- Australia

- /

- Capital Markets

- /

- ASX:MFG

Insider Activity Highlights 3 Undervalued Small Caps In Australia

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has experienced a slight decline of 1.5%, though it has shown a robust growth of 19% over the past year, with earnings expected to increase by 12% annually in the coming years. In this context, identifying stocks that are potentially undervalued can be crucial for investors looking to capitalize on future growth opportunities, especially when insider activity suggests confidence in these companies' prospects.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| SHAPE Australia | 13.8x | 0.3x | 36.17% | ★★★★★☆ |

| GWA Group | 16.9x | 1.6x | 40.38% | ★★★★★☆ |

| Collins Foods | 17.8x | 0.7x | 7.74% | ★★★★☆☆ |

| Centuria Capital Group | 21.9x | 4.9x | 44.29% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 49.49% | ★★★★☆☆ |

| Corporate Travel Management | 19.8x | 2.3x | 6.07% | ★★★★☆☆ |

| Eagers Automotive | 11.6x | 0.3x | 35.25% | ★★★★☆☆ |

| Mader Group | 24.0x | 1.6x | 42.61% | ★★★☆☆☆ |

| Dicker Data | 20.0x | 0.7x | -65.01% | ★★★☆☆☆ |

| Abacus Storage King | 12.2x | 7.7x | -29.91% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates as a major car retailer in Australia, with a focus on selling new and used vehicles, and has a market capitalization of approximately A$3.66 billion.

Operations: Car Retailing is the primary revenue stream, generating A$10.50 billion. The gross profit margin has fluctuated over time, reaching 18.17% in the latest period analyzed. Operating expenses and non-operating expenses contribute significantly to cost structures, with general and administrative expenses being a notable component within operating costs.

PE: 11.6x

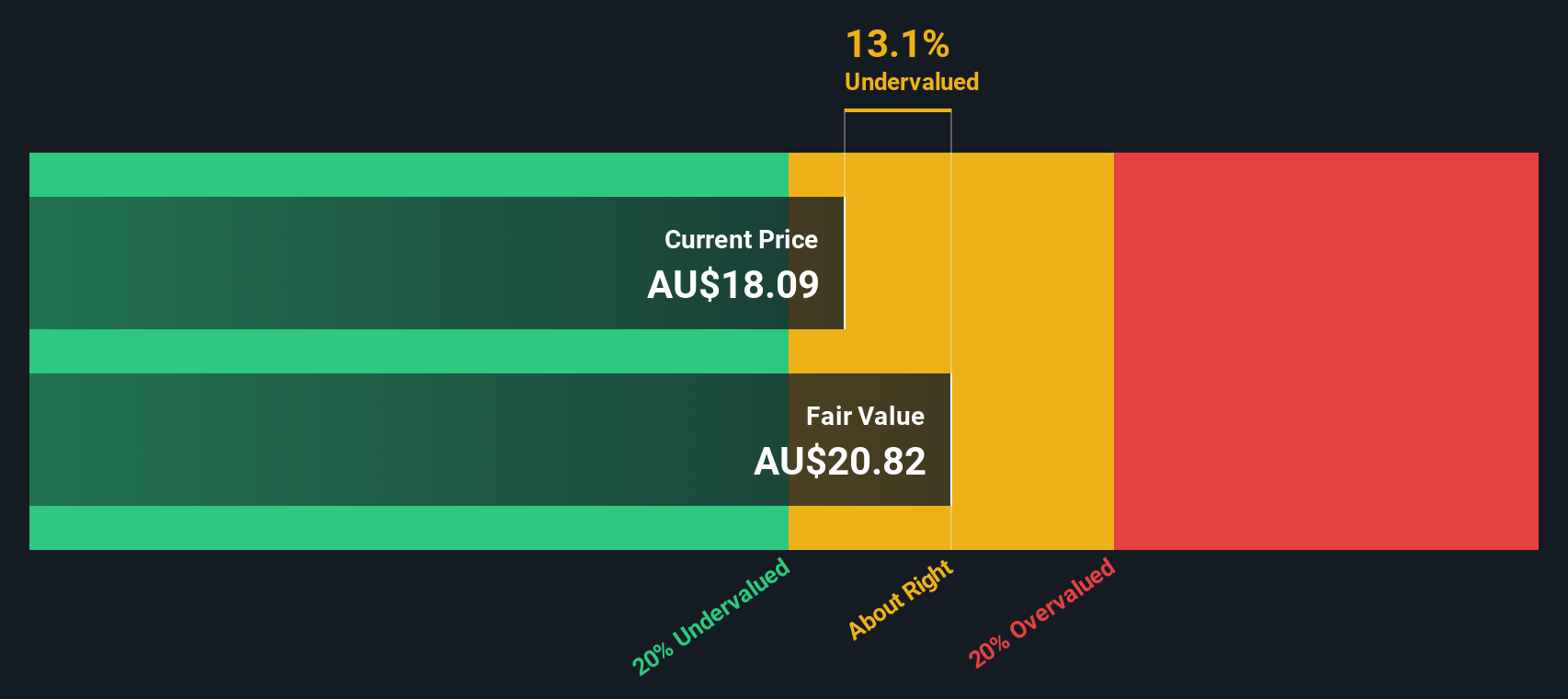

Eagers Automotive, a contender among undervalued stocks in Australia, recently showcased insider confidence when Nicholas Politis acquired 200,000 shares for A$2.09 million. Despite a dip in net income to A$116 million for H1 2024 from A$137.76 million the previous year, sales increased to A$5.46 billion from A$4.82 billion. The company operates with external borrowing as its sole funding source yet maintains a manageable debt position supported by operating cash flow.

- Click here and access our complete valuation analysis report to understand the dynamics of Eagers Automotive.

Explore historical data to track Eagers Automotive's performance over time in our Past section.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group is a company specializing in staffing and outsourcing services, with a market capitalization of A$1.03 billion.

Operations: Mader Group's primary revenue stream is from Staffing & Outsourcing Services, generating A$774.47 million. The company's gross profit margin has shown a notable increase, reaching 22.92% in the latest period. Operating expenses are primarily driven by general and administrative costs, which amounted to A$89.97 million recently.

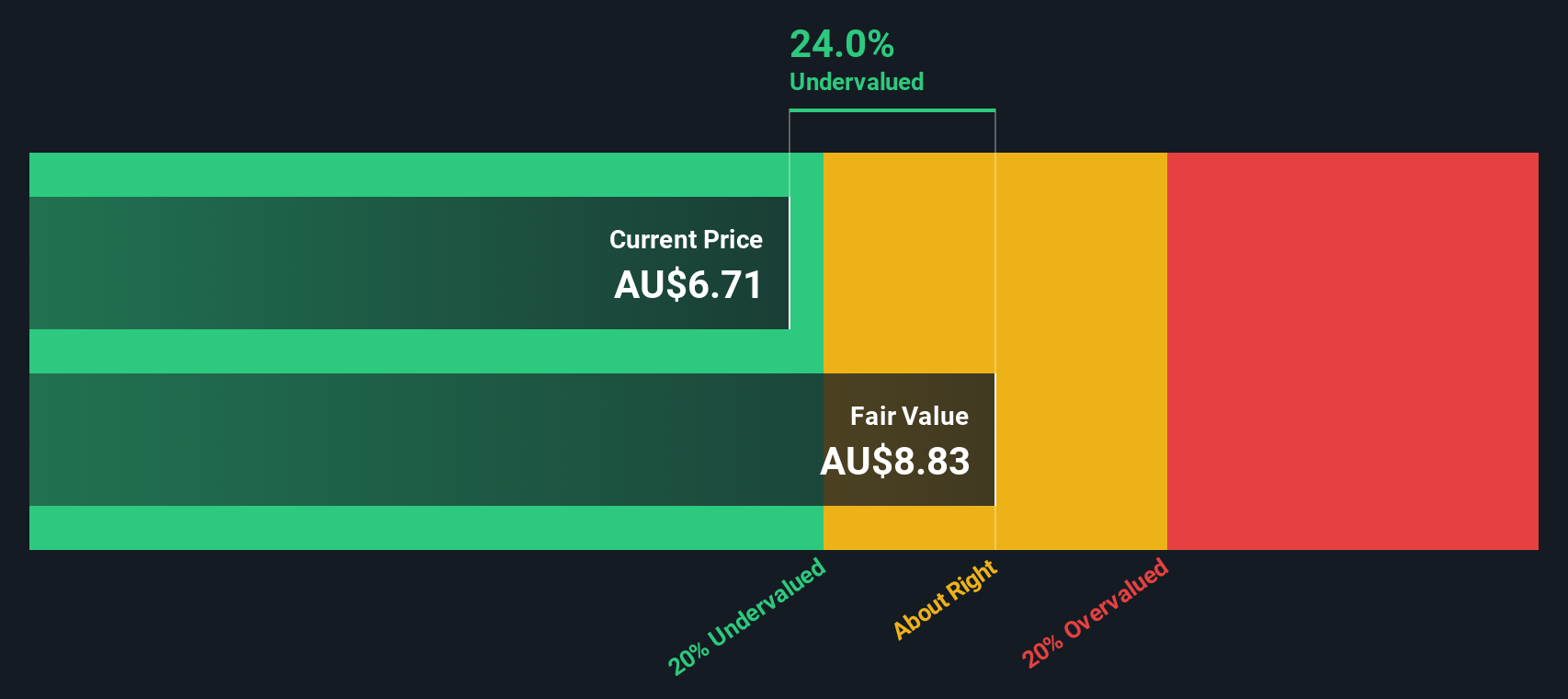

PE: 24.0x

Mader Group, part of Australia's dynamic smaller companies, shows potential with its recent inclusion in the S&P Global BMI Index as of September 2024. The company projects growth for fiscal 2025, expecting revenues to reach at least A$870 million and net profits to exceed A$57 million. Insider confidence is evident with share purchases earlier this year, reflecting optimism about future performance. Despite relying on external borrowing for funding, Mader's forecasted earnings growth of around 13% annually suggests a promising trajectory.

- Take a closer look at Mader Group's potential here in our valuation report.

Review our historical performance report to gain insights into Mader Group's's past performance.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm specializing in global equities and infrastructure, with a market capitalization of A$4.91 billion.

Operations: Magellan Financial Group generates revenue primarily through its Investment Management Services, complemented by Fund Investments and Corporate activities. The company has experienced fluctuations in its gross profit margin, reaching 80.78% as of the latest reporting period. Operating expenses are a significant component of the cost structure, with general and administrative expenses consistently being a major part of these costs over time.

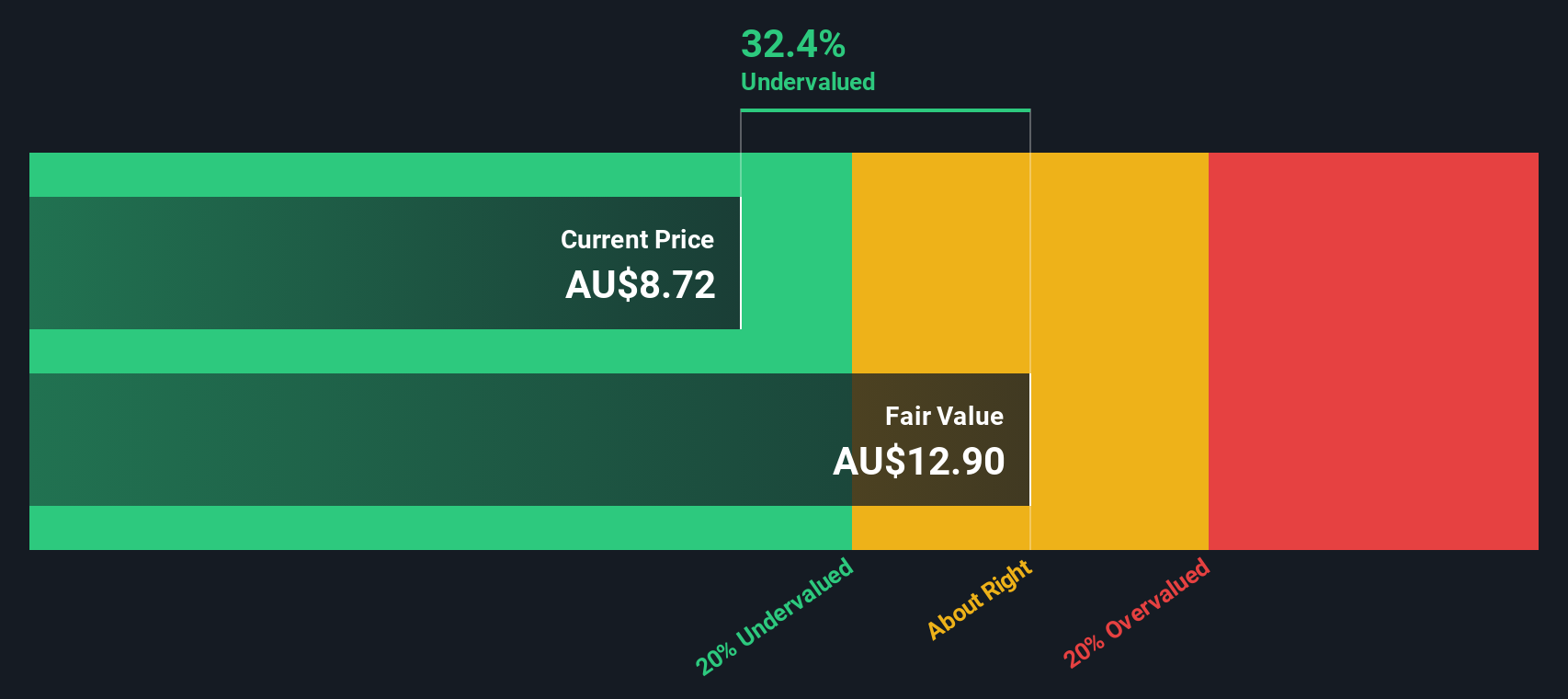

PE: 8.5x

Magellan Financial Group, a smaller player in Australia's financial sector, recently reported a revenue drop to A$378.63 million for the year ending June 30, 2024, down from A$431.65 million the previous year. Despite this decline, net income rose to A$238.76 million from A$182.66 million, with earnings per share increasing to A$1.318 from A$1. This indicates strong earnings quality despite reliance on external borrowing for funding and anticipated earnings decline of 9.2% annually over three years. The company repurchased 4,969,671 shares since March 2022 for approximately A$52.47 million and extended its buyback plan till April 3, 2025—reflecting strategic capital management amidst evolving market conditions.

- Unlock comprehensive insights into our analysis of Magellan Financial Group stock in this valuation report.

Understand Magellan Financial Group's track record by examining our Past report.

Taking Advantage

- Access the full spectrum of 22 Undervalued ASX Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFG

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives