- Australia

- /

- Metals and Mining

- /

- ASX:IMA

3 ASX Penny Stocks With Market Caps Under A$500M

Reviewed by Simply Wall St

The Australian stock market recently saw a modest uplift, with the ASX 200 closing up 0.29% as sectors like Real Estate and Healthcare led gains, while Materials lagged behind. In this context of fluctuating sector performances and ongoing economic considerations such as inflation concerns, investors are increasingly exploring diverse opportunities within the market. Penny stocks, despite being an older term in trading parlance, continue to capture interest due to their potential for growth when backed by solid financials. These smaller or newer companies can offer intriguing possibilities for those looking to uncover hidden value amidst broader market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,055 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Civmec (ASX:CVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Civmec Limited is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia, with a market cap of A$474.60 million.

Operations: The company's revenue is derived from three main segments: Energy (A$31.04 million), Resources (A$876.48 million), and Infrastructure, Marine & Defence (A$125.96 million).

Market Cap: A$474.6M

Civmec Limited, with a market cap of A$474.60 million, demonstrates financial stability in the penny stock category by having short-term assets (A$358.0M) that cover both short-term (A$242.3M) and long-term liabilities (A$179.8M). The company shows strong earnings growth over five years at 33.8% annually, although recent growth has slowed to 11.7%. Civmec's debt management is robust, with more cash than total debt and interest well-covered by EBIT at 39.9x coverage. Recent developments include a significant A$90-100 million shiploader project enhancing future prospects and board restructuring to strengthen governance.

- Click here and access our complete financial health analysis report to understand the dynamics of Civmec.

- Assess Civmec's future earnings estimates with our detailed growth reports.

Image Resources (ASX:IMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Image Resources NL is a mineral sands mining company operating in Western Australia with a market cap of A$102.48 million.

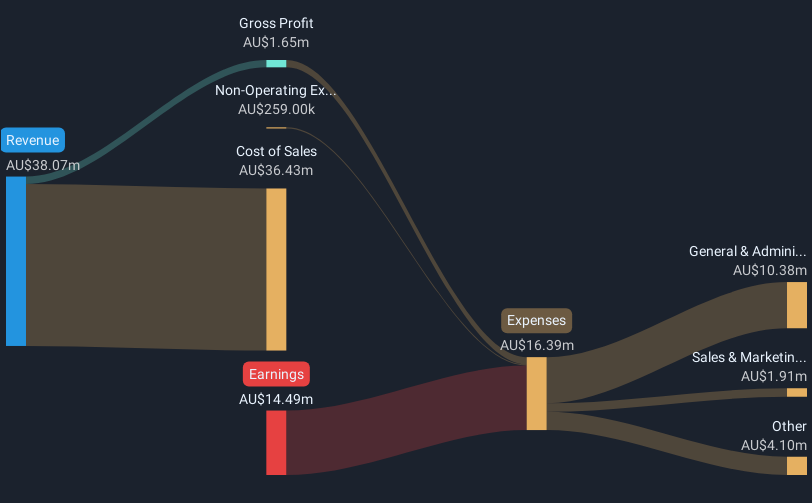

Operations: No revenue segments have been reported.

Market Cap: A$102.48M

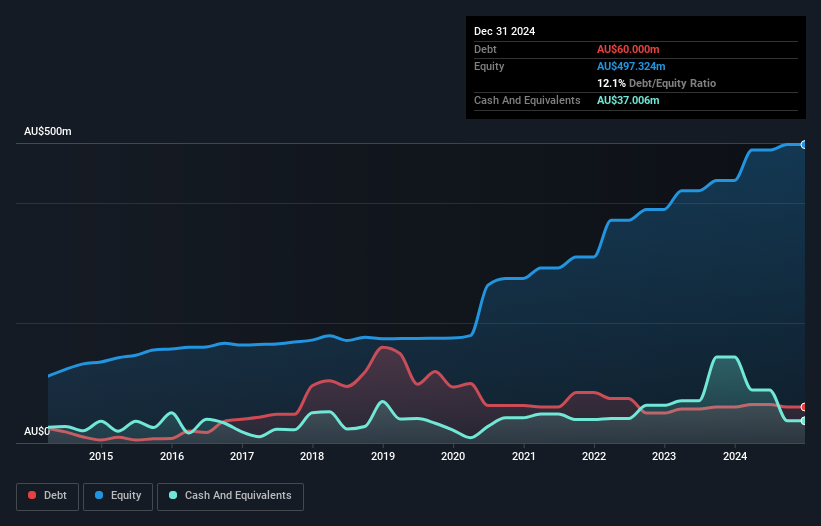

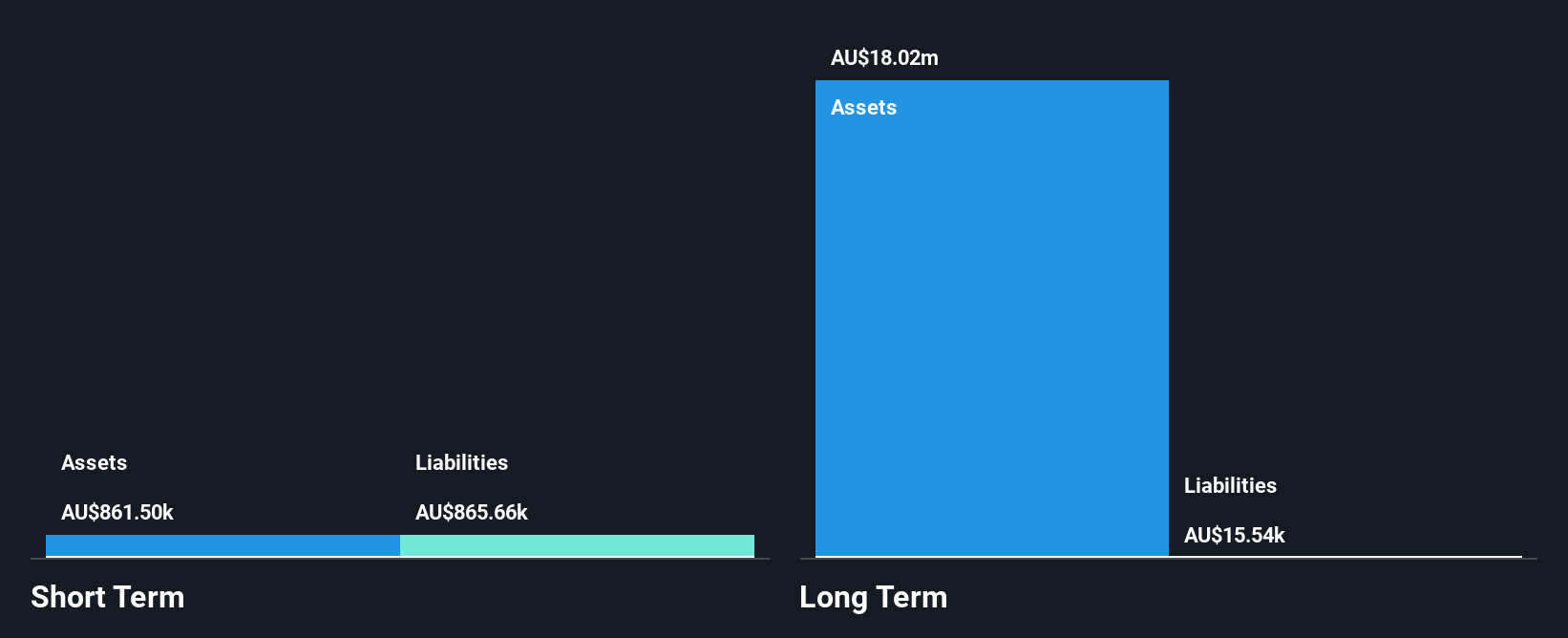

Image Resources NL, with a market cap of A$102.48 million, operates without debt and maintains stable weekly volatility at 9%. Despite its seasoned management team and board, averaging tenures of 9.3 and 8.5 years respectively, the company remains pre-revenue in the mineral sands sector. Shareholders faced dilution last year as shares outstanding increased by 3%. The company's short-term assets (A$43.8M) exceed short-term liabilities (A$4.1M), but do not cover long-term liabilities (A$51.5M). Image Resources has experienced increasing losses over the past five years at a rate of 33.2% annually, reflecting ongoing financial challenges.

- Navigate through the intricacies of Image Resources with our comprehensive balance sheet health report here.

- Explore historical data to track Image Resources' performance over time in our past results report.

Rimfire Pacific Mining (ASX:RIM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rimfire Pacific Mining Limited is involved in the exploration and evaluation of mineral deposits in Australia, with a market cap of A$82.44 million.

Operations: Rimfire Pacific Mining Limited does not report any revenue segments.

Market Cap: A$82.44M

Rimfire Pacific Mining Limited, with a market cap of A$82.44 million, operates as a pre-revenue entity in the exploration sector. The company has experienced increased losses over five years at an annual rate of 8.6%, reflecting financial challenges typical for early-stage mining ventures. Despite being debt-free and having short-term assets exceeding long-term liabilities, Rimfire's short-term liabilities surpass its assets. Shareholder dilution occurred with a 6.1% increase in shares outstanding over the past year. While management and board tenures are considered experienced, high weekly volatility remains a concern for investors seeking stability in penny stocks.

- Get an in-depth perspective on Rimfire Pacific Mining's performance by reading our balance sheet health report here.

- Gain insights into Rimfire Pacific Mining's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Reveal the 1,055 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IMA

Image Resources

Operates as a mineral sands mining company in Western Australia.

Excellent balance sheet low.