- Australia

- /

- Consumer Durables

- /

- ASX:SHM

The Returns On Capital At Shriro Holdings (ASX:SHM) Don't Inspire Confidence

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after investigating Shriro Holdings (ASX:SHM), we don't think it's current trends fit the mold of a multi-bagger.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Shriro Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.18 = AU$14m ÷ (AU$110m - AU$31m) (Based on the trailing twelve months to December 2021).

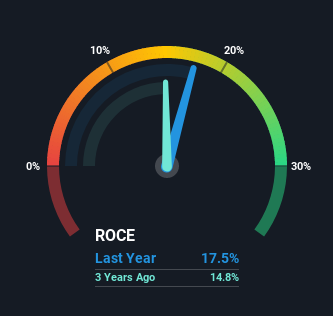

So, Shriro Holdings has an ROCE of 18%. On its own, that's a standard return, however it's much better than the 14% generated by the Consumer Durables industry.

See our latest analysis for Shriro Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Shriro Holdings, check out these free graphs here.

How Are Returns Trending?

When we looked at the ROCE trend at Shriro Holdings, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 18% from 33% five years ago. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

The Key Takeaway

We're a bit apprehensive about Shriro Holdings because despite more capital being deployed in the business, returns on that capital and sales have both fallen. In spite of that, the stock has delivered a 37% return to shareholders who held over the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

On a final note, we found 4 warning signs for Shriro Holdings (1 is a bit concerning) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SHM

Shriro Holdings

Manufactures, markets, and distributes consumer products in Australia, New Zealand, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives