- Australia

- /

- Professional Services

- /

- ASX:SIQ

3 Top Undervalued Small Caps In Australia With Recent Insider Activity

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX200 closing up 0.39% at 8,013 points driven by a rally in bank stocks, while energy and mining sectors slumped due to falling commodity prices. Amid these fluctuations, small-cap stocks continue to present unique opportunities for investors looking for growth potential. In this environment, identifying undervalued small-cap companies with recent insider activity can be particularly appealing. This article will explore three such stocks in Australia that may offer significant upside based on current market conditions and insider confidence.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 20.2x | 2.4x | 6.37% | ★★★★★☆ |

| Beach Energy | NA | 1.4x | 38.57% | ★★★★★☆ |

| SHAPE Australia | 13.7x | 0.3x | 37.66% | ★★★★☆☆ |

| Lycopodium | 9.0x | 1.3x | 27.90% | ★★★★☆☆ |

| Eagers Automotive | 10.4x | 0.3x | 39.97% | ★★★★☆☆ |

| Credit Corp Group | 20.1x | 2.7x | 43.01% | ★★★★☆☆ |

| Dicker Data | 20.1x | 0.7x | -63.98% | ★★★☆☆☆ |

| Coventry Group | 239.3x | 0.4x | -15.79% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 1.53% | ★★★☆☆☆ |

| Abacus Group | NA | 5.9x | 27.01% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading car retailing company with operations primarily in Australia and a market cap of approximately A$3.80 billion.

Operations: Car Retailing generates the bulk of revenue at A$10.50 billion, with Gross Profit Margin showing a trend between 17.71% and 19.13% over recent periods. Operating Expenses have been significant, often exceeding A$1 billion per period, impacting net income margins which have ranged from -1.42% to 3.75%.

PE: 10.4x

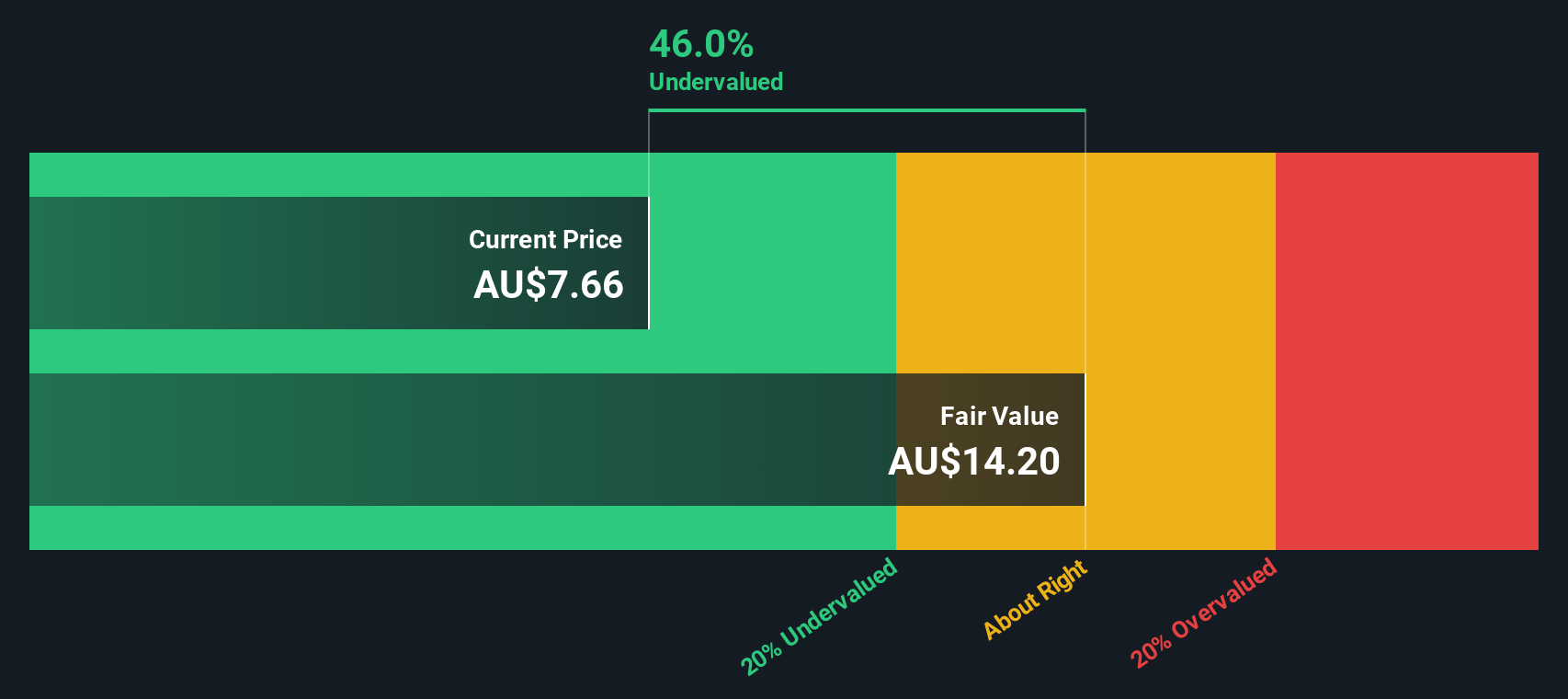

Eagers Automotive, a small-cap stock in Australia, reported half-year sales of A$5.46 billion for June 30, 2024, up from A$4.82 billion last year. Net income dropped to A$116 million from A$137.76 million. The company announced a dividend of A$0.24 per share and initiated a buyback program for up to 25.8 million shares by June 2025, showing insider confidence through share repurchases and potential value growth despite higher-risk external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Eagers Automotive.

Evaluate Eagers Automotive's historical performance by accessing our past performance report.

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Corporate Travel Management is a company that provides travel services across Asia, Europe, North America, and Australia/New Zealand with a market cap of A$2.76 billion.

Operations: The company generates revenue primarily from travel services across Asia (A$63.66 million), Europe (A$168.32 million), North America (A$309.63 million), and Australia and New Zealand (A$168.82 million). Over the observed periods, the company's net income margin showed variability, with a recent value of 11.88% as of June 30, 2024, while gross profit margin reached up to 49.97% in June 2018 before seeing fluctuations thereafter reaching around 40%.

PE: 20.2x

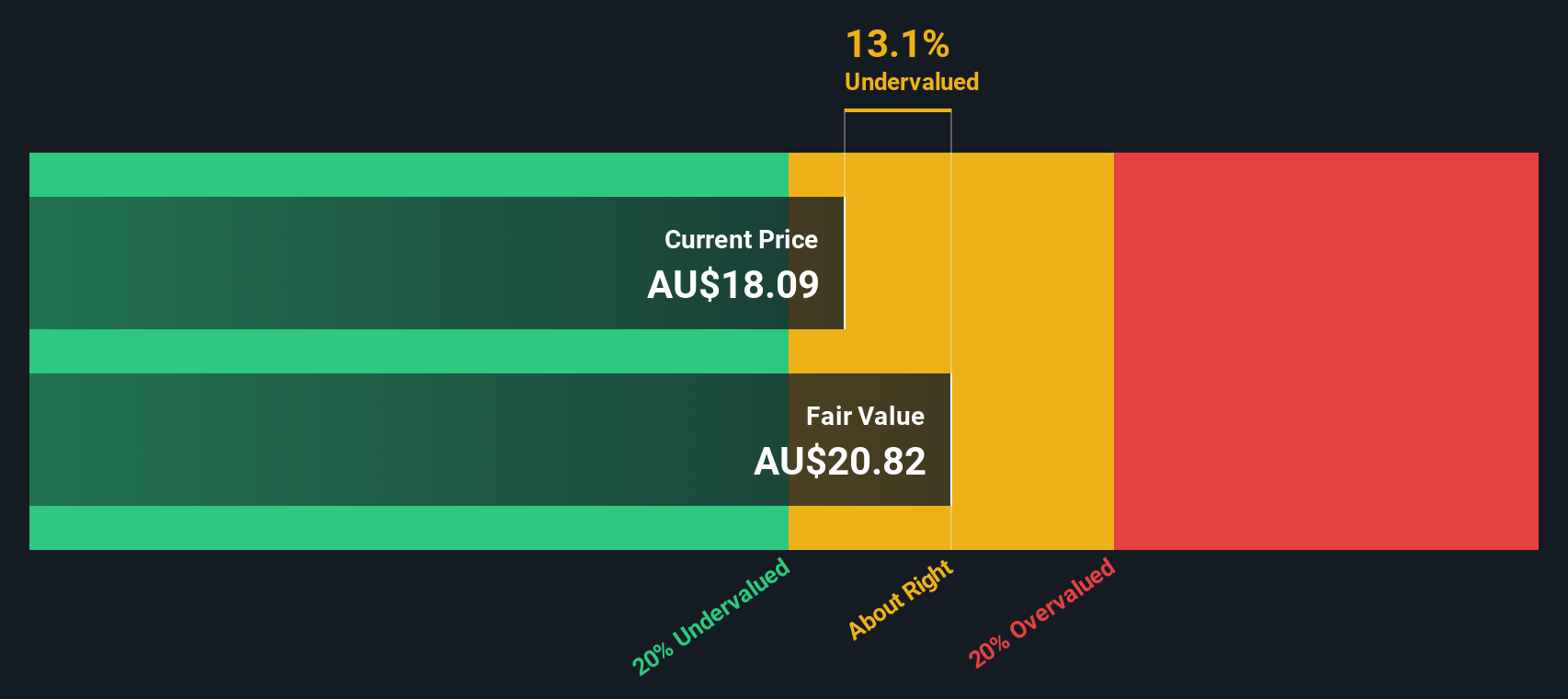

Corporate Travel Management (CTM), an Australian small-cap, has shown promising signs of being undervalued. For the full year ending June 30, 2024, CTM reported A$710.42 million in sales and A$84.45 million in net income, reflecting solid growth from the previous year. Insider confidence is evident as Jamie Pherous recently purchased 87,500 shares valued at approximately A$1.4 million. The company also repurchased 1,488,232 shares for A$23.14 million between January and June 2024 and extended its buyback plan to June 2025 with increased authorization to A$126.1 million.

- Click here and access our complete valuation analysis report to understand the dynamics of Corporate Travel Management.

Learn about Corporate Travel Management's historical performance.

Smartgroup (ASX:SIQ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Smartgroup provides outsourced administration, vehicle services, and software distribution solutions with a market capitalization of A$0.93 billion.

Operations: Smartgroup generates revenue primarily from Outsourced Administration (A$263.07 million), Software, Distribution and Group Services (A$41.02 million), and Vehicle Services (A$19.53 million). The company has seen its gross profit margin fluctuate, with recent figures around 54.94%. Operating expenses include significant allocations to General & Administrative Expenses and Non-Operating Expenses, impacting the net income margin which stood at approximately 24.61% as of the latest period ending September 2023.

PE: 16.4x

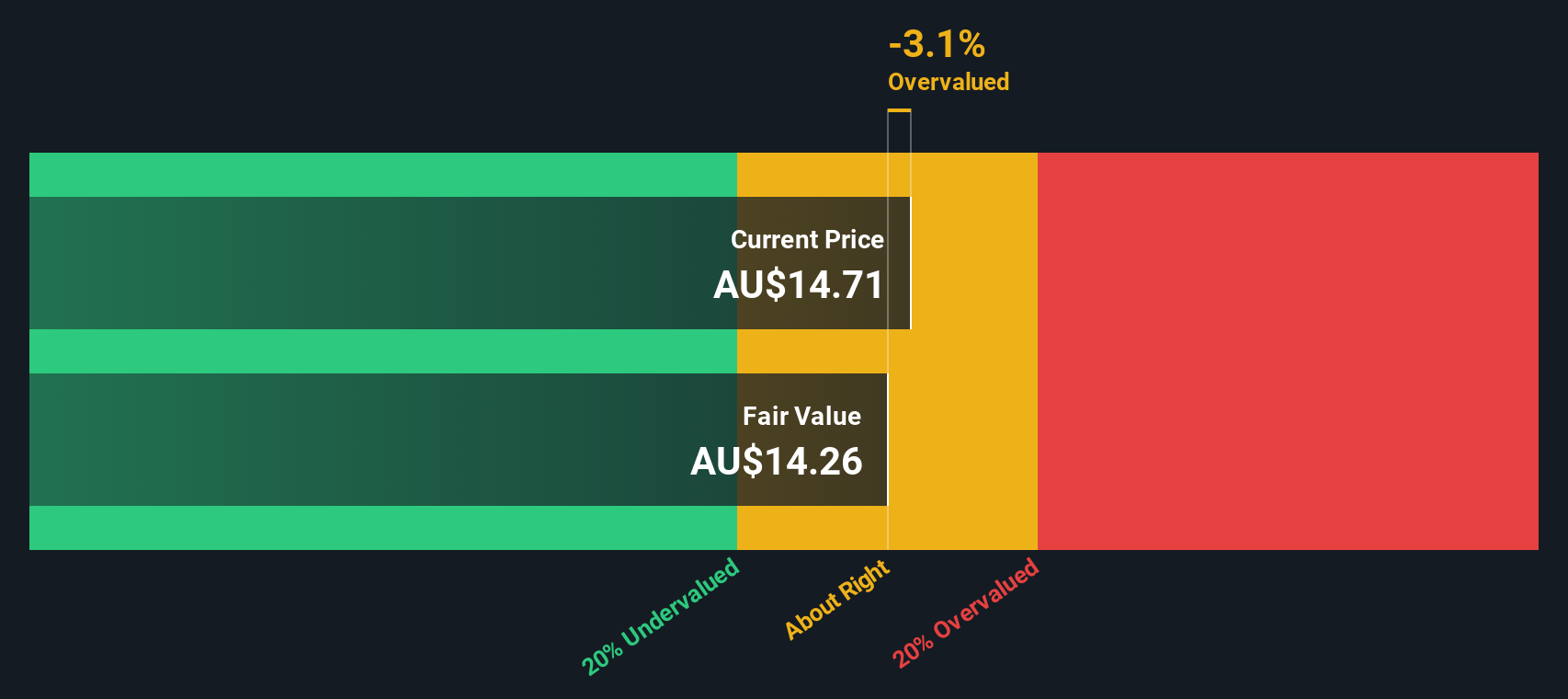

Smartgroup's recent financial performance showcases growth, with half-year sales rising to A$148.49 million from A$116.62 million a year ago and net income climbing to A$34.26 million from A$28.94 million in the same period. Basic earnings per share increased to A$0.264 from A$0.223, reflecting solid operational efficiency despite higher risk funding sources reliant on external borrowing. Insider confidence is evident as multiple insiders purchased shares recently, indicating trust in future prospects amidst a 6% annual earnings growth forecast.

- Dive into the specifics of Smartgroup here with our thorough valuation report.

Explore historical data to track Smartgroup's performance over time in our Past section.

Where To Now?

- Dive into all 29 of the Undervalued ASX Small Caps With Insider Buying we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SIQ

Very undervalued with solid track record and pays a dividend.