High Insider Ownership Growth Stocks On The ASX For July 2024

Reviewed by Simply Wall St

As the ASX200 shows marginal gains in a largely flat trading environment, sectors like Discretionary and Materials are seeing slight upticks, indicating selective investor interest amidst broader market caution. In such a context, stocks with high insider ownership might offer investors a sense of added security, as significant insider stakes often align management’s interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Catalyst Metals (ASX:CYL) | 17.1% | 75.7% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 94.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 49.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Let's dive into some prime choices out of from the screener.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of A$5.06 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel sectors, amounting to A$1.28 billion and A$1.06 billion respectively.

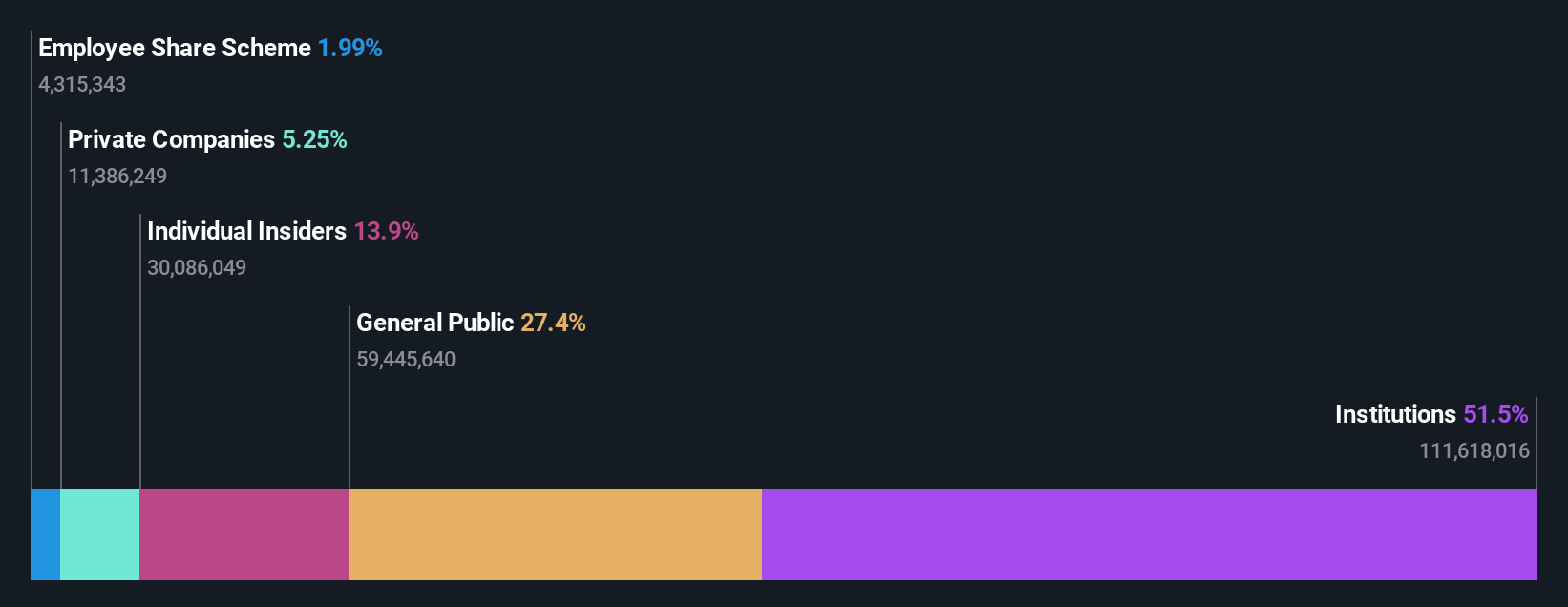

Insider Ownership: 13.3%

Flight Centre Travel Group, reflecting a promising outlook, has recently transitioned into profitability. With earnings expected to grow at 18.55% annually, it outpaces the broader Australian market's forecast of 13.5%. Additionally, revenue growth projections stand at 9.7% per year, again surpassing the national average of 5.6%. Despite these positive indicators, the company is trading at a significant discount—25.7% below estimated fair value—highlighting a potential undervaluation amidst its growth trajectory.

- Unlock comprehensive insights into our analysis of Flight Centre Travel Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that Flight Centre Travel Group is priced higher than what may be justified by its financials.

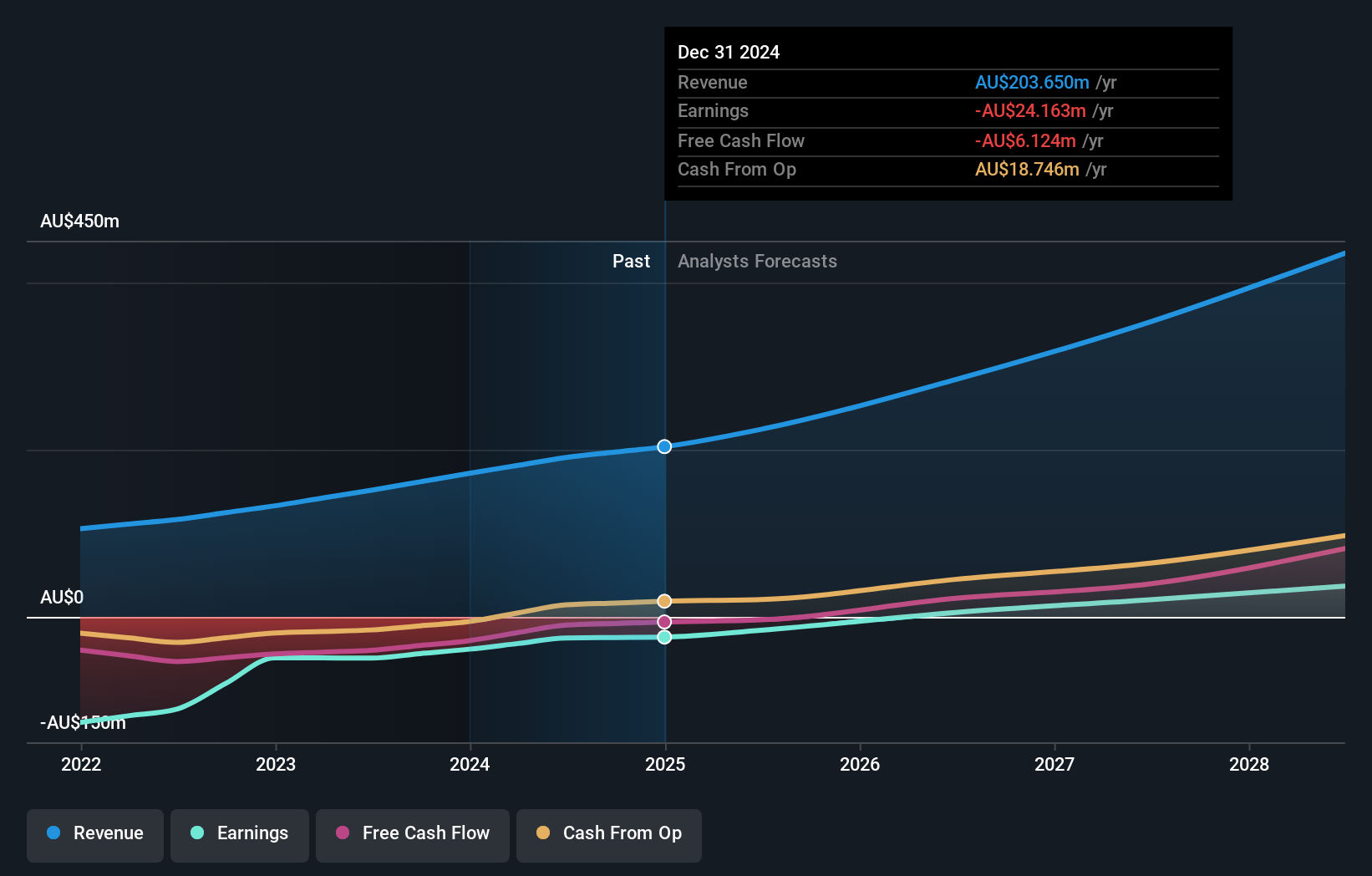

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited, operating both in Australia and internationally, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers, with a market capitalization of approximately A$1.46 billion.

Operations: The company generates revenue primarily through its software and programming segment, which amounted to A$171.70 million.

Insider Ownership: 11.3%

SiteMinder, poised for significant growth, is trading 44.1% below its estimated fair value, signaling a potential undervaluation. The company's earnings are expected to surge by 74.41% annually, with revenue growth also robust at 19.1% per year—exceeding Australia's average market growth of 5.6%. Recently, SiteMinder enhanced its strategic position through a partnership with Cloudbeds, aimed at expanding distribution and improving operational efficiency for hoteliers globally—a move that could further bolster its market standing and profitability in the coming years.

- Click here and access our complete growth analysis report to understand the dynamics of SiteMinder.

- Insights from our recent valuation report point to the potential overvaluation of SiteMinder shares in the market.

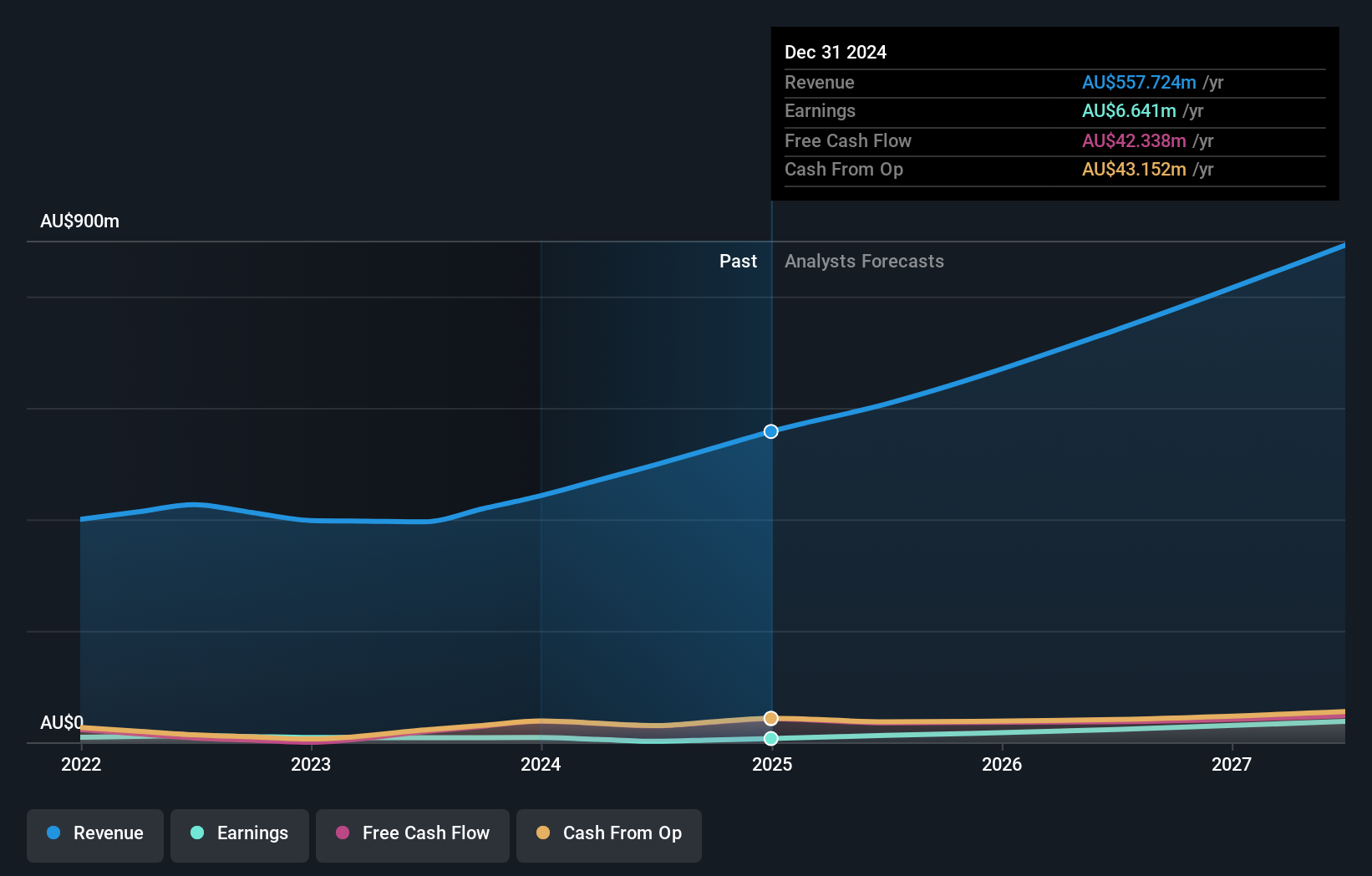

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temple & Webster Group Ltd is an Australian online retailer specializing in furniture, homewares, and home improvement products, with a market capitalization of approximately A$1.10 billion.

Operations: The company generates its revenue primarily from the online sales of furniture, homewares, and home improvement items, totaling approximately A$442.25 million.

Insider Ownership: 12.9%

Temple & Webster's earnings are projected to increase by 35.16% annually, outpacing the Australian market's average of 13.5%. Despite revenue growth forecasts being below the high-growth threshold at 19.3%, it still exceeds the national market rate of 5.6%. Recently, the firm initiated a share buyback program to repurchase up to A$30 million worth of shares, enhancing shareholder value and indicating strong internal confidence in its financial health and growth trajectory.

- Dive into the specifics of Temple & Webster Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility Temple & Webster Group's shares may be trading at a premium.

Make It Happen

- Gain an insight into the universe of 88 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Develops, markets, and sells online guest acquisition platform and commerce solutions for accommodation providers in Australia and internationally.

High growth potential with excellent balance sheet.