- Australia

- /

- Food and Staples Retail

- /

- ASX:MTS

Top ASX Dividend Stocks To Consider In June 2024

Reviewed by Simply Wall St

As the ASX200 experiences fluctuations, with sectors like utilities and communications showing strength amidst broader market uncertainties, investors may find dividend stocks particularly appealing. These stocks can offer potential stability and regular income, qualities that are valuable in the current economic environment marked by volatility in tech sectors and changes in commodity prices.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.82% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.99% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.57% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.61% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 6.81% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 9.24% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.05% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.56% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

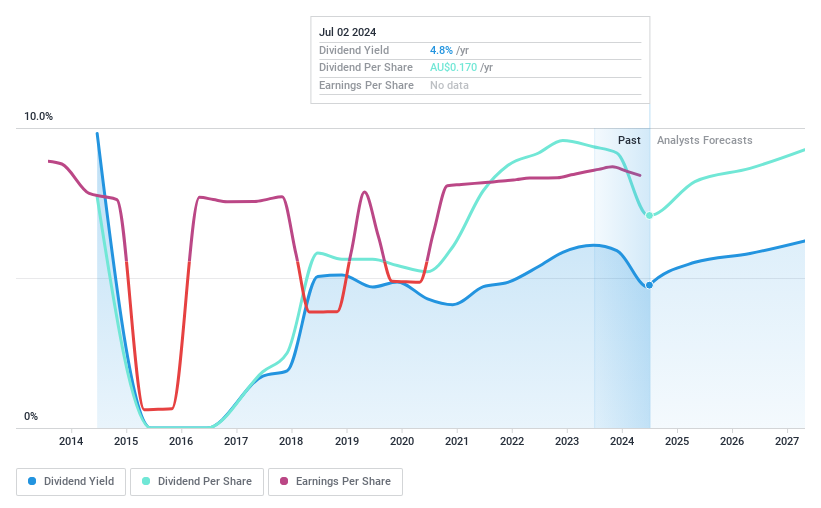

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd is a financial services provider in Australia, operating through its subsidiaries with a market capitalization of approximately A$236.08 million.

Operations: Fiducian Group Ltd generates revenue from four primary segments: Funds Management (A$20.49 million), Corporate Services (A$12.06 million), Financial Planning (A$28.95 million), and Platform Administration (A$15.38 million).

Dividend Yield: 4%

Fiducian Group maintains a payout ratio of 83.7%, ensuring dividends are well-covered by earnings, with a stable dividend yield of 4.04%. Dividend sustainability is bolstered by a cash payout ratio of 60.5%. However, its yield lags behind the top quartile in the Australian market at 6.54%. Despite this, FID has shown consistent growth in dividends over the past decade and recently reported a robust earnings increase of 12% year-over-year, trading at an attractive valuation, approximately 8.9% below estimated fair value.

- Dive into the specifics of Fiducian Group here with our thorough dividend report.

- According our valuation report, there's an indication that Fiducian Group's share price might be on the cheaper side.

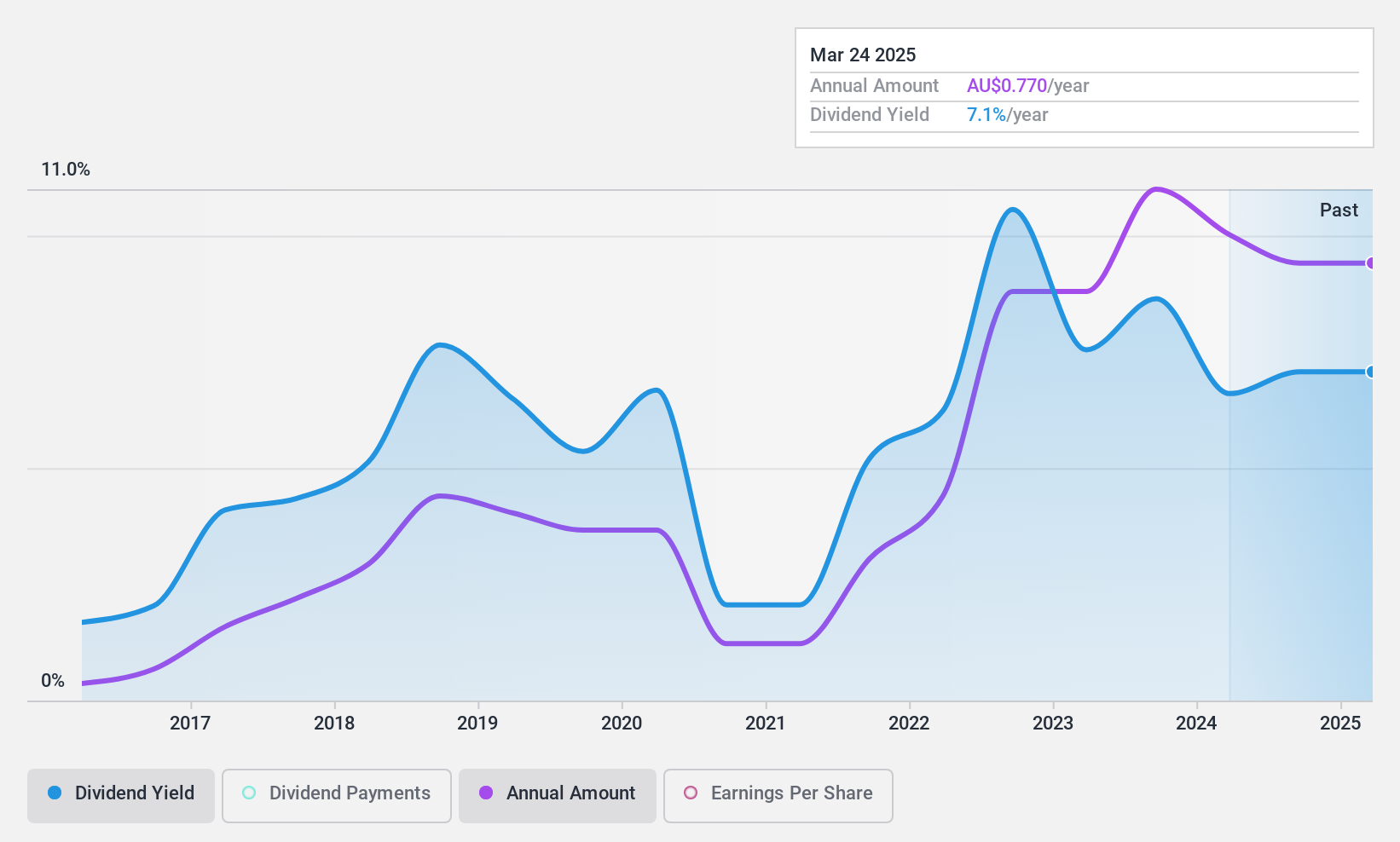

Lycopodium (ASX:LYL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lycopodium Limited, with a market capitalization of A$498.34 million, offers engineering and project delivery services across the resources, infrastructure, and industrial processes sectors.

Operations: Lycopodium Limited generates revenue primarily from its involvement in the process industries sector, amounting to A$11.85 million.

Dividend Yield: 6.5%

Lycopodium has seen a 10-year increase in dividend payments, boasting a yield of 6.54%, placing it among the top 25% of Australian dividend payers. However, with a cash payout ratio of 244.7%, dividends are not well supported by cash flows, indicating potential sustainability issues despite a reasonable earnings payout ratio of 57.2%. Additionally, Lycopodium's dividends have shown volatility over the decade and significant insider selling has occurred recently, suggesting caution.

- Get an in-depth perspective on Lycopodium's performance by reading our dividend report here.

- The analysis detailed in our Lycopodium valuation report hints at an deflated share price compared to its estimated value.

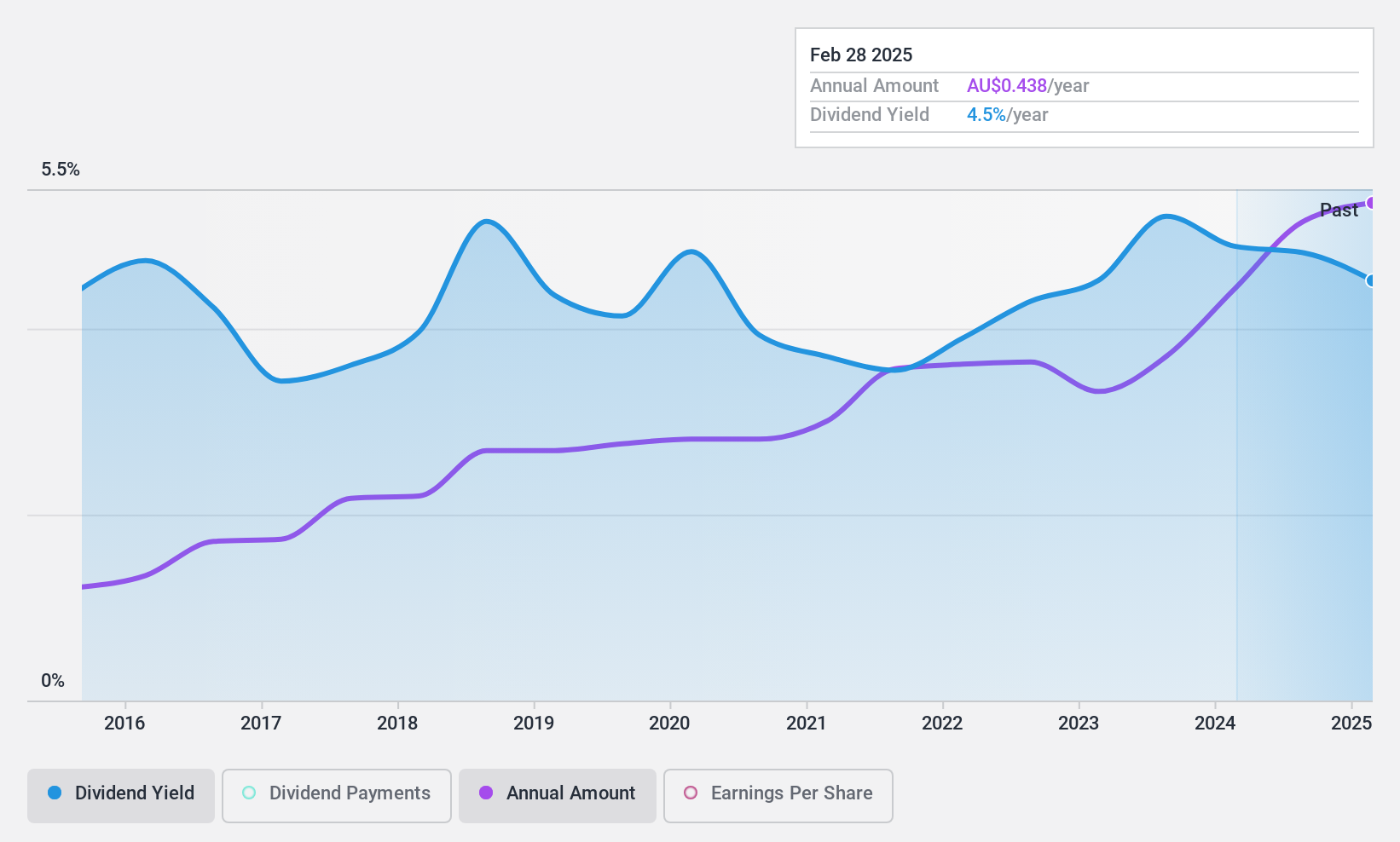

Metcash (ASX:MTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Metcash Limited is a wholesale distribution and marketing company in Australia, with a market capitalization of approximately A$4.13 billion.

Operations: Metcash Limited generates revenue through three primary segments: Food (A$8.40 billion), Liquor (A$5.11 billion), and Hardware (A$2.40 billion).

Dividend Yield: 5.8%

Metcash has experienced fluctuations in its dividend payments over the last decade, with notable volatility impacting reliability. Despite this, dividends have grown during this period and are currently supported by a cash payout ratio of 64.5% and an earnings payout ratio of 77.6%. However, Metcash's dividend yield of 5.82% remains below the top quartile average in Australia's market at 6.54%, reflecting potential concerns about its attractiveness to dividend-focused investors. Additionally, shareholder dilution occurred over the past year, further complicating its investment profile.

- Unlock comprehensive insights into our analysis of Metcash stock in this dividend report.

- Upon reviewing our latest valuation report, Metcash's share price might be too pessimistic.

Where To Now?

- Dive into all 27 of the Top ASX Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Metcash, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MTS

Metcash

Operates as a wholesale distribution and marketing company in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives