Reliance Worldwide (ASX:RWC) shareholders have earned a 30% return over the last year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Reliance Worldwide Corporation Limited (ASX:RWC) share price is 29% higher than it was a year ago, much better than the market return of around 10% (not including dividends) in the same period. So that should have shareholders smiling. However, the stock hasn't done so well in the longer term, with the stock only up 4.4% in three years.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Reliance Worldwide

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, Reliance Worldwide actually shrank its EPS by 21%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 1.4% dividend yield is doing much to support the share price. Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

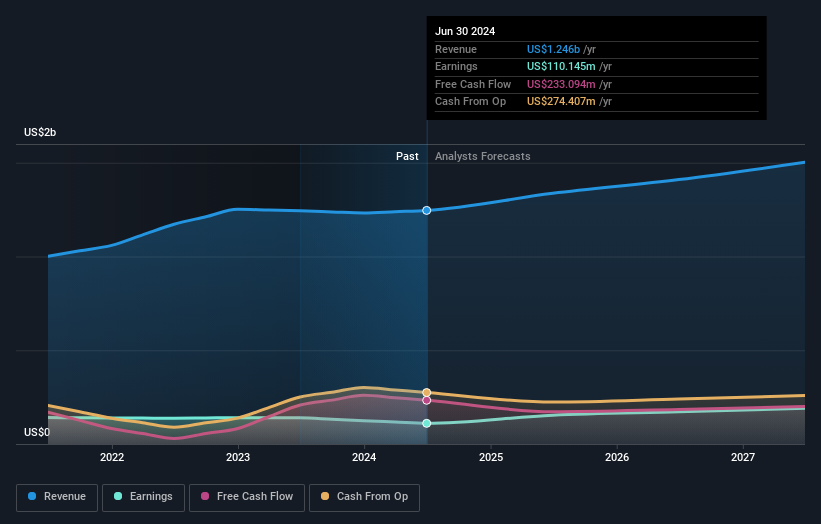

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Reliance Worldwide is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

We're pleased to report that Reliance Worldwide shareholders have received a total shareholder return of 30% over one year. That's including the dividend. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is Reliance Worldwide cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Reliance Worldwide better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RWC

Reliance Worldwide

Engages in the design, manufacture, and supply of water flow, control, and monitoring products and solutions for plumbing and heating industries.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives