- Australia

- /

- Capital Markets

- /

- ASX:HMC

ASX Penny Stocks To Watch: 3 Picks With Market Caps Under A$2B

Reviewed by Simply Wall St

As Australian shares are poised for a mid-week advance, buoyed by Wall Street’s optimism and promising GDP figures, investors are keeping a keen eye on emerging opportunities within the market. For those interested in exploring beyond the well-trodden paths of large-cap stocks, penny stocks—despite their vintage name—remain an intriguing area of potential value. These smaller or newer companies can offer compelling opportunities with less risk than one might expect, especially when they exhibit strong financial foundations and growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$71.47M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.55 | A$262.21M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.97 | A$3.39B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.61 | A$241.64M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.49 | A$653.07M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 412 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Barton Gold Holdings (ASX:BGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Barton Gold Holdings Limited, with a market cap of A$308.84 million, is involved in the exploration and development of mineral properties in Australia.

Operations: The company's revenue segment consists solely of exploration, generating A$5.04 million.

Market Cap: A$308.84M

Barton Gold Holdings Limited, with a market cap of A$308.84 million, is pre-revenue and focuses on mineral exploration in Australia. The company has reduced its net loss to A$1.84 million from A$9.4 million the previous year, indicating improved financial management despite ongoing unprofitability. Barton Gold recently completed several equity offerings totaling over A$45 million to bolster its cash reserves, ensuring a sufficient runway for over a year based on current free cash flow trends. The experienced board and management team support strategic decisions as the company navigates growth opportunities within the mining sector.

- Navigate through the intricacies of Barton Gold Holdings with our comprehensive balance sheet health report here.

- Learn about Barton Gold Holdings' future growth trajectory here.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Duratec Limited, along with its subsidiaries, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia and has a market cap of A$458.97 million.

Operations: Duratec's revenue is primarily derived from its operations in Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial sectors (A$136.65 million).

Market Cap: A$458.97M

Duratec Limited, with a market cap of A$458.97 million, is actively seeking acquisitions to diversify its operations across sectors like Energy, Defence, and Mining & Industrial. The company has demonstrated stable financial health with earnings growth averaging 24.3% annually over the past five years and a current net profit margin of 4%. Duratec's debt is well-managed, with more cash than total debt and strong coverage by operating cash flow. Its seasoned board supports strategic initiatives as it trades below estimated fair value while maintaining robust short-term asset coverage over liabilities. Earnings are forecasted to grow by 13.09% annually.

- Jump into the full analysis health report here for a deeper understanding of Duratec.

- Gain insights into Duratec's future direction by reviewing our growth report.

HMC Capital (ASX:HMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HMC Capital Limited, along with its subsidiaries, owns and manages real estate-focused funds in Australia and has a market cap of A$1.49 billion.

Operations: HMC Capital generates revenue from four primary segments: Digital (A$84.1 million), Real Estate (A$79.8 million), Private Credit (A$42 million), and Private Equity (A$28.3 million).

Market Cap: A$1.49B

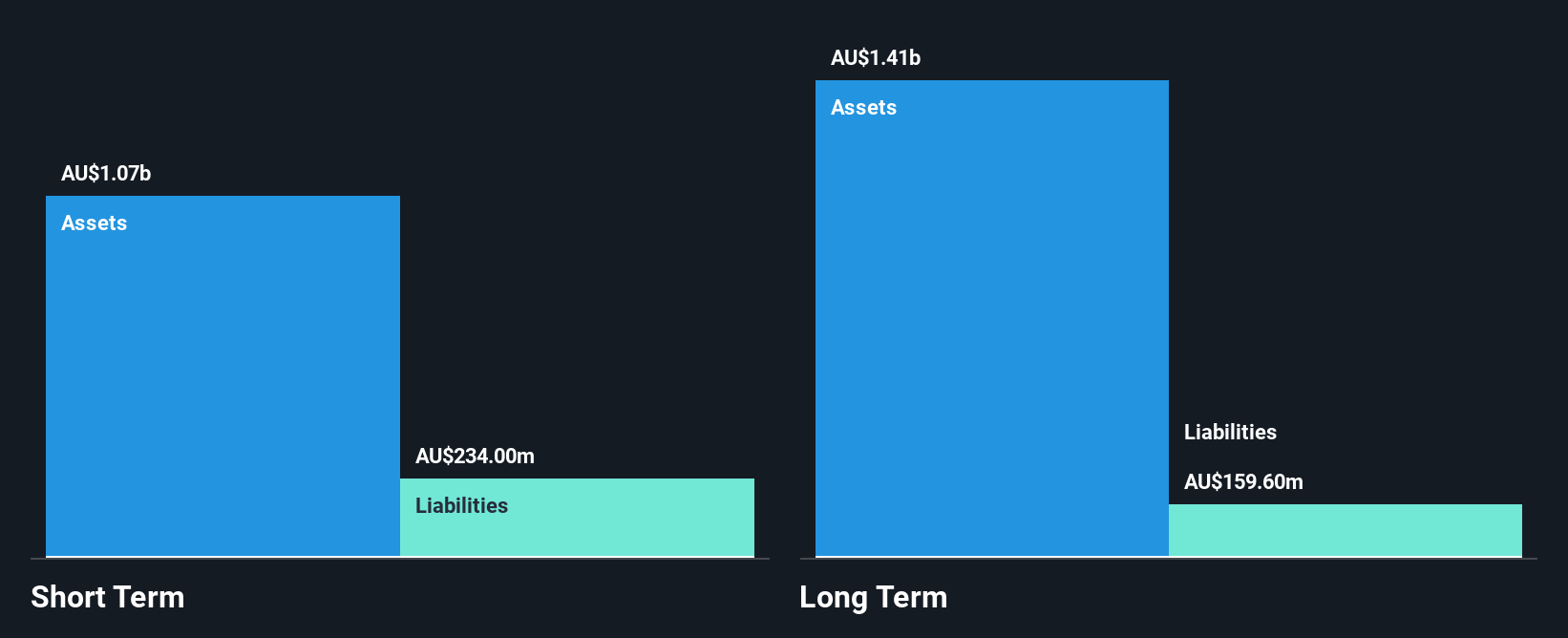

HMC Capital, with a market cap of A$1.49 billion, has shown significant earnings growth of 123.2% over the past year, surpassing its five-year average of 60% per annum and outperforming industry norms. Despite a large one-off loss impacting recent financials, its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. The company's debt management is robust with more cash than total debt and adequate coverage by operating cash flow. However, HMC's dividend sustainability is questionable due to insufficient free cash flow coverage. Trading below fair value estimates suggests potential for value investors despite low return on equity at 14.1%.

- Click to explore a detailed breakdown of our findings in HMC Capital's financial health report.

- Gain insights into HMC Capital's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Unlock our comprehensive list of 412 ASX Penny Stocks by clicking here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMC Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMC

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026