ASX Growth Leaders With High Insider Ownership September 2025

Reviewed by Simply Wall St

As the Australian market navigates fluctuating foreign direct investment flows and a mixed performance across sectors, investors are closely watching for opportunities amidst these shifts. In this environment, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.1% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.2% | 92.5% |

| Gratifii (ASX:GTI) | 17.8% | 137.7% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Echo IQ (ASX:EIQ) | 18% | 49.9% |

| BlinkLab (ASX:BB1) | 35.5% | 101.4% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.1% | 121.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market cap of A$895.47 million.

Operations: The company generates its revenue primarily from mining services, amounting to A$66.11 million.

Insider Ownership: 15.2%

Earnings Growth Forecast: 68.1% p.a.

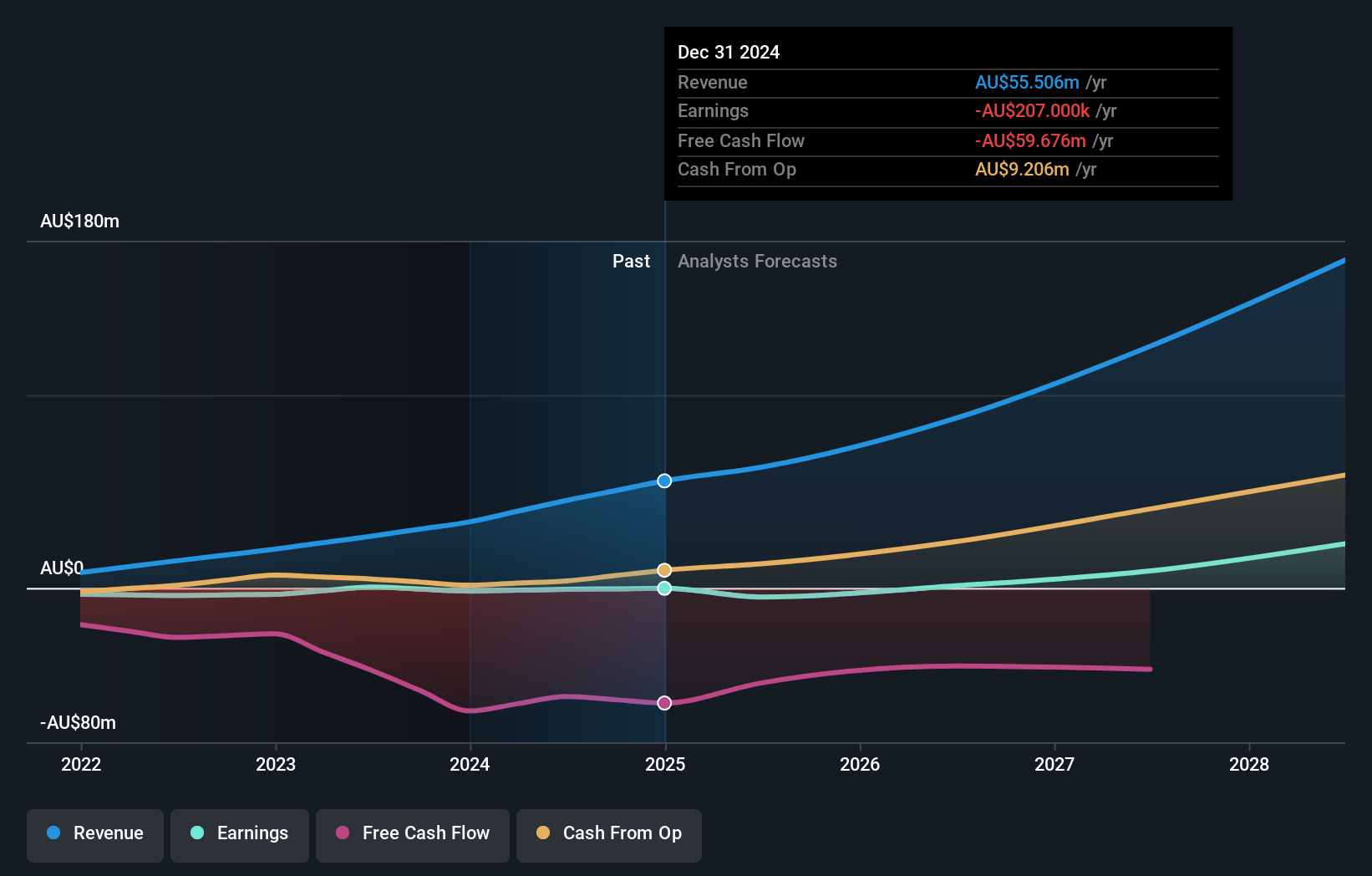

Chrysos Corporation is experiencing robust growth, with revenue forecasted to increase by 27% annually, surpassing the Australian market's average. Despite a current net loss of A$8.22 million, the company aims to achieve profitability within three years. However, insider activity shows significant selling recently. Recent earnings revealed revenue of A$67.32 million for fiscal 2025, with guidance for 2026 set between A$80 million and A$90 million, indicating continued strong growth potential despite financial challenges.

- Take a closer look at Chrysos' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Chrysos is priced higher than what may be justified by its financials.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market cap of A$12.59 billion.

Operations: The company's revenue is primarily derived from its Software segment, contributing A$378.25 million, followed by the Corporate segment at A$90.55 million and Consulting at A$82.87 million.

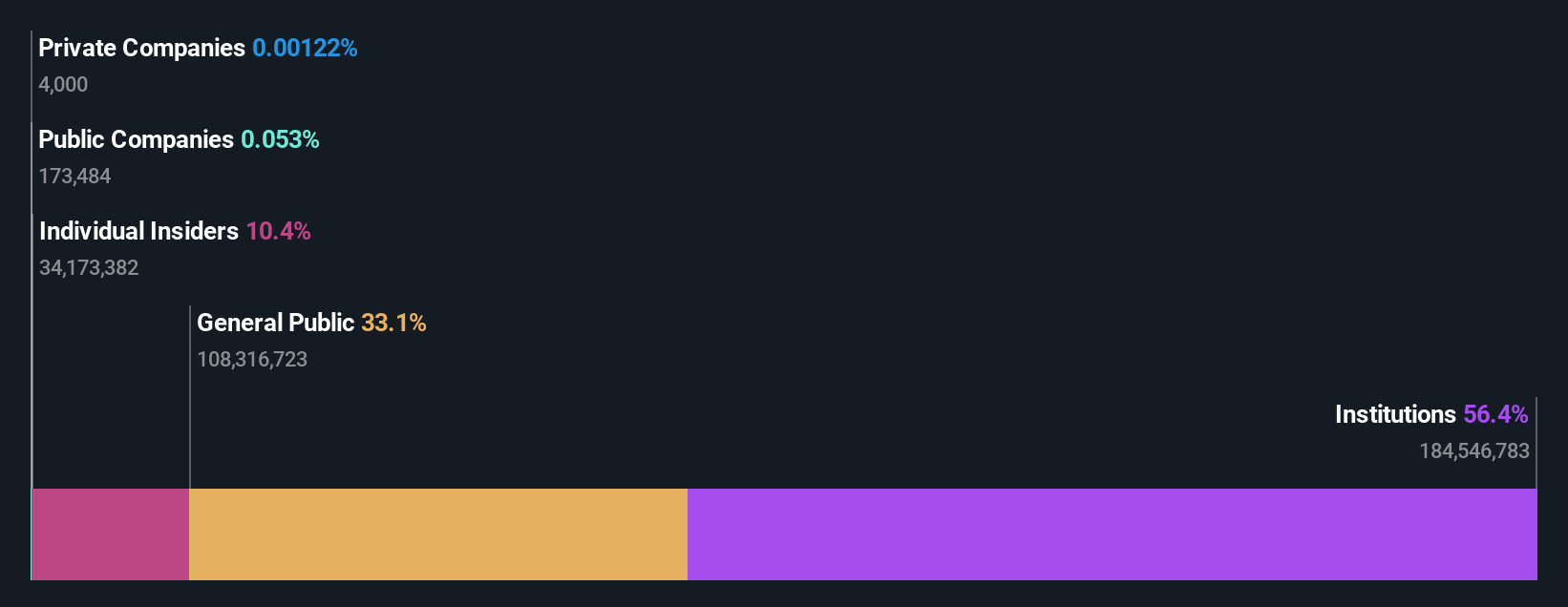

Insider Ownership: 10.4%

Earnings Growth Forecast: 16.6% p.a.

Technology One demonstrates solid growth potential with forecasted earnings growth of 16.6% annually, outpacing the Australian market average. Revenue is expected to grow at 13.2% per year, also above the market rate. Recent additions to major indices like S&P Global 1200 enhance its visibility and credibility among investors. New board appointments bring expertise in scaling tech businesses and strategic leadership, potentially bolstering future performance despite no significant insider trading activity recently observed.

- Navigate through the intricacies of Technology One with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Technology One's share price might be too optimistic.

Universal Store Holdings (ASX:UNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Universal Store Holdings Limited operates in the retail sector, focusing on the fashion market in Australia, with a market cap of A$659.03 million.

Operations: The company's revenue segments include A$40.06 million from CTC and A$306.41 million from US & PS.

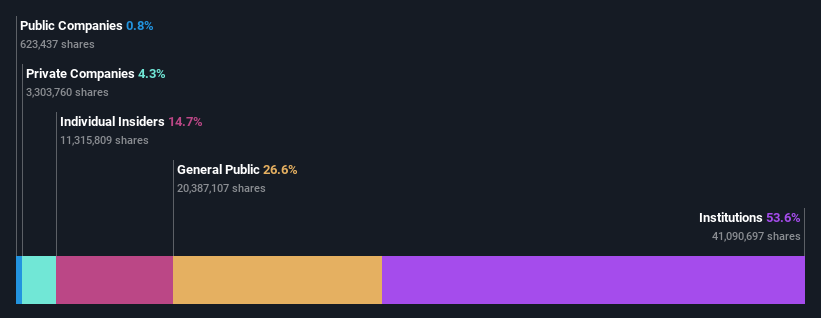

Insider Ownership: 12.9%

Earnings Growth Forecast: 16.3% p.a.

Universal Store Holdings is experiencing robust growth, with earnings forecasted to rise 16.34% annually, surpassing the Australian market average. The company has recently been added to key indices such as the S&P/ASX 300 and S&P Global BMI, increasing its visibility. Despite a decrease in profit margins and net income over the past year, insiders have shown confidence by substantially buying shares recently. Plans for new store openings further support long-term expansion prospects.

- Click to explore a detailed breakdown of our findings in Universal Store Holdings' earnings growth report.

- The valuation report we've compiled suggests that Universal Store Holdings' current price could be inflated.

Taking Advantage

- Investigate our full lineup of 110 Fast Growing ASX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives