- Australia

- /

- Metals and Mining

- /

- ASX:DRR

Top Undervalued Small Caps With Insider Action In Australia For September 2024

Reviewed by Simply Wall St

The Australian market has climbed 1.7% in the last 7 days, with a gain of 4.5%, and over the past year, it has increased by 12%. In this environment of steady growth and optimistic earnings forecasts, identifying small-cap stocks with insider action can offer unique opportunities for investors seeking value.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 20.1x | 2.4x | 5.43% | ★★★★★☆ |

| SHAPE Australia | 13.9x | 0.3x | 35.99% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 46.66% | ★★★★☆☆ |

| GWA Group | 16.3x | 1.5x | 42.20% | ★★★★☆☆ |

| Credit Corp Group | 20.3x | 2.7x | 41.65% | ★★★★☆☆ |

| Coventry Group | 218.0x | 0.4x | -9.69% | ★★★☆☆☆ |

| Dicker Data | 20.3x | 0.7x | -66.57% | ★★★☆☆☆ |

| Megaport | 124.2x | 6.1x | 45.11% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.7x | 2.58% | ★★★☆☆☆ |

| Abacus Group | NA | 6.1x | 22.91% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

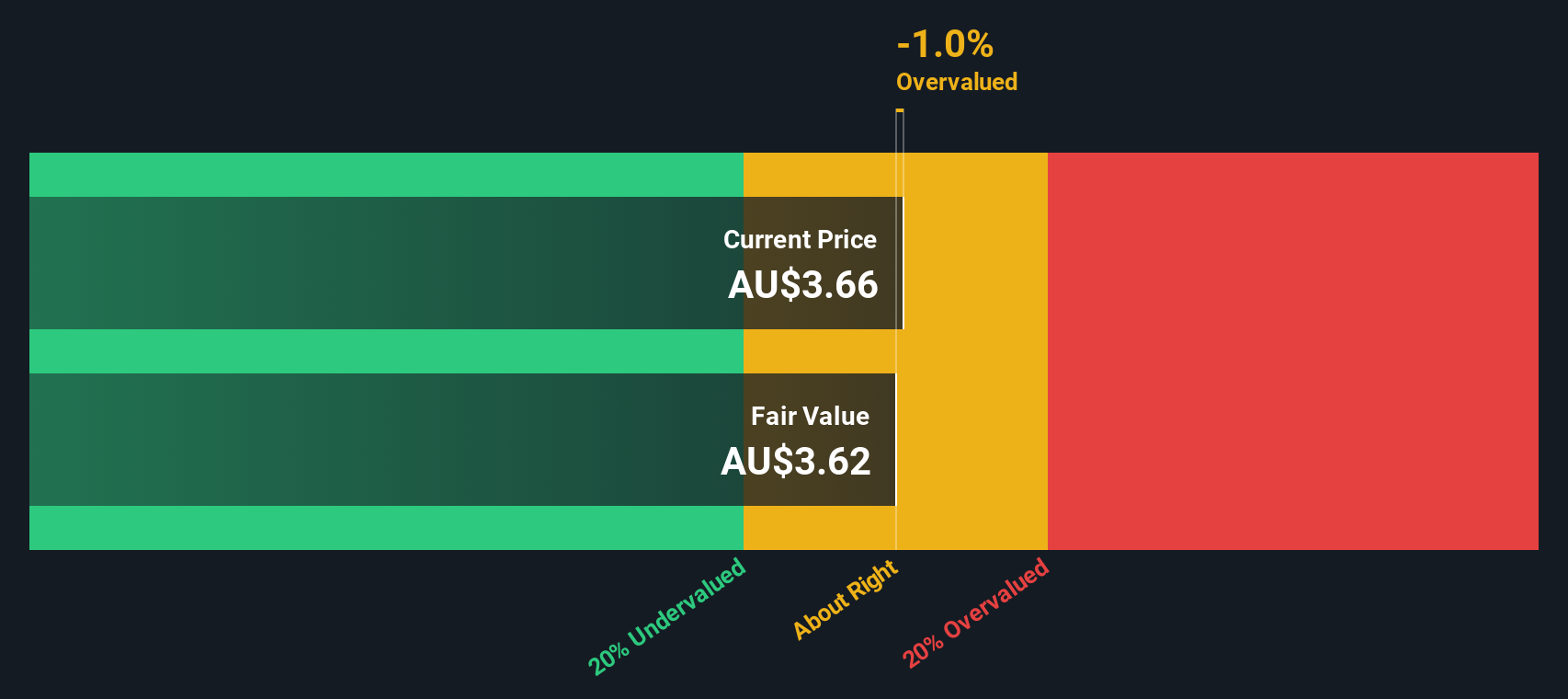

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Deterra Royalties is a company that primarily operates through royalty arrangements and has a market cap of A$2.53 billion.

Operations: The company's revenue primarily comes from royalty arrangements, with a gross profit margin of 96.22% as of the latest period ending on 2024-09-18. Operating expenses and non-operating expenses are relatively low compared to revenue, contributing to a net income margin of 64.40%.

PE: 12.5x

Deterra Royalties, a smaller Australian company, recently reported net income of A$154.89 million for the year ending June 30, 2024, up slightly from A$152.46 million the previous year. Basic earnings per share rose to A$0.293 from A$0.2885. Despite a forecasted earnings decline of 6.6% annually over the next three years and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in August 2024 indicating potential long-term value amidst current challenges.

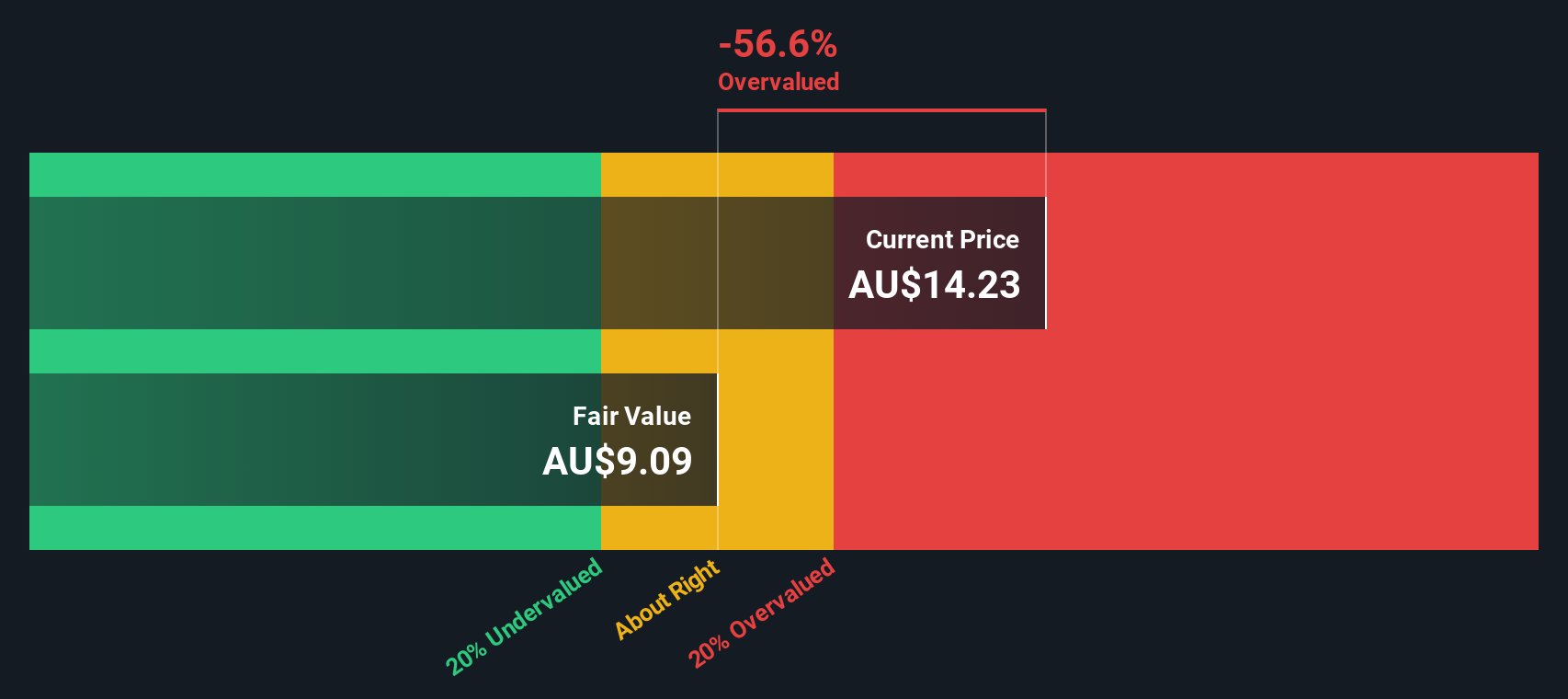

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims operates in the metal and electronics recycling industry with significant segments including North America Metals, Australia/New Zealand Metals, and Global Trading, and has a market capitalization of A$2.60 billion.

Operations: The company generates revenue primarily from North America Metals (A$4487.80 million) and Australia/New Zealand Metals (A$1599.60 million), with additional contributions from Global Trading (A$771.20 million) and Sims Lifecycle Services (A$350 million). The cost of goods sold is a significant expense, impacting the gross profit margin, which has shown variability, reaching up to 14.22% in recent periods. Operating expenses and non-operating expenses also play substantial roles in determining net income margins, which have fluctuated over time.

PE: 1182.4x

Sims Limited, a small Australian company, has shown insider confidence with share purchases in the past six months. Despite reporting a net loss of A$57.8 million for the year ended June 30, 2024, sales increased to A$7.22 billion from A$6.66 billion last year. The company's profit margins have declined from 3% to 0.02%. Additionally, Sims announced a reduced dividend of A$0.10 per share payable on October 16, 2024.

- Unlock comprehensive insights into our analysis of Sims stock in this valuation report.

Examine Sims' past performance report to understand how it has performed in the past.

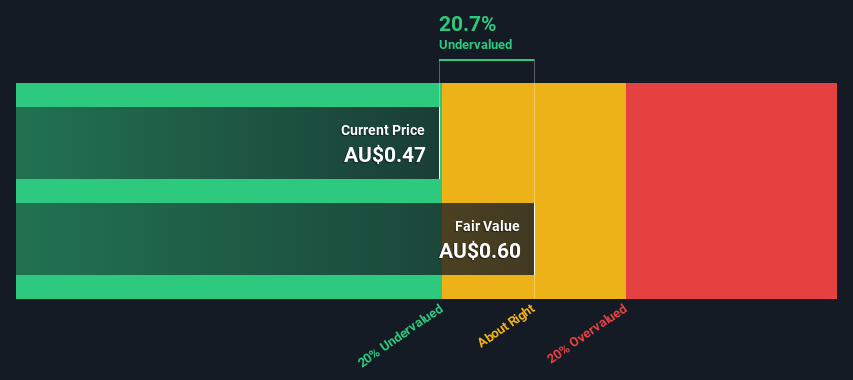

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tabcorp Holdings is an Australian company engaged in gaming services and wagering and media operations, with a market cap of A$6.57 billion.

Operations: Tabcorp Holdings generates revenue primarily from its Wagering and Media segment (A$2162.80 million) and Gaming Services segment (A$176.10 million). The company has experienced fluctuations in net income margin, ranging from -0.5763% to 15.50%. Operating expenses have varied significantly, with notable costs in sales and marketing as well as general and administrative expenses. Gross profit margins have consistently been at or near 100%.

PE: -0.7x

Tabcorp Holdings, a smaller player in the Australian market, recently reported a net loss of A$1.36 billion for the year ending June 30, 2024, compared to a net income of A$66.5 million previously. Despite this setback, insider confidence is evident with significant share purchases over the past six months. The company’s earnings are forecast to grow by 117.91% annually, indicating potential future value despite current financial challenges and reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Tabcorp Holdings.

Explore historical data to track Tabcorp Holdings' performance over time in our Past section.

Summing It All Up

- Take a closer look at our Undervalued ASX Small Caps With Insider Buying list of 24 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRR

Flawless balance sheet with acceptable track record.