- Australia

- /

- Metals and Mining

- /

- ASX:FRB

Discovering Opportunities: 3 ASX Penny Stocks With Market Caps Under A$2B

Reviewed by Simply Wall St

The Australian market recently closed on a positive note, with the ASX 200 gaining 0.29%, as sectors like Real Estate and Healthcare led the way despite ongoing concerns about inflation remaining high. In this context, penny stocks continue to capture investor interest due to their potential for growth and affordability, even though the term itself might seem outdated. These smaller or newer companies can offer unique investment opportunities when supported by strong financials, and we'll explore three such stocks that stand out in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,055 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market cap of A$1.37 billion.

Operations: The company generates revenue of A$68.34 million from the securities industry segment.

Market Cap: A$1.37B

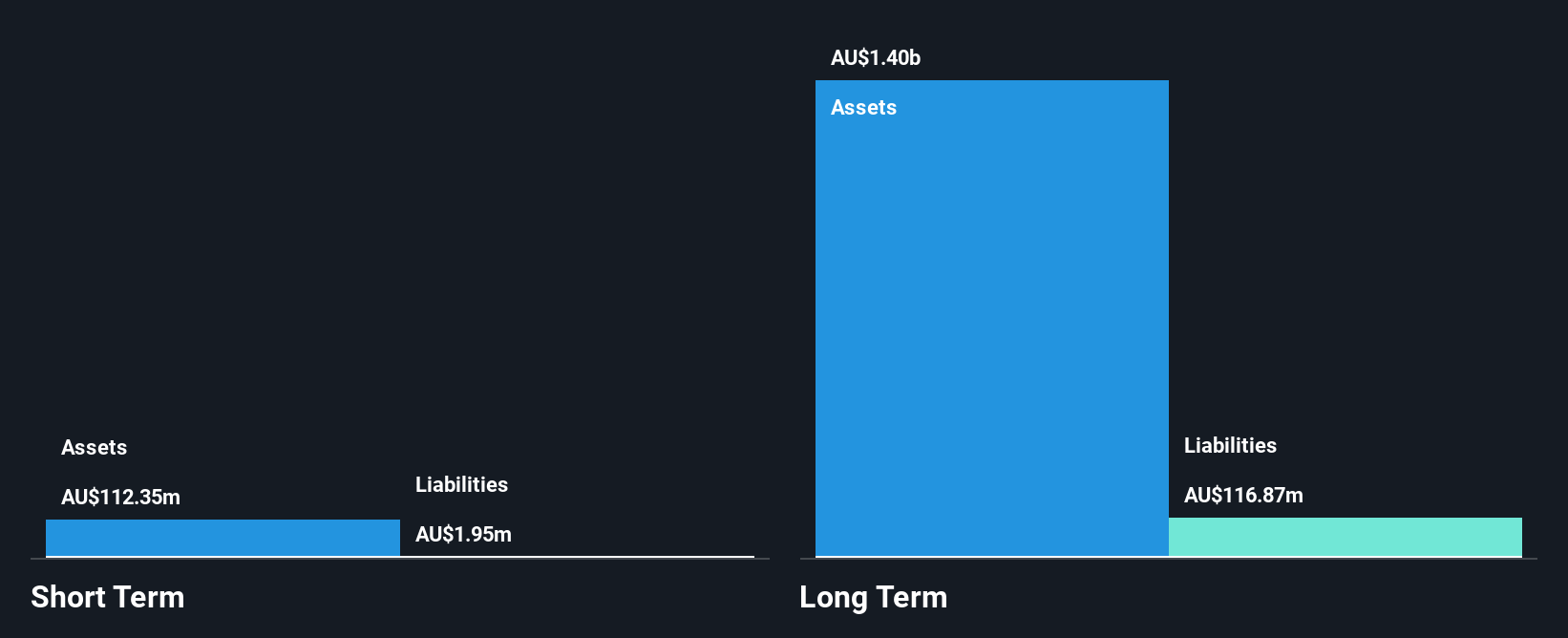

BKI Investment Company Limited, with a market cap of A$1.37 billion and revenue of A$68.34 million, is debt-free and has not diluted shareholders over the past year. Despite its seasoned board with an average tenure of 21.2 years, BKI experienced negative earnings growth last year, contrasting with its 7.6% annual profit growth over five years. The company's net profit margins have slightly decreased to 94.2%, and its dividend yield of 4.62% isn't well covered by earnings or free cash flows, highlighting potential sustainability concerns amidst low return on equity at 4.7%.

- Click to explore a detailed breakdown of our findings in BKI Investment's financial health report.

- Learn about BKI Investment's historical performance here.

Elixir Energy (ASX:EXR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Elixir Energy Limited is a natural gas and hydrogen exploration and development company with operations in Australia, Mongolia, and the United States, and has a market cap of A$53.86 million.

Operations: The company's revenue is primarily derived from its Oil & Gas Exploration activities, with A$1.69 million coming from Australia and A$0.02 million from Mongolia.

Market Cap: A$53.86M

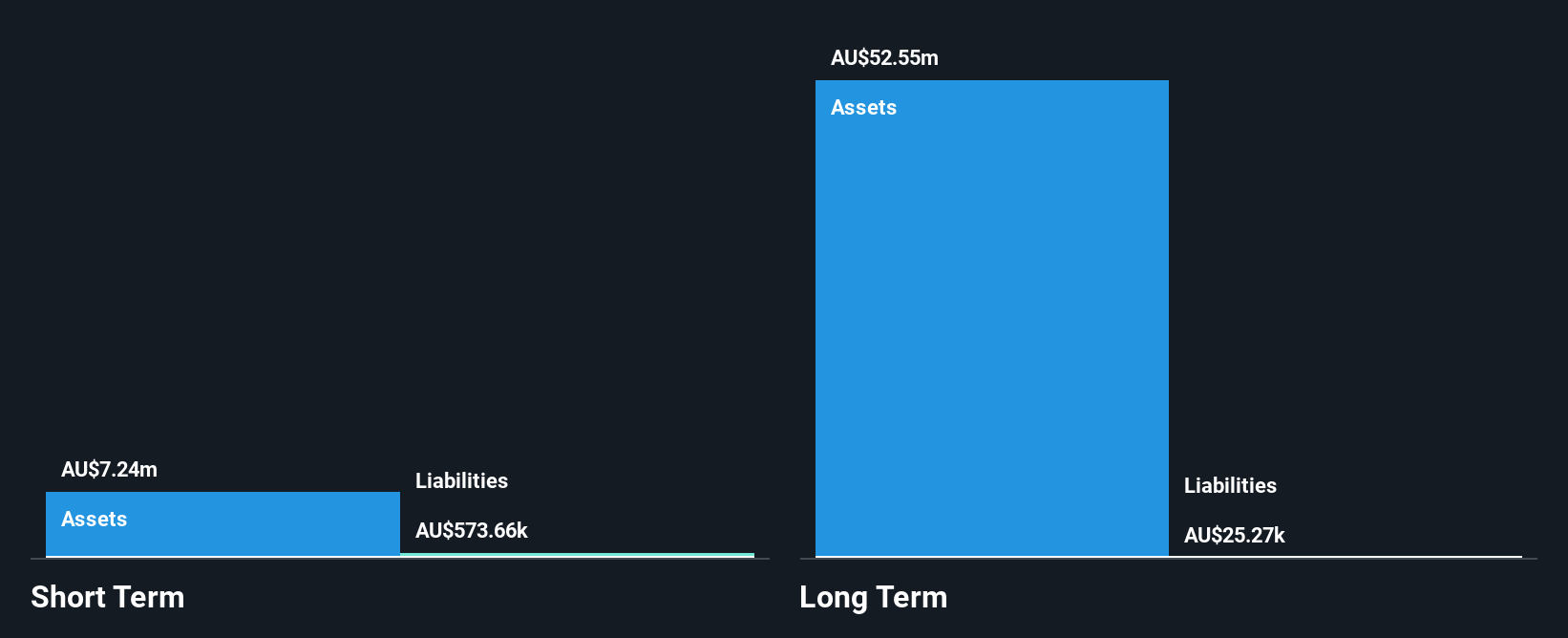

Elixir Energy Limited, with a market cap of A$53.86 million, operates in natural gas and hydrogen exploration but remains pre-revenue, generating A$1.71 million primarily from Australia. The company is unprofitable and has seen its losses increase by 1.6% annually over the past five years, with a negative return on equity of -2.98%. Despite its challenges, Elixir's short-term assets (A$16.5M) comfortably cover both short-term (A$8.8M) and long-term liabilities (A$31.7K). Recent developments include operational updates on the Daydream-2 well in Project Grandis, indicating ongoing efforts to optimize production capabilities amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Elixir Energy.

- Gain insights into Elixir Energy's historical outcomes by reviewing our past performance report.

Firebird Metals (ASX:FRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Firebird Metals Limited is involved in the acquisition, exploration, evaluation, and exploitation of mineral resources in Australia and China, with a market cap of A$15.66 million.

Operations: Currently, there are no specific revenue segments reported for the company.

Market Cap: A$15.66M

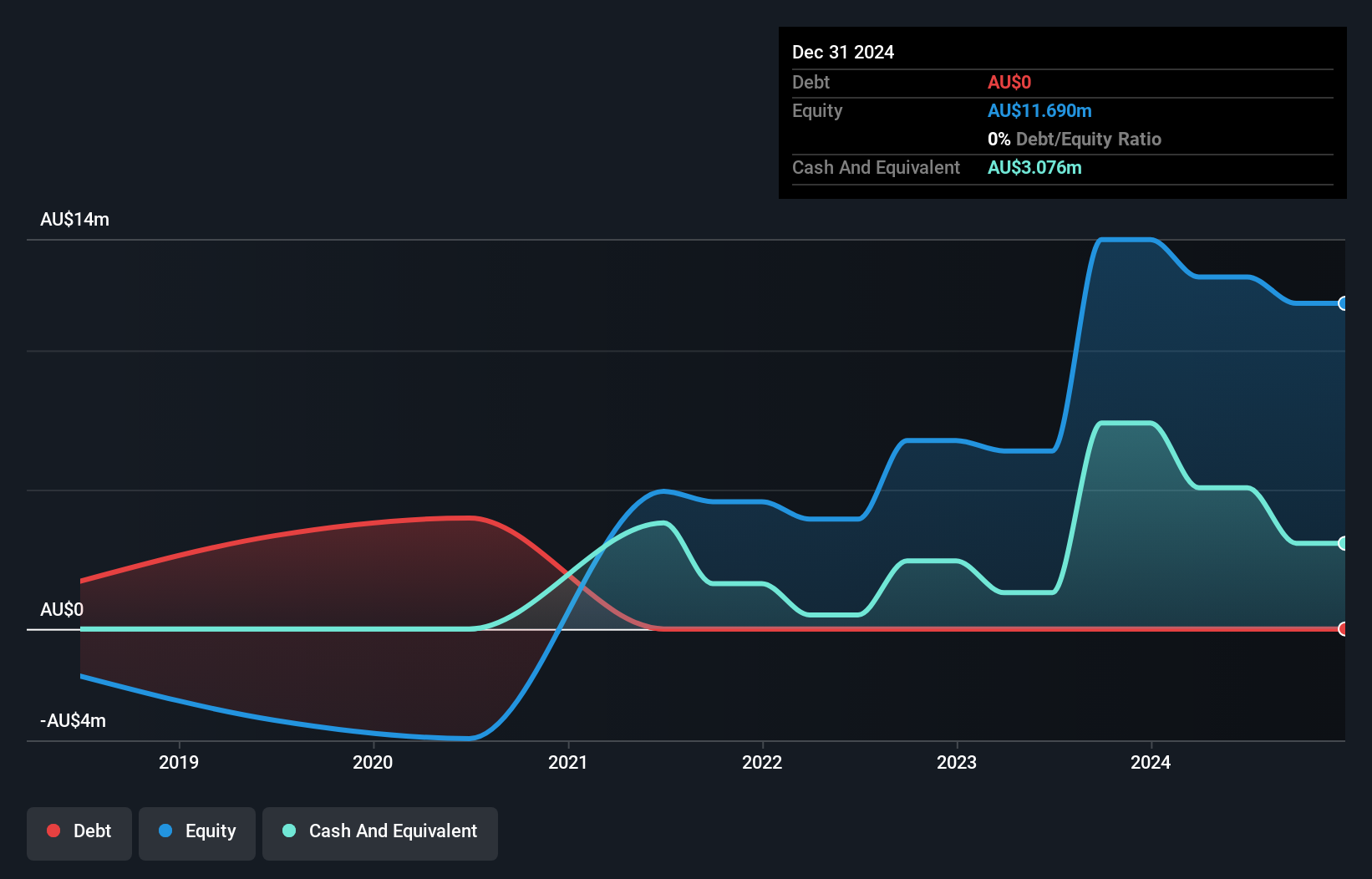

Firebird Metals Limited, with a market cap of A$15.66 million, is pre-revenue and currently unprofitable, reporting a net loss of A$4.66 million for the year ending June 30, 2024. Despite being debt-free with sufficient cash runway for over a year, the company faces high share price volatility and has experienced shareholder dilution over the past year. The board is considered experienced but concerns about its ability to continue as a going concern were raised by auditors recently. Firebird's short-term assets significantly exceed its liabilities, providing some financial stability amidst operational challenges.

- Click here to discover the nuances of Firebird Metals with our detailed analytical financial health report.

- Assess Firebird Metals' previous results with our detailed historical performance reports.

Where To Now?

- Unlock our comprehensive list of 1,055 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FRB

Firebird Metals

Engages in the exploration, development, and evaluation of mineral resources in Australia and China.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion