- Australia

- /

- Trade Distributors

- /

- ASX:RDX

Discovering Australia's Undiscovered Gems This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.3%, but it remains up 10% over the past year with earnings forecasted to grow by 12% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors looking to uncover hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia with a market capitalization of A$2.50 billion.

Operations: Emerald Resources NL generates revenue primarily from its mine operations, amounting to A$366.04 million. The company has a market capitalization of A$2.50 billion.

Emerald Resources, a promising player in Australia's mining sector, reported A$371.07 million in sales for the year ending June 2024, up from A$299.48 million the previous year. Net income also rose to A$84.27 million from A$59.36 million. Despite shareholder dilution over the past year, Emerald's debt-to-equity ratio stands at a manageable 8.5%. The company is trading at 60% below its estimated fair value and boasts an impressive EBIT coverage of interest payments at 18.6x.

- Click to explore a detailed breakdown of our findings in Emerald Resources' health report.

Explore historical data to track Emerald Resources' performance over time in our Past section.

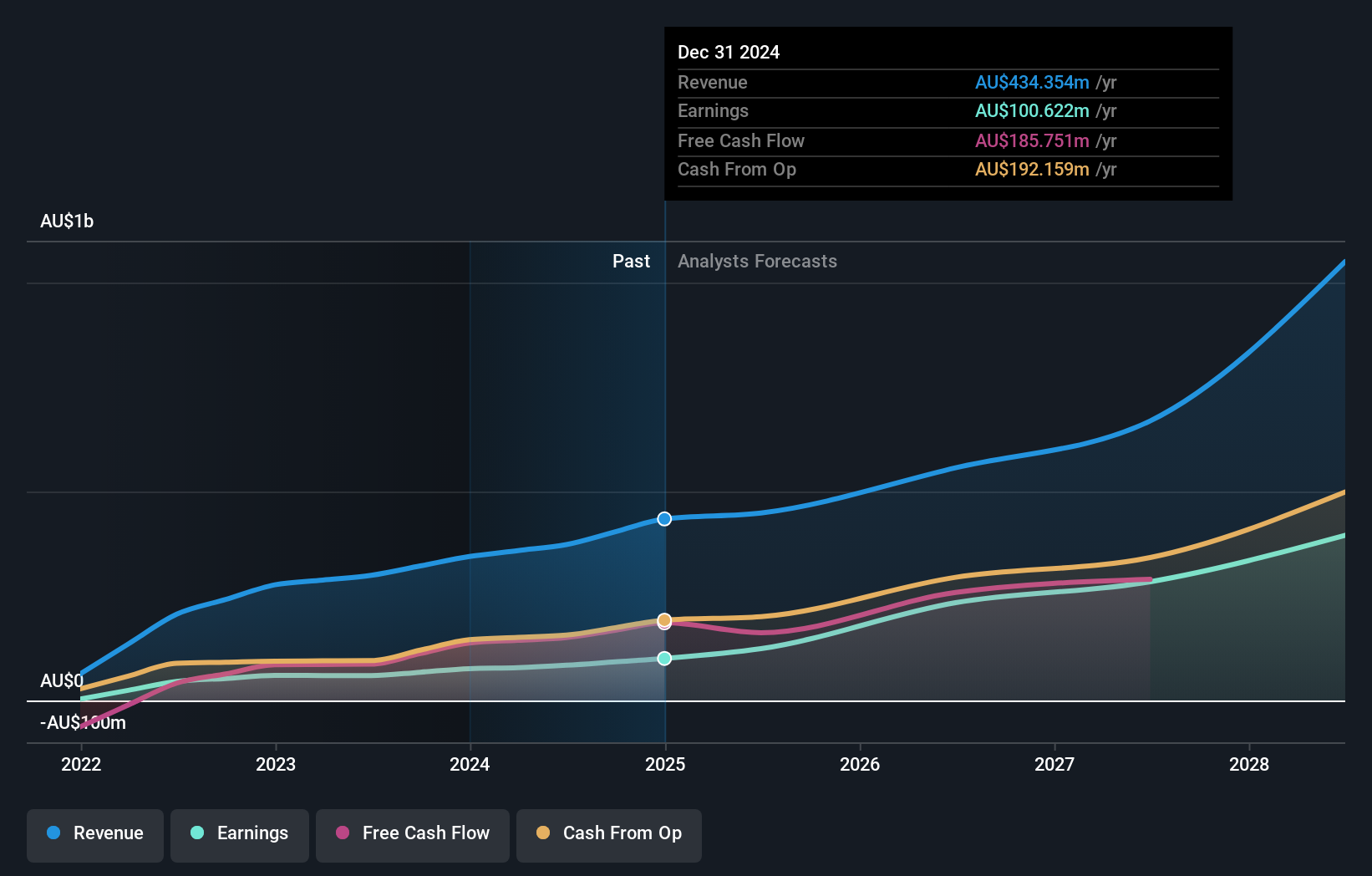

Redox (ASX:RDX)

Simply Wall St Value Rating: ★★★★★★

Overview: Redox Limited supplies and distributes chemicals, ingredients, and raw materials in Australia, New Zealand, the United States, and internationally with a market cap of A$1.69 billion.

Operations: Redox generates revenue primarily from its wholesale drugs segment, amounting to A$1.14 billion.

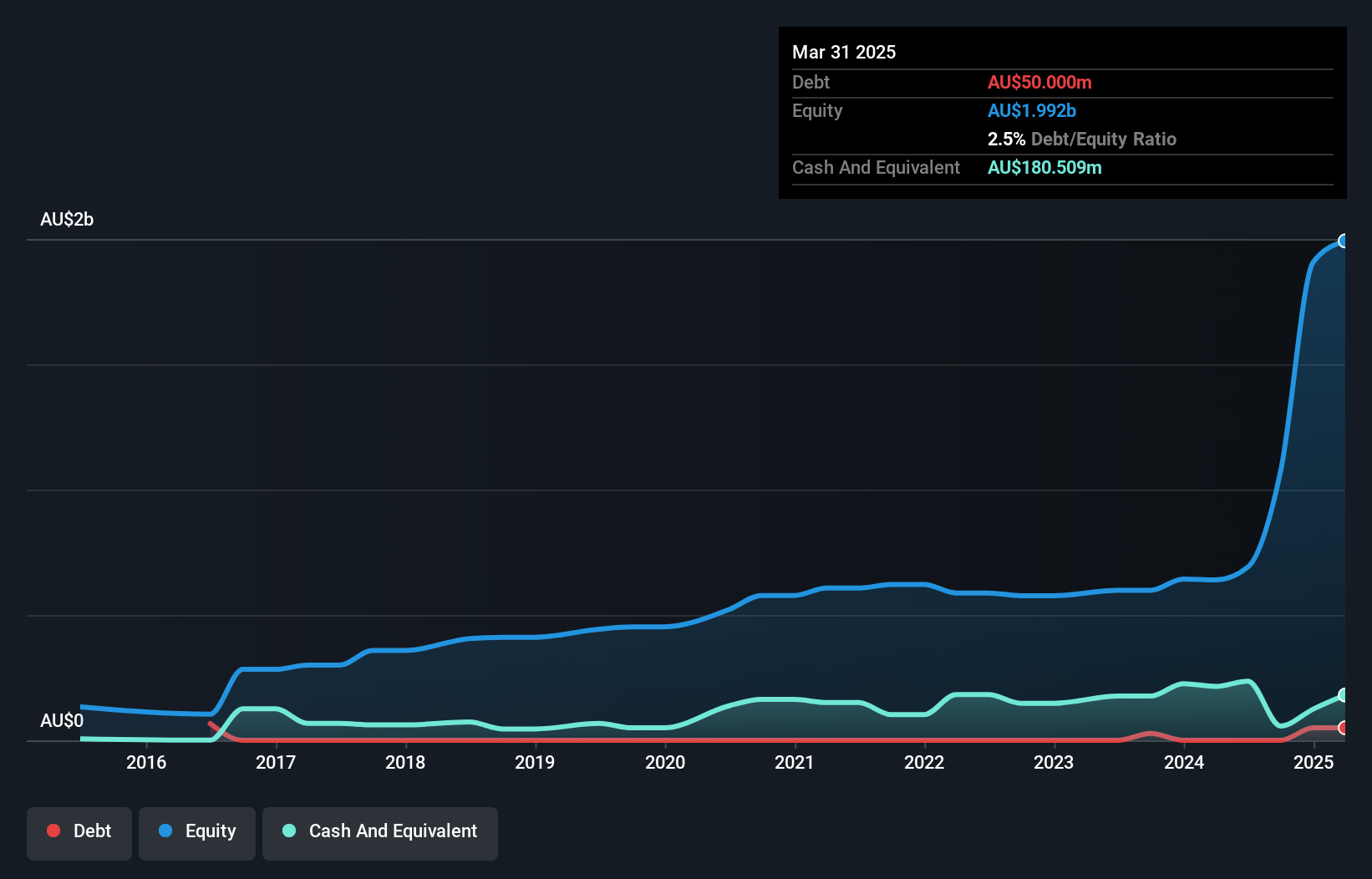

Redox's earnings growth of 11.8% over the past year lagged behind the Trade Distributors industry at 19.6%. However, its earnings have grown impressively by 18.3% annually over the last five years, and it is trading at a value 13% below estimated fair value. The company reduced its debt to equity ratio from 69.6% to just 2.6% in five years, demonstrating strong financial management. Recent results showed net income of A$90.24 million compared to A$80.73 million last year, with a final dividend declared at A$0.065 per share for FY2024

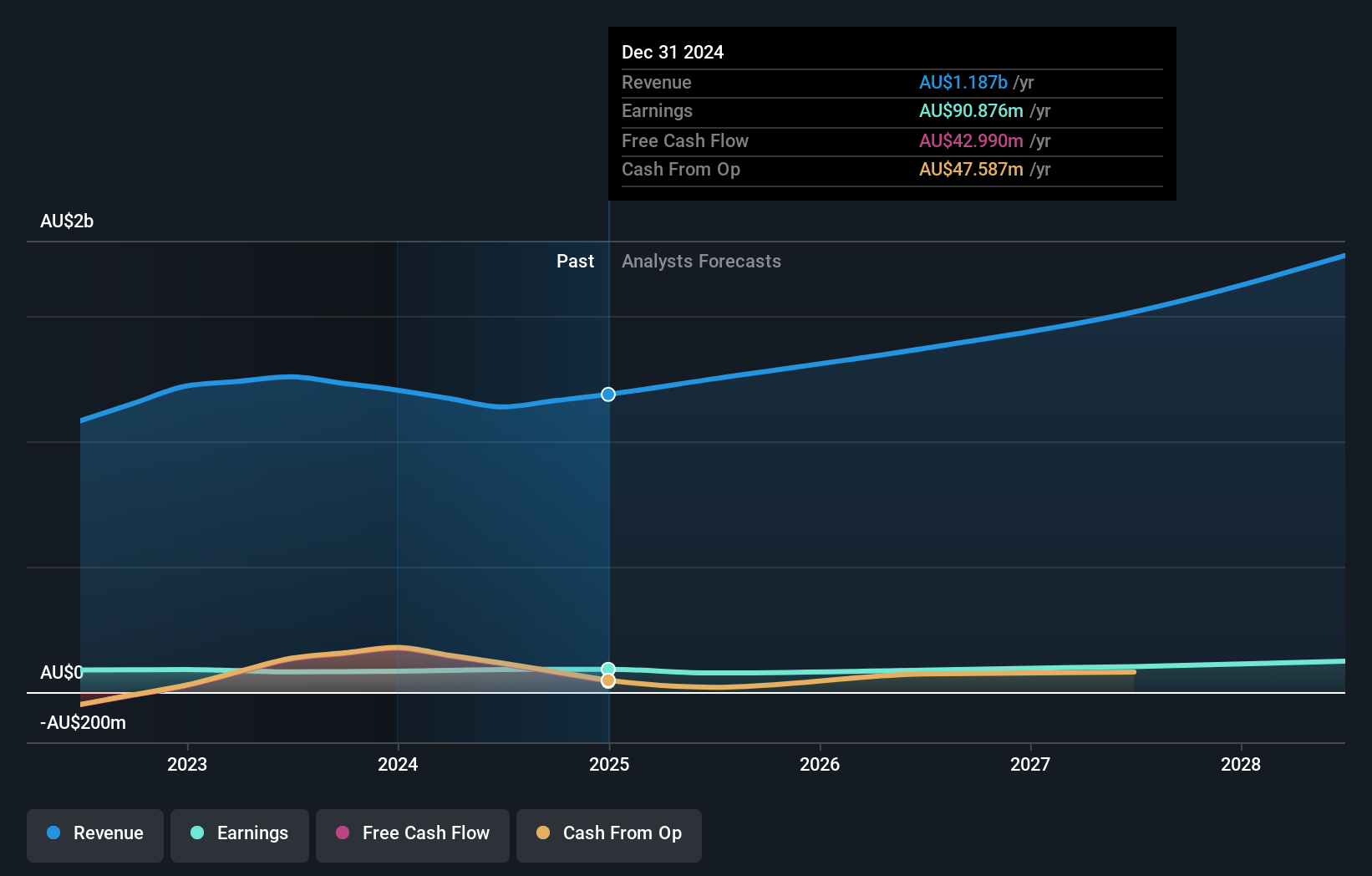

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited focuses on the exploration, operation, development, mining, and treatment of gold and other assets primarily in Western Australia with a market cap of A$2.64 billion.

Operations: Westgold Resources Limited generates revenue primarily from its Bryah and Murchison segments, contributing A$183.25 million and A$533.23 million respectively. The company has a market cap of A$2.64 billion.

Westgold Resources, trading at 50.1% below its estimated fair value, has seen a substantial earnings growth of 852% over the past year, far outpacing the Metals and Mining industry’s 0.7%. The company is debt-free and has not diluted shareholders in the past year. Recent developments include commencing mining at the South Junction Lode with promising drill intersections like 14.93m @ 15.95g/t Au in hole 24SJDD029, aiming for a production ramp-up by Q3 FY25 to support their Bluebird processing plant.

- Click here to discover the nuances of Westgold Resources with our detailed analytical health report.

Gain insights into Westgold Resources' past trends and performance with our Past report.

Seize The Opportunity

- Embark on your investment journey to our 54 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDX

Redox

Supplies and distributes chemicals, ingredients, and raw materials in Australia, New Zealand, the United States, and internationally.

Flawless balance sheet with proven track record.