- Australia

- /

- Construction

- /

- ASX:WOR

Worley (ASX:WOR) Reports 718.9% Earnings Growth; Dividend of AUD 0.25 Announced for September

Reviewed by Simply Wall St

Navigate through the intricacies of Worley with our comprehensive report here.

Core Advantages Driving Sustained Success for Worley

Worley's recent financial performance showcases a remarkable earnings growth of 718.9% over the past year, far surpassing the industry average of 16.2%. This highlights the company's strong market position and effective strategies. The management team, with an average tenure of 4.8 years, brings valuable experience, contributing to strategic goals and fostering stability. Additionally, Worley's forecasted earnings growth of 15.1% per year exceeds the Australian market average, indicating strong future prospects. The company is currently trading below its estimated fair value of A$29.67, with a target price suggesting potential for a 26.5% increase from its current share price of A$13.94, reflecting its strong market positioning.

To gain deeper insights into Worley's historical performance, explore our detailed analysis of past performance.Internal Limitations Hindering Worley's Growth

Worley faces challenges such as a low Return on Equity of 5.7%, which is below the acceptable threshold of 20%. This indicates inefficiencies in generating returns from shareholders' equity. The company's earnings growth forecast of 5.8% per year is also slower than the desired rate of 20%, suggesting potential hurdles in maintaining its growth trajectory. Furthermore, the dividend yield of 3.59% is relatively low compared to top-tier payers, and the high payout ratio of 87% raises concerns about sustainability. These factors, combined with volatile dividend payments over the past decade, highlight areas for improvement.

Learn about Worley's dividend strategy and how it impacts shareholder returns and financial stability.Areas for Expansion and Innovation for Worley

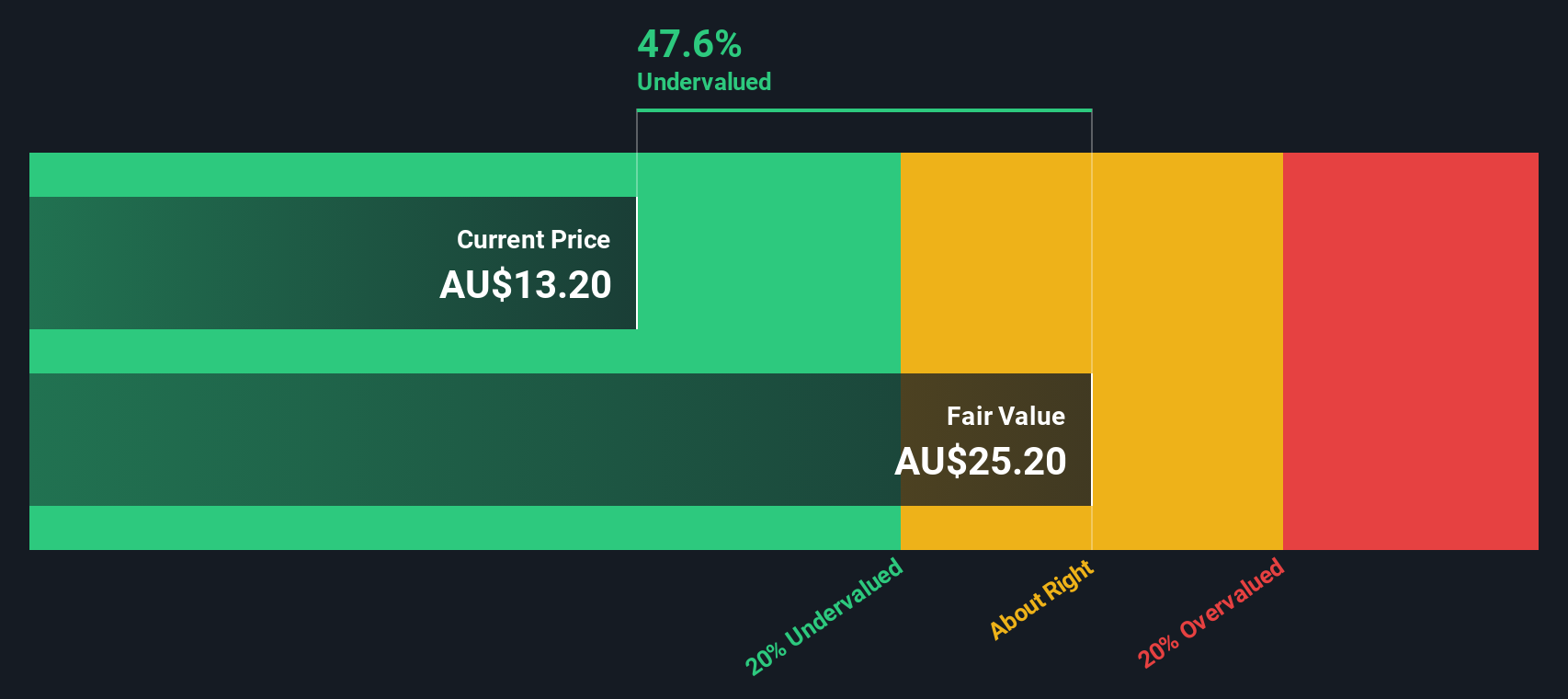

Analysts predict a target price more than 20% higher than the current share price, indicating significant potential for stock price appreciation. This, coupled with the company trading at 53% below its estimated fair value, suggests ample room for growth. Worley's commitment to product innovation, as evidenced by recent product line launches, positions it well to capture emerging market opportunities and enhance customer loyalty. Strategic alliances and business expansions could further strengthen its market position and drive future success.

See what the latest analyst reports say about Worley's future prospects and potential market movements.Regulatory Challenges Facing Worley

Worley must navigate an increasingly complex regulatory environment, which could impact operational flexibility and increase compliance costs. Economic headwinds, such as inflation and changing consumer spending habits, pose risks to revenue stability. Additionally, supply chain vulnerabilities remain a concern, with disruptions potentially affecting production and delivery timelines. The management's proactive approach to diversifying suppliers demonstrates a commitment to mitigating these risks and maintaining operational resilience.

To dive deeper into how Worley's valuation metrics are shaping its market position, check out our detailed analysis of Worley's Valuation.Conclusion

Worley's impressive earnings growth of 718.9% over the past year, significantly outpacing the industry average, underscores its effective strategies and strong market positioning. Internal challenges such as a low Return on Equity and sustainability concerns regarding its dividend payout exist, but the company's forecasted earnings growth and commitment to innovation signal promising future prospects. Trading at A$13.94, well below its estimated fair value of A$29.67, Worley presents a 26.5% potential increase in share price, reflecting investor confidence in its strategic direction. However, navigating regulatory complexities and economic uncertainties will be crucial for maintaining its growth trajectory and achieving long-term success.

Summing It All Up

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Worley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ASX:WOR

Worley

Provides professional services to energy, chemicals, and resources sectors worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives