- Australia

- /

- Hospitality

- /

- ASX:FLT

3 ASX Stocks Estimated To Be Up To 46.9% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has seen a positive trend, rising 1.7% over the last week and 12% over the past year, with earnings projected to grow by 12% annually in the coming years. In such a promising environment, identifying undervalued stocks can offer significant opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.35 | A$8.20 | 46.9% |

| Duratec (ASX:DUR) | A$1.415 | A$2.61 | 45.7% |

| MLG Oz (ASX:MLG) | A$0.655 | A$1.18 | 44.7% |

| Genesis Minerals (ASX:GMD) | A$2.11 | A$4.00 | 47.3% |

| Charter Hall Group (ASX:CHC) | A$15.79 | A$29.35 | 46.2% |

| Megaport (ASX:MP1) | A$7.51 | A$13.59 | 44.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.37 | A$0.72 | 48.5% |

| Ai-Media Technologies (ASX:AIM) | A$0.76 | A$1.42 | 46.5% |

| Superloop (ASX:SLC) | A$1.81 | A$3.31 | 45.4% |

Here we highlight a subset of our preferred stocks from the screener.

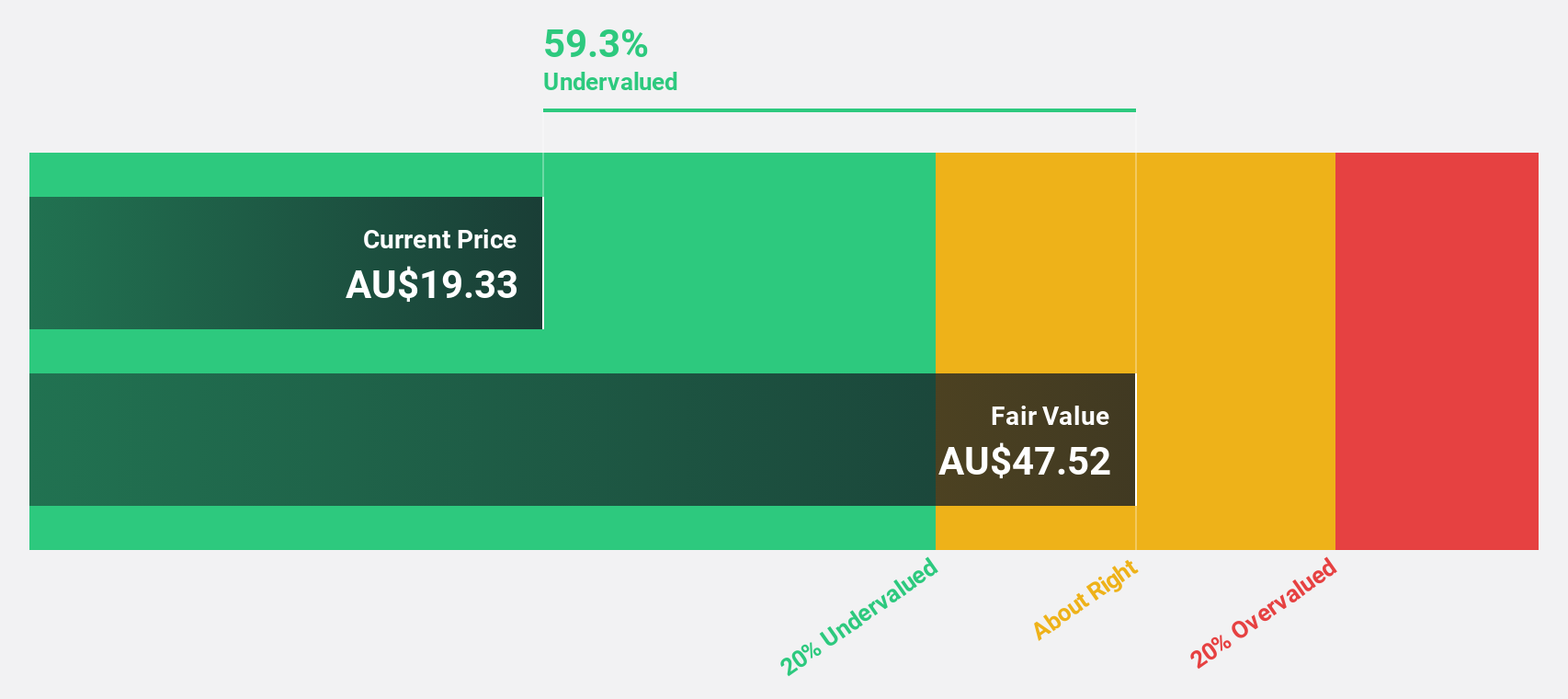

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market cap of approximately A$2.92 billion.

Operations: Domino's Pizza Enterprises Limited generates revenue primarily from its restaurants segment, which amounted to A$2.38 billion.

Estimated Discount To Fair Value: 22.5%

Domino's Pizza Enterprises is trading at A$32.11, significantly below its estimated fair value of A$41.42, suggesting it may be undervalued based on cash flows. Despite a high level of debt and recent shareholder dilution, earnings are expected to grow 20.49% annually over the next three years, outpacing the Australian market's growth rate of 12.3%. Recent legal issues related to alleged misleading conduct in Japan could impact investor sentiment but have not yet affected financial forecasts significantly.

- Insights from our recent growth report point to a promising forecast for Domino's Pizza Enterprises' business outlook.

- Navigate through the intricacies of Domino's Pizza Enterprises with our comprehensive financial health report here.

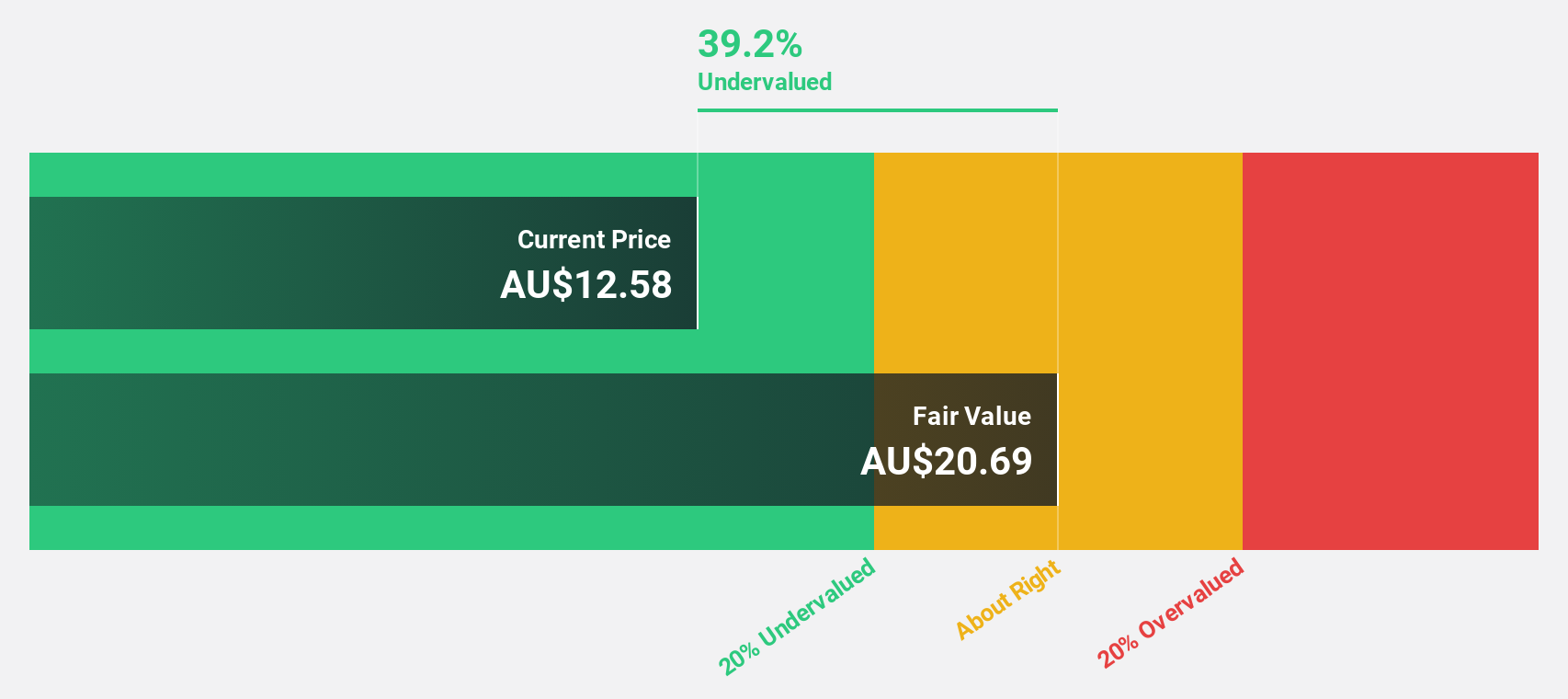

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for leisure and corporate clients across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally with a market cap of A$4.60 billion.

Operations: The company's revenue segments include A$1.35 billion from leisure travel services and A$1.11 billion from corporate travel services.

Estimated Discount To Fair Value: 18.6%

Flight Centre Travel Group is trading at A$20.85, below its estimated fair value of A$25.63, indicating it may be undervalued based on cash flows. The company reported a net income increase to A$139 million for the full year ending June 30, 2024, up from A$47 million the previous year. With a strong cash position and plans for acquisitions in the cruise and touring segments, Flight Centre shows potential for continued growth despite moderate revenue forecasts.

- Our earnings growth report unveils the potential for significant increases in Flight Centre Travel Group's future results.

- Unlock comprehensive insights into our analysis of Flight Centre Travel Group stock in this financial health report.

Hansen Technologies (ASX:HSN)

Overview: Hansen Technologies Limited (ASX:HSN) develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$883.27 million.

Operations: The company's revenue from billing systems software for the energy, utilities, communications, and media sectors totals A$347.61 million.

Estimated Discount To Fair Value: 46.9%

Hansen Technologies is trading at A$4.35, significantly below its estimated fair value of A$8.2, suggesting it is undervalued based on cash flows. Despite a decrease in net profit margin from 13.7% to 6%, the company reported increased revenue of A$355.43 million for the year ending June 30, 2024, up from A$315.22 million previously. Recent client wins and cloud-based SaaS offerings bolster its growth prospects, with earnings forecasted to grow significantly over the next three years.

- Our comprehensive growth report raises the possibility that Hansen Technologies is poised for substantial financial growth.

- Get an in-depth perspective on Hansen Technologies' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Delve into our full catalog of 38 Undervalued ASX Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with excellent balance sheet.