- Australia

- /

- Specialty Stores

- /

- ASX:TPW

ASX Growth Companies With High Insider Ownership To Watch In July 2024

Reviewed by Simply Wall St

The Australian stock market has experienced a slight decline of 1.2% over the past week, though it maintains an overall growth of 8.6% over the past year with earnings expected to grow by 13% annually. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially enhancing performance in robust market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Catalyst Metals (ASX:CYL) | 17.1% | 75.7% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 94.8% |

| Liontown Resources (ASX:LTR) | 16.4% | 49.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Let's review some notable picks from our screened stocks.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of A$5.06 billion.

Operations: The company generates its revenue primarily through two segments: leisure travel, which brings in A$1.28 billion, and corporate travel, contributing A$1.06 billion.

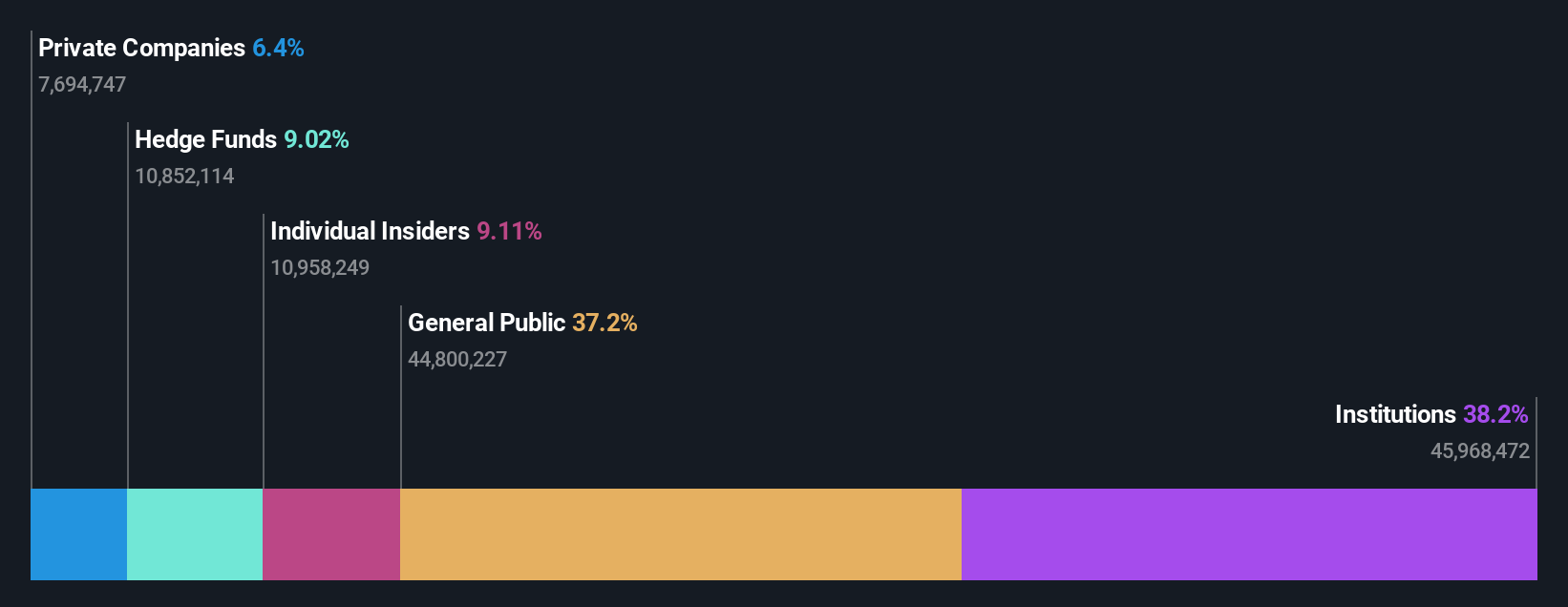

Insider Ownership: 13.3%

Flight Centre Travel Group, with high insider ownership, shows promising financial trends. Currently trading at 25.7% below its estimated fair value, FLT's revenue is expected to outpace the Australian market with a 9.7% annual growth compared to the market's 5.6%. Additionally, earnings are projected to increase by 18.55% annually, surpassing the broader market forecast of 13.5%. The company's Return on Equity is also anticipated to be robust at 22.1% in three years.

- Take a closer look at Flight Centre Travel Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Flight Centre Travel Group's share price might be on the expensive side.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited, with a market capitalization of A$1.46 billion, develops and sells online guest acquisition platforms and commerce solutions for accommodation providers both in Australia and globally.

Operations: The company generates revenue primarily through its software and programming segment, which amounted to A$171.70 million.

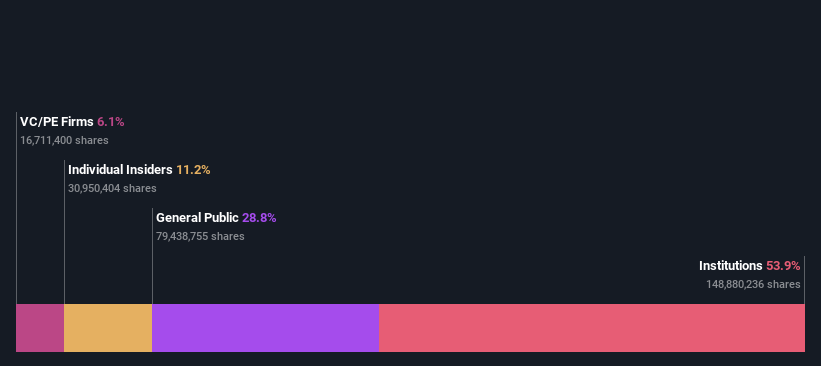

Insider Ownership: 11.3%

SiteMinder, demonstrating significant growth potential and high insider ownership, is poised for substantial development. The company's earnings are expected to grow by 74.41% annually, with revenue projections also outpacing the Australian market significantly at 19.1% per year compared to 5.6%. Recently, SiteMinder formed a strategic partnership with Cloudbeds, enhancing operational capabilities and expanding market reach for over 60,000 hoteliers globally—a move that could further fuel its growth trajectory while still trading at 44.1% below its fair value estimate.

- Dive into the specifics of SiteMinder here with our thorough growth forecast report.

- Our valuation report unveils the possibility SiteMinder's shares may be trading at a premium.

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products across Australia, with a market capitalization of approximately A$1.10 billion.

Operations: The company generates its revenue primarily through the online sale of furniture, homewares, and home improvement items, totaling A$442.25 million.

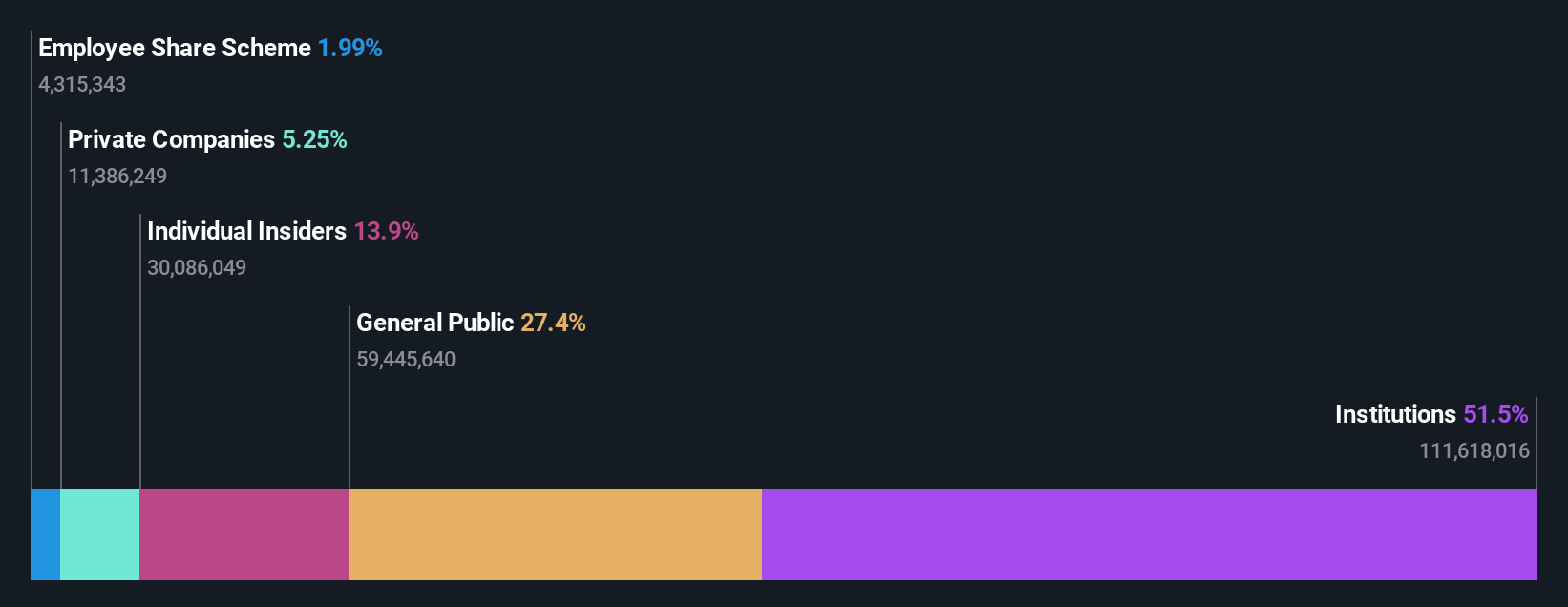

Insider Ownership: 12.9%

Temple & Webster Group, amidst executing a share repurchase program to manage capital efficiently and support growth, is set to see substantial earnings growth at 35.2% annually, outpacing the Australian market average of 13.5%. Although its revenue growth forecast of 19.3% yearly does not meet the high-growth threshold of 20%, it still exceeds the market's expectation of 5.6%. Despite these positives, projected Return on Equity remains modest at 19.3%, indicating potential areas for improvement in financial efficiency.

- Click to explore a detailed breakdown of our findings in Temple & Webster Group's earnings growth report.

- Our expertly prepared valuation report Temple & Webster Group implies its share price may be too high.

Seize The Opportunity

- Discover the full array of 88 Fast Growing ASX Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products in Australia.

Flawless balance sheet with high growth potential.