- Australia

- /

- Hospitality

- /

- ASX:HLO

Helloworld Travel And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian stock market recently experienced a downturn, with the ASX200 hitting a seven-week low and sectors such as Health Care and Financials underperforming. In such fluctuating markets, investors often turn to penny stocks for their potential value and growth opportunities. Despite being an older term, penny stocks can still represent smaller or newer companies that offer financial strength and stability, making them intriguing prospects for those interested in exploring under-the-radar investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.81 | A$291.55M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$127.72M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.31 | A$61.65M | ★★★★★☆ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company that operates in Australia, New Zealand, and internationally, with a market cap of A$291.55 million.

Operations: The company's revenue segments include A$158.66 million from Australian travel operations, A$37.71 million from New Zealand travel operations, A$16.74 million from transport, logistics and warehousing, and A$3.74 million from travel operations in the rest of the world.

Market Cap: A$291.55M

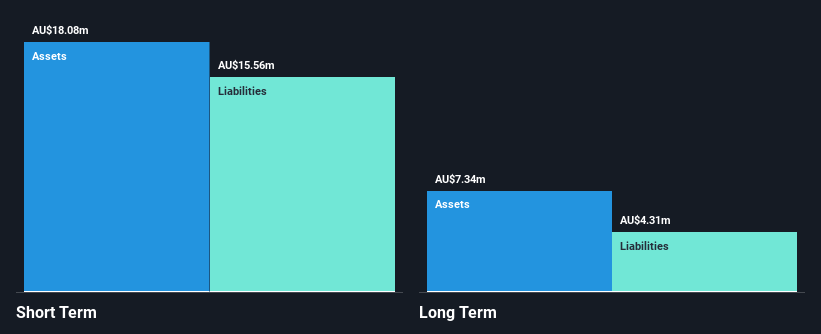

Helloworld Travel has demonstrated strong financial performance, with earnings growing significantly by 59.4% over the past year, surpassing both its five-year average growth rate of 16.9% and the broader hospitality industry. The company is debt-free, with short-term assets exceeding both long-term and short-term liabilities, highlighting a solid balance sheet. Despite trading at a substantial discount to its estimated fair value and below analyst price targets suggesting potential upside, Helloworld's dividend history remains unstable. The management team and board are experienced, contributing to high-quality earnings amidst stable weekly volatility in stock performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Helloworld Travel.

- Examine Helloworld Travel's earnings growth report to understand how analysts expect it to perform.

Pureprofile (ASX:PPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pureprofile Ltd is a data and insights company that offers online research solutions to agencies, marketers, researchers, publishers, and businesses across Australasia, Europe, and the United States with a market cap of A$32.46 million.

Operations: The company's revenue is derived from two segments: Data & Insights, generating A$48.07 million, and Pure.Amplify Media AU, contributing A$0.0003 million.

Market Cap: A$32.46M

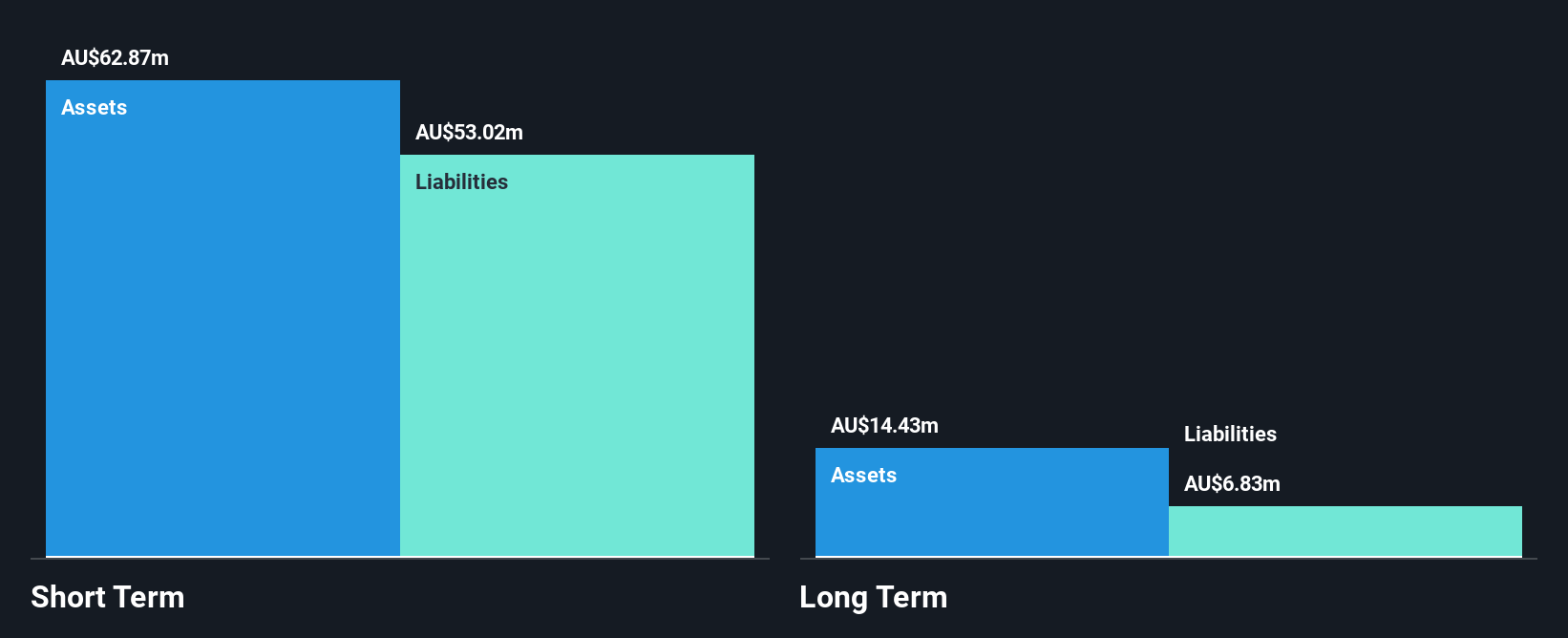

Pureprofile Ltd has shown financial improvement, transitioning to profitability with a net income of A$0.094 million for the year ending June 30, 2024. The company has more cash than debt, indicating sound financial health and its short-term assets cover both short and long-term liabilities. Despite positive earnings growth over five years, recent shareholder dilution and low return on equity at 1.9% are concerns. Trading significantly below estimated fair value suggests potential undervaluation; however, interest coverage remains weak at 1.8x EBIT. The board's inexperience contrasts with a seasoned management team averaging 5.2 years in tenure.

- Navigate through the intricacies of Pureprofile with our comprehensive balance sheet health report here.

- Learn about Pureprofile's future growth trajectory here.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$178.19 million.

Operations: The company's revenue primarily comes from the Lighting and Audio-Visual Markets, generating A$136.31 million.

Market Cap: A$178.19M

SKS Technologies Group has demonstrated significant financial growth, with earnings surging by 948% over the past year and achieving a net income of A$6.62 million for the year ending June 30, 2024. The company operates debt-free, enhancing its financial stability, and its short-term assets comfortably cover both short- and long-term liabilities. Despite shareholder dilution of 2.1% in the past year, SKS's return on equity remains outstanding at 54.5%, indicating efficient capital use. Recent participation in industry conferences highlights active engagement with investors while trading below estimated fair value suggests potential undervaluation opportunities for investors seeking growth prospects within this sector.

- Get an in-depth perspective on SKS Technologies Group's performance by reading our balance sheet health report here.

- Explore SKS Technologies Group's analyst forecasts in our growth report.

Next Steps

- Click through to start exploring the rest of the 1,030 ASX Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Very undervalued with flawless balance sheet.