%), questioning sustainability despite past reliability and stability in dividend payments.

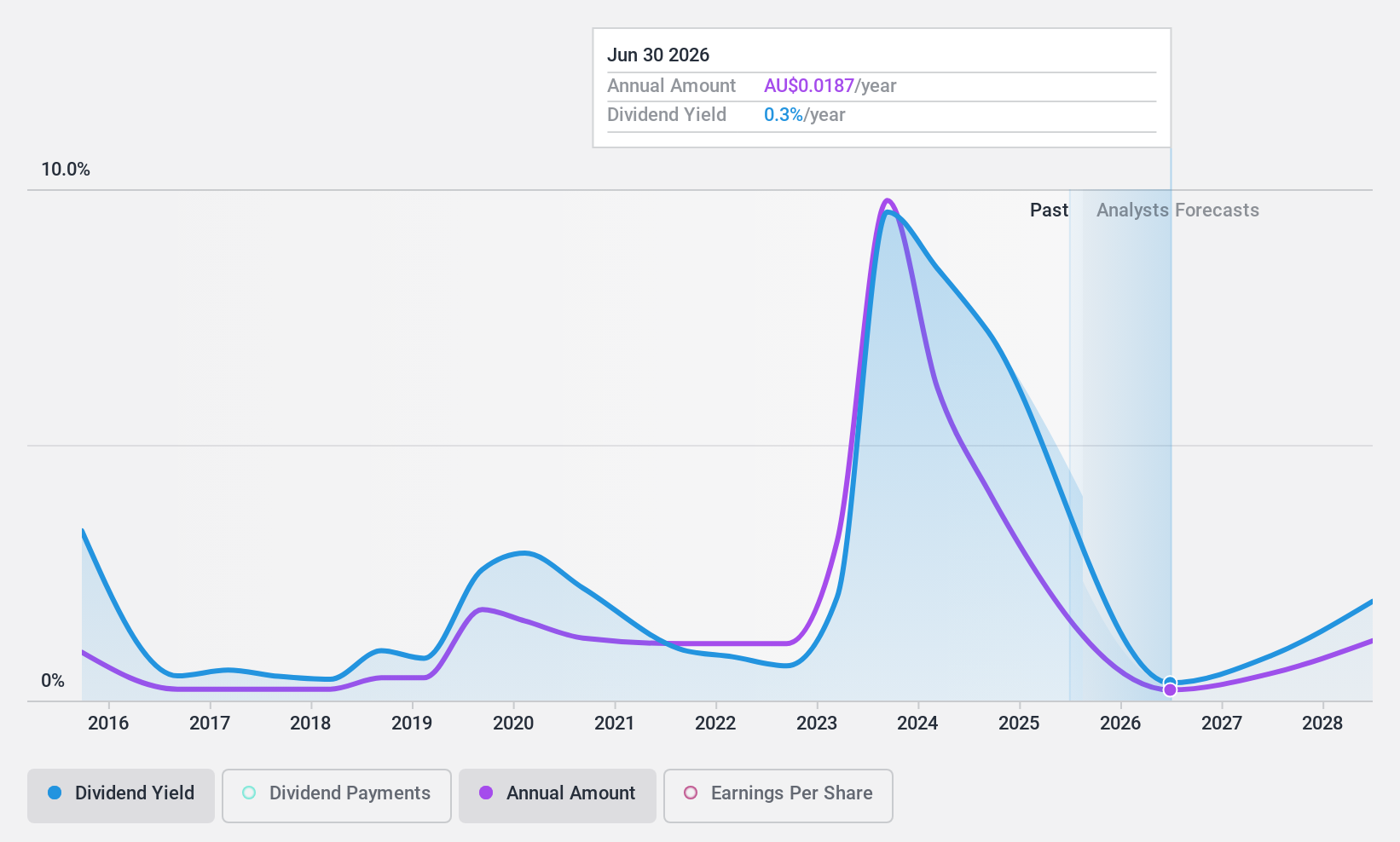

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an Australian exploration and mining company specializing in metals critical for clean energy, with a market capitalization of A$5.53 billion.

Operations: IGO Limited generates its revenue primarily from the Nova Operation and Forrestania Operation, totaling approximately A$903.4 million.

Dividend Yield: 7.5%

IGO Limited's recent financial performance reveals a decline in sales to A$438.2 million and net income to A$288.3 million for the half-year ended December 31, 2023, from higher figures last year. Despite this downturn, IGO announced a regular cash dividend of A$0.11 on February 22, showcasing its commitment to returning value to shareholders. However, the company faces challenges with a high payout ratio of 185%, indicating that its generous dividend yield of 7.52% may not be sustainable over the long term without improved earnings coverage or cash flow support. Additionally, ongoing legal disputes over royalty payments could introduce further financial uncertainties affecting future dividends.

- Take a closer look at IGO's potential here in our dividend report.

Upon reviewing our latest valuation report, IGO's share price might be too optimistic.

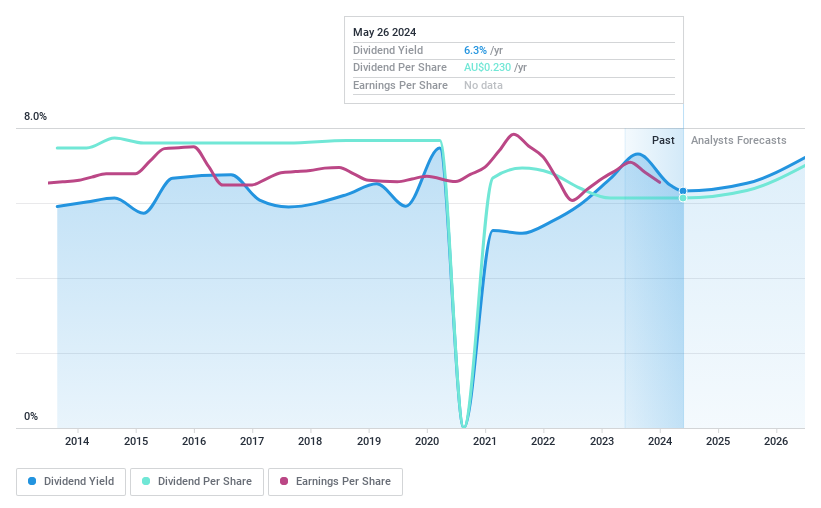

MyState (ASX:MYS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MyState Limited operates in Australia, offering banking, trustee, and managed fund products and services with a market capitalization of approximately A$407.01 million.

Operations: MyState Limited generates its revenue primarily from banking services, amounting to A$129.43 million.

Dividend Yield: 6.2%

MyState Limited's recent financial update indicates a decrease in net interest income to A$63 million and net income to A$17.47 million for the half-year ending December 31, 2023. Despite this downturn, MyState maintained its dividend commitment, declaring a fully franked interim dividend of A$0.115 per share with a payout ratio of 72.6%. However, the company's dividend track record shows volatility over the past decade and an unstable dividend history. While its current yield is competitive at 6.25%, placing it in the top quartile of Australian market payers, concerns about sustainability arise from fluctuating earnings and dividends alongside a low allowance for bad loans at 16%, suggesting potential future risks in maintaining these payouts without improved financial stability or growth prospects.

- Navigate through the intricacies of MyState with our comprehensive dividend report here.

Our expertly prepared valuation report MyState implies its share price may be lower than expected.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 45 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AUI

Excellent balance sheet average dividend payer.