- Australia

- /

- Consumer Services

- /

- ASX:IEL

3 ASX Stocks Estimated Up To 48.6% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian stock market has been experiencing a mix of volatility and cautious optimism, influenced by higher-than-expected inflation data that keeps interest rate cuts at bay. Despite these challenges, certain sectors like health care have shown resilience, while others such as discretionary have struggled. In this environment, identifying undervalued stocks becomes crucial for investors seeking potential opportunities amidst the market's uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.38 | A$4.63 | 48.6% |

| Superloop (ASX:SLC) | A$3.11 | A$5.66 | 45.1% |

| Resimac Group (ASX:RMC) | A$1.09 | A$2.17 | 49.7% |

| Reckon (ASX:RKN) | A$0.605 | A$1.18 | 48.8% |

| NRW Holdings (ASX:NWH) | A$4.79 | A$9.10 | 47.4% |

| James Hardie Industries (ASX:JHX) | A$32.83 | A$60.74 | 45.9% |

| IDP Education (ASX:IEL) | A$5.65 | A$10.57 | 46.5% |

| CleanSpace Holdings (ASX:CSX) | A$0.705 | A$1.38 | 48.9% |

| Betmakers Technology Group (ASX:BET) | A$0.17 | A$0.32 | 47% |

| Airtasker (ASX:ART) | A$0.37 | A$0.71 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

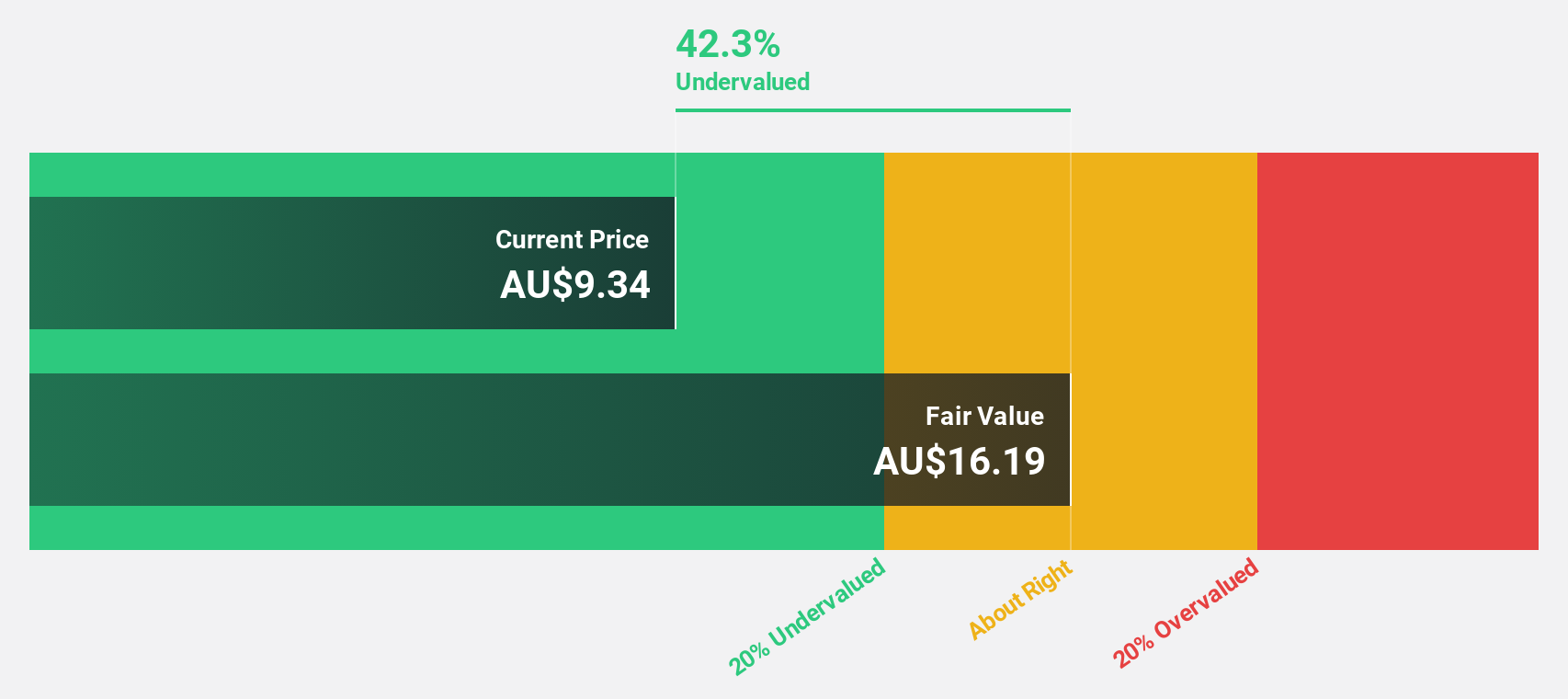

Collins Foods (ASX:CKF)

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$1.26 billion.

Operations: The company's revenue segments include Taco Bell Australia generating A$53.02 million, KFC Restaurants Europe contributing A$312.27 million, and KFC Restaurants Australia bringing in A$1.15 billion.

Estimated Discount To Fair Value: 37.8%

Collins Foods appears undervalued based on cash flows, trading at A$10.67, which is 37.8% below its estimated fair value of A$17.16. Despite a recent dip in profit margins from 3.7% to 0.6%, earnings are expected to grow significantly at 28.63% annually over the next three years, outpacing the Australian market's growth rate of 11.7%. However, its return on equity is forecasted to remain low at 17.3%.

- Insights from our recent growth report point to a promising forecast for Collins Foods' business outlook.

- Get an in-depth perspective on Collins Foods' balance sheet by reading our health report here.

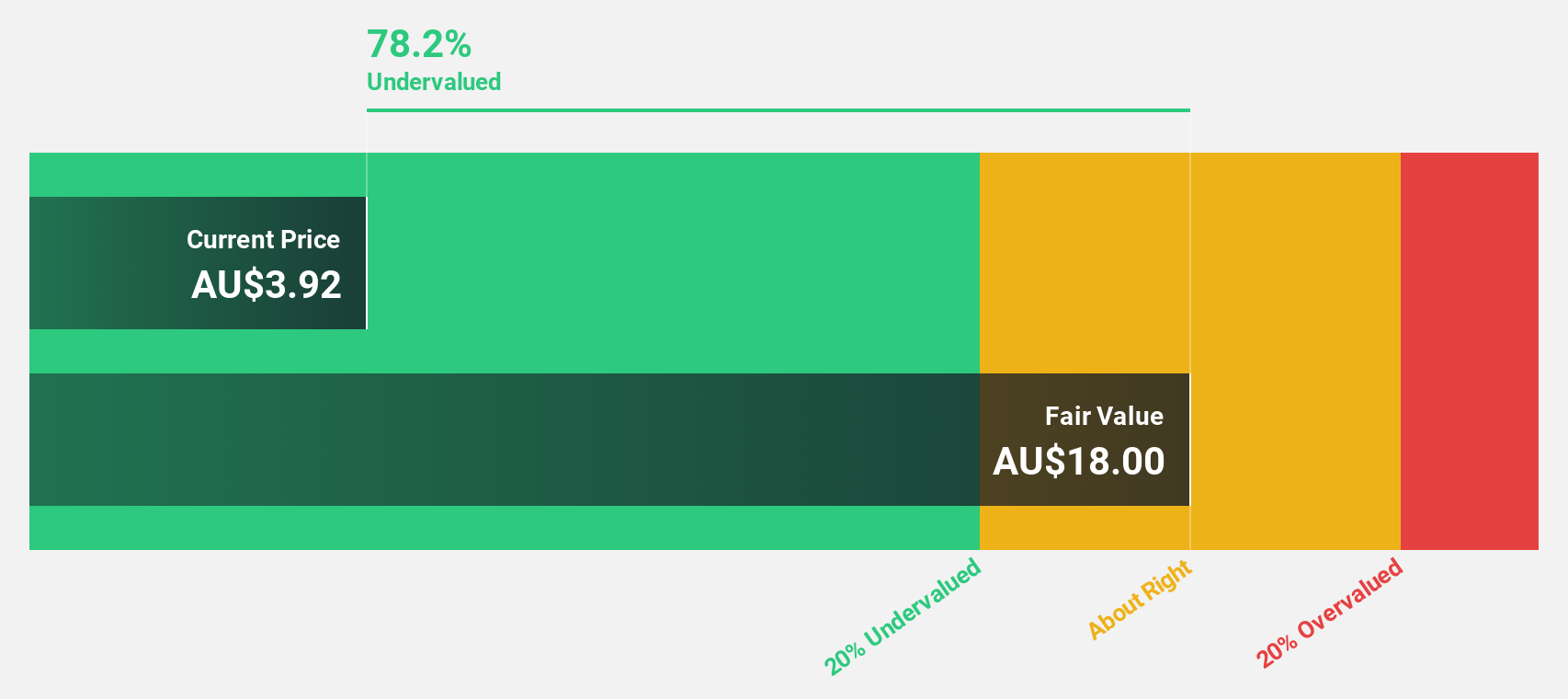

IDP Education (ASX:IEL)

Overview: IDP Education Limited facilitates the placement of students into educational institutions across Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland with a market cap of A$1.57 billion.

Operations: The company's revenue is primarily derived from its Educational Services segment, specifically Education & Training Services, amounting to A$882.20 million.

Estimated Discount To Fair Value: 46.5%

IDP Education is trading at A$5.65, significantly below its estimated fair value of A$10.57, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 12.8% to 5%, earnings are forecasted to grow substantially at 23.6% annually over the next three years, surpassing the Australian market's growth rate of 11.7%. The company was recently added to the S&P/ASX Small Ordinaries Index but dropped from larger indices like FTSE All-World and S&P/ASX 100.

- Our comprehensive growth report raises the possibility that IDP Education is poised for substantial financial growth.

- Navigate through the intricacies of IDP Education with our comprehensive financial health report here.

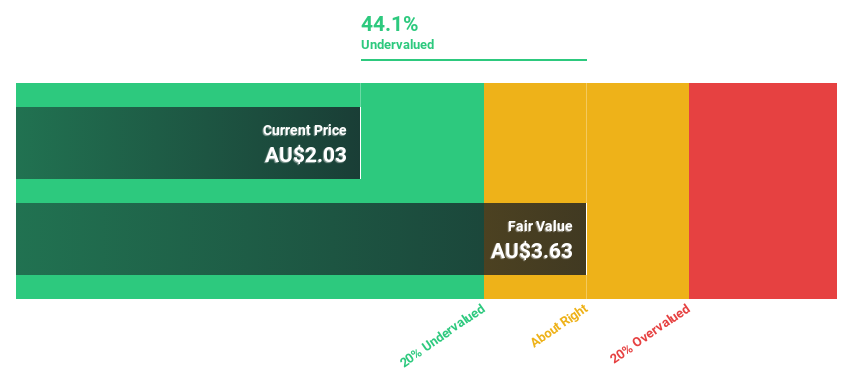

Symal Group (ASX:SYL)

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering services such as construction contracting, equipment hires, material sales, recycling, and remediation, with a market cap of A$562.06 million.

Operations: The company's revenue is derived from Plant & Equipment at A$183.60 million and Contracting Services at A$713.75 million.

Estimated Discount To Fair Value: 48.6%

Symal Group's stock is trading at A$2.38, well below its estimated fair value of A$4.63, highlighting potential undervaluation based on cash flows. The company's revenue grew to A$888.59 million from A$755.42 million last year, though net income slightly decreased to A$34.64 million from A$36.18 million. Earnings are expected to grow 13.2% annually, outpacing the broader Australian market's growth rate of 11.7%. Recent dividend affirmations further indicate financial stability amidst moderate earnings growth expectations.

- Our growth report here indicates Symal Group may be poised for an improving outlook.

- Dive into the specifics of Symal Group here with our thorough financial health report.

Make It Happen

- Click here to access our complete index of 36 Undervalued ASX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IEL

IDP Education

Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)